By Danish Lim, Investment Analyst, Phillip Nova

The recent twist in the Bank of Japan’s (BoJ) Yield Curve Control (YCC) policy has set financial markets abuzz. Thinking of how to capitalise on the dollar’s strength against the Yen? Read our analyst view now.

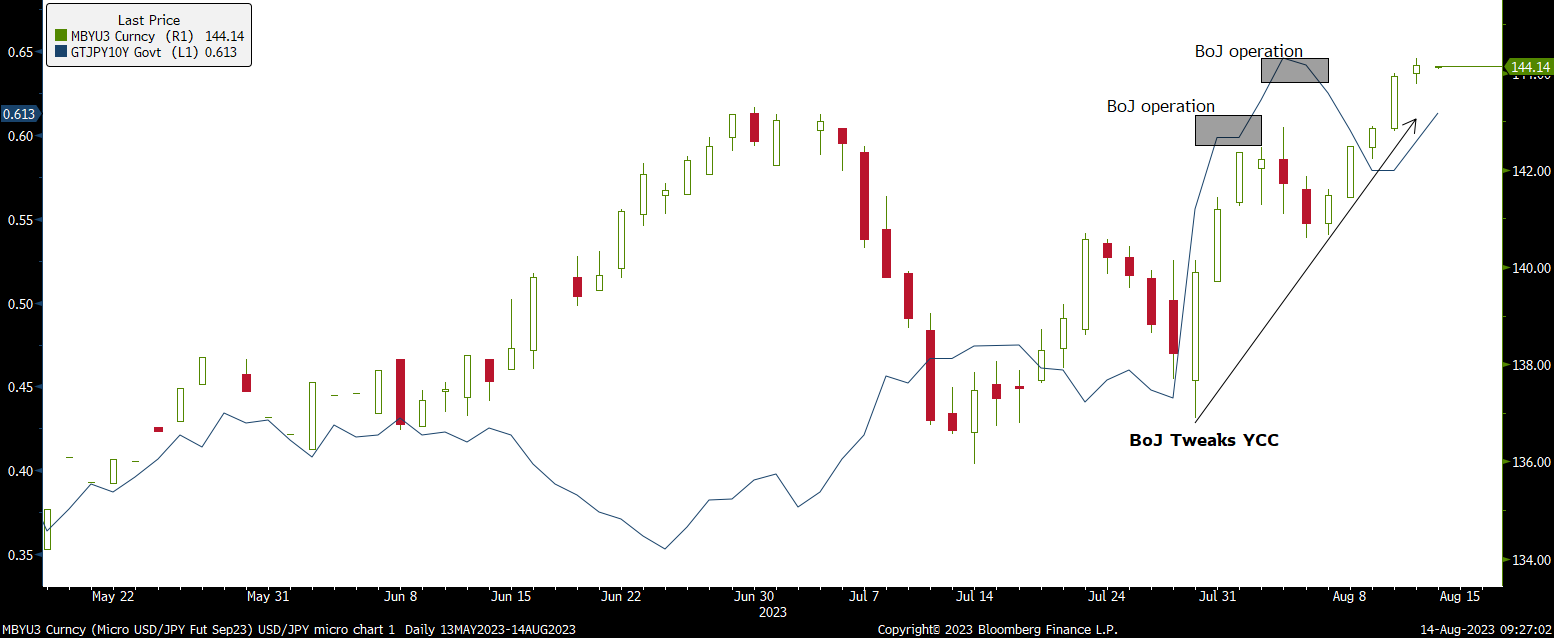

The Bank of Japan (BoJ) surprised markets on July 28 by tweaking its Yield Curve Control (YCC) policy, allowing 10Y JGB yields to move above the previous cap of 0.5%. Although this can be seen as a signal towards policy normalisation, markets remained skeptical, with the Micro USD/JPY Futures contract for September delivery now at levels higher than that before the announcement, trading near the closely watched 145 level which saw BoJ intervention last year.

10Y JGB yields surged well above 0.5% following the YCC tweak. However, the BoJ intervened via 2 unscheduled buying operations to slow the spike in yields, thereby weakening the Yen.

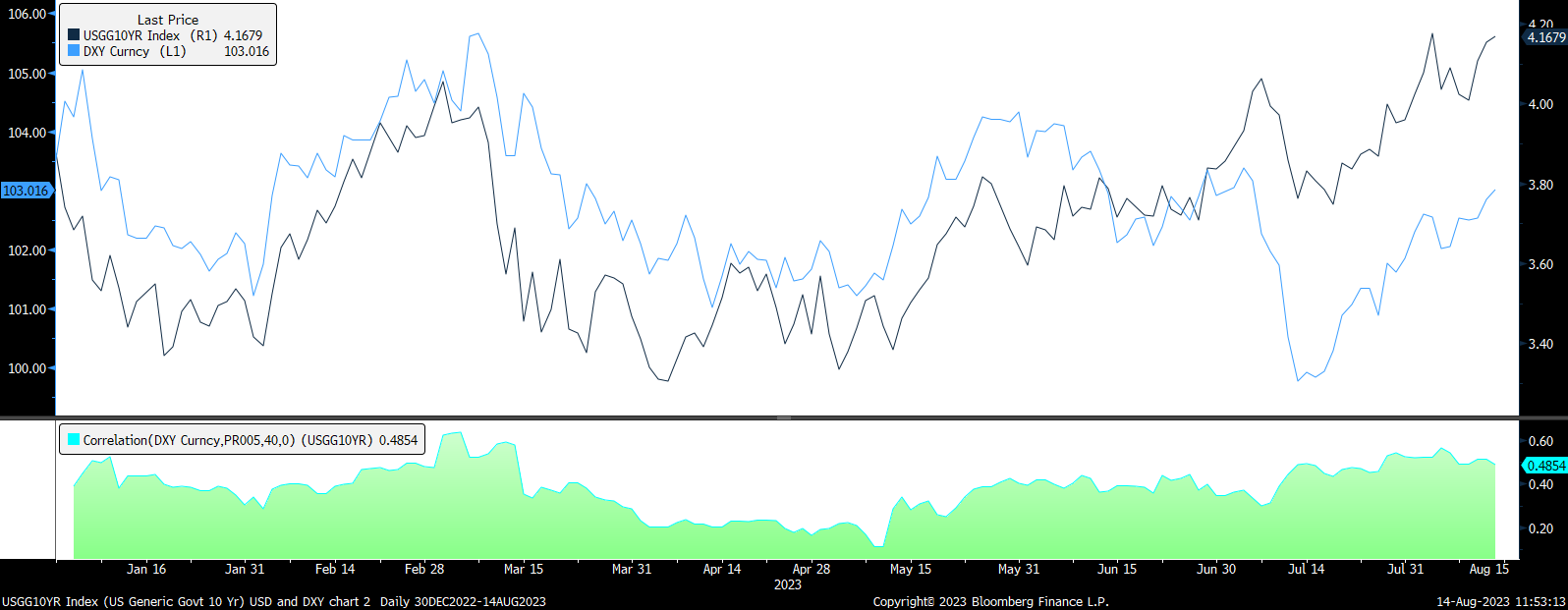

On the other hand, US 10Y Treasury yields climbed above 4%, driven by Fitch’s credit downgrade of the US, and a massive issuance of Treasury notes to fund the US’s budget deficit. This has strengthened USD, which has historically shown a positive correlation with 10Y Treasury yields as seen below. A resilient US economy has also supported USD.

4 Considerations in Forming Our View

We expect the Yen to remain weak against the USD for the remainder of the year, supporting USD/JPY long positions. Our view depends on several variables and how they evolve moving forward will have huge implications on the trajectory of USD/JPY:

1.Interest Rate Differential & Carry Trades

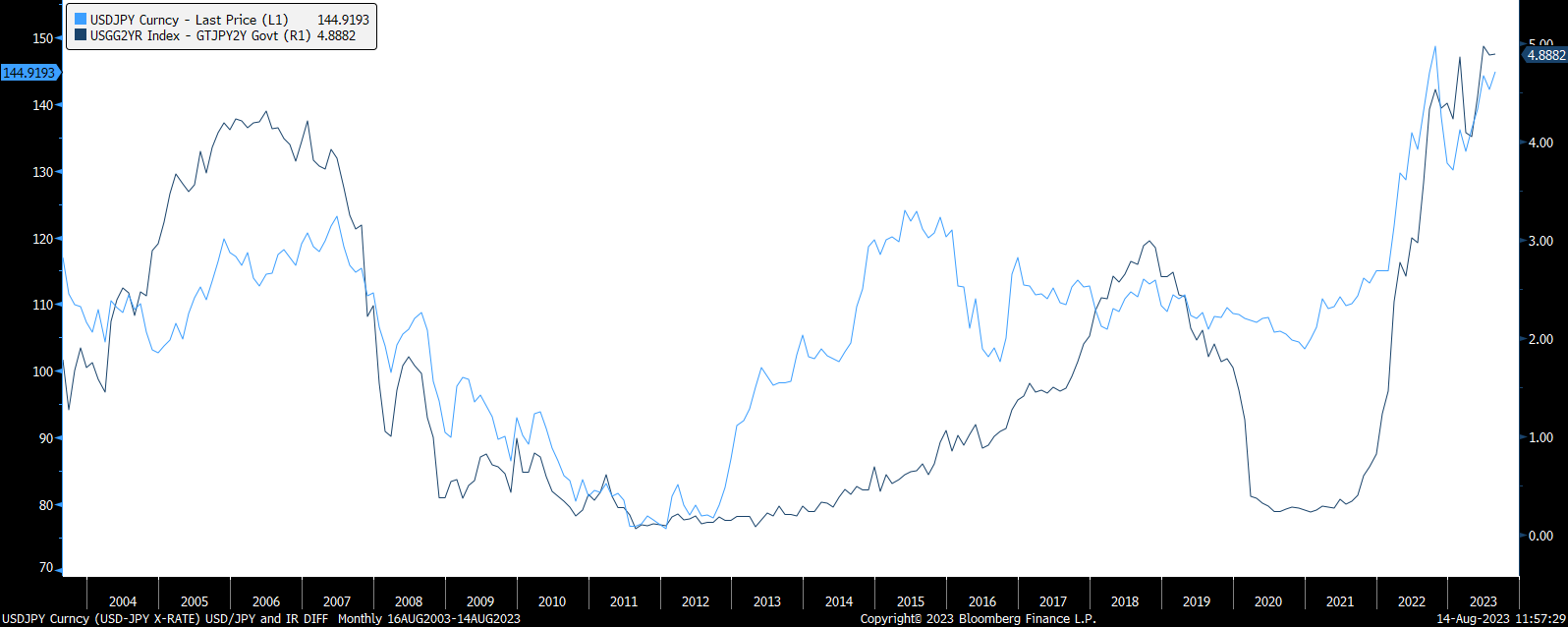

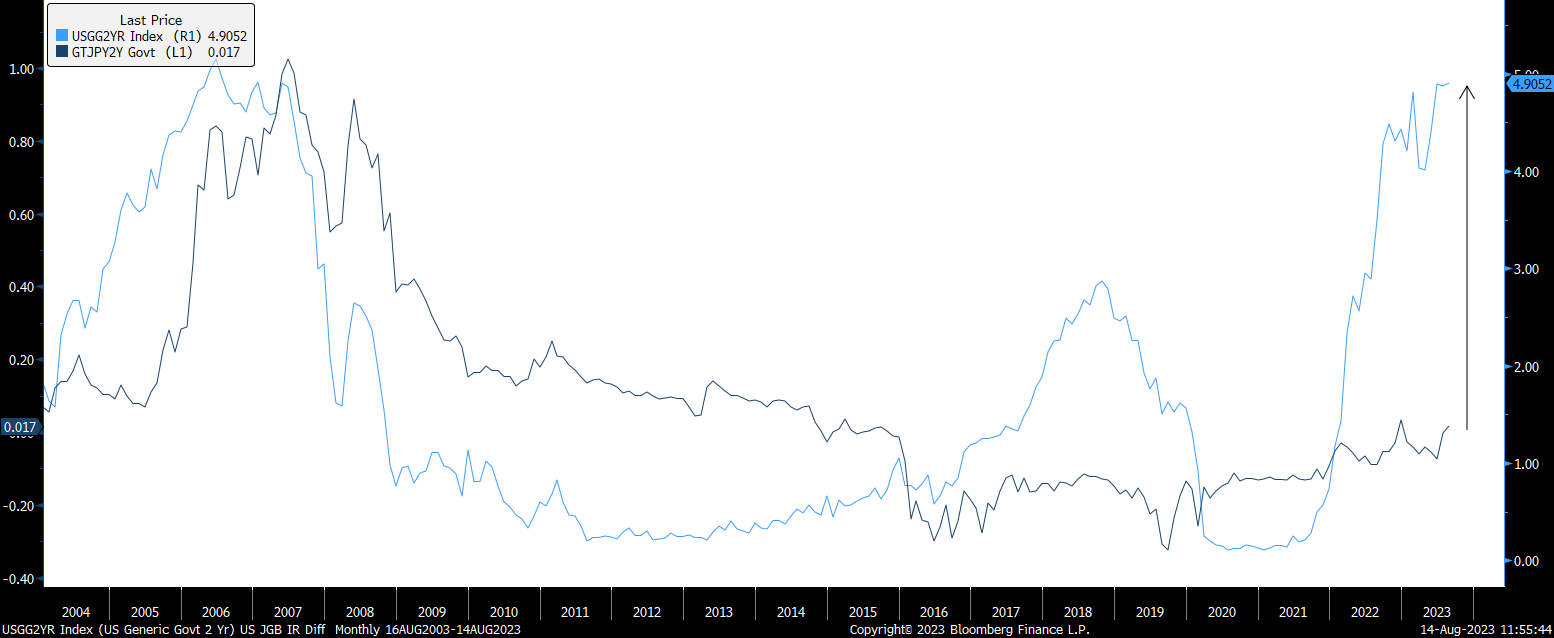

Since the Fed began hiking rates in March 2022, the gap between US and Japanese interest rates has expanded to its widest since the Global Financial Crisis.

As seen below, USD/JPY has followed this yield gap due to carry trades-where JPY is often used as a funding currency due to its ultra-low rates. Investors typically borrow money in Yen and deploy that capital in other higher-yielding currencies such as the USD.

Source: Bloomberg, USD/JPY (Light Blue) and US 2Y Yield – JGB 2Y Yield spread (Dark Blue)

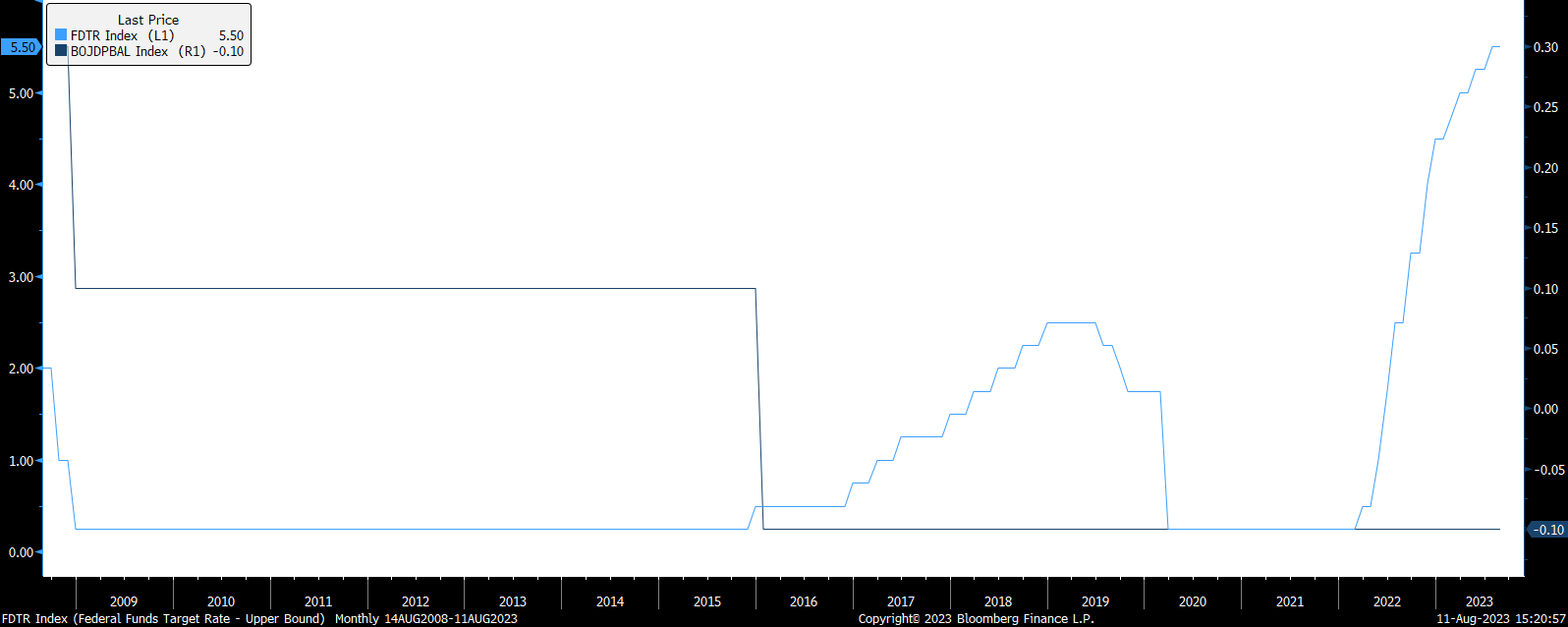

2.Bank of Japan’s Policy Divergence

One of the main reasons for this yield gap is due to the BoJ’s policy divergence with the rest of the world. The BoJ has largely maintained an ultra-easy monetary policy since 2016.

Latest commentary from BoJ officials signal a dovish bias, with Deputy Governor Shinichi Uchida stating that the BoJ is far from an exit or raising its negative interest rates.

We expect the BoJ to maintain its ultra-easy monetary policy for the remainder of the year; with a pivot only likely if inflation in Japan needs to be urgently addressed.

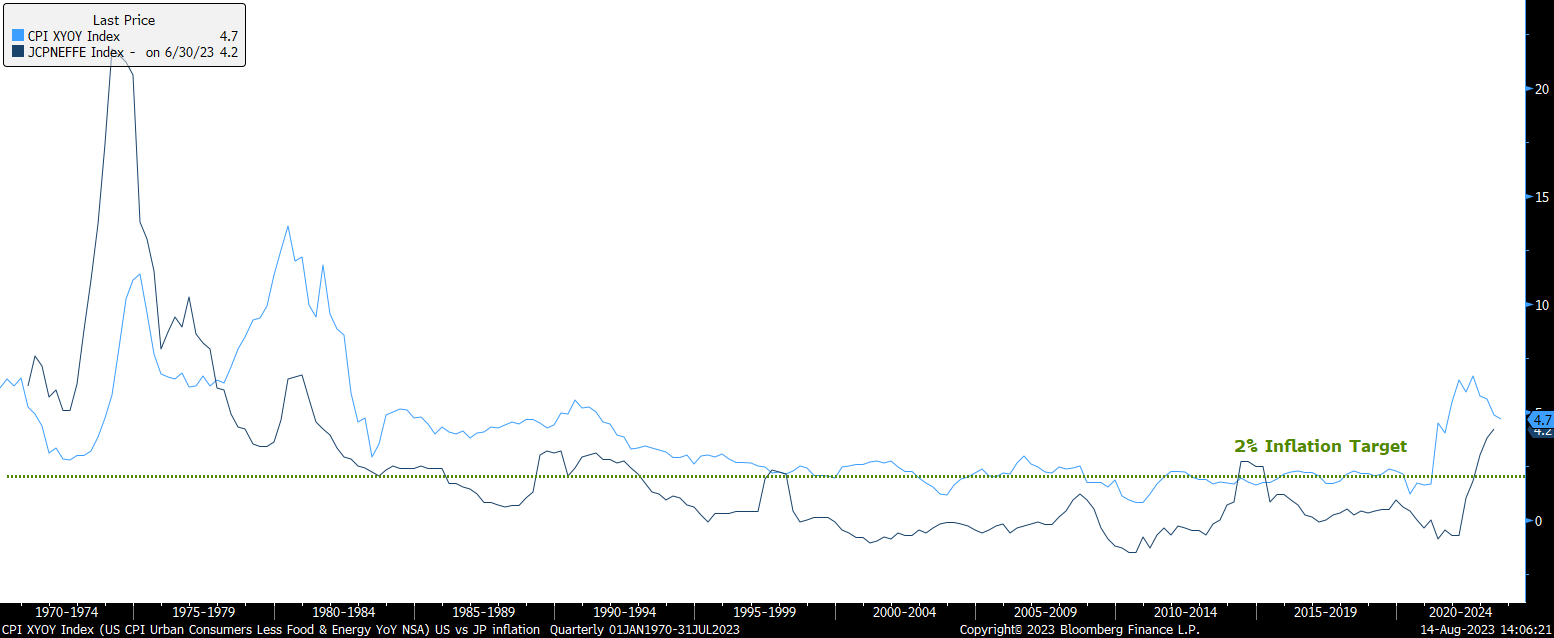

3.Japan Inflation

Japan has struggled with deflation for nearly 3 decades since the 1990s, a period termed the “Lost Decades”, resulting in a prolonged period of economic stagnation, prompting then-PM Shinzo Abe to introduce the YCC in 2016 to stimulate growth.

As seen below, in contrast to other developed economies like the US, inflation in Japan has threaded below the 2% target level since the 1990s. The post-pandemic inflation surge hit Japan about a year later than the US, finally marking an exit from deflation.

The BoJ forecasts Core CPI to be around 2.5% for this fiscal year, 1.9% in FY 2024, and 1.6% in FY 2025. The central bank views current inflationary pressures as being driven mainly by cost-push factors, which are expected to subside later this year.

This is the biggest reason why the BoJ has remained dovish despite inflation staying above 2% for over a year. We believe that the BoJ is currently more concerned about slipping back into deflation, rather than inflation.

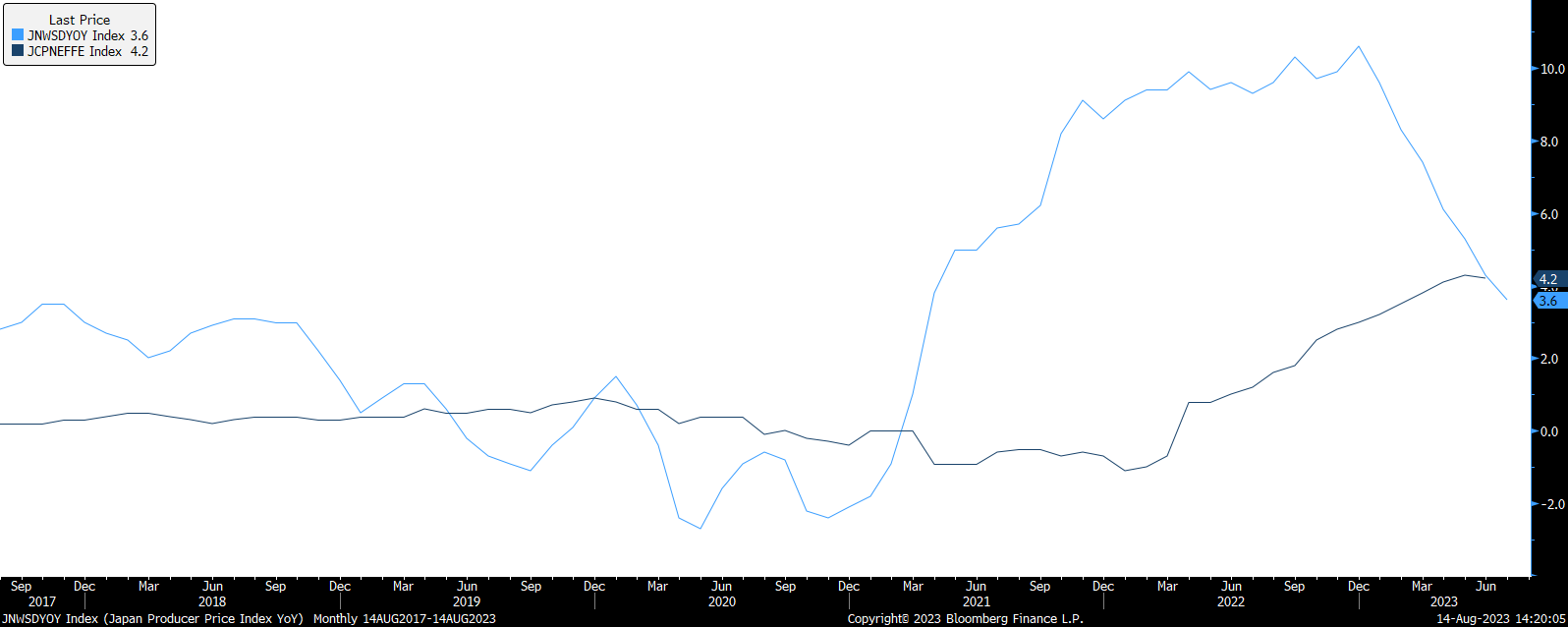

Furthermore, as seen below, Japan’s Producer Price Index (PPI) rose 3.6% YoY in July, the slowest pace since March 2021. This steep decline in material inflation appears to be consistent with the BoJ’s assessment that cost-push inflation is peaking, a development that supports the BoJ keeping its ultra-easy monetary policy.

4. Japan Wage Growth

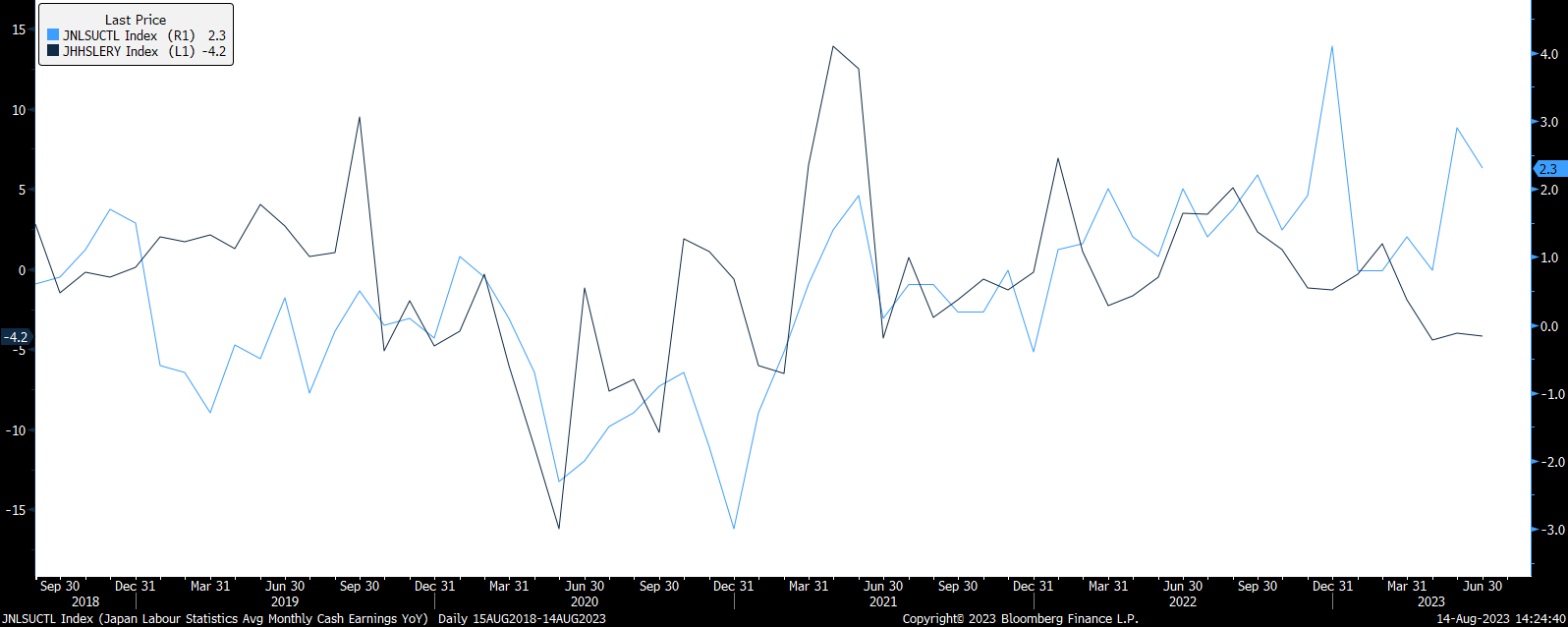

The BoJ is also watching wage growth trends to determine the long-term likelihood of achieving sustainable inflation. Nominal Cash Earnings declined to 2.3% YoY in June, disappointing investors who were expecting more after this year’s spring “Shunto” wage negotiation ended with an agreed 3.58% wage hike. Household spending remains subdued, declining for the 4th straight month at -4.2% YoY in June.

The data hints that the labour market may be losing steam, supporting the case for the BoJ to keep its ultra-easy monetary policy.

Our View

We expect the Yen to remain weak against the USD for the remainder of the year, supporting USD/JPY long positions. We believe the BoJ is more concerned about slipping back into deflation and wants to avoid raising rates until it is certain that sustainable 2% inflation has been achieved– supported by higher wage growth translating into higher spending.

Our outlook is supported by the latest economic data (inflation, wage growth) which appears to be consistent with the BoJ’s assessment that sustainable 2% inflation remains a hurdle, reinforcing the need for maintaining ultra-easy monetary policy.

Expressing Our View

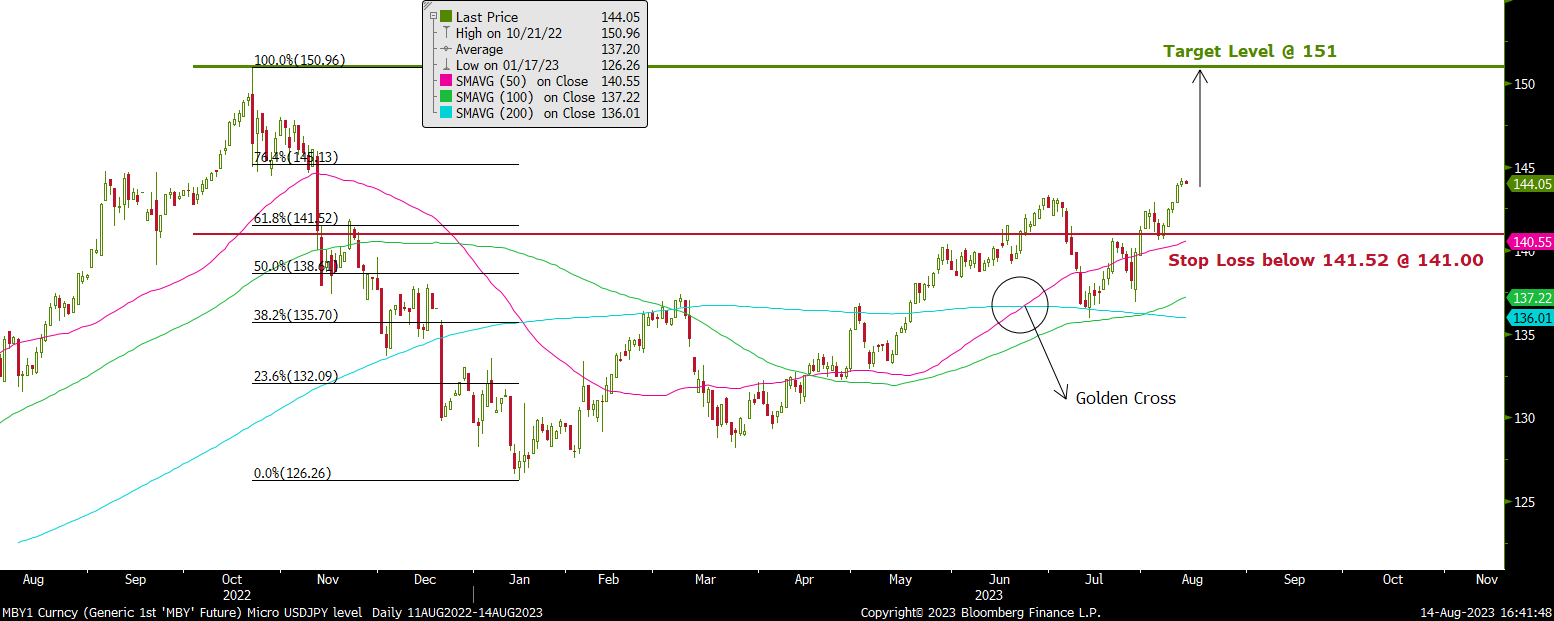

We favour the hypothetical trade setup below in order to express our view. The Micro USD/JPY contract can be found under CME exchange as part of Nova’s Futures offering.

Long CME’s USD/JPY Micro Futures:

We favour taking a long position with entry at the present level of 144.05, target level of 151.00, and stop loss at 141.00. Immediate resistance is sighted around 145, if this level is broken, the contract may head further upwards towards 151.00. This setup delivers a reward: risk ratio of 2.28x.

- Entry Level: Present level of 144.05

- Target Level: 151.00

- Stop Loss Level: 141.00

- Profit at Target: 69,500 pips x JPY 1 = JYP 69,500

- Loss at Stop: 30,500 pips x JPY 1 = JPY 30,500

- Reward: Risk Ratio: 2.28x

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova