Phillip Nova高级投资分析师林知霖先生

ST Engineering (SGX: S63) has grown 85.84% YTD, outperforming even the highly popular local banks like DBS (SGX: D05), UOB (SGX: U11) and OCBC (SGX: 039) which gained 10.75%, 0.77% and 1.98% respectively. In this Market Trends article, we will deep dive into the business lines operated by ST Engineering, learn more about the key drivers for the growth and assess if prices could trace higher in the latter half of 2025.

Summary of Singapore Technologies Engineering (SGX: S63) Performance YTD

SGD 8.66 (+85.84% YTD)

52-Week High: SGD 8.94

Business Lines Operated by ST Engineering

ST Engineering (STE) operates in 3 key segments:

1. Defence & Public Security (44% of FY24 Revenue): Includes cybersecurity

2. Commercial Aerospace (39%): Aircraft Maintenance, Repair, and Overhaul (MRO) services

3. Urban Solutions & Satcom (17%): Smart city solutions, rail projects, utilities, satellite communication (satcom)

Key Drivers for Prices for ST Engineering

STE has been by far the best performing stock in the STI this year, with order backlog at a record S$29.8b, and S$7.3b expected to be delivered for the rest of the year. 23% of revenue is generated from the US, 19% from Europe, and 51% from Asia.

1Q25 revenue rose 8% YoY, driven by 18% growth in the defence segment. We expect STE to be able to sustain its current pace of revenue growth given that:

- The stock has been driven by a global increase in defence spending, especially in Europe, as NATO members have agreed to raise annual defence spending from current floor of 2% of GDP to 5% of GDP by 2035

- Defence-segment growth will be boosted by rising demand for AI-enabled command and controls, as well as cybersecurity infrastructure

- Singapore also raised its defence spending by 12% for the current FY

- Commercial aerospace should also see increased demand for MRO, as more airlines expand their networks and more aircrafts return to service – driving maintenance needs

- The company observed immaterial financial impact from tariffs

最近的发展

More recently, ST Engineering secured some new contracts which could potentially keep its prices elevated in 2H2025. Below, please find a summary of the key contracts secured by the rapidly rising home grown company:

- STE secured contracts worth about S$4.7B in 2Q25

- S$1.5b , commercial aerospace

- S$1.5b , defence and public security

- S$1.7b , urban solutions and satcom (Satellite communications)

- 5-year MRO (Maintenance, Repair, Overhaul) agreement with Air Cairo and a contract with Saudi Arabia’s Saudi Telecom Company (STC) to upgrade and expand its ground network to advance satellite communication services

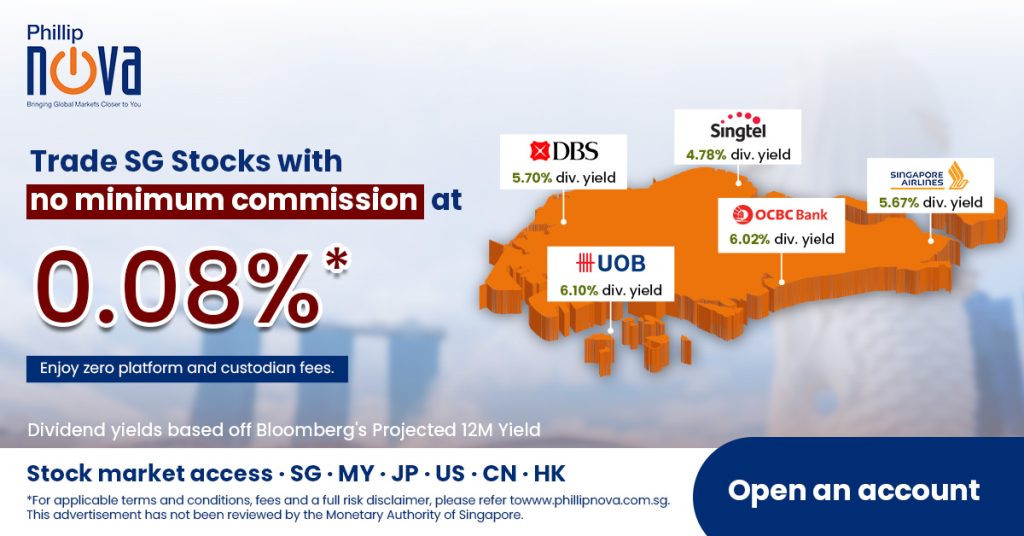

Trade ST Engineering and other Singapore stocks (with no minimum commission) on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0