Phillip Nova高级投资分析师林知霖先生

要点:

- Net retail buying continued despite market drop: Retail investors net bought over S$1.4B in Singapore-listed stocks during the STI’s 10.7% drop in the first half of April, but turned net sellers after an 8% rebound in the STI.

- STI banks (DBS, OCBC, UOB) remained top retail picks ahead of their 1Q25 results, while 新加坡房地产投资信托基金 rebounded alongside easing policy expectations and their domestic revenue stability.

- Fixed income ETFs saw inflows amid risk-off sentiment. Money market funds faced outflows as 3-month SORA yields declined sharply.

- Trump’s tariff pause and softer rhetoric lifted markets, but policy uncertainty remains.

- Post-election, staples, REITs, and cyclicals tend to outperform; banks and developers often lag.

- A PAP vote share below 60% could potentially trigger short-term volatility, though macro and Fed policy remain the key market drivers.

- Historically, the SiMSCI Index has shown modest post-election gains. Stock outperformers are concentrated in staples (Wilmar, DFI), REITs (MLT, MIT), and cyclicals (Keppel, SGX, SATS).

- While the election outcome is unlikely to drive markets, a PAP vote share falling below 60% could spark short-term volatility.

Market Overview:

The Straits Times Index (STI) ended 1Q25 up +4.88%, closing at 3,972.43 as of 31 March. However, the index has since declined by -3.96% to 3,811.80 amid rising uncertainty over U.S. tariffs and the risks they pose to Singapore’s trade-dependent economy.

Encouragingly, the STI rebounded by +6.54% from April 10, largely due to a 90-day pause in tariffs announced by President Trump, which provided markets with temporary relief.

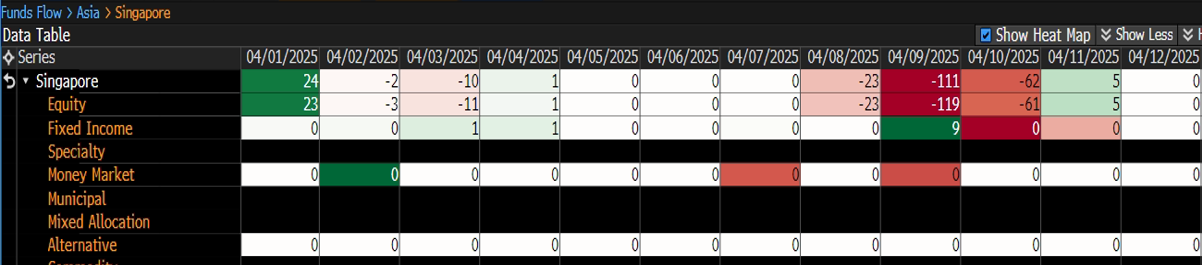

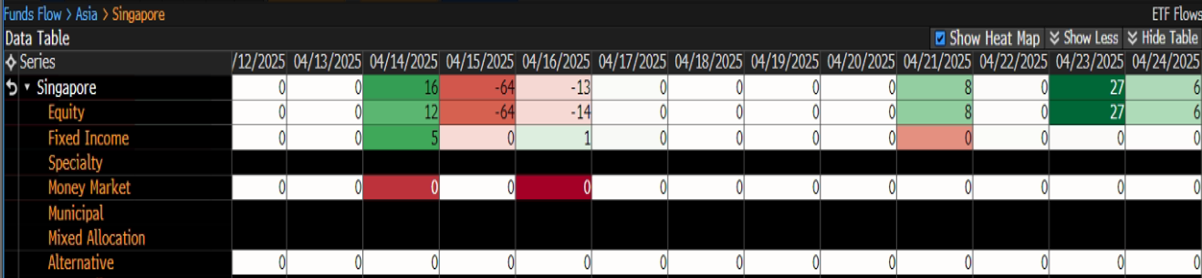

Tracking ETF Flows: In Millions USD

Based on Bloomberg Data, we track investment flows for ETFs by asset class:

1 April to 12 April:

- According to Bloomberg data, Singapore equity ETFs experienced strong net inflows in early April. However, outflows accelerated after Trump’s 2 April announcement of reciprocal tariffs. The situation escalated following China’s counter-tariffs, with peak outflows occurring on 9–10 April.

- Notably, we observed net inflows of approximately USD 9 million into Fixed Income ETFs on 9 April, indicating a rotation into safe-haven assets by risk-averse investors.

13 April to 24 April:

- Following Trump’s 90-day tariff pause, inflows into both equity and fixed income ETFs resumed gradually. However, equity ETFs recorded significant outflows on 15 April, after the Monetary Authority of Singapore (MAS) eased monetary policy and cut its 2025 GDP forecast, citing downside risks from escalating trade tensions.

- Flows turned positive again on 23–24 April, after Trump confirmed he had no intention of dismissing Fed Chair Jerome Powell and signaled that the final round of China tariffs would likely be “nowhere near” the proposed 145% rate.

- These developments raised hopes of a potential de-escalation, although a concrete trade agreement may take another 1–2 months to finalize.

- This softer tariff rhetoric from the US has provided a boost to markets.

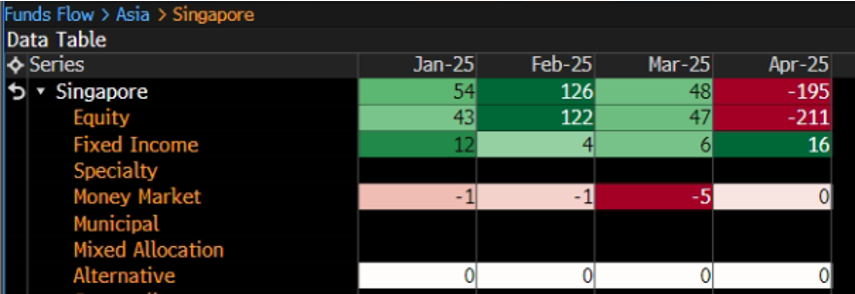

Monthly Flows:

- Despite the recent rebound in equity ETF flows, April remains a broadly risk-off month. Fixed income ETFs emerged as a bright spot, likely benefiting from the flight to safety.

- Meanwhile, money market funds saw steady outflows throughout April, potentially due to falling yields.

- The 3-month compounded SORA rate fell by nearly 70 bps to 2.38% as of 29 April.

Retail Flows: SGX Data Highlights

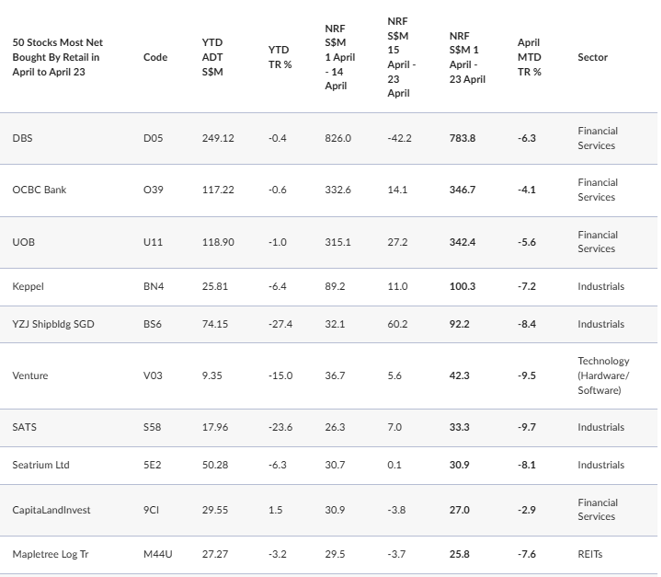

Data from SGX– Top 10 Stocks Most Net Bought By Retail in April to April 23

Data from SGX indicates that retail investors net bought S$1.162b in Singapore stocks from the beginning of April through to the close on April 23.

Looking further into the data, we observe certain key trends and findings:

Net Retail Buying Despite Market Drop:

- According to SGX, retail investors net bought S$1.162b worth of Singapore-listed stocks from 1 to 23 April.

- A deeper dive reveals that between 1 and 14 April—when the STI fell 10.7% from 3,972.43 to 3,548.91—retail investors were net buyers of S$1.415b.

This suggests strong dip-buying activity amid tariff uncertainty, even as institutional investors likely drove the overall market decline through more aggressive net selling.

- Top retail buys (April 1–14) included all three STI banks—DBS, OCBC, UOB—alongside Venture Corporation, Yangzijiang Shipbuilding, CapitaLand Investment, Seatrium, Mapletree Logistics Trust, and SATS.

- Outside the STI, iFAST, Keppel DC REIT, UMS, SingPost, and Suntec REIT were among the top names.

Profit-Taking After Rebound:

Since April 14, retail investors net sold S$253m through to the April 23 close, as the STI gained 8.0% from 3,548.91 to 3,832.32.

The stocks most net sold by retail investors include:

- Singtel, DBS, Singapore Exchange, Singapore Airlines, ComfortDelGro, Frasers Centrepoint Trust, ST Engineering, CapitaLand Ascendas REIT, Sheng Siong Group, and Frasers Logistic & Commercial Trust.

- Notably, Singtel—despite being the most net sold stock by retailers—rose 9.6% over the period and recorded S$493 million in net institutional buying.

STI Banks Remain Retail Favourites in April:

- Retail investors were net buyers of S$1.162b in April through 23 April, led by strong interest in STI banks—DBS, OCBC, and UOB.

- The trio is set to report 1Q25 results post-election: UOB (7 May), DBS (8 May), and OCBC (9 May).

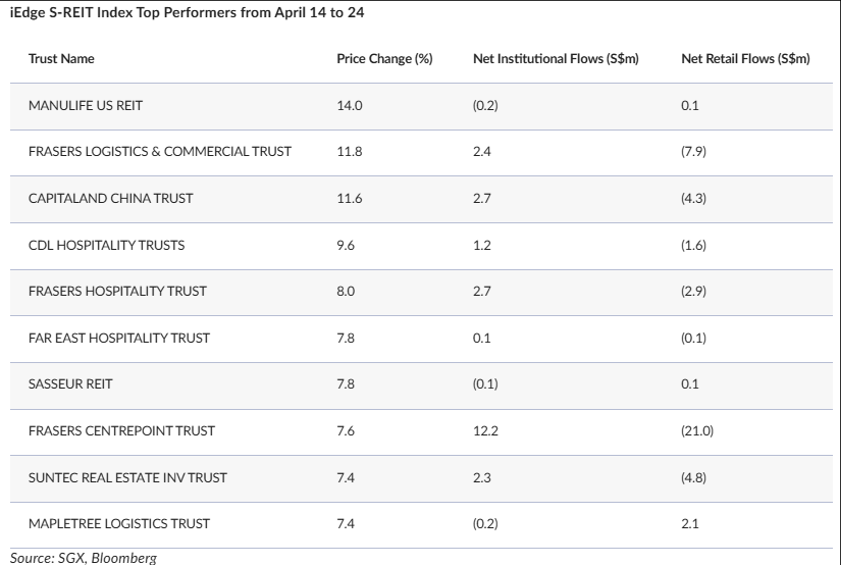

S-REITs seeing a Rebound:

- S-REITs rebounded in tandem with the broader market recovery post-14 April, supported by expectations of easier monetary policy and their domestic revenue exposure.

- Frasers Centrepoint Trust, for example, derives 100% of revenue from local properties such as Causeway Point, Northpoint City, and Waterway Point.

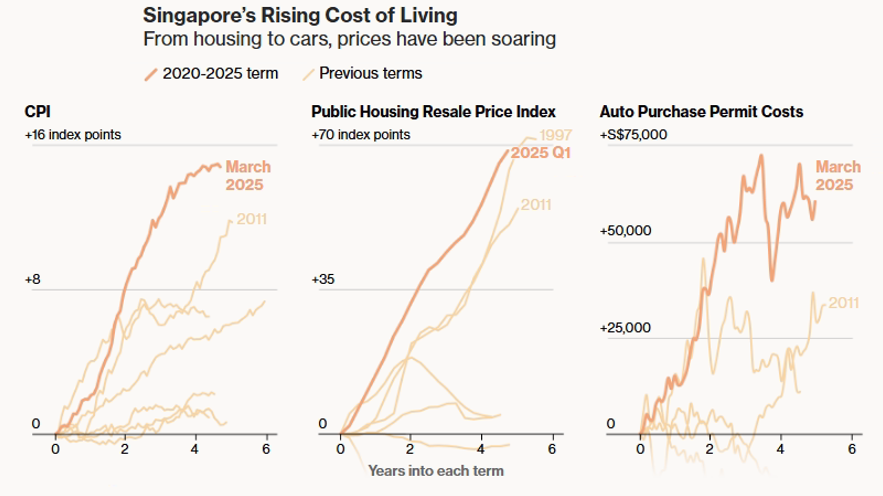

What Does This Mean for Polling Day:

- Retail participation has gradually recovered, as seen in ETF and stock flows. However, we believe the Singapore equity market will be driven less by politics and more by macro risk and the Fed’s interest rate trajectory.

- Nevertheless, rather than the election outcome itself, markets are likely to be more impacted by the margin of victory of the ruling People’s Action Party (PAP).

- The party’s share of the popular vote declined to ~61% in the previous election—near a historic low. A dip below 60% this year could increase market volatility.

- High living costs are a top concern for voters, with the government announcing plans to spend almost S$124b on everything from airport upgrades to vouchers for supermarkets and elder care.

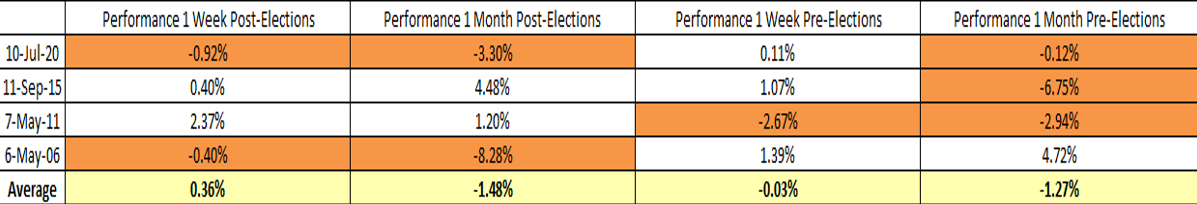

Market Behavior Around Elections:

SiMSCI performance pre-post elections:

- Our research suggests that historically, the SiMSCI Index has shown a modest bounce one week after elections, likely due to policy continuity and expected support measures.

Looking at Bloomberg data showing the historical best/worst stock performers after the previous 4 elections, we observe that:

Historical Outperformers After 1 Week or 1 Month:

- Staples & Defensives: Wilmar, DFI Retail Group, Jardine Matheson, Sheng Siong.

- S-REITs: CapitaLand Ascendas REIT, Mapletree Logistics Trust, Mapletree Industrial Trust.

- Cyclicals: Singapore Exchange, Keppel, Sembcorp Industries, Genting Singapore, and SATS.

- Industrials: Yanzijiang Shipbuilding , Jardine Cycle & Carriage

下一步是什么?

Markets respond to clarity — and GE2025 could offer plenty. Stay nimble and tuned in as the Singapore index could move in anticipation of post-election policies.

Trade the Volatility with Phillip Nova 2.0

Take advantage of election-driven market opportunities in Singapore, trade the SGX MSCI Singapore Index Futures (SGP) at S$1.38*.

Or take a view on the Singapore market via Singapore stocks and the STI ETFs on the Phillip Nova 2.0. Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0