By Eric Lee, Sales Director, Phillip Nova

Have you heard of this market phenomena called the Santa Claus rally? Have you wondered what it implies and if there’s any truth in it? Well, this is one of the seasonal trends, observed in U.S. stock markets, and it refers to a period of increased stock market performance typically seen during December, sometimes extending into the beginning of the new year. Are we able to quantify and test this phenomenon to derive a calculated definition to it?

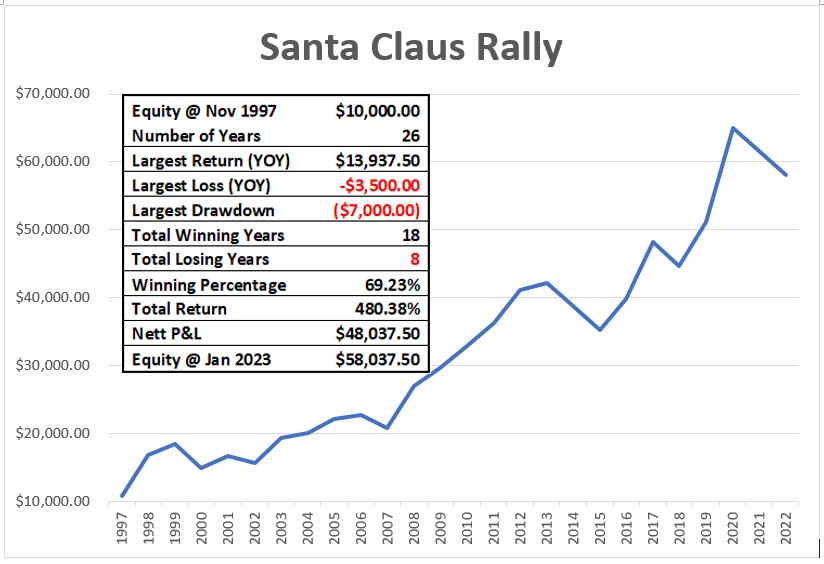

To test this out, I had developed a set of simple rules and apply the rules on historical data of E-mini S&P futures since 1997 and until 2022. The rules are:

- Buy 1 lot of E-mini S&P on the 2nd last Monday of November

- Sell 1 lot of E-mini S&P on the 1st Friday of January in the new year

- Sell (cut-loss) if E-mini S&P falls 70 points below the Entry Price, based on point 1.

E-mini S&P futures contracts are designed to track the performance of the S&P 500 Index, which comprises 500 of the largest publicly traded companies in the United States. The S&P 500 Index is a widely followed index and is regarded as a barometer of the overall health and performance of the U.S. stock market.

Over the last 26 years, this test had resulted in a gross profit of $48,000 and achieved a winning percentage of close to 70%. So far, the largest profitable trade it achieved was in December 2020 with a profit of close to $14,000. The stop-loss rule of 70 points capped its largest loss to $3,500 per year. The largest drawdown observed was 2 years in a roll. It happened twice, once in 2014 and 2015, once in 2021 and 2022 (referring to the statistics I compiled as seen below).

The impact of the Santa Claus rally on the E-mini S&P futures varies from year to year. While it is not a guaranteed phenomenon and does not occur uniformly every year, historical data suggests that the market tends to exhibit positive movements during this period more often than not.

The 3 simple rules were set out for the purpose of running this test and traders are advised not to take these rules literally for trading. Other factors such as geo-political events, market sentiments and economic activities will influence how the index will move.

Phillip Nova offers products and services which allow traders to trade in futures such as E-mini S&P and many others. My clients have also benefitted from interesting research such as this, which I produce periodically to enable customers get a better understanding of the financial markets.

In conclusion, while the Santa Claus rally is a widely observed as seasonal trend, its impact on the E-Mini S&P is not absolute. Traders should exercise prudence, conduct thorough analysis, and utilise a suite of analytical tools to navigate the markets successfully, regardless of seasonal trends.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.