Phillip Nova高级投资分析师林知霖先生

这 Nikkei 225 Index Futures — available in standard, mini, and micro contracts — track Japan’s flagship equity benchmark, the Nikkei 225 Index. Its top three weighted components are Advantest (semiconductor testing), SoftBank (investment holding), and Fast Retailing (Uniqlo).

As of 5 November, 14:30 SGT, the Nikkei 225 stood at 50,212, down by -2.50% on the day but still up +25.86% YTD in JPY terms after a strong +16.63% rally in October. The selloff was likely driven by an overnight slump in US Tech, with AMD dropping in postmarket trading following a mixed earnings report. This came alongside warnings from Wall Street CEOs, including Morgan Stanley’s Ted Pick and Goldman Sachs’ David Solomon, whom said that investors should brace for an equity drawdown of more than 10% in the next 10-12 months, and that such a correction is a normal feature of market cycles. Capital Group’s Mike Gitlin also mentioned that corporate earnings are strong but valuations are challenging. Furthermore, Michael Burry, the fund manager known for The Big Short, disclosed bearish puts on Palantir and Nvidia In post-market trading,

Additionally, the Nikkei 225’s sensitivity to the Tech sector like exacerbated the decline, as the tech sector makes up ~55% of the Nikkei 225’s weight, far higher than the S&P 500’s 36%, with semiconductor firms like Tokyo Electron 和 Advantest leading.

Nevertheless, absent a sustained drawdown, we expect the Nikkei 225 to maintain its uptrend towards the end of the year.

New Leadership and Policy Direction

The rally in the past month coincided with Sanae Takaichi’s appointment as Japan’s first female Prime Minister and LDP president. A long-time supporter of Abenomics, Takaichi is expected to maintain expansionary fiscal and monetary policies, a stance viewed positively by markets.

Takaichi has emphasized pro-growth policies, dismissing the idea of raising interest rates and highlighting the benefits of a weaker yen for exporters. This rhetoric contributed to yen depreciation and bolstered export-related stocks in October.

She has also unveiled plans for new economic measures to address cost-of-living pressures, supported by a supplementary budget to be finalized by year-end. Additionally, a long-term growth strategy is set for release by mid-2026.

Catalysts Behind the Rally

Cooling U.S.–China trade tensions, moderating inflation, and a new auto tariff deal between Japan and the U.S. — which includes a $550B U.S. investment pledge — have all boosted sentiment toward Japan’s export-heavy sectors.

Meanwhile, the Tokyo Stock Exchange and the government are pushing firms to enhance shareholder returns through buybacks, improved dividends, and even creative initiatives like providing gifts to shareholders to nurture loyalty. Rising shareholder activism is also pressuring corporate leaders to deploy idle cash more efficiently.

Outlook for the Nikkei 225

While systemic risks have narrowed, policy missteps in the U.S. or renewed geopolitical tensions could still unsettle markets in 2026. Corporate earnings will likely take centre stage, leading to greater performance dispersion among stocks.

With the Nikkei at record highs, much of the optimism may already be reflected in prices, leaving limited room for error. Key events to watch include Japan’s year-end budget announcement 和 Takaichi’s mid-2026 growth strategy, both potential catalysts for the next leg higher.

Currency volatility remains a risk: a stronger yen could weigh on exporters. BOJ Governor Kazuo Ueda has not ruled out rate hikes even amid fiscal stimulus planning. Toyota estimates that each ¥1 rise in the USD/JPY rate cuts its operating profit by ¥50B.

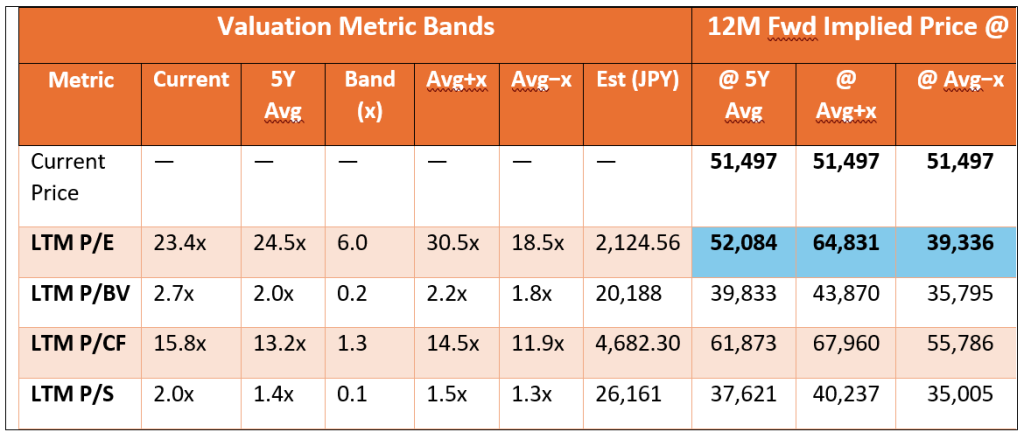

From a valuation perspective, the Nikkei remains appealing — trading at a ~21% discount to the S&P 500 (TTM P/E 23.4x vs 28.5x) and just below its own 5-year average of 24.5x. Structural supports such as AI-related growth, corporate governance reforms, cross-holding unwinds, NISA inflows, 和 active shareholder engagement continue to underpin Japan’s long-term equity story.

技术面

On the Osaka Nikkei 225 Mini Futures, the contract has rallied from its April low of ¥30,650, maintaining strong upward momentum above the 200% extension level at ¥51,120 prior to today’s tech-led selloff.

The 50-day moving average remains above the 200-day average, confirming a bullish setup. The 14-day RSI at 60 suggests the market is approaching, but not yet in, overbought territory.

We expect a potential re-test of support at ¥48,704 (176.4% extension), with a deeper floor at ¥47,210.23 (161.8% extension).

A strongly received economic package could, however, lift the index back toward the ¥51,120 level (200% extension) and potentially even higher at ¥53,535 (223.6% extension). However, we remain cautious of asymmetric downside risk in the short term, as markets appear more vulnerable to a larger drawdown than to a rebound that would re-test all-time highs. We believe this asymmetric risk warrants more conservative stop losses in trading setups.

Take a view on the Japan market via the Nikkei 225 Futures now. Open an account now!

Or Trade Japanese stocks & ETFs at 0.08% (with no minimum fee) now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0