新加坡股市投资工具箱再升级!除了传统的个股与广泛覆盖市场的STI指数基金外,投资者如今还可使用上市指数期货,以及新近推出、 与MSCI新加坡指数挂钩的杠杆与反向(L&I)交易所交易产品(ETPs)。 tied to the MSCI Singapore Index.

这些工具让投资者能够双向布局市场走势,并根据自身的风险偏好灵活选择投资策略。

新加坡股票市场的传统投资方法

- 海峡时报指数 (STI) ETFs

- 新加坡股票

- MSCI 新加坡指数 (SiMSCI) 期货

海峡时报指数 (STI) ETFs

长期投资,买入并持有

- 这些 ETF 追踪海峡时报指数,涵盖 30 家规模最大、流动性最强的新加坡公司

- 海峡时报指数对利率较为敏感,因为银行 (约 50%) 和新加坡房地产投资信托 (约 11%) 的权重较高

- 主要持股包括星展银行、华侨银行、大华银行、新加坡电信、怡和集团、新交所和凯德综合商业信托

- 两只最活跃的海峡时报指数 ETFs 是:

- SPDR® 海峡时报指数 ETF (ES3) │ 费用比率:0.28% │ 12 个月收益率:4.13%

- 日兴资产管理/Amova 海峡时报指数 ETF (G3B) │ 费用率:0.24% │ 12个月收益率:4.06%

- 股息每半年派发一次

- 投资追踪海指的ETF简单易行,提供股息,是长期买入并持有策略的理想选择

- 为投资者提供即时分散投资(降低单一公司风险)

- 适合没有时间关注新闻、收益和风险的投资者

新加坡股票

新加坡股票:高度确定的投资机会,追求超额回报(Alpha)

- 当投资者对某只股票有高度把握时,直接投资个股往往能带来最大的潜在收益。

- 一旦判断正确,单只股票通常能显著跑赢大盘指数。

- 个股投资没有持续的管理费或费用比率,成本更透明。

MSCI 新加坡指数 (SiMSCI) 期货

高贝塔值和高杠杆

- SiMSCI 指数期货是一种交易所交易衍生品,提供对 SiMSCI 指数的杠杆敞口。

- 与海峡时报指数 (STI) 相比,SiMSCI 指数涵盖 Sea Ltd 和 Grab Holdings 等国际上市公司。

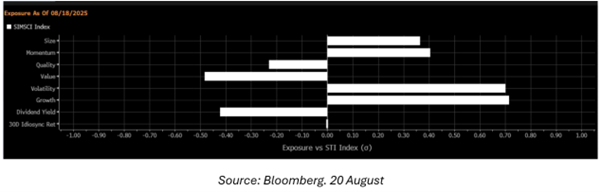

- 因此,SiMSCI 指数比海峡时报指数更倾向于增长和波动性,使其成为寻求新加坡股票高增长和高贝塔值敞口的投资者的首选投资工具。

- SiMSCI 指数因其对 Sea(约占指数的 18%)和 Grab(约占指数的 3.5%)等国际上市成分股的敞口而脱颖而出。

- 就因子倾斜度而言,如下所示,SiMSCI 指数对增长和波动性的敞口明显高于海峡时报指数。但代价是股息较低。

- 就行业敞口而言,SiMSCI 对新加坡房地产投资信托基金 (S-REIT) 的配置低于 STI。

- 期货允许双向交易——投资者可以根据个人市场观点或交易目的做多或做空。

- 通常用于战术对冲、杠杆押注和事件驱动策略(例如,财报季)。

Straits Times Index (STI) ETFs, Singapore Stocks, and MSCI Singapore Index (SiMSCI) Futures are all available on NOVA.

新加坡股票市场的新方法

- 辉立-Nova MSCI 新加坡指数每日 2 倍杠杆交易所交易产品(新交所: LSS)*。

- 费用比率:8.60%

- 目标收益约为 SiMSCI 每日收益的 2 倍

- 辉立-Nova MSCI 新加坡指数每日 -1 倍反向交易所交易产品(SGX:SSS)

- 费用比率:6.80%

- 目标收益与 SiMSCI 每日反向收益相同

这两款产品均在交易所交易,以期货为基础,在新加坡被归类为特定投资产品 (SIP),可在辉立Nova 2.0 平台上购买。 新星.

衰减效应

由于复利效应,在多日持有期内,业绩表现可能与简单的 2 倍/-1 倍计算结果有所不同。

以下示例均从 100 开始。

(1) 横盘/平盘但波动

- 指数:+10% 然后 -9.09% → 回到 100(0% 回报率)

→ back to 100 (0% return) - 2 倍 ETP:+20% 然后 -18.18% → 98.18(-1.82% 回报率)

→ 98.18 (−1.82% return)

(2) 对称波动

- 指数:+10% 然后 -10% → 99(-1% 回报率)

→ 99 (−1% return) - 2 倍 ETP:+20% 然后 -20%

→ 96 (-4% 回报率)

→ 回报率比“2 倍 -1%”更差“

(3) 稳步上升

- 指数:连续 10 天每日上涨 1%

→ 100 x 1.01¹⁰ ≈ 110.46 (+10.46% 回报率) - 2 倍 ETF(每日上涨 2%)

→100 × 1.02¹⁰ ≈ 121.90 (+21.90% 回报率)

→ 复利为正且平滑

从长期来看,杠杆产品的收益会受到价格路径的影响。

在低波动、稳步上行的市场中,杠杆型ETP能够受益于正向复利效应,表现相对理想。但若市场区间震荡或方向频繁反转,则会出现明显的收益衰减(Decay)。

因此,杠杆与反向(L&I)ETP通常被视为短期策略性工具,适用于战术性交易、择时操作或风险对冲,而非长期持有型投资产品。

如何在新加坡股票市场选择投资方法

目标 | 工具适配 | 交易产品 |

被动长期投资,低成本核心敞口 | STI ETFs 提供简单的被动投资,带来收益 维护成本极低 |

|

高确定性,特定股票阿尔法值 | 单一新加坡股票而非指数产品 |

|

更高的杠杆 | 期货合约提供更高的杠杆,且无“衰减”效应 盈亏不基于每日活动百分比。 |

|

新加坡大盘的战术性短期方向性观点 | 杠杆与反向产品(2 倍用于看涨势头;-1 倍用于对冲短期下行风险) 保证金追缴风险和展期风险更低,比期货更容易操作 |

|

总结洞察:杠杆与反向ETF丰富投资工具箱

辉立Nova的 MSCI 新加坡杠杆与反向产品(L&I)弥补了现金股票/ETF 与期货之间的空白:作为上市、易于获取的战术性工具,它们可在做空或衍生品访问受限时,用于表达市场观点或实施对冲。如果使用得当——并注意每日重置机制及SIP适配性——这些产品能够提升个人交易者和专业交易者的交易灵活性。

- 辉立-Nova MSCI 新加坡指数每日 2 倍杠杆交易所交易产品(新交所: LSS)*。

- 辉立-Nova MSCI 新加坡指数每日 -1 倍反向交易所交易产品(SGX:SSS)

Now available for trading on NOVA, with an exclusive promotion:

How does the China A50 Index fit in?

The FTSE China A50 Index focuses on A-shares — specifically the 50 largest and most liquid companies on the mainland.

By investing in instruments like the UOBAM FTSE China A50 Index ETF (JK8) 或者 新交所富时中国 A50 指数期货, you’re tapping into pure onshore growth, directly aligned with China’s domestic market drivers.

Diversify your portfolio with UOBAM FTSE China A50 Index ETF (SGX: JK8) 或者 SGX FTSE China A50 Index Futures (SGX: CN) and stand to win a trip to China! Click to find out more.

NOVA 平台

- 一站式交易全球市场:股票、ETF、期货、外汇、差价合约(CFD)等

- 一站式交易

- 一个账户 轻松覆盖所有产品合约

- 零托管费与平台费

- 支持移动端、iPad 和桌面设备

- 由 TradingView 提供支持的图表

立即开户,无需最低资金要求。