The allure of MetaTrader 5 (MT5) lies in its ability to run your forex strategy automatically, 24/5. As many traders discover, MT5 is more than a charting platform – it’s an automated forex trading platform where custom programs (Expert Advisors) handle analysis and order execution with data-driven precision. Instead of trading on emotion or fatigue, an EA follows predefined rules and can act even when you’re offline.

This guide explains what MT5 Expert Advisors (EAs) are, how they work, and why they can help you trade smarter. Along the way, we’ll cover how to use MetaTrader 5 for beginners, how to trade with MetaTrader 5 using EAs, and best practices for testing and managing your automated strategies.

What Are MT5 Expert Advisors (EAs)?

An Expert Advisor is essentially a program written in MQL5 that links to a chart and automatically trades on your behalf. In MT5’s own terminology, an EA “contains event handlers to manage predefined events… [and] can also automatically execute trades and send them directly to a trading server”. In plain terms, an EA encodes your trading strategy in algorithmic form. You set the entry and exit conditions, and the EA watches price data to trade whenever those conditions occur. This contrasts with manual trading, where human emotions can cause hesitation or panic. As MetaTrader’s help notes, EAs allow you to “strictly follow a trading strategy, eliminating emotions”. In practice, that means your strategy can run consistently every day, without second-guessing or fatigue.

For traders learning how to use MetaTrader 5, EAs are a key feature. Many MetaTrader 5 for beginners tutorials highlight how these “mechanical trading systems” can execute both analysis and trading activities on autopilot. They are popular: by 2021, MT5 had millions of accounts worldwide, and thousands of robots were available on the MQL5 Market. You don’t need programming skills to benefit: MetaTrader’s built-in MQL5 Wizard can automatically generate an EA from selected indicators and money management rules. Otherwise, traders can buy or download EAs from the online Market or CodeBase. The Market alone offers thousands of tested robots and indicators to suit every strategy. In short, MT5 Expert Advisors let you turn rules into trades so you can scale and refine your strategy without constant manual oversight.

How Do Expert Advisors Work in MT5?

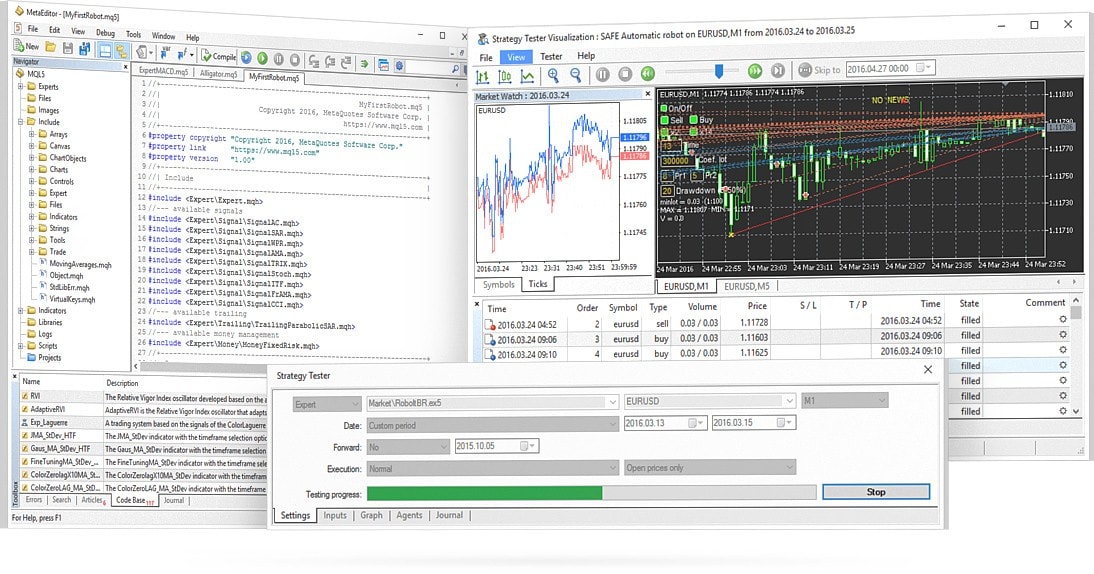

Behind the scenes, MT5 Expert Advisors run in MetaTrader’s MQL5 development environment (MetaEditor). This IDE provides tools for writing, debugging and compiling your EA code. Beginners can use the MQL5 Wizard to generate a robot by choosing signals, indicators, and stop-loss rules – no coding required. Every EA consists of logical rules: entry and exit conditions (e.g. “buy when 50-day MA crosses above 200-day MA”), risk management parameters (e.g. stop-loss or lot size), and any technical indicators it uses. Once compiled, the EA goes into the platform’s MQL5/Experts folder and can be attached to a chart. There, it constantly monitors price ticks and other events. When the predefined conditions are met, the EA sends orders to the broker’s server just as if you had clicked “Buy” or “Sell” yourself.

MetaTrader also provides vast resources for EAs. The MQL5 Market is an online store where you can buy or rent hundreds of trading robots; many can be tested for free first. In addition, the MQL5 Code Base offers free robots and indicators, with thousands of trading robots and indicators available for free download. In this way, traders have access to thousands of ready-made and customizable EAs. The image above shows an EA loaded into MetaEditor and running a strategy tester: you can write or select your strategy in code, then immediately backtest it on historical data using MT5’s tools.

Benefits of Using Expert Advisors on MT5

- 24/5 Automated Trading: EAs can run continuously, executing trades even when you’re asleep or away. By using a Forex VPS or leaving MT5 open, you ensure uninterrupted trading 24 hours a day. This means your strategy never misses an opportunity just because you dozed off or went on vacation.

- Powerful Backtesting: MetaTrader 5 includes a built-in Strategy Tester that uses historical data to simulate EA performance. As a result, you can test a strategy over years of past ticks in just minutes. This lets you fine-tune your system and check if it would have been profitable before risking real money. The Tester also provides detailed charts and statistics – profit/loss curves, win rate, drawdowns – giving confidence that the EA works as expected.

- Consistency and Discipline: Because EAs follow code, they eliminate human error. You won’t suffer from fear or greed during trades: the robot will simply open and close positions by the book. This consistency (trading “strictly by the strategy”) removes bias and fatigue from your decision-making.

- Scalability: Once programmed, an EA can run on multiple charts and instruments simultaneously. MT5 even lets you test an EA on multiple currency pairs at once. In practice, a trader can deploy several EAs across different forex pairs or timeframes to diversify. Even a single EA can trade multiple correlated currencies if coded to do so. This scalability means you can leverage one good strategy into many markets without adding manual workload.

- Versatility (Multi-Asset Trading): Unlike older platforms, MT5 is a true multi-asset platform. It supports not just forex, but also CFDs on stocks, commodities, indices, and more. In other words, your Expert Advisors aren’t limited to EUR/USD – they can run on indices, spot gold, energy, commodities CFD etc. This broad asset coverage and the ability to hedge positions make MT5 a flexible trading environment. For traders looking to diversify beyond forex majors, this versatility is a major plus.

Getting Started with EAs: A Beginner’s Guide

If you’re new to how to trade with MetaTrader 5, adding an EA to your arsenal starts with installation and testing. First, obtain an EA file (usually a .ex5 or .mq5 file) from the MQL5 Market, Code Base or a developer. Then open MT5’s File > Open Data Folder and navigate to MQL5/Experts. Copy the EA file into this folder, and restart MT5 (or right-click “Expert Advisors” in the Navigator and Refresh). The robot should appear under “Expert Advisors” in the Navigator pane. To run it, simply drag it onto a chart.

Always begin with demo trading. Before going live, enable the EA on a demo account to verify it behaves as expected. Adjust its parameters (such as stop-loss and take-profit levels) and monitor how it trades. Take advantage of MetaTrader’s strategy tester and Optimise function (see next section) to fine-tune inputs. Moreover, check the EA’s permission settings: in the EA’s Properties, allow live trading and DLL imports if needed. As a beginner, keep your risk small: use low leverage and small lot sizes until you’re comfortable.

For sourcing EAs, MT5 provides easy options. Use the “Market” button or MQL5 website to download or purchase robots that suit your strategy. Free EAs are also available in the MQL5 Code Base. If coding interests you, the integrated MQL5 Wizard can help you build a simple EA by selecting chart indicators and money management rules. Otherwise, skilled programmers on MQL5’s Freelance can build a custom EA for you. Wherever you get an EA, treat it like any tool: start small, confirm it works on demo data, and keep an eye on its performance as you trade live.

Testing & Optimising with the MT5 Strategy Tester

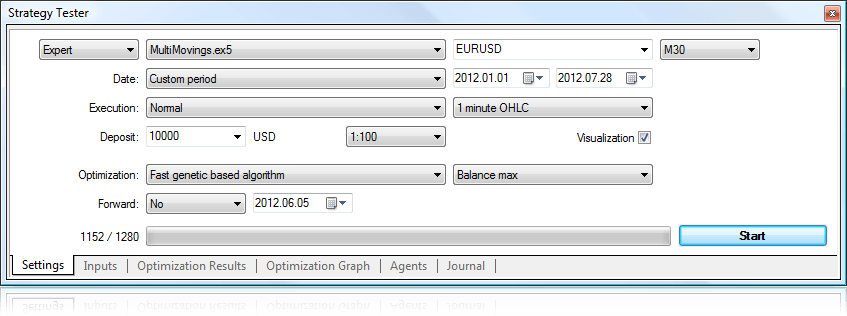

MetaTrader 5’s Strategy Tester is a powerful tool to validate and improve your EAs before risking real capital. In the tester window, you can configure all test settings: choose the EA (Expert), symbol (e.g. EURUSD), timeframe, date range, deposit and model (every tick, 1-minute bars, etc.). You can even enable Visual Mode to watch trades play out on a chart. For optimisation, the tester can run genetic algorithm-based sweeps of input parameters (for example, testing thousands of stop-loss or indicator settings) to find the most robust combinations.

The image above illustrates the Strategy Tester interface with options for an optimisation run. By using these features, a beginner can systematically explore the EA’s parameter space and identify the settings that historically yielded the best balance of profit and risk.

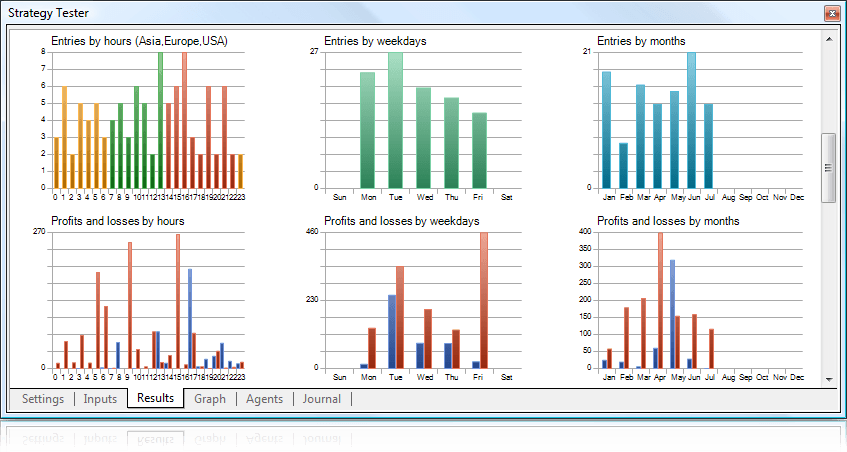

After running a backtest, MT5 displays rich performance charts and statistics for your Expert Advisor. The results tab shows graphs of equity over time and profit/loss by periods (hours, weekdays, months), along with key metrics (total return, drawdown, number of winning trades, etc.). These visual reports let you quickly grasp how the EA performed. You can zoom in on the equity curve or switch to the “Journal” to see each trade. If the results look promising, you can proceed to live testing. If not, the data can guide further improvements – for example, adjusting trade filters or exits. In this way, backtesting and optimisation on MT5 turns guesswork into data-driven refinement.

When using these tools, be mindful of over-optimisation. It’s tempting to pick parameters that made the EA look great on past data, but this can lead to overfitting. In other words, the system might be tuned to historical quirks that won’t repeat. As one trading blog cautions, backtest results “can be extremely deceiving… random chance starts to be more dominant than the meaningful information” if statistical significance is low. To guard against this, use sensible forward-testing (e.g. optimise on one period and test on a later period) and avoid overly complex EAs with too many parameters. Always set realistic expectations: even a well-tested EA can lose money if markets change.

Risks and Things to Watch Out For

Expert Advisors greatly aid traders, but they aren’t magic. Overreliance on automation can be dangerous. Markets can shift abruptly (for example, during news events), and an EA that was profitable in one market regime may struggle in another. In fact, the number one reason EAs fail is that they don’t adapt to changing market conditions. Building an all-weather EA is nearly impossible. Therefore, always supervise your robots: check performance regularly and be ready to switch strategies if conditions change.

Another risk is using untested or poorly coded EAs from third-party sources. Always start any new EA on a demo account or with very small stakes. Make sure you understand its logic or at least trust the source. When downloading from marketplaces, prefer well-reviewed products or those with a free trial period.

Finally, remember that trading costs still apply. High spreads or frequent slippage can turn a profitable strategy into a loss. For example, one review points out that wide spreads cause more losing trades by “getting you stopped out” more often. In automated trading, even tiny cost differences can stack up because robots typically make many trades. To mitigate this, use a low-spread account like Phillip MetaTrader 5 and consider using virtual servers (VPS) near the broker’s server to reduce latency. In short, automation helps your strategy run smoothly, but it still needs human oversight, proper risk management, and realistic cost considerations.

Why Phillip Nova is the Ideal Platform for MT5 Algo Traders

For Singapore and Southeast Asian traders, Phillip Nova provides a robust environment for MT5 algo trading. Phillip Nova is a MAS-licensed broker within the PhillipCapital group, offering local reliability and support. Its MT5 servers are known for low-latency execution, which is crucial for automated strategies – trades hit the market with precision and minimal delay.

Phillip Nova also caters to both beginners and pros. The broker offers educational resources (webinars, 1-1 coaching, demo accounts) and a regional focus on popular instruments (FX majors, commodities, futures). MT5 clients at Phillip Nova can trade a wide range of markets (FX, CFDs on stocks/commodities, etc.) just as on other MT5 brokers. In short, with its fast execution, reliable infrastructure and dedicated support, Phillip Nova is well-suited for anyone wanting to trade MT5 Expert Advisors in Singapore.

Conclusion

MetaTrader 5 Expert Advisors let you trade smarter, not harder. By automating your strategy in MT5, you can run complex systems 24/5 without human emotion or fatigue. But remember: automation is a tool, not a guarantee. The true edge comes from your strategy design, thorough testing, and ongoing control of the robots. With the techniques outlined above – installing EAs, backtesting with the Strategy Tester, and watching out for market changes – you can harness MT5 EAs effectively.

Ready to explore automated trading? Sign up for a Phillip MetaTrader 5 demo account and unlock the full potential of MT5 Expert Advisors. Whether you’re new and learning how to use MetaTrader 5 or already know how to trade with MetaTrader 5, Phillip Nova’s platform and support can help you put these powerful EAs to work. When you’re ready, open a Phillip Nova MT5 account and start trading today.