By Danish Lim, Investment Analyst for Phillip Nova

The FTSE China A50 Index (+6.06% YTD) has outperformed both the broader CSI 300 (+2.23%) and the Hang Seng Index (-0.77%) as of 24 April.

It is a free float market cap-weighted index that tracks the 50 largest A-Share securities, adjusted for foreign ownership limits. A-shares are securities of companies incorporated in mainland China that trade on the Shanghai or Shenzhen stock exchanges. The top 3 largest holdings include domestic players such as “national liquor” Kweichow Moutai, EV battery giant CATL, and China Merchants bank.

Most A-share companies generate the bulk of their revenue domestically, making the index relatively less sensitive to ongoing geopolitical/trade tensions and global macroeconomic trends.

Historically, Chinese fiscal and monetary policy have been out of sync with their western counterparts. While the US and EU have been tightening monetary policy to curb inflationary pressures since 2022, China has been on an easing path in order to stimulate its economy and fuel domestic demand.

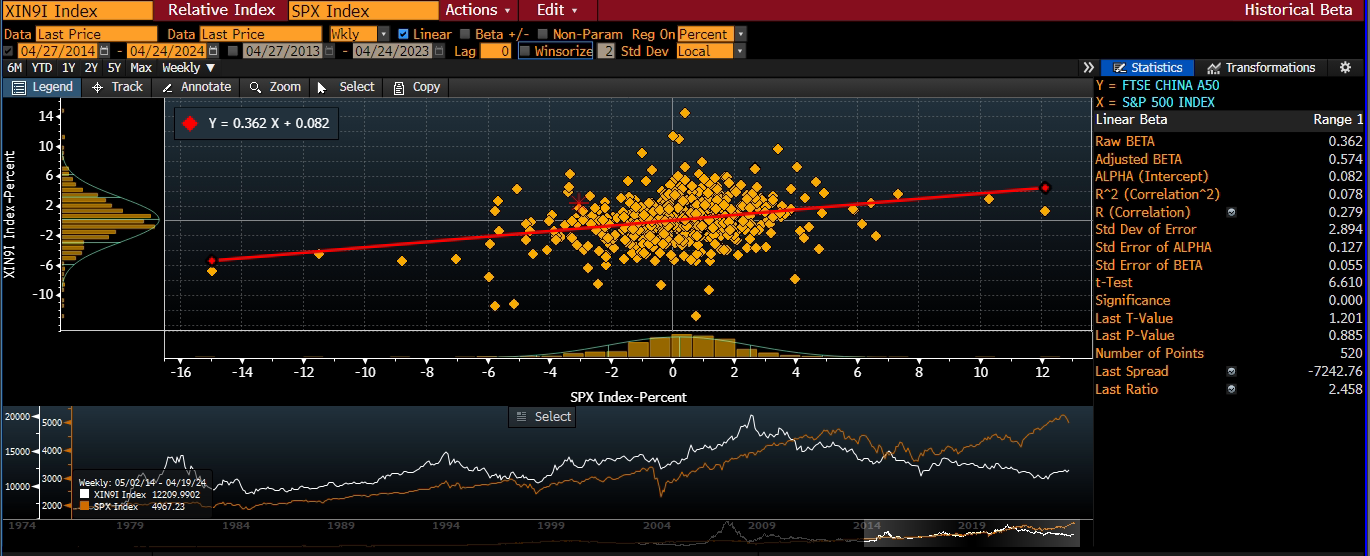

This divergence in monetary and fiscal policies has resulted in a low correlation between the FTSE China A50 Index and other markets, as seen below. This provides valuable diversification benefits for investors.

China’s economic transition from export-driven “high-speed growth” to a consumption-driven “high-quality growth” presents exciting investment opportunities.

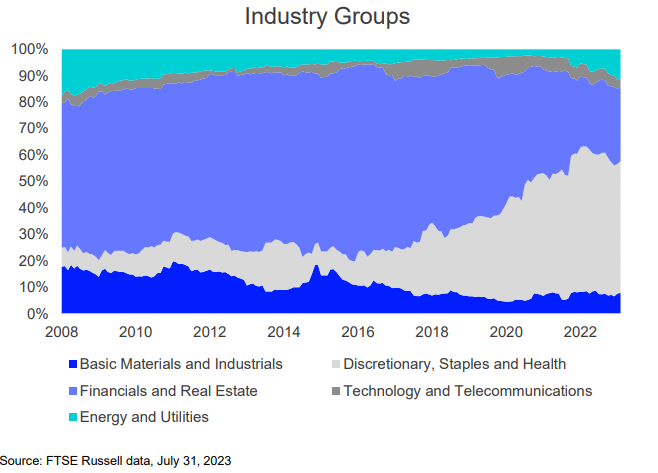

When examining the Index’s sector weightage, as seen below, we observe that the Financial & Real Estate industry were by far the largest industries in 2008, with its weight exceeding 50%.

In recent years, the industry distribution has become more diversified. At the end of 2022, we see that the Discretionary, Staples, and Health industry had replaced Financials & Real Estate as the largest industry in the A50 Index.

This shift can be attributed to China’s ongoing transition towards a consumption-driven economy; as well as a growing middle-income population which may have helped spur consumer spending. The middle class group is expected to reach 400 million by 2030, driving consumer spending to around US$6.4 trillion annually.

The Healthcare and Renewable Energy industries are also seeing increased weightage:

- A gradually aging population and increased healthcare spending is supporting the growth of biotech and pharmaceuticals in China.

- A focus on “decarbonisation” and a push to become carbon neutral has supported renewable energy, electric vehicles, and EV batteries.

We think the changes in the A50 Index weightage is parallel to China’s ongoing economic reforms – reflecting a greater focus towards industries such as consumption, healthcare and decarbonisation.

Launched in 2006, the SGX FTSE China A50 Index Futures is based on the underlying FTSE China A50 Index. It provides an efficient and liquid way for investors to gain exposure to China’s A-shares market. The contract has seen deep institutional and retail trading, with daily traded value of US$5bn and open interest of US$11bn as of 29 March 2024.

A key feature of the contract is its extended trading session – as it is available for trading even during onshore Mainland and Hong Kong holidays.

In summary, China’s onshore equity market offers excellent diversification benefits due to its low correlation to global peers. In contrast to offshore markets, onshore A-shares are less subject to regulatory interventions. The FTSE China A50 Index can be viewed as a value-oriented, lower-beta play on Chinese equity markets.

Flash Deal of the Month – Trade the SGX FTSE China A50 Index Futures at Only 50 cents*

Click here to learn more about our SGX FTSE China A50 Index Futures Promotion.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova