By Danish Lim, Investment Analyst for Phillip Nova

[Data accurate as of 10 January 2024]

The Chinese markets are off to quite a rough start. Since the start of the new year, the CSI 300 saw a 5-day losing streak before finally closing higher yesterday. While the Hang Seng saw 6 straight losing sessions and it hasn’t even seen a positive session yet this year.

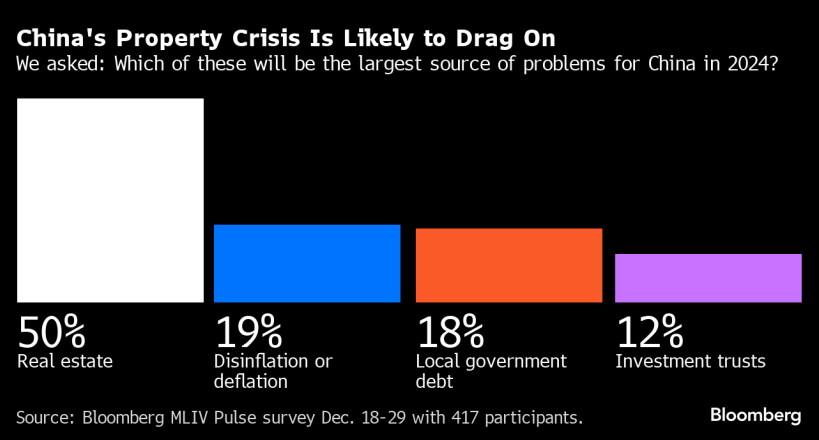

I would attribute this slump mainly to very poor investor sentiment towards Chinese equities, people are still very bearish about issues like China’s economic recovery, geopolitical tensions, the property sector downturn, and deflation risks. It seems like we are continuously seeing negative headlines everyday about China, manufacturing data surprised to the downside, trade tensions getting worse with Europe, and we also had the bankruptcy of the shadow bank ZhongZhi Enterprise last Friday, making it one of the largest-ever bankruptcies in China, highlighting the financial risks which then also adds stress onto the investor sentiment.

Weakness in tech stocks

So far the worst performing sector of the CSI 300 is the tech sector, down by nearly 10%. And if you take a deeper look, u will find that it is mostly semiconductor and software companies that are seeing the biggest declines. I would say that this is quite a concern, because it means that the market slump of 2023 only got worse even though we are only a little more than one week into 2024.

Risk-off sentiment, Regulatory risks and geopolitical risks are probably the key factors driving tech shares lower, Last week we had ASML cancelling their shipments of chip manufacturing equipment to China at the request of the US. At the same time, we also saw very harsh new gaming regulations at the end of December that caused a rout in internet stocks like Tencent. And I think this probably made investors recall the tech sector crackdowns in 2021, when authorities very abruptly imposed curbs on many tech companies including the Jack Ma-backed Ant Group and Alibaba.

Overall, some investors are probably still traumatised by the Tech crackdowns of 2021, and the recent surprise gaming curbs may have actually accelerated the tech selloff as people are afraid that we could see more surprise curbs or policy changes from the government.

Is a reversal in the horizon for Chinese stocks

Quite surprisingly, in a recent Bloomberg survey held at the end of December, almost a third or 31% of respondents say they will increase their China investments over the next 12 months, compared to just 19% one year ago.

So it does seem like investors are become more bullish on Chinese stocks, and I think the biggest reason for this is because they look relatively cheap right now. At the same time, the 2023 outperformance of other markets like the US, Japan, and India means that investor positioning and allocation to China is very low. So, yes there are still bulls, and they say that valuations have become way too cheap to ignore and that there is potential for huge profits as long as we see positive catalysts like rate cuts and policy support from the government.

What kind of signals will buoy the investor sentiment towards the Chinese markets?

I think that despite all the support from the government, investors are probably still looking for something bigger, and they remain unconvinced that the support measures so far will actually be able to move the needle or change the big picture because of structural issues that are unlikely to go away anytime soon such as geopolitics, the ongoing property downturn, deflation risks, lacklustre domestic demand, and a very poor external trade environment.

And it seems like the support measures so far have only managed to address the symptoms but not the disease itself – which are the underlying fundamental issues of the economy. To turn the market around, I think there needs to be increased transparency, as well as more aggressive policy support and monetary easing. I think China requires more than just economic stimulus- but also a fundamental shift of their main economic growth engine away from the debt-driven property market, which previously made up about a quarter of GDP.

Instead they should focus on boosting domestic consumption which only makes up about 40% of GDP compared to around 70% in the US. But this could be difficult because Chinese consumers right now are choosing to put their money into savings accounts and bank deposits to pay back mortgages and other debt, rather than invest and spend.

There were reports yesterday that the PBOC is looking to lower the reserve ratio- or the amount of money that banks must set aside as reserves, in order to boost lending. But I think other that cutting the reserve ratio, the PBOC should also look to cut medium-term interest rates and loan prime rates which determines mortgage rates. More importantly, I believe policymakers should look to encourage households to become net spenders instead of net savers.

Should investors then be looking to bonds instead?

Investors are expecting the PBOC to lower interest rates as early as this month and this is reflected in the drop in the 10-year yield. This has benefitted Chinese bonds mainly because of the inverse relationship between interest rates and bond prices, where bond prices will rise when yields drop.

So personally, in terms of risk-reward, I do think that Chinese bonds look more attractive as there’s less uncertainty regarding the bond market. Rate cuts by the PBOC are very likely given the need for authorities to stimulate the economy. However, this doesn’t mean that stocks will be completely unprofitable, there will definitely be pockets of tactical growth opportunities in specific sectors of the market such as EV battery makers, or dividend paying stocks.

With Chinese stocks being viewed as cheap at the moment, is this the time to buy?

If you look at things purely from a valuation perspective, Chinese stocks does look cheap, with the CSI 300 trading at a p/e ratio of 12.0, well below the its 5yr average of 15.2. meaning that the CSI 300 is trading at a discount of around -21%. There hasn’t really been any major catalysts to re-attract investors. Valuations are definitely cheap, but we have to remember that sometimes stocks are cheap for a reason.

We have also seen for a majority of 2023, cheap valuations alone aren’t really a strong enough reason for investors to ignore the fundamentals and start buying Chinese stocks. From my perspective, I believe the upcoming batch of economic data this month is unlikely to change much of the current narrative on china.

Inflation data this Friday will likely continue to highlight the risk of deflation. in contrast to developed markets, China’s CPI numbers are in negative territory. And I believe we should continue to see Chinese bond yields go lower amid expectations for more policy support in the coming months. Though, I don’t think this is going to be a huge game changer for the stock market, because given what we’ve seen so far, it seems like investors have placed a very high bar for investing in China. They want to see stronger evidence of improving fundamentals and massive policy support before they start allocating their money into china.

Nonetheless, there should still be tactical opportunities, and I expect companies that provide high dividend payouts to outperform as long as sentiment remains risk-off and the macro backdrop remains a big question mark. In fact, the Shanghai Stock Exchange dividend index, which tracks high dividend paying Chinese companies, actually rose by about 9% last year and it has rallied by over 2% so far in 2024, outperforming other Chinese indices.

So I think it is possible that this high dividend strategy can be a winning strategy once again in 2024, as investors seem to prefer positioning defensively with these dividend stocks because their regular pay-outs will help to provide a cushion against market volatility.

Should investors look at other markets instead in the present climate?

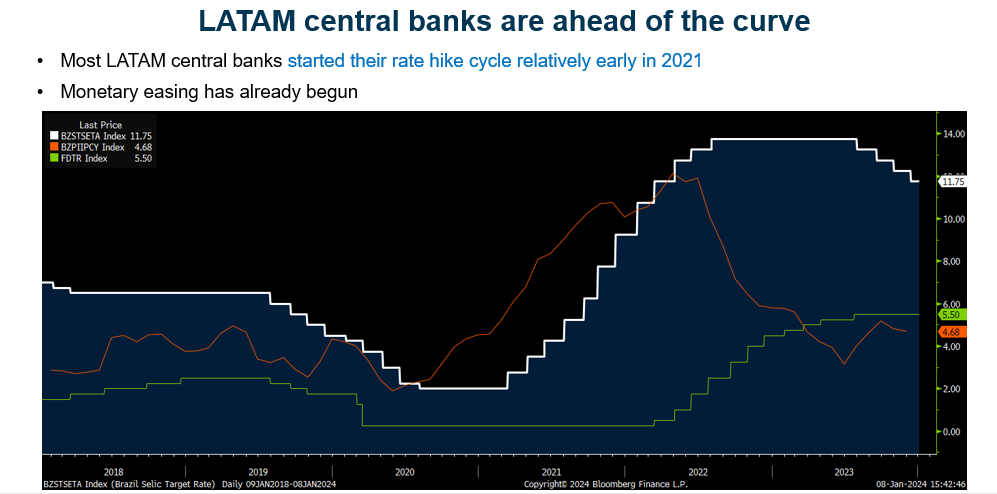

There are definitely other markets that look better purely from a risk-reward perspective. For example, Latin America stocks which consists of countries like Brazil and Mexico, were actually the top performing regional market last year. They out performed even Japanese and US equities. The key reason for their outperformance is because Latin American central banks are actually ahead of the curve when it comes to cutting interest rates.

Brazil, for example, actually started hiking interest rates as early as March 2021, while the US Federal Reserve started their rate hike cycle around March 2022. So the US was about a year behind.

This means that inflation in Latin America actually peaked earlier and central banks were able to cut rates earlier compared to the US and other developed markets. Brazil has actually been cutting rates since August last year. So this creates a very supportive backdrop for Latin America equities.

What are the key events in the next few weeks that investors should keep an eye on?

There are important economic releases to monitor such as CPI data this Friday, and investors should also keep an eye on whether the PBOC cuts their medium-term interest rates (15 Jan) and loan prime rates (22 Jan). We should also watch out for any escalation in geopolitical tensions, as well as any new trade sanctions/restrictions, especially for semiconductors.

Looking further out, a very important event to watch would be the National People’s Congress (NPC) annual parliamentary meeting on 5 March. And if u recall, last year, this was where the government announced a disappointing GDP growth target of 5% which was what kind of kick started the stock market slump in 2023.

So it will be very important for investors to keep an eye on what is the new GDP growth target for 2024, as well as the government’s stimulus plans and policy direction this year. Because China is ultimately a policy driven market rather than an economically-driven one.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova