作者:Priyanka Sachdeva,Phillip Nova 高级市场分析师

The Johor-Singapore Special Economic Zone (JS-SEZ), a bilateral initiative to deepen economic integration between Malaysia and Singapore, is emerging as a potential game-changer for regional commodity markets. With nine flagship zones – including the Iskandar Malaysia corridor and Pengerang Integrated Petroleum Complex – the SEZ is poised to catalyse a new wave of infrastructure, manufacturing, and green economy investments that will have direct and measurable impacts on commodity demand, especially for industrial materials like steel, cement, copper, aluminium, and energy-related feedstocks.

The zone’s focus on sectors like advanced manufacturing, logistics, and green infrastructure suggests a multi-year uplift in consumption of raw and semi-finished materials. From a commodity perspective, the JS-SEZ is more than a policy framework—it is a signal for structural demand creation. Amid global headwinds, SG-Johor SEZ offers opportunities of growth to South East Asia.

1) Steel:

The initial phases of the JS-SEZ will be infrastructure-heavy, requiring substantial inputs of construction steel, particularly long products such as rebar, wire rods, and structural sections. Based on historical benchmarks from other Southeast Asian infrastructure corridors, demand for steel could grow by 15–20% annually over the next five years, driven by cross-border infrastructure (bridges, roads, rail), industrial park developments in Johor’s logistics and manufacturing clusters, green building projects under the digital and clean economy push.

2) Cement:

Cement demand will rise in tandem with foundational works across the JS-SEZ, particularly in large-scale developments like Forest City and the PIPC. The JS-SEZ is expected to offer a turnaround story for Malaysia’s cement sector, which has been operating below optimal capacity in recent years. From a trading strategy standpoint, coal – a key input in cement production – could see localised demand spikes, reinforcing its role despite the long-term green transition.

3) Copper, Aluminium and Other Base Metals:

Copper and aluminium will play critical roles in JS-SEZ’s advanced manufacturing, digital economy, and green energy infrastructure. These non-ferrous metals/Base metals are essential in electrical cabling and wiring for new industrial and residential zones, solar and renewable energy grids as well as semiconductor-related manufacturing.

The zone’s emphasis on supply chain integration may lead to a build-out of electrical infrastructure, EV components manufacturing, and data centres – all copper and aluminium intensive sectors. Traders should watch London Metal Exchange (LME) price movements closely, particularly any arbitrage windows between China/ASEAN demand and global inventories. Aluminium, with its dual use in both construction and packaging, may see twin tailwinds.

4) Energy:

The Pengerang Integrated Petroleum Complex (PIPC) designated as a hub for petrochemical and chemical activities, has completed its first phase of development. It will continue to anchor demand for petroleum products, feedstocks, and potentially LNG. While long-term plans point to a green economy shift, near-term infrastructure and industrial growth will depend on conventional energy sources. Traders can monitor Singapore-Malaysia fuel differentials and demand elasticity in the downstream petroleum sector. With PIPC capacity expanding, arbitrage plays in refined products or fuel oil could present short-term opportunities.

Macro Implications for Commodity Investors raise opportunities in following:

- Infrastructure-linked commodity ETFs

- Regional steel and cement producers

- Energy and utilities stocks with cross-border exposure

- Commodity futures in steel, aluminium, and copper, particularly on SGX, LME, and CME Group

From an investment perspective, construction-related counters, REITs with Johor industrial exposure, and ASEAN infrastructure ETFs may benefit, while commodity-linked stocks in the energy, metals, and plantation sectors are worth monitoring for positive momentum. Over the medium term, the SEZ’s role in fostering a dual-nation supply chain hub could lift regional demand for commodity hedging products, offering strategic entry points for clients trading commodity futures and ETFs linked to infrastructure and ASEAN growth themes.

Additionally, increased project activity could influence freight rates and shipping demand across the Singapore Strait, offering a secondary trading angle via dry bulk or tanker plays. The plan also signal potential investment opportunities in strategic sectors such as semiconductors, renewable energy technologies, artificial intelligence and advanced materials.

The Johor-Singapore SEZ is more than a geopolitical project – it is a signal for broad-based demand in industrial commodities across construction, manufacturing, and energy. For commodity investors and traders, this presents a rare window to capitalise on cyclical and structural drivers in Southeast Asia. As groundwork turns to skyline, those positioned early in the right materials will likely ride the wave of Southeast Asia’s next phase of industrial ascent.

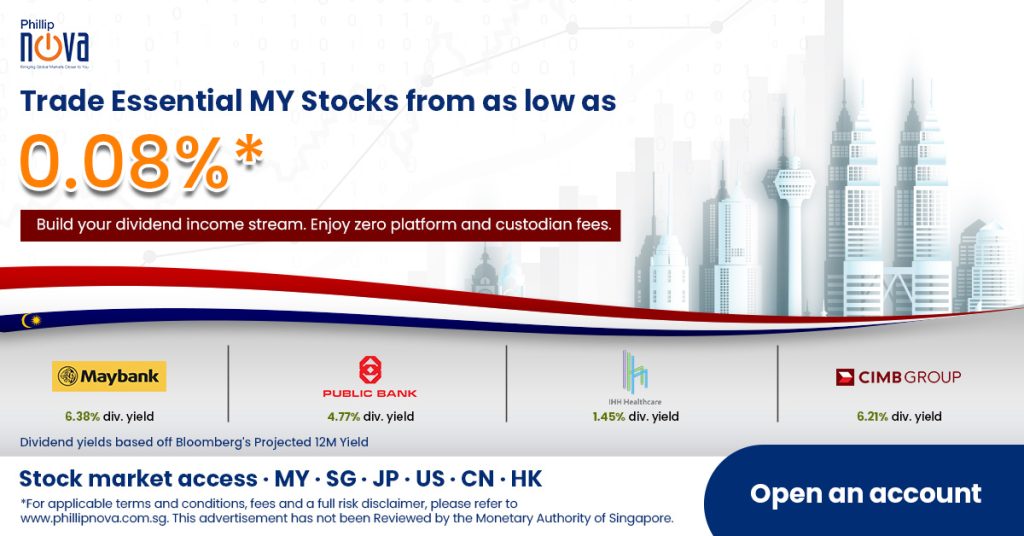

Trade Malaysian Stocks and Commodity Futures on Phillip Nova 2.0 now

Capture bubbling opportunities in the Malaysian market now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0