By Eric Lee, Account Manager, Phillip Nova

The Trade Desk (TTD) operates a programmatic advertising platform. Instead of advertisers simply buying ad space on a particular social media platform or on a specific mobile app, it uses high-speed computers and sophisticated algorithms to match the ads with the right viewers.

It offers advertisers the opportunity on multiple platforms which include social media, connected TV, audio, mobile, etc. Trade Desk has a global presence and is present in major business hubs like Europe, Asia and the United States.

The Trade Desk works with ad agencies to empower them to realise the full impact of their campaigns and optimise them in real time. As the company says, it is “an enabler, not a disruptor”.

Using their industry-leading AI Koa™ which analyses data from across the internet, to provide insights and recommendations match the ads with the right viewers, in the most efficient and effective way. With Koa™, its customers can tap into data analysis from over 600 billion queries each day, more than 100x the volume of global search.

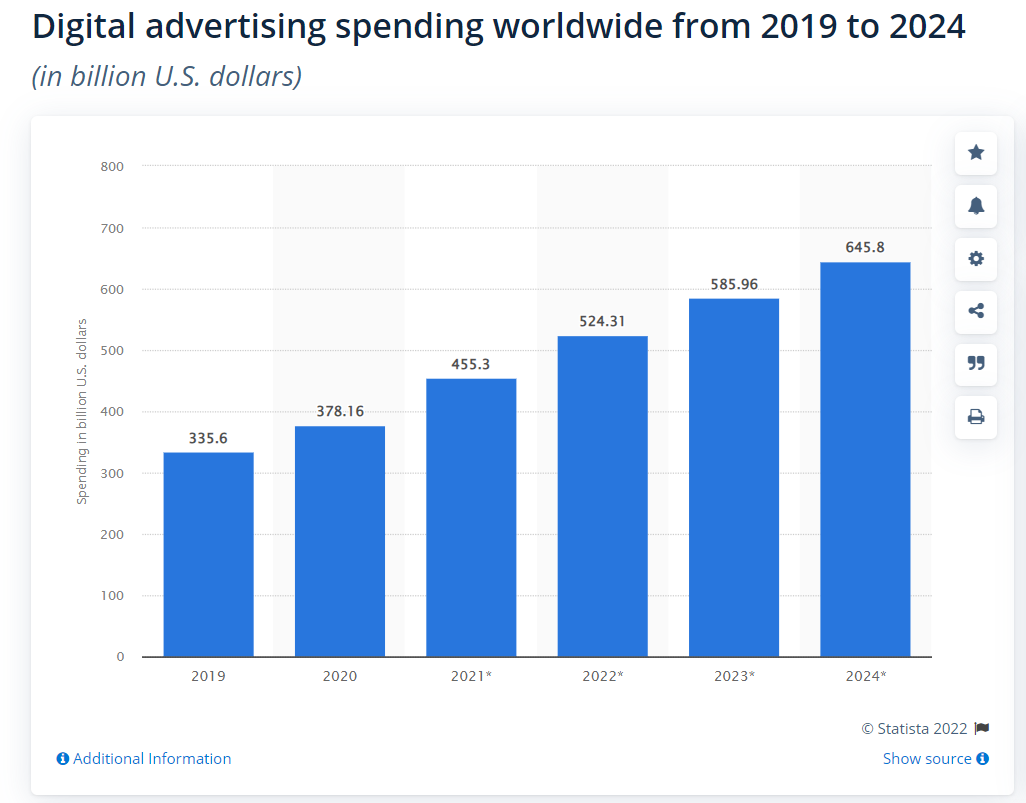

According to report by GlobeNewswire, the total addressable market (T.A.M.) of the advertising industry is expected to cross $1 trillion over the coming decade. The Trade Desk generated revenue of $836 million Fiscal Year 2020, which helps illustrate its huge potential for growth in the coming years.

Source: Statista

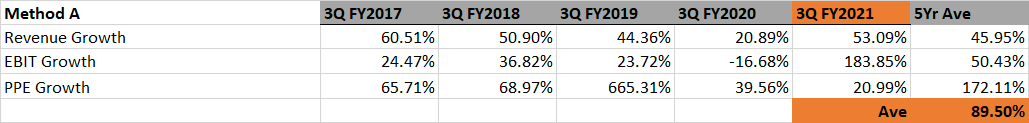

Source: Koyfin.com

Growth in share value of the stock is loosely correlated with its growth in its revenue, earnings and assets. Over the past 5 years, these 3 financial metrics grew by 89% per year on average, which explains its 85% p.a. CAGR in its market value. From its Trailing-Twelve-Month result and the enormous T.A.M. that is still projected to grow by 15% per year over the next decade, we can extrapolate and project the company’s future growth.

Source: Bloomberg

Since its debut, the 250-days Moving Average has been acting as a support for the share price of The Trade Desk (TTD). Since 2017 whenever the share price was trading at or below this 250-day moving average, as indicated by the KST indicator, it offered investors with a good entry point to the stock.

Eric Lee is an Account Manager with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.