A simple, investor-ready breakdown with bullish/neutral/bearish implications

Netflix has signed a US$72B deal to acquire Warner Bros Discovery’s film, TV, and HBO assets — but the transaction is far from complete.

A competing US$108B hostile bid from Paramount Skydance, combined with direct political comments from President Trump, has thrown the media landscape into a rare, high-stakes corporate showdown.

Below is a clear breakdown of the current situation and the key paths ahead.

⭐ Where Things Stand Now

- Netflix and Warner Bros agreed on terms, but approvals are pending.

- Paramount Skydance is trying to take Warner Bros away from Netflix with a much richer bid.

- President Trump has said the Netflix deal “could be a problem,” signalling unusual scrutiny.

- Hollywood labour unions oppose the Netflix deal, arguing it reduces competition.

- Warner’s board must weigh price, stability, integration risk, regulatory risk, and long-term strategic fit.

Markets now await direction expected within the next 3–5 weeks.

THE 6 POSSIBLE SCENARIOS (MOST LIKELY → LEAST LIKELY)

Each includes:

✔ Why it might happen

✔ What might stop it

✔ Whether it’s bullish / neutral / bearish for Netflix (short and long term)

Scenario 1:⃣ Netflix Wins the Deal WITH Conditions

Regulators approve but impose restrictions (licensing, exclusivity limits, or partial divestitures).

✔ Why it might happen

- Regulators often prefer conditional approvals rather than total blocks.

- Netflix has superior financial and operational strength to integrate Warner globally.

- Warner Bros may trust Netflix to scale its franchises internationally.

✖ What might stop it

- Trump’s comments raise political risk.

- Labour unions and rivals actively lobby against Netflix gaining HBO.

- Paramount’s much higher bid puts pressure on Warner’s board.

- Conditions may become too costly, prompting Netflix to withdraw.

📈 Impact on NFLX

Short term: Bullish (certainty returns, manageable restrictions)

Long term: Modestly bullish (bigger content moat, but less than a clean approval)

Scenario 2:⃣ Paramount Skydance Wins the Acquisition

Warner rejects Netflix and accepts Paramount’s more aggressive cash-focused bid.

✔ Why it might happen

— Paramount’s political ties may help shape regulatory tone.

This is a key factor:

- Larry Ellison (founder of Oracle), one of the wealthiest and most influential tech leaders in America, is deeply aligned with the Republican establishment and is a major supporter and ally of President Trump.

- His son, David Ellison, leads Skydance and is spearheading the Paramount bid.

- Jared Kushner — Trump’s son-in-law — is financially involved through Affinity Partners, backing the Skydance/Paramount deal.

- These relationships give Paramount unusual visibility, access, and influence as the deal lands in a regulatory environment where Trump has stated he will be “personally involved.”

Because of this constellation of relationships, Warner’s board may see Paramount as the politically smoother path, reducing the risk of a prolonged DOJ review.

Additional reasons it might happen:

- Paramount’s offer is dramatically higher than Netflix’s.

- A “studio acquiring a studio” may appear less threatening than Netflix absorbing HBO + Warner IP.

- Paramount is aggressively pursuing strategic scale after its own restructuring.

✖ What might stop it

- Paramount’s balance sheet is weaker; financing is fragile.

- Regulators may fear excessive studio consolidation.

- Warner may prefer Netflix’s reliable cash flow, strong execution, and global scale.

📈 Impact on NFLX

Short term: Bullish (Netflix avoids risk, leverage, political battles)

Long term: Neutral to slightly bearish (Netflix misses out on iconic IP, competitor strengthens)

Scenario 3: Netflix Walks Away Voluntarily

Netflix decides not to counterbid or refuses burdensome regulatory conditions.

✔ Why it might happen

- Netflix historically avoids mega-acquisitions; this is out of character.

- Paramount’s higher bid may make matching it economically unjustifiable.

- Regulatory conditions could erase Netflix’s strategic upside.

✖ What might stop it

- Surrendering Warner IP to a competitor weakens Netflix long-term.

- Investors may want the strategic moat gained from owning HBO + Warner.

📈 Impact on NFLX

Short term: Bullish (clean exit, no debt, clearer focus)

Long term: Neutral-to-bearish (misses generation-defining IP)

Scenario 4:⃣ Deal Blocked by Regulators / White House

The DOJ, influenced by political sentiment or industry pressure, halts the Netflix–Warner deal.

✔ Why it might happen

- Trump openly questioned Netflix’s market share and influence.

- Writers Guild and creative industries argue the merger reduces content diversity.

- Regulators may see Netflix + HBO as too dominant in premium storytelling.

✖ What might stop it

- Netflix can argue competition includes YouTube, Amazon, Disney+, and cable TV.

- Courts may view blocking as politically influenced.

- Regulators often prefer concession-based fixes over blocking mergers outright.

📈 Impact on NFLX

Short term: Bearish (breakup fee + headline shock)

Long term: Neutral (core business intact; shifts strategy)

Scenario 5: Warner Cancels the Entire Sale Process

Warner pauses or terminates the sale due to complexity or political uncertainty.

✔ Why it might happen

- Regulatory or political climate becomes unmanageable.

- Financing concerns make both bids volatile.

- Warner reconsiders internal restructuring.

✖ What might stop it

- Warner needs scale urgently due to debt and declining cable revenue.

- Two active bidders make cancellation financially unattractive.

- Shareholder backlash would be fierce.

📈 Impact on NFLX

Short term: Bullish (clean relief, Netflix avoids all risk)

Long term: Neutral (industry dynamics unchanged)

Scenario 6: Netflix Gets a CLEAN Approval

Deal passes with little resistance.

✔ Why it might happen

- Regulators frame the market broadly, including YouTube and Amazon.

- Industry sentiment swings in favour of consolidation.

- Political pressure eases unexpectedly.

✖ What might stop it

- Current antitrust environment is aggressive.

- Trump’s negative comments are a headwind.

- Labour unions strongly oppose Netflix’s dominance.

📈 Impact on NFLX

Short term: Strongly bullish

Long term: Extremely bullish — Netflix becomes the unmatched global content superpower

🎯 Investor Takeaways

- The acquisition is not secure — multiple paths remain open.

- Paramount’s bid is strengthened by powerful political ties that influence perception, access, and regulatory tone.

- Most scenarios produce short-term upside for Netflix, except a full regulatory block.

- Long-term outcomes depend on whether Netflix eventually controls Warner’s franchise IP.

- Expect direction within 3–5 weeks, with markets reacting instantly once clarity emerges.

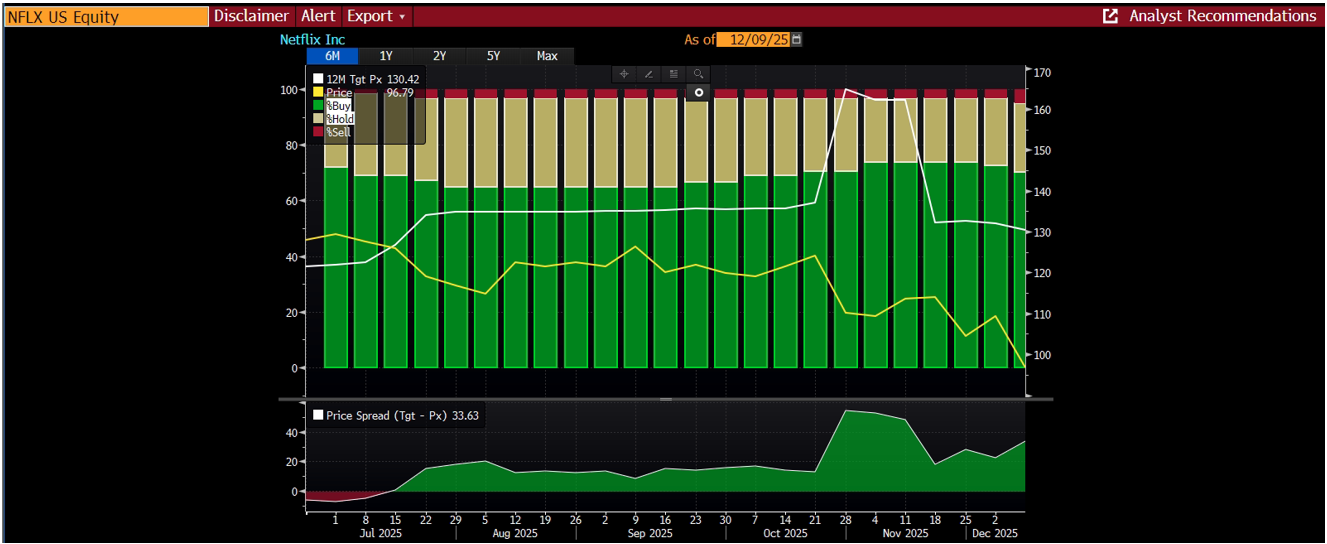

Latest Market Reactions

News reports (New York Post) indicate that Netflix currently has an edge in the Warner Bros Discovery auction, ahead of Paramount Skydance and Comcast.

But instead of lifting the stock, this development adds to the overhang because:

- A transaction north of US$70B would be expensive

- The deal risks becoming a major distraction for Netflix

- Media mega-mergers historically deliver 混合结果

- Investors worry about integration challenges, political resistance, and regulatory delays

At the same time, a combination could deepen Netflix’s content moat and reinforce its position as the most dominant global streaming platform.

Still, analysts widely agree that Warner is not a must-have acquisition for Netflix’s success — it is a potential accelerant, not a requirement.

Trade Netflix and other US stocks on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0