For many investors, Malaysian stocks may feel less familiar compared to markets like Singapore or the US. Yet Malaysia is home to several large, diversified companies with long operating histories, and Sunway Bhd (KLSE: SUNWAY) is one of them.

A Landmark Takeover in Malaysia

Sunway recently made headlines after announcing a takeover bid for fellow Malaysian construction and property group IJM Corp Bhd (KLSE: IJM), valuing the company at around RM11 billion (approximately US$2.7 billion). If completed, this would be one of the largest corporate acquisitions in Malaysia in recent years and could mark a major step toward consolidation in the country’s construction sector.

Why Sunway Is Making This Move

The proposed acquisition would allow Sunway to gain control of IJM, with the option to eventually delist the company if sufficient shares are acquired. The move reflects Sunway’s ambition to build scale and strengthen its position across construction, infrastructure and property development, at a time when competition for large projects remains intense.

How the Market Responded

Market reaction to the announcement was mixed but largely in line with expectations. IJM shares rose following the news, as investors responded positively to the takeover offer, while Sunway shares edged lower slightly as markets assessed the size and implications of the transaction. Such movements are common in large mergers, where the target company benefits from takeover interest while the acquiring company faces questions around funding and integration.

What a Combined Sunway–IJM Could Mean

Analysts have noted that a combined Sunway–IJM group could emerge as one of Malaysia’s largest property and construction conglomerates, supported by a larger asset base and stronger balance sheet. This could improve access to financing, potentially lower borrowing costs, and enhance the group’s ability to bid for major domestic and regional infrastructure projects.

What Investors Should Watch Next

While the announcement is significant, the transaction is still subject to shareholder acceptance and regulatory approvals. Investors will be watching closely for updates on acceptance levels, timelines and any changes to the deal structure. As with all major acquisitions, the potential benefits must be weighed against execution and integration risks.

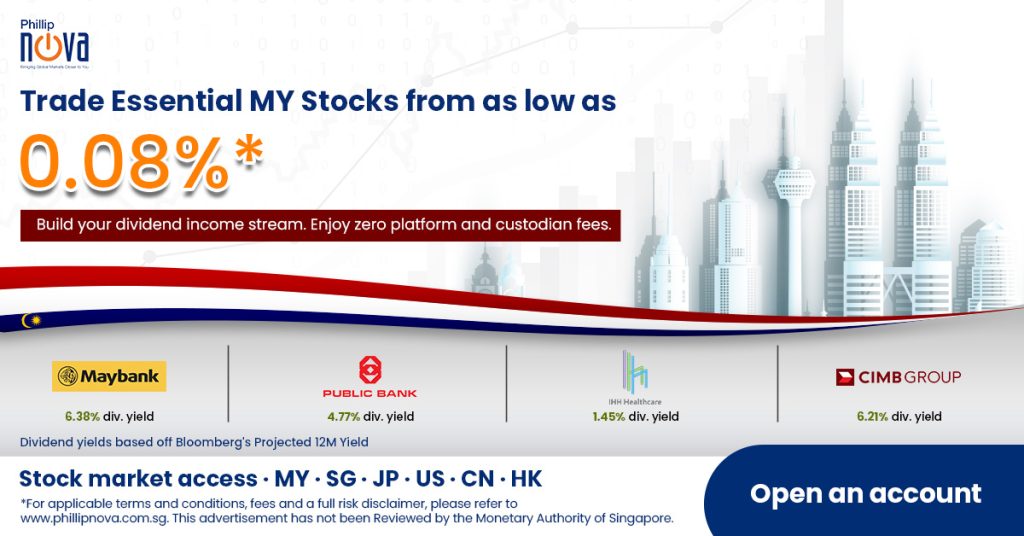

Trade MY stocks on NOVA now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0