By Eric Lee, Sales Director, Phillip Nova

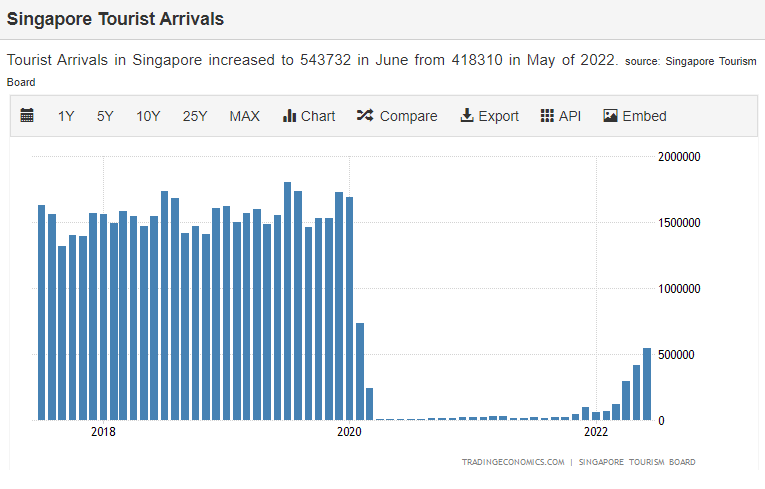

Since opening its borders to fully vaccinated travellers from 1 April 2022, Singapore has been experiencing gradual month-on-month gain in its number of visitors. Based on data from the Singapore Tourism Board (STB), the garden city welcomed a little over 500 thousand visitors in June 2022, which makes up to about a third of its monthly numbers pre-covid. STB expects up to 6 million visitors in 2022 and for arrival numbers to return to pre-covid levels by 2025.

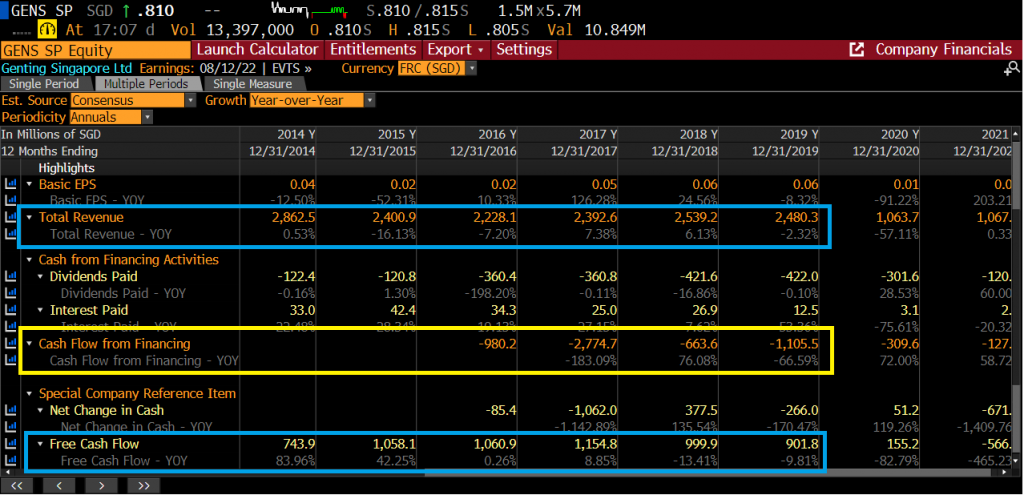

The table below shows the cash distribution of Genting Singapore in the 5 years prior to 2020. There isn’t much growth prospect as we can see that the total revenue of Genting Singapore had hovered around $2.5b per year. This is likely because its business is largely confined to Resorts World Sentosa. However, the company is a great cash generating machine, averaging 40% Free Cash Flow margin yearly. As a result, Genting Singapore’s management had been rewarding its shareholders with dividend yields of 3-4% and actively paying down their debt from $3.2 billion in 2011 to just $200 million currently.

Similar to the rest of the hospitality sector, Genting Singapore’s business had suffered greatly as tourist arrival numbers had plummeted due to intense border lockdown measures taken by governments all over the world to limit the spread of the coronavirus. Its revenue had dropped 60% and profit by more than 90%. Yet, even in the worst of times, Genting Singapore was still able to maintain some profitability. As a result of its strong balance sheet, the company did not need to raise any debt, unlike many others in the travel and hospitality sector.

As the world gradually opens their borders and learn to live with covid, Genting Singapore’s shareholders should be able to benefit greatly from the travel recovery as profit need not be shared with other debtholders due to Genting Singapore’s almost negligible debt level.

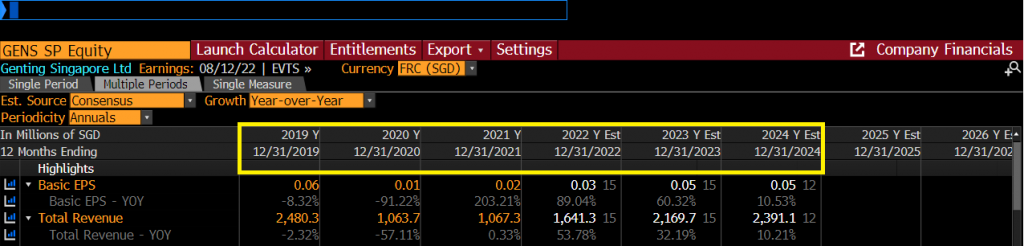

Based on Bloomberg’s consensus estimates (as shown on the table above), analysts are expecting Genting Singapore’s revenue to reach 90% of its pre-covid levels by 2023. Assuming the company is unable to return to its average Free Cash Flow margin of 40% due to increase in costs, their FCF margin will instead remain at 30%. Any cash distribution as interest expense of debt repayment will not be significant as Genting Singapore’s debt is low. It should be not too far-fetched to assume a Free Cash Flow of $700 million per year by 2024.

As one of the 2 integrated resorts in Singapore and the only theme-park in the country, Resorts World Sentosa should likely be on the top of the list of must-see destination for tourists planning to visit. Over the past decade, tourist arrivals here had grown at a compounded rate of 4% p.a. until the disruption the pandemic has caused. Once the number returns to the 2019 level, there’s a good chance that it will resume on this trajectory of 4% growth per year.

Genting Singapore is expected to release its 1H 2022 results on 12 August 2022. However, recent result announcement by Las Vegas Sands (LVS), which wholly owns and operates Marina Bay Sands (MBS), gave investors a cause for celebration. As shown above, even though Singapore had only opened for vaccinated travellers for 3 months and tourist arrivals are only at a third of its peak, MBS already reported that its net revenue for Q2 2022 is 80% of its Q4 2019 results.

Charting wise, since 2020, Genting Singapore had been consolidating into a possible Ascending Triangle formation with its breakout level at $0.93. The recent bounce from $0.70 for the 3rd time could imply that we have a significant support at $0.70. Investors who are bullish in the prospect of Genting Singapore can look to buy if price falls back close to $0.75. Once the resistance of $0.93 is broken through, the next resistance to look out for it at $1.20.

Genting Singapore is available for trading under Phillip’s MT5 account as a CFD contract.

Value-Added Service

Periodically, I will be sending out market analysis like this to my clients, as well as alerting them when the trading strategies I used indicated potential entry and exit signals. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures & forex, and how you may benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

- Receive S$100* when you open an account!

*T&Cs apply, contact Eric below for more information.