碎股是什么意思?

零碎股,又称碎股,代表着公司股票 完整股份的一部分。 投资者无需购买苹果、特斯拉或亚马逊等价格可能高达数百甚至数千美元的完整股票,而是可以选择购买零 碎股, 以更低的金额满足其预算需求。 例如,如果 XYZ 公司的一股交易价格为 1000 美元,而您投资 100 美元,您将拥有 0.1 股,即该股票中与您投资额相对应的份额。

通过辉立 Nova, 您只需低至 1 美元的预算即可购买零碎股!

交易美股零碎股的优势

-

1. 更低的入场门槛

对于新手或年轻投资者而言,这是进入市场、建立信心并在无需大量前期投资的情况下实现投资组合多元化的绝佳方式。 -

2. 以有限资金实现多元化

投资者可以用 500 美元的资金购买五家不同行业的美国公司的零碎股,而不是只能购买一两只价格较高的科技股。

-

3. 定期定额投资(DCA)

零碎股与 DCA 策略完美契合。在 DCA 策略中,投资者定期投资固定金额,而无需考虑股票价格(例如,每月 100 美元)。 -

4. 投资高价股

零碎股让每个人都能以可接受的价格直接投资优质股票,包括更容易投资 Meta、苹果、亚马逊、奈飞和谷歌等科技巨头!

佣金与交易所费用

| 交易所 | 佣金(线上交易) | 佣金(电话下单交易) |

| 美国(纽约证券交易所、美国证券交易所、纳斯达克) | 碎股 (新推出) 每笔固定收费 USD0.38 |

0.18%(每笔订单最低18美元) |

| 整股 0.01%(每笔最低 USD3.88) |

| 交易所 | 类型 | 收费 | 收费人 |

| 美国 (纽约证券交易所、美国证券交易所、纳斯达克) | SEC 会员费(仅限销售) | 交易金额的 0.0% (自 2025 年 5 月 13 日起生效) | SEC(美国证券交易委员会) |

| 交易活动费(仅限卖出) | USD0.000195 per share, max USD9.79 (w.e.f 1 Jan 2026) | FINRA(金融业监管局) | |

| ADR(美国存托凭证)费用 | 每股 0.01 美元 – 0.05 美元 | DTCC(美国存托信托与清算公司) |

注意:ADR 费用由 DTCC 收取。这些是定期收取的服务费,以补偿代理银行提供的托管服务。 ADR 招股说明书中应提供有关任何此类费用的更多详细信息。

| 交换 | 通讯(在线) | 通讯(电话接入) |

| 美国(纽约证券交易所、美国证券交易所、纳斯达克) | 碎股 (新推出) 每笔固定收费 USD0.38 |

0.18%(每单最低消费18美元) |

| 整股 0.01%(每笔订单最低3.88美元) |

| 交易所 | 类型 | 收费 |

| 我们 (NYSE, AMEX, NSDQ) | SEC 会员费(仅限卖出)由美国证券交易委员会 (SEC) 收取 | 交易金额的 0.0% (eff. 13 May 2025) |

| FINRA(金融业监管局)收取的交易活动费(仅限卖出) | USD 0.000195 per share, max USD 9.79 | |

| ADR Fee by DTCC (U.S. Depository Trust & Clearing Corporation) | 每股 0.01 – 0.05 美元 |

注意:ADR 费用由 DTCC 收取。这些是定期收取的服务费,以补偿代理银行提供的托管服务。 ADR 招股说明书中应提供有关任何此类费用的更多详细信息。

使用我们的多资产交易平台

NOVA 套件

通过 Phillip Nova 2.0, 与 NOVA 合作。

享受由 TradingView 提供支持的图表,使用内置市场深度工具进行有效交易,并体验我们低廉的外汇差价。只需专注于交易,无需支付托管费和平台费。

由 TradingView 提供支持的图表

- 获取超过 100 种技术指标

低价差

- 从 31 个外汇对中进行选择,点差低至 0.8 点

设置价格提醒

- 不错过任何交易机会

超过 11,000 种全球产品的真正多资产交易

- 交易股票、ETF、CFDs、外汇、期货、期权与贵金属

市场深度

- 轻松查看市场上特定价格的流动性和交易

支持浅色与深色模式

- 使用您喜欢的模式获得更好的焦点

How to trade fractional shares by notional amount on NOVA?

Fractional Trading & Amount-based Order FAQs

A fractional share is a portion of a whole share. For example, holding 1.5 shares means you own one full share and half a share—this 0.5 portion is considered a fractional share.

An amount-based order allows you to specify the total dollar amount you wish to trade instead of entering the number of shares. This is useful when you prefer to invest a fixed amount—such as USD 50—without having to calculate the exact share quantity.

For securities that do not support fractional share trading, the entered amount is used to calculate and submit the maximum whole-share quantity.

Only Day Market and Day Limit orders are supported. Sell orders are not permitted for amount-based orders.

Securities that support fractional share trading

Market Orders

- The amount entered is submitted directly as an amount-based order.

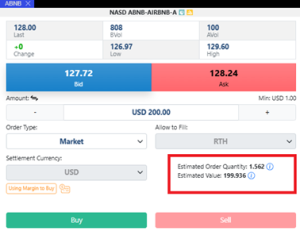

Market Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 using a Market order to buy.

- The executed amount may return as USD 199.936, depending on the fill quantity and execution price.

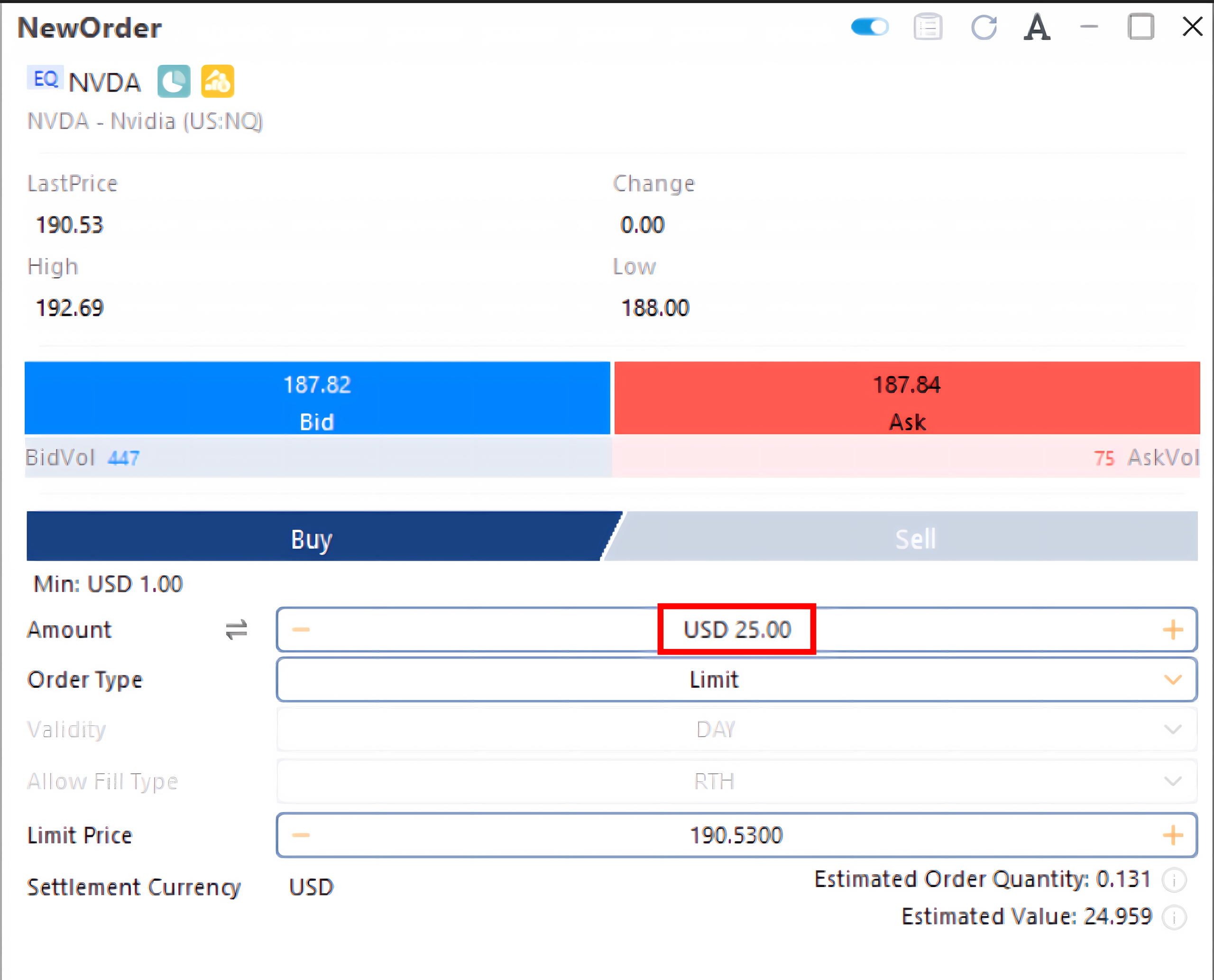

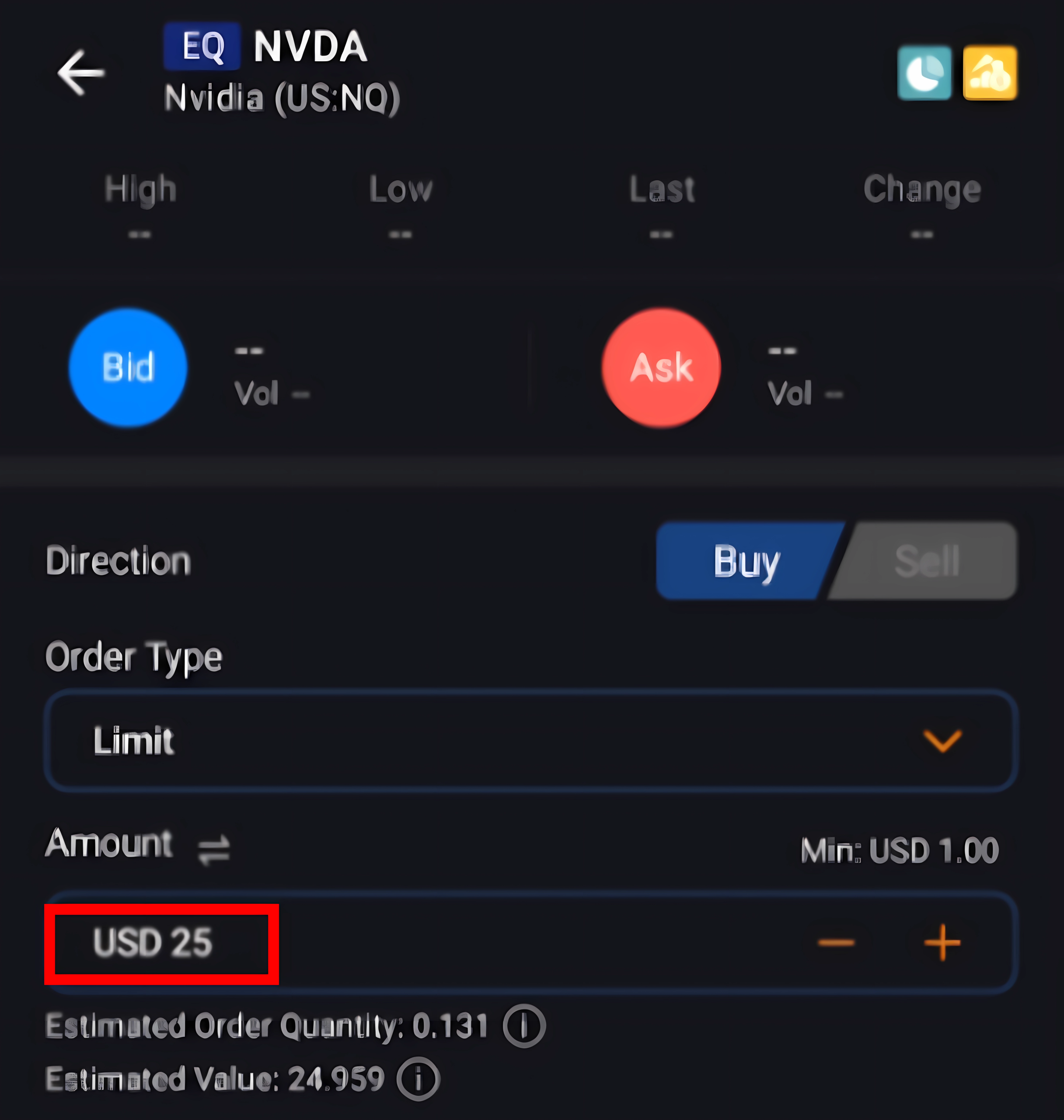

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

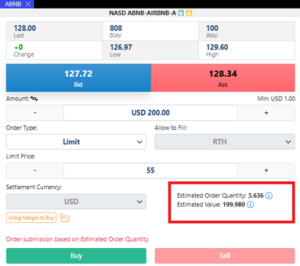

Limit Orders

- Nova converts the entered amount into an estimated share quantity, rounded down to three decimal places, and submits the order using this calculated quantity at the specified limit price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

Limit Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 with a Limit Price of USD 55 to buy.

- Nova calculates an order quantity of 3.636 shares (USD 200 ÷ USD 55).

- This quantity will be submitted at the limit price, resulting in an executed amount of up to USD 199.98 (3.636 × USD 55), but never more than USD 200.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

Securities that do not support fractional share trading

For these securities, the amount-based order field functions as a calculation aid. Nova converts the entered amount into the maximum whole-share quantity based on the applicable price and submits the order using this calculated quantity.

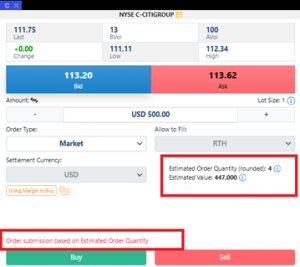

Market Orders

- Nova calculates the order quantity using the entered amount divided by the prevailing market price.

- The quantity is rounded down to the nearest whole share.

- The Estimated Order Value shown on Nova is based on the calculated quantity × prevailing market price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

Market Order Example

- Company XYZ is not eligible for fractional share trading. The Last Traded Price is USD 40.

- You place an amount-based order of USD 100 as a Market Order to buy

- Nova calculates and sends an order for 2 shares (USD 100 ÷ USD 40) to be purchased at the market

- The executed amount may differ from the estimated value depending on the final execution price.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value

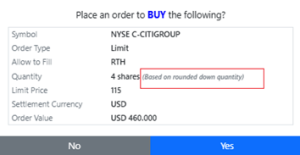

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

Limit Orders

- Nova calculates the order quantity based on the entered amount divided by the Limit Price.

- The quantity is then rounded down to the nearest whole share.

- The resulting Actual Order Value is the calculated quantity × Limit Price.

- You will be prompted that order submissions are based on the Actual (rounded down) Order Quantity

Limit Order Example

- Company XYZ is not eligible for fractional share trading

- You place an amount-based order of USD 100 with a Limit Price of USD 30.

- Nova calculates and sends an order for 3 shares (USD 100 ÷ USD 30) to be purchased at USD 30

- The order submitted is 3 shares, with an executed amount of up to USD 90.

In the Order Ticket, you will be informed of the Actual (rounded) Order Quantity and its Estimated Value.

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

You are advised to always review the derived share quantity before submitting the order.

How NOVA Determines the Prevailing Market Price

US securities:

- Uses the Last Traded Price from the Regular Trading Session.

- If unavailable, the Closing Price is used.

Non-US securities:

- Uses the Last Traded Price.

- If unavailable, the Closing Price is used.

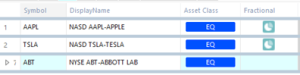

- Nova Web/Desktop: Look for the “Fractional” column in the Watchlist or on the Order Ticket. A pie symbol indicates eligibility.

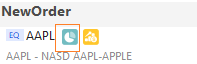

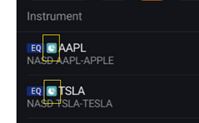

- Mobile app: The pie symbol appears next to the symbol code in the Watchlist and on the Order Ticket

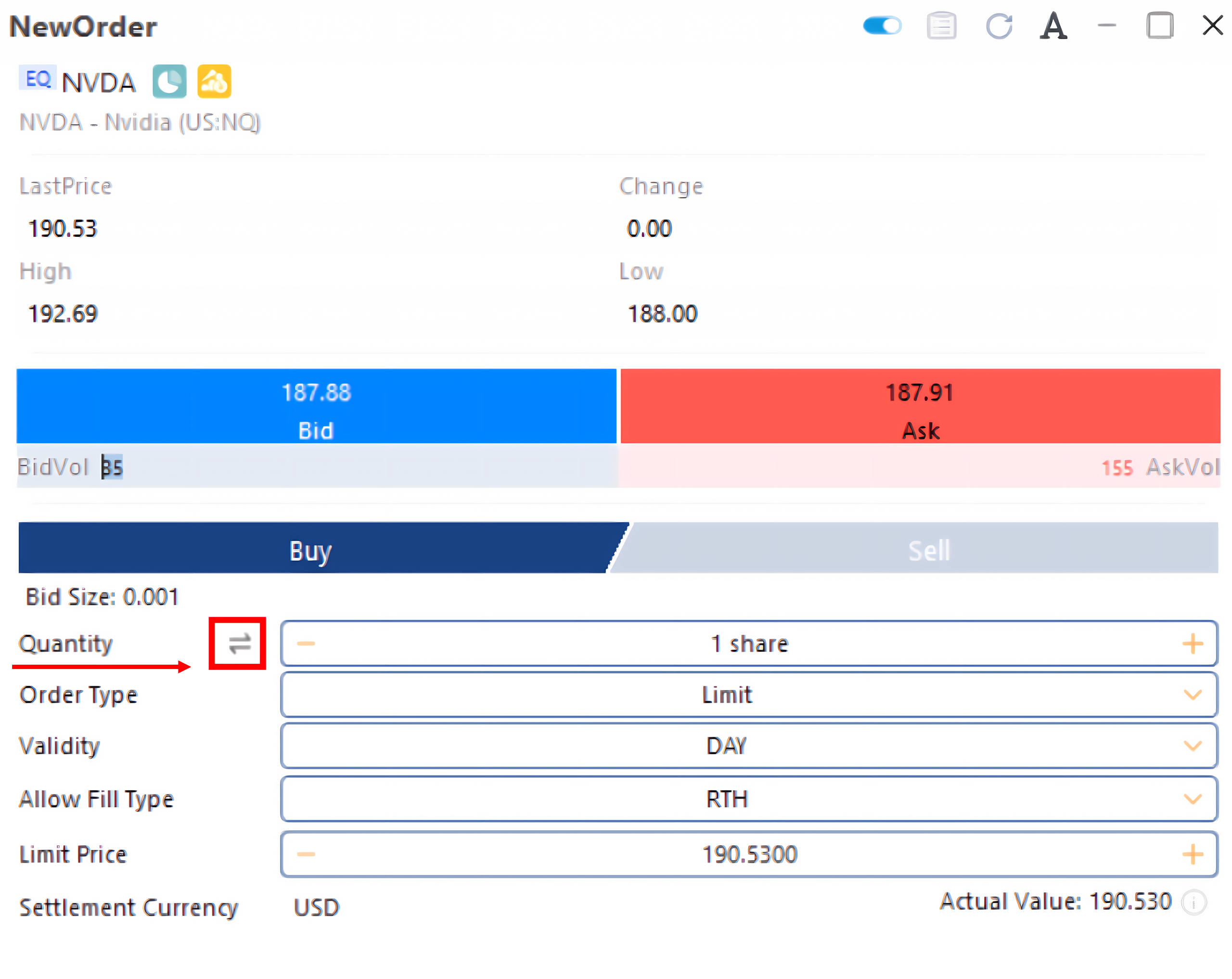

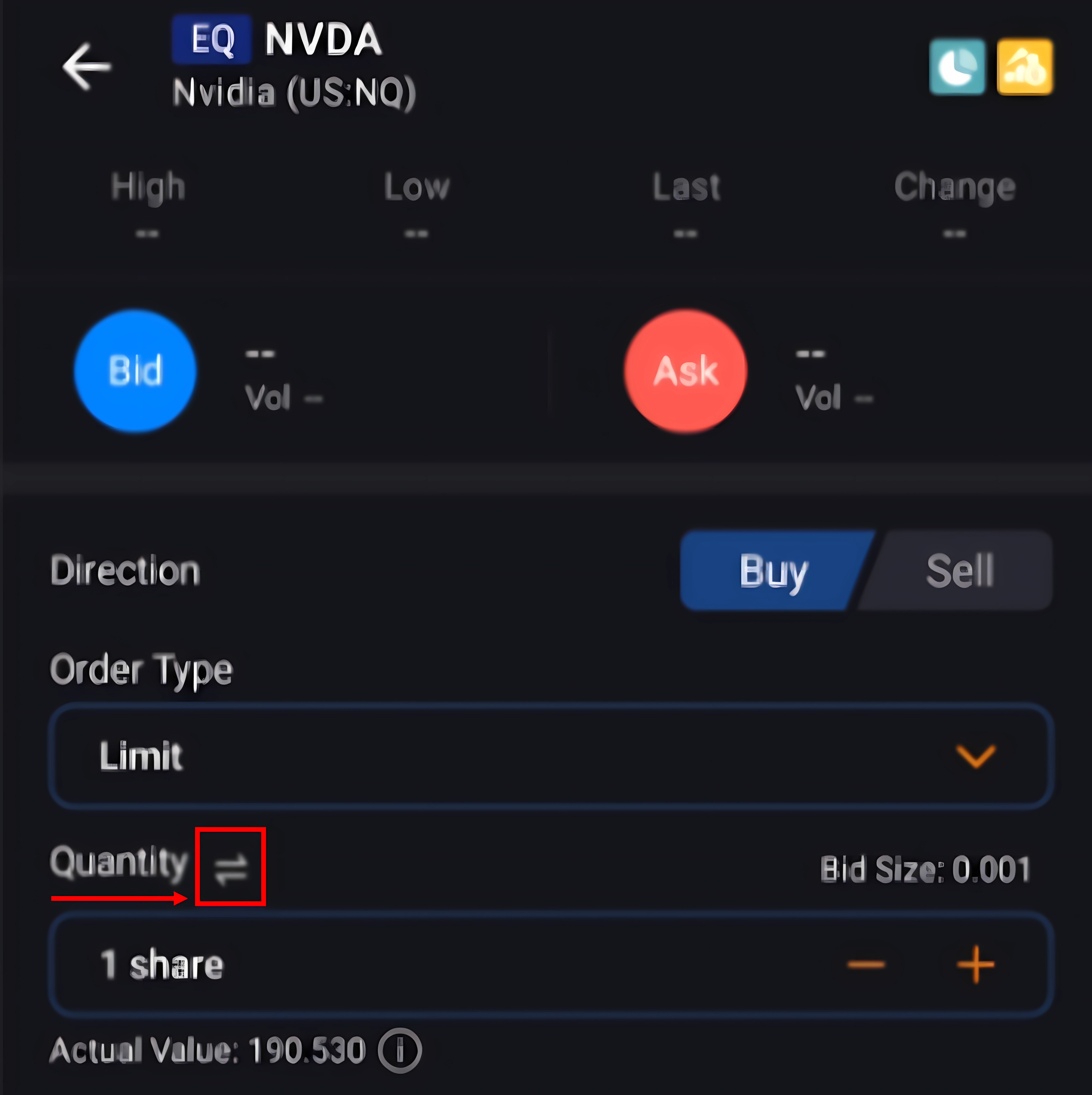

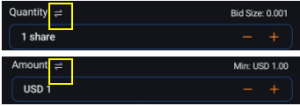

Amount-based orders can only be placed via the Order Ticket. Clicking the toggle icon will switch order placement in “Quantity” to “Amount”. Click the same button again to revert to order placement in “Quantity”.

- Nova Web/Desktop:

- Mobile app:

Fractional share trading and amount-based orders are currently supported only for U.S. exchanges, including NYSE, Nasdaq, and AMEX.

However, not all securities listed on these exchanges are eligible. Only securities that support fractional share trading can be executed as true amount-based orders.

Fractional share orders are routed to a separate execution venue. When you place an order that includes both whole and fractional shares, your order is submitted as a single order but may be executed in parts—whole share(s) and fractional shares separately—potentially at different prices.

You must opt in and agree to our Fractional Shares Trading Terms and Conditions.

You can opt in via:

- Nova Web/Desktop: Settings > Trade > Slide “On” for Opt-in to Fractional Shares Trading

- Order Ticket: “Opt-in to Fractional Shares” (visible only for eligible securities) > Click “Agree” on Fractional Shares Trading Terms and Conditions

Orders with fractional shares are only supported during regular trading hours.

Trading fractional shares involves risks similar to trading whole shares, including market volatility and security-specific risks. However, fractional shares may also be subject to limited liquidity and execution constraints.

For full details, please refer to our Fractional Shares Trading Disclosure Statement.

Yes, if a stock pays dividends, you will receive a pro-rated dividend based on the fractional amount you hold.

Shareholder rights and/or participation in stock splits, mergers, or other mandatory corporate actions is subjected to the discretion of the Company and/or issuer.

No, fractional shares do not carry voting rights.

No, fractional shares cannot be transferred in or out of your account.

Commission for amount-based orders are based on quantity executed.

Please refer to our website 立即开户。 for the latest commission structure and applicable fees.

关于我们

Phillip Nova(前称辉立期货)成立于 1983 年,是 PhillipCapital Group 的成员,也是新加坡交易所衍生品交易公司 (SGX-DT) 的创始清算成员之一。从那以后,我们已经发展成为该地区股票、差价合约、外汇、全球期货和商品交易的顶级经纪商之一。集团在 21 家全球交易所拥有清算会员资格,包括 APEX、BMD、CME Group 交易所、DGCX、HKEX、ICDX、ICE Singapore、JPX Group 交易所、NSE、TFEX、TOCOM 和 SGX。