Market updates provided by Eurex

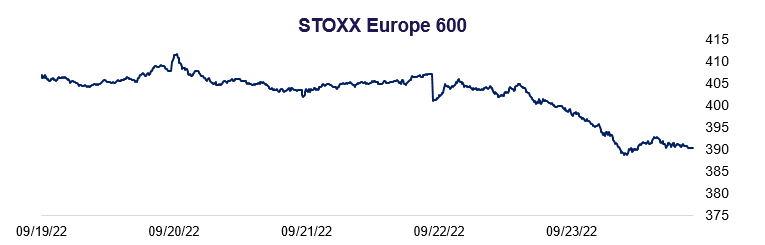

European shares slipped sharply for a second consecutive week due to central banks’ rate hikes and prolonged concerns on the economic forecast. The STOXX Europe 600 Index hit a 52-week low of 388.40 points during the market on Friday (23 September). The release of Eurozone PMI and weakened currencies further dampened European market outlook.

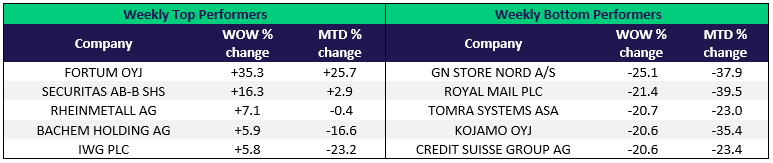

All 20 Sectors within the STOXX Europe 600 Index ended the week in red. The Real Estate led the decline with a weekly loss of 11.51% as the European property market faces several risks ahead: rise in mortgage rates, prolonged geopolitical tension from Russia’s partial mobilization, and continuing energy crunch. Meanwhile, Travel and Leisure sector recorded 8.45% weekly loss, with French hotel group Accor seeing a drop of 6.9% after J.P.Morgan adjusted its rating to “underweight.” Financial services dropped 7.12% as European central banks raised their policy rate, pressurizing the advisories with increased repayment of leveraged financing. Heavy production business, such as industrials and automotives, also slumped as September PMI recorded two-year lowest of 48.2. PMI below 50 implies expected contraction in business activity by rising production costs and lower consumer demands.

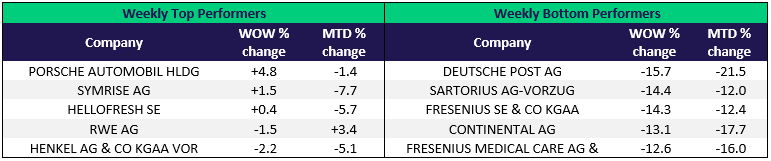

The DAX index recorded a weekly loss of 3.6%, as its price hit a new low since November 2020. The German 10-year yield also rose to decade highs. Nonetheless, Porsche Automobile Holdings was the top gainer, marking a weekly gain of 3.3%. This comes as the IPO of Porsche AG is expected to happen this coming week, targeting a valuation of up to 75 billion EUR.

Across the past week, several central banks also increased their rate decisions: The Bank of England hiked interest rates by 50 bps to 2.25%, the Swiss National Bank raised interest rates by 75 bps to 0.50%, and Norway raised by 50 bps to 2.25%.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova