After two years of aggressive global rate hikes, the tide may be turning. Inflationary pressures are easing, and central banks – including the US Federal Reserve – have signalled that rate cuts could be on the horizon. For Singapore‑listed Real Estate Investment Trusts (S‑REITs), this shift may mark the start of a recovery after a prolonged period of valuation pressure.

Historically, a lower interest‑rate environment supports REITs by:

- Reducing borrowing costs, which can boost distributable income over time

- Lifting asset valuations as property yields look more attractive relative to bonds

- Encouraging portfolio reallocation into yield‑generating assets as fixed income returns soften

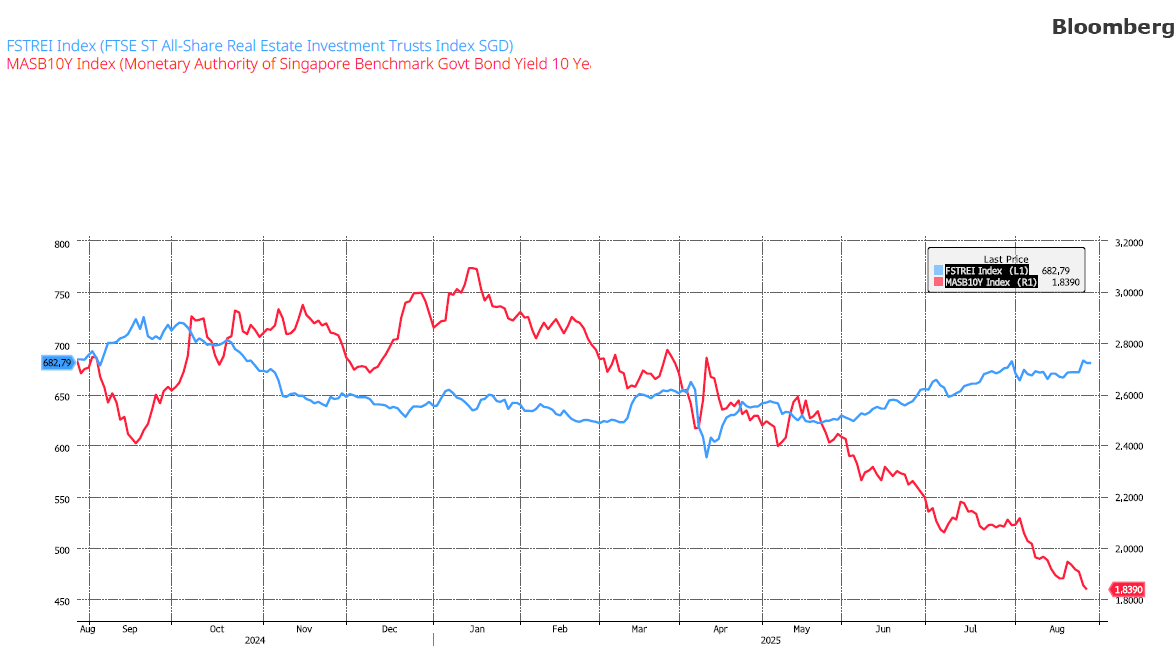

A Look at the Historical Link Between the FTSE ST REITs Index and the Singapore 10‑Year Government Bond Yield

Over the past year, the FTSE ST REITs Index has generally moved opposite to the Singapore 10-Year Government Bond yield, consistent with the sector’s yield-spread dynamics. Falling bond yields widen spreads, boosting REITs’ relative appeal, while rising yields narrow spreads and weigh on valuations. With major central banks signalling rate cuts into late-2025, a sustained decline in yields could potentially widen spreads further and support renewed demand for S-REITs.

Why S‑REITs Merit Renewed Attention

S‑REITs provide access to professionally managed portfolios of income‑producing properties – from retail malls and Grade A offices to logistics hubs, data centers, and healthcare facilities.

Key advantages:

- Accessibility: Invest from just 100 units, versus the large capital outlay for physical property

- Income visibility: Many distribute ≥90% of taxable income, with recent sector yields typically in the 4.5–7.5% range

- Liquidity: SGX‑listed units can be bought or sold quickly compared with direct property transactions

- Diversification: Across sectors and geographies, with many holding overseas assets

- Tax efficiency: Distributions to individuals are tax‑exempt in Singapore

While a rate‑cut cycle can lift the entire S‑REIT sector, those with structural advantages – from essential‑service assets to long‑term inflation‑linked leases – are positioned to outperform. Below are four names with defensive moats that have historically delivered resilient cash flows through varying rate environments.

Four REITs with Defensive Moats That Should Be In Your Watchlist

CapitaLand Integrated Commercial Trust (SGX: C38U)

- Singapore’s largest integrated retail and CBD office landlord, with 21 local assets and selective holdings in Germany and Australia.

- Its CBD presence includes Raffles City, Asia Square Tower 2, and CapitaSpring – placing it among the sector’s largest Grade A office owners.

- Suburban and downtown retail assets such as Plaza Singapura and Junction 8 are directly linked to MRT stations, a competitive advantage that is hard to replicate.

Frasers Centrepoint Trust (SGX: J69U)

- Pure‑play suburban retail REIT with 100% Singapore exposure, anchored by high‑traffic malls including Causeway Point, Northpoint City, and Tampines 1.

- Limited land supply in suburban hubs curbs competing developments, supporting rental resilience.

- Reported +9% rental reversions in 1H FY2025 and portfolio occupancy of 99.9% (excluding Hougang Mall under AEI).

Keppel DC REIT (SGX: AJBU)

- Asia’s first pure‑play data center REIT, with assets in Singapore, Asia‑Pacific, and Europe.

- Operates in a sector with high technical barriers to entry and structural demand from cloud, AI, and digitalization trends.

- Singapore’s 2019–2022 moratorium on new DCs has kept supply tight.

- Reported 95.8% portfolio occupancy (Jun 2025), 6.9‑year WALE, and ~51% positive rental reversion in 1H 2025 from a major renewal.

Parkway Life REIT (SGX: C2PU)

- Owns three of Singapore’s eight private hospitals – Gleneagles, Mount Elizabeth Orchard, and Mount Elizabeth Novena – all operated by IHH Healthcare.

- Backed by 20.4‑year master leases with built‑in rent escalations.

- Expanded into Japan and France nursing homes in 2024; 1H 2025 net property income rose 8.0% YoY.

The Case for a 2025–2026 Re‑Rating

As rates ease, three potential catalysts stand out:

- Earnings uplift: Lower refinancing costs could improve distributable income, although benefits may be gradual for REITs with longer debt maturities.

- Valuation expansion: Potential cap‑rate compression may lift property values and NAV/unit.

- Capital flows: Wider yield spreads over government bonds could attract both institutional and retail inflows.

底线: With rate cuts back in play, S‑REITs could be entering a more favorable cycle. Those with strong competitive moats, resilient demand drivers, and visible cash flows are well‑placed to benefit.

Trade S-REITs with Phillip Nova

Position yourself for the next cycle by trading S-REITs on Phillip Nova 2.0 – enjoy 0.08% commission with no minimum fee when you trade Singapore-listed REITs on our platform. Click here to open an account now!

Or take a view via Singapore stocks, or explore opportunities in ETFs via the Phillip MSCI Singapore Daily (2X) Leveraged ETF (LSS) or the

Phillip MSCI Singapore Daily (-1X) Inverse ETF (SSS) now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0