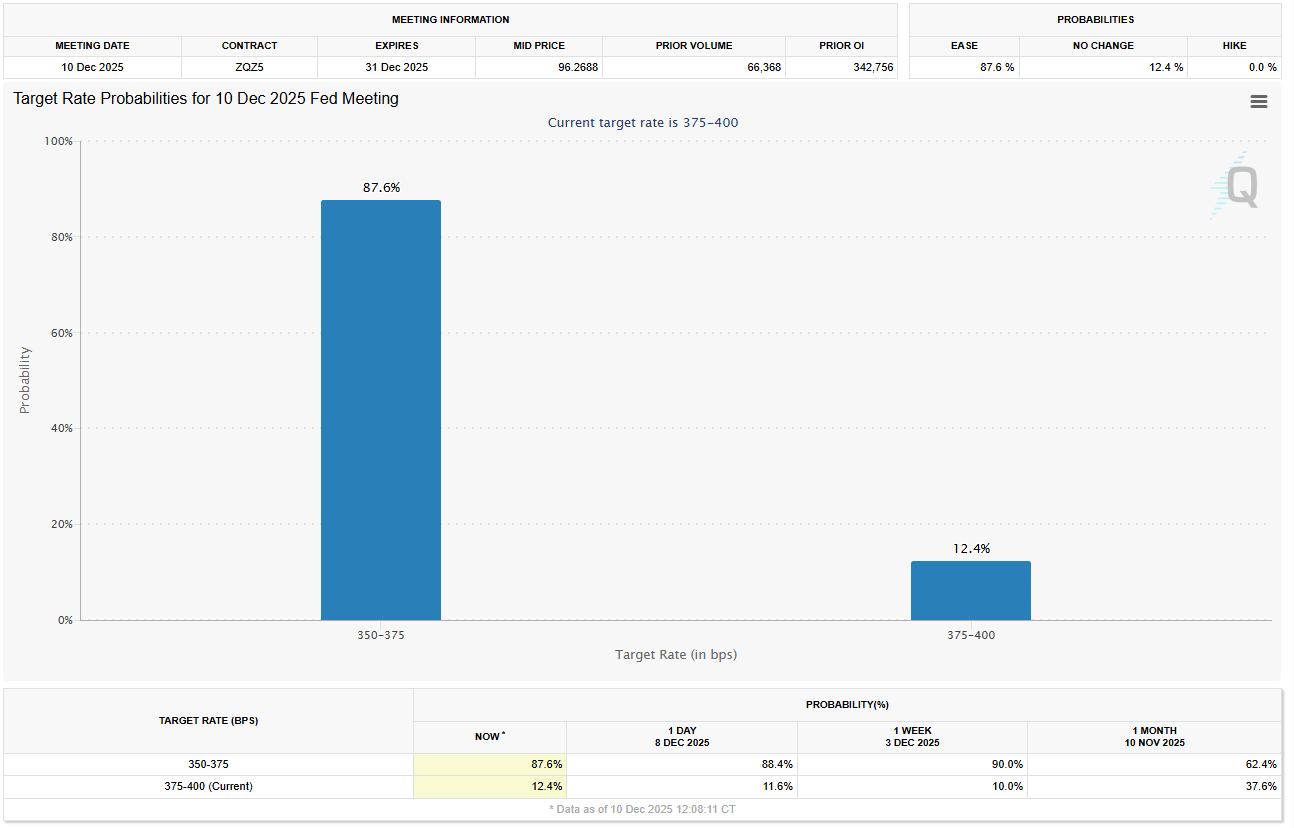

Silver prices surged to an all-time high this week, breaking above $60 an ounce on the spot market for the first time. The milestone comes just ahead of the widely expected US Federal Reserve interest rate cut (next FOMC meeting on 11 Dec 2025 at 3am SGT), adding fresh momentum to a rally that has already captivated global investors.

The surge follows months of heightened demand for precious metals, with gold also advancing after hitting record highs earlier this year amid concerns over US tariffs and a cloudier global economic outlook. Both metals are drawing inflows as traders reposition for a lower-rate environment and a softer US dollar—conditions that typically boost non-yielding safe-haven assets.

When interest rates fall, holding cash or short-term bonds becomes less attractive, prompting investors to shift into stores of value like silver. The metal is also enjoying a spillover boost, as some investors priced out of gold turn to more affordable alternatives.

A Supply Crunch Meets Tech-Driven Demand

Beyond financial flows, the silver rally is being fuelled by a deeper structural imbalance: demand from the technology and renewable energy industries is outpacing supply.

Silver’s unique properties—especially its superior electrical conductivity—make it indispensable for electric vehicles, solar panels, and high-tech manufacturing. This industrial hunger has helped more than double silver’s value this year, outperforming even gold.

But boosting supply is no simple task. Most silver is produced as a by-product of mining other metals, such as copper, lead, and gold. That means production cannot easily ramp up in response to rising prices.

Tariff Concerns Add Fuel to the Fire

Adding to the supply strain are market jitters over potential US tariffs on silver as part of President Donald Trump’s trade policies. The prospect of new trade restrictions has sent manufacturers scrambling to secure inventory, further tightening global availability.

Analysts expect silver prices to stay elevated in the months ahead as supply constraints, policy uncertainty, and shifting investor sentiment continue to support the precious metal.

Take a view on Gold and Silver Micro Futures now. 立即了解详情!

Or take a view on precious metals via ETFs, mining Stocks and Forex now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0