(Data accurate as of 10 Nov 2025)

As of 10 Nov Close, in terms of Total Return: DBS (+30.05% YTD), OCBC (+15.65% YTD), UOB (-1.16% YTD).

DBS has outperformed peers YTD.

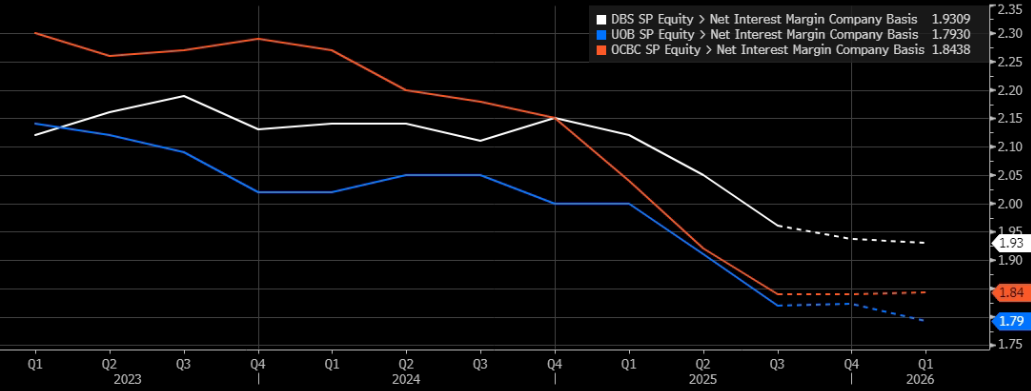

- 3 banks all reported Net Interest Margin (NIM) compression, guided for more if Fed cuts again.

- 这 3M SORA is currently at 1.26%, down from 3% at the end of 2024. This is equivalent to seven 25bps rate cuts by the Fed.

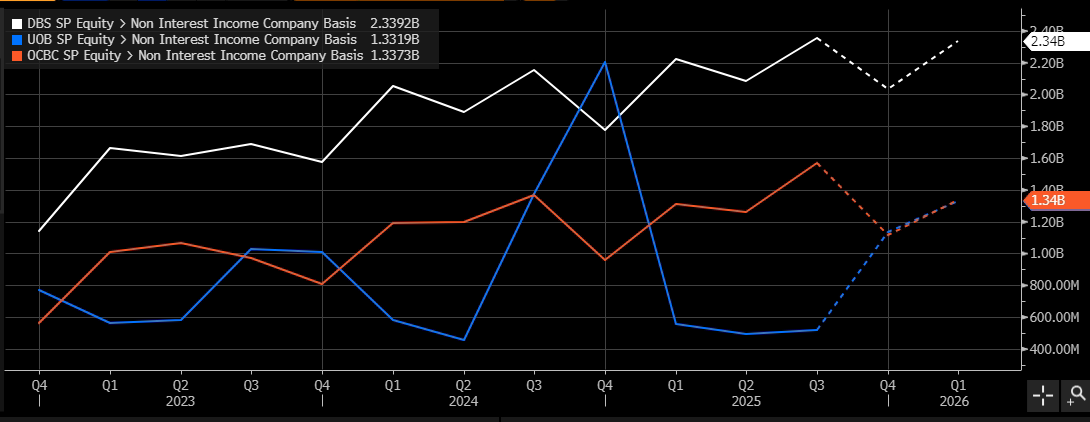

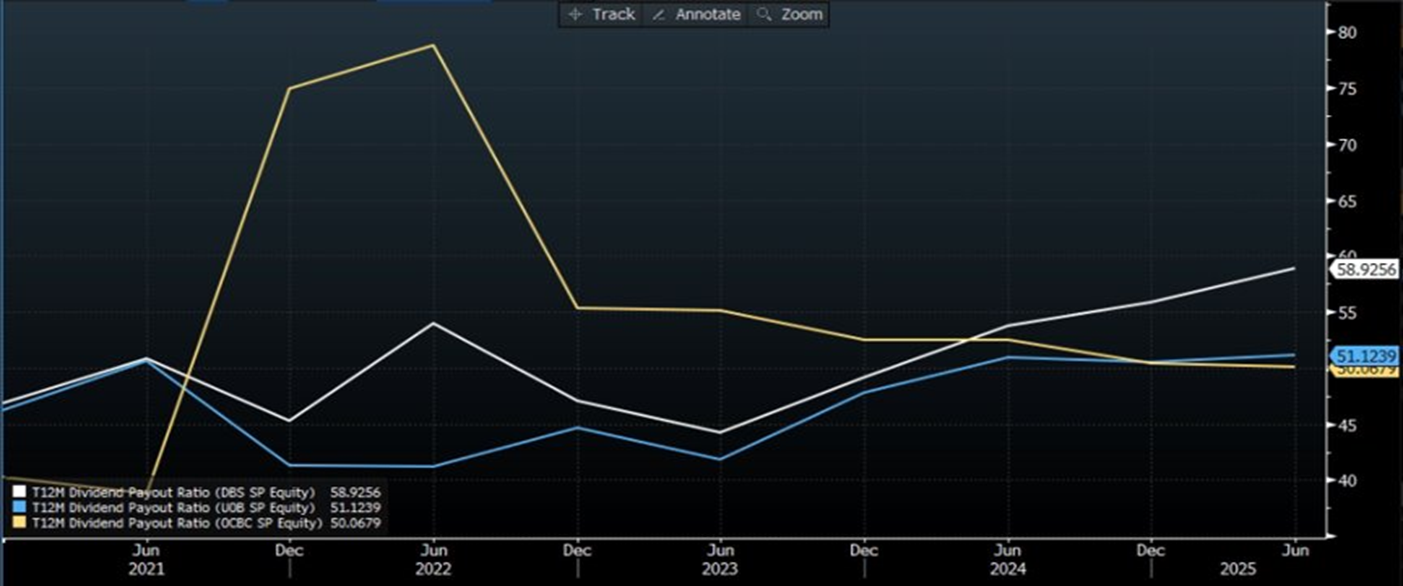

- Banks with lower non-interest income growth and lower payouts underperformed.

Earnings Summary

星展银行

DBS posted higher-than-expected profits, supported by sustained momentum in its wealth management business due to strong money flows from the wealthy; and robust trading income due to strong equity markets.

- Net Income down 2.4% to S$2.95b, but above S$2.79b est

- Interim DPS S$0.60

- Net interest income S$3.56b, -6.3% YoY, missed S$3.62 est

- Non-interest income S$2.35b, beat est S$2.18b, mainly driven by increased income from commission and fees

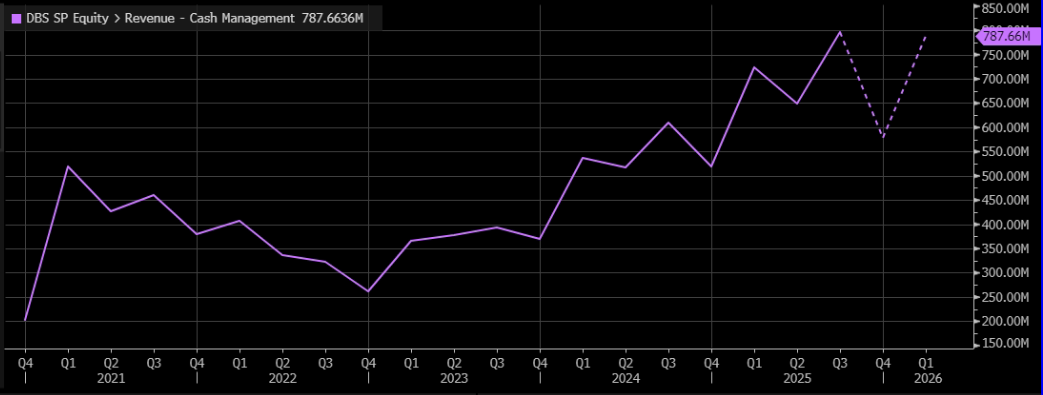

- Net fee and commission income S$1.36b, +22% YoY, above est S$1.20b, mainly driven by wealth management

- Wealth management fees S$796m, +31% YoY, above est S$690.4m

Markets trading income S$439m, +33% YoY - NIM 1.96%, matching est of 1.96%

- DBS forecasts 2026 Net profit and Net interest income to be “slightly” below 2025 levels.

- Forecasts mid-teens growth in wealth mgt in 2026

大华银行

UOB missed 3Q profit estimates as the lender set aside S$615m to guard against commercial real estate headwinds in the US and Greater China.

- Net income of S$443m, well below est S$1.35b

- Net interest income S$2.27b, match est S$2.27, down by 8%

- Non-interest income at S$1.1b, down from S$1.4b on higher card rewards expenses + lower trading and investment income

- Net fee income S$615m, below est S$674.3m and down by -2.4% YoY

- NIM of 1.82%, down from 2.05% in 3Q24 and below est of 1.84%

- Additional S$615m set aside in pre-emptive General allowance, General Allowance Coverage at 1% of Performing Loans.

- UOB forecasted low single-digit loan growth in 2026, FY26 NIM of 1.75%-1.80%, but “high single to double digit” fee growth in 2026

- No change in dividend policy, final dividend payment for 2025 will not be impacted by the general allowance set aside

华侨银行

Joining DBS in benefitting from strong money flows from the wealthy, 华侨银行 beat estimates as strong wealth management fees helped offset a decline in interest income.

- Net Income S$1.98b vs est S$1.78b

- Net interest income S$2.22b vs est S$2.27b [missed est by -1.98%]

- NIM 1.84% vs est 1.88%

- Non-interest Income S$1.57b vs est S$1.31b, [beat est by +19.35%] driven by:

- Wealth management S$376m vs est S$278.4m [beat est by 35%]

- Trading income S$683m vs est S$434.1m [beat est by 57%]

Analyst View

- Singapore loan growth has continued to rise (Sep25: +6.8%) as interest rates come down. This is broadly beneficial for banks.

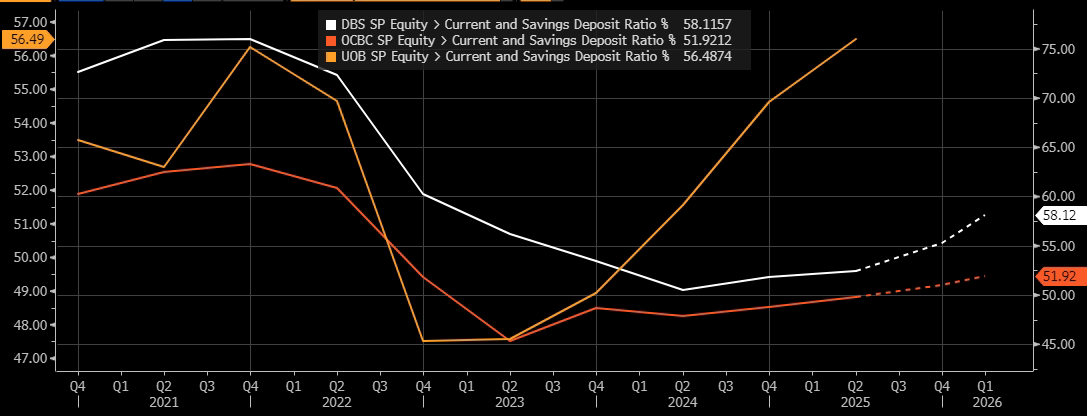

- CASA ratio to total deposits rose across the 3 major banks, a tailwind for the banks as it indicates lower funding costs.

- NEUTRAL on SG banks as a continued decline in the 3M SORA should result in continued NIM compression, affecting both Net Interest Income (NII) and overall earnings.

- Furthermore, lower FD rates should help lower funding costs and ease NIM compression.

- Lower interest rates is also resulting in an increase in the the volume of lending (loan growth).

- We expect the increase in loan volume and fee income (e.g., from wealth management) to mitigate the impact on overall profitability.

Trade SG Stocks and ETFs with Phillip Nova

Amid a backdrop of a rising Singapore index, enjoy 0.08% commission with no minimum fee when you trade Singapore stocks on our platform. Click here to open an account now!

Or click 立即开户。 to learn more about our special promotion for the Phillip-Nova MSCI Singapore Daily L&I Products now.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0