人民币有两种形式:CNY(在中国大陆境内交易,受资本管制);CNH(离岸人民币),即不受资本管制、可供全球投资者使用的离岸人民币。尽管两种货币的价格会短暂波动,但 CNY 和 CNH 通常走势一致。

截至 2025 年 9 月撰写本文时,CNH 兑美元汇率已走强,美元/CNH 从 4 月份的 7.40 上方跌至近 7.11,这得益于美元走弱、中美利差距收窄以及中国股市走强。

离岸人民币价值的驱动因素

利率和收益率差异

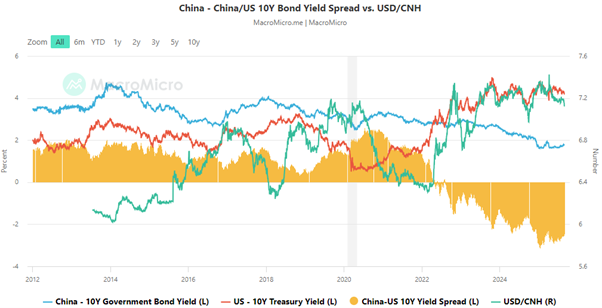

离岸人民币最大的短期驱动因素之一是中美收益率差。当美国债券收益率高于中国债券收益率时,中国企业往往会持有更多美元,这通常会削弱离岸人民币。当中国债券收益率超过美国债券收益率,且两者之间的差距扩大时,离岸人民币通常会企稳或走强。这种相关性会随时间变化,因为两国的政策变动可能会减弱或增强这种相关性。

这种模式在2020年至2024年期间都清晰可见:随着中美10年期债券收益率利差(橙色带,中国减美国)向正方向扩大,美元/离岸人民币汇率趋于走低,人民币走强;随着利差反转并转为负值,美元/离岸人民币汇率趋于走高,人民币走弱。

来源: MacroMicro

另一个独特因素在于离岸人民币(CNH)的货币市场。在中国香港,如果当局收紧流动性,离岸人民币香港银行同业拆借利率(HIBOR)可能会飙升,从而推高做空人民币的成本。即使利差指向相反方向,这类突然的流动性紧缩也可能引发离岸人民币(CNH)的短期大幅反弹。

中国人民银行的每日中间价区间

每天北京时间上午9:15,中国人民银行(PBoC)都会设定美元兑人民币的参考汇率,即“每日中间价”。在岸人民币交易的波动幅度在该汇率的±2%范围内。尽管CNH是离岸人民币且不受中间价影响,但它通常会对每日中间价做出反应。如果中国人民银行设定的中间价强于预期,则表明当局希望支持人民币,而离岸人民币(CNH)通常会相应走强。中间价设定得较弱往往会产生相反的效果。

经济增长政策

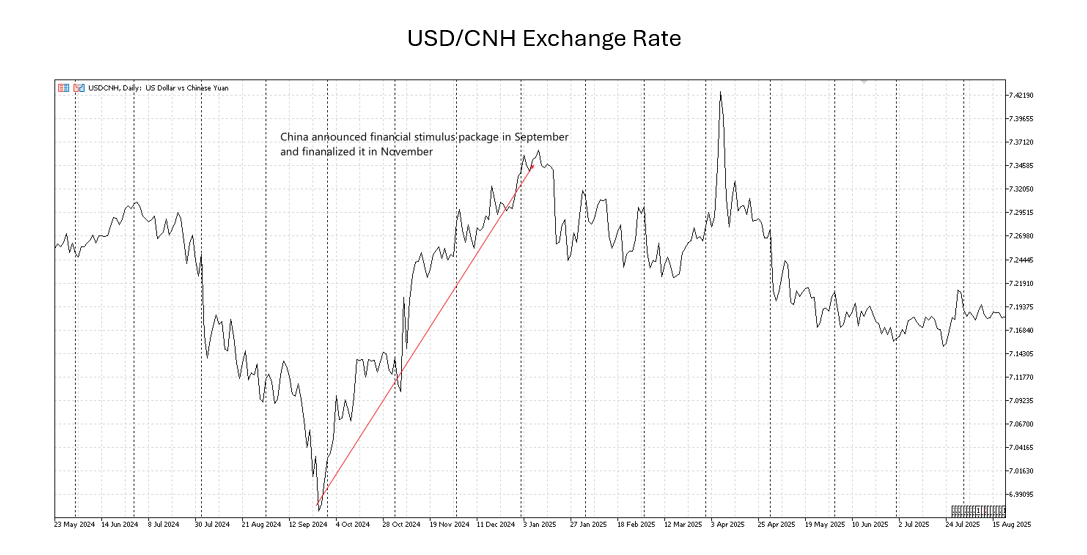

除了货币政策外,财政政策也至关重要,因为市场将其解读为当局致力于经济增长的信号。政府支出、基础设施、科技投资和房地产等领域的政策声明可能会改变人民币的预期。当增长前景改善时,企业和投资者更愿意购买人民币,从而支撑离岸人民币。另一方面,疲软或延迟的政策行动可能会加剧悲观情绪、资本外流,并导致更多离岸人民币抛售。 2024年9月,中国政府宣布的包括地方政府债务重组计划在内的财政刺激措施不及市场预期,在此期间,人民币从9月至2024年底大幅贬值。

2024年9月,中国政府宣布的包括地方政府债务重组计划在内的财政刺激措施不及市场预期,在此期间,人民币从9月至2024年底大幅贬值。

交易者为何应该关注离岸人民币 (CNH)

不断增长的离岸人民币交易量

过去十年,离岸人民币 (CNH) 已从一种小众货币发展成为全球交易量最大的货币之一。国际清算银行 (BIS) 2022 年调查显示,人民币(受离岸人民币交易推动)位列全球第五大交易货币,日交易量从 2010 年的约 600 亿美元增长至超过 5000 亿美元。 离岸人民币衍生品也快速增长。例如,8 月份新交所美元/离岸人民币外汇期货成交量同比增长 25%,达到 340 万份合约,带动新交所外汇期货总成交量同比增长 33%,达到创纪录的 560 万份合约。

离岸人民币衍生品也快速增长。例如,8 月份新交所美元/离岸人民币外汇期货成交量同比增长 25%,达到 340 万份合约,带动新交所外汇期货总成交量同比增长 33%,达到创纪录的 560 万份合约。

中国经济与股市表现

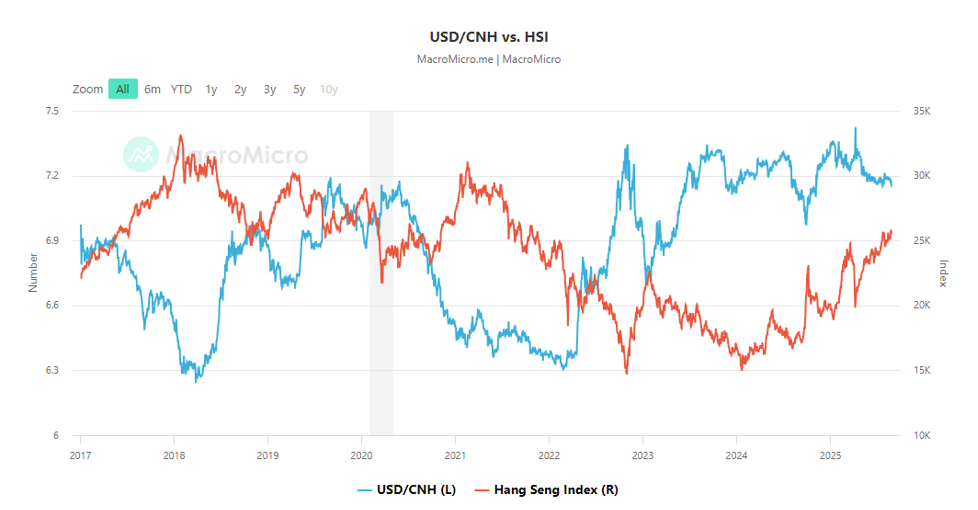

离岸人民币 (CNH) 是中国经济前景的实时晴雨表,因为它自由交易,并反映了全球资金流入和流出中国市场。历史数据显示,美元/离岸人民币 (USD/CNH) 的走势通常与恒生指数的波动呈负相关:离岸人民币走强(美元/离岸人民币走低)往往与恒生指数走强同步,反之亦然。同样,美元/离岸人民币 (USD/CNH) 也可以提供外资参与 A 股市场的线索。

来源: MacroMicro

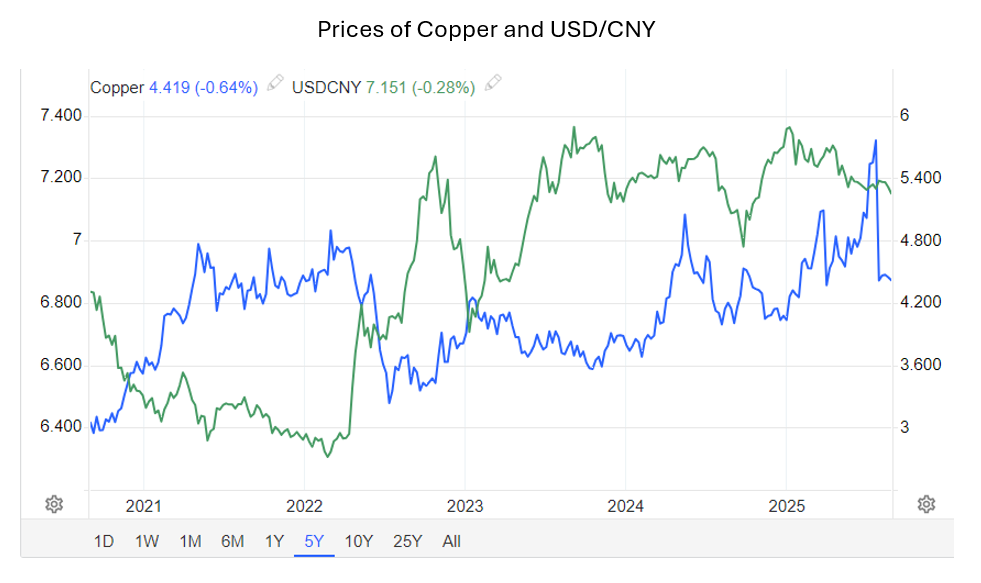

人民币与大宗商品价格的相关性

对于金属和能源而言,离岸人民币 (CNH) 和大宗商品价格通常通过中国需求渠道挂钩。例如,铜价与美元/离岸人民币 (USD/CNH) 或美元/人民币 (USD/CNY) 的走势通常相反。然而,当美国或中国政策主导汇率走势时,这种联系可能会减弱。因此,许多对冲者倾向于使用美元/离岸人民币作为支撑信号,而非单独进行对冲。

持有离岸人民币交叉货币对的收益和机会

离岸人民币对冲的用例

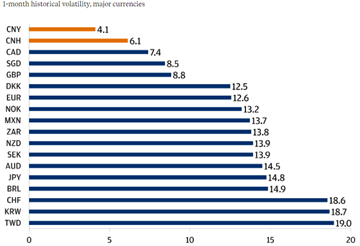

据彭博社报道,离岸人民币的日内波动通常低于许多其他货币,截至2025年5月,其兑美元的月波动率约为4.1%。对于对冲者而言,更稳定的波动意味着更平稳的市值波动、更少的意外追加保证金通知以及更简单的头寸调整。如果您接收或持有人民币,您可以比波动较大的货币更有信心地设置对冲规模。

Source: Bloomberg Finance L.P.. Data as of May 2025

使用离岸人民币交叉货币对(例如欧元/离岸人民币、日元/离岸人民币),企业可以直接用人民币对冲发票货币,而无需通过美元。这通常使对冲者更接近实际现金流,并省去了额外的美元交易环节。

示例:以欧元计价的中国出口商可以按发票金额卖出欧元/离岸人民币。

- 如果欧元/离岸人民币下跌,对冲利润将抵消兑换时获得的人民币减少。

- 如果欧元/离岸人民币上涨,对冲将亏损,但汇率更有利。

如果没有交叉货币对,对冲者需要关注欧元/美元和美元/离岸人民币两笔交易,这增加了对冲过度或对冲不足的风险。

交易机会

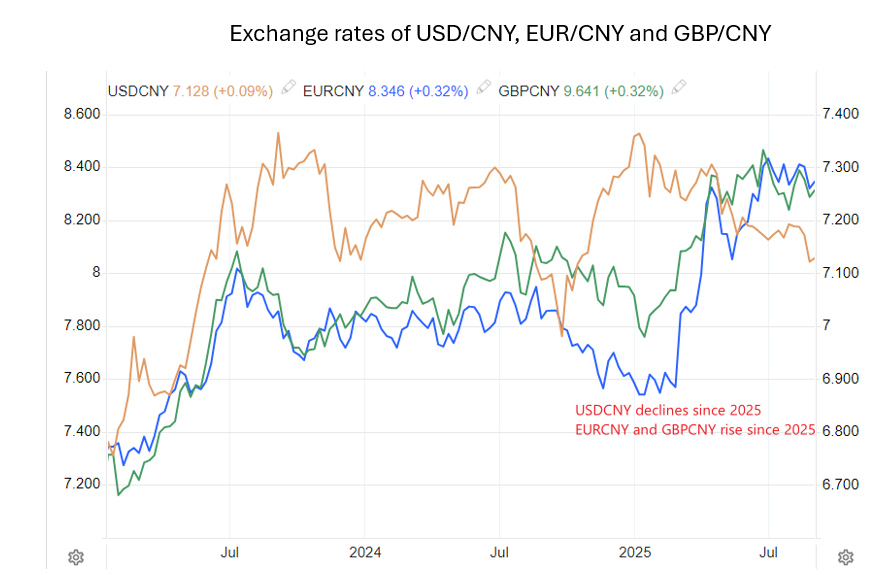

自2025年初以来,人民币兑美元走强,但兑欧元、英镑和加元等其他主要货币走弱。主要有两方面因素在起作用:

- 中国的巨额贸易顺差和净外国资产流入给人民币带来了上行压力。

- 中国人民银行控制人民币过快升值,以保护出口商。据彭博社报道,中国国有银行一直在离岸外汇掉期市场借出美元,并借入人民币,从而控制了人民币的需求。这导致人民币或离岸人民币兑美元的升值速度慢于其他主要货币,因此离岸人民币兑这些货币走弱。

那么,这对交易者意味着什么?

- 短期来看:美元兑离岸人民币汇率通常在快速下跌后反弹,因为银行买入往往出现在逢低买入。这有利于小规模区间交易(在近期低点附近买入,在高点附近卖出),以及快速套利并设置严格止损。

- 中期来看:离岸人民币交叉货币对通常比美元/离岸人民币更稳定。如果您希望您的交易/对冲与人民币现金流保持一致,可以使用它们。

- 如果宏观经济形势发生变化,当前趋势可能会减弱。例如,如果中国下半年净出口放缓,资本流入将下降,从而导致人民币需求下降。在这种情况下,美元/离岸人民币的走势可能会反弹或进入区间波动。

澳元/离岸人民币和加元/离岸人民币等货币对通常随其经济体销售的大宗商品而波动——澳大利亚是铁矿石,加拿大是石油。这些大宗商品价格往往会大幅波动,然后随着时间的推移回落至正常水平,而且外汇交叉货币对也具有均值回归模式。一种实用的方法是将交叉汇率与其近期平均值(例如过去12个月)进行比较。如果澳元/离岸人民币或加元/离岸人民币远高于该平均值,则考虑卖出,以期回落至平均水平。如果远低于该平均值,则考虑买入。始终使用明确的止损和适度的仓位规模:大宗商品之间的关联性并非始终有效,美元的大幅波动或中国的政策信号都可能颠覆这种模式。

Conclusion

总而言之,离岸人民币几乎实时地反映了收益率差异、政策信号和中国经济增长前景的相互作用。

为何交易离岸人民币对:

- 宏观敞口:离岸人民币会受到中美利差、政策和关键经济数据变化的影响,从而创造事件驱动型机会。

- 对冲效率:离岸人民币交叉货币对(例如欧元/离岸人民币、日元/离岸人民币)允许企业在一笔交易中直接对冲计价货币兑人民币的汇率。

- 大宗商品与股票的关联性:离岸人民币 (CNH) 走势通常与对中国市场敏感的主要大宗商品和中国香港股票指数相关,从而提供信号。

在辉立 Nova 2.0 和辉立 MetaTrader 5 平台上交易美元离岸人民币 (USDCNH)、新加坡元离岸人民币 (SGDCNH)、欧元离岸人民币 (EURCNH)、英镑离岸人民币 (GBPCNH)、离岸人民币日元 (CNHJPY) 等离岸人民币对——对冲货币风险,捕捉政策动向,并把握中国市场趋势