By Eric Lee, Sales Director, Phillip Nova

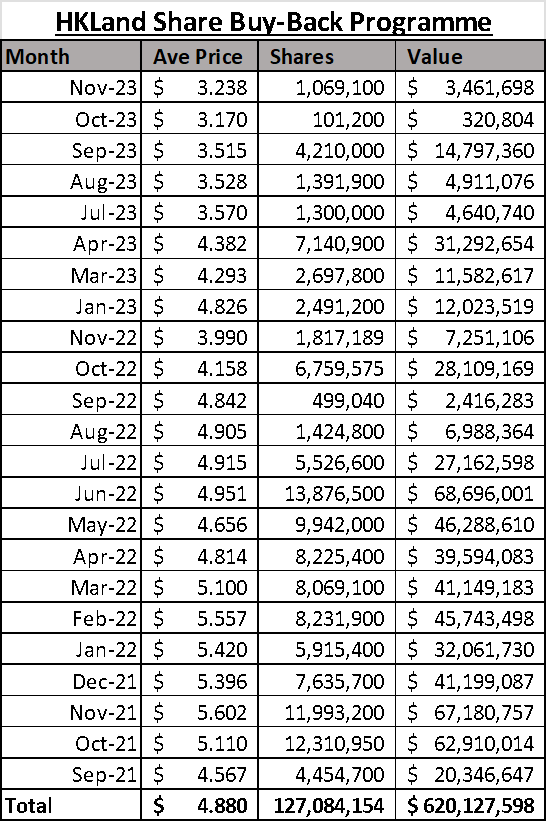

Hongkong Land Holdings Limited (H78) has been orchestrating a silent symphony of stock market manoeuvres, dazzling investors with its audacious share buyback program. Since September 2021, Hongkong Land has been on a shopping spree, snatching up 127 million shares at an average price of US$4.88, splurging a total of US$620 million in just over two years. As the curtain falls on their US$500 million share buyback extravaganza, investors are left on the edge of their seats, wondering if the encore will bring a new share purchase initiative. Let’s dive into the financial rollercoaster and see if Hongkong Land’s performance is worthy of an encore.

Overview of the financial metrics:

1) Attractive Valuation Metrics:

– The current share price of US$3.17 has the allure of a discounted designer handbag – a steal compared to the average purchase price of US$4.88 during the recent buyback spree.

– The price-to-book ratio (P/B) is a dazzling 0.22x, reminiscent of a flash sale, beating historical lows like a rockstar – 0.24x during the Global Financial Crisis (GFC) and 0.19x during the COVID-19 pandemic in March 2020. It’s like paying 20 cents for a dollar, or for 50 cents, if you’ want to “play it safe” and haircutting the book value by half.

2) Financial Health:

– Despite a change in debt from US$4 billion in 2019 to the current US$6.7 billion, Hongkong Land’s cashflow has been steady, averaging a cool US$940 million over the past five years.

– The debt-to-equity ratio is a investor’s dream at 0.22x, and the interest coverage ratio of 3.8x indicates Hongkong Land can comfortably handle its debt, giving you confidence it won’t run into a debt crisis.

3) Potential for Future Dividends and Share Buybacks:

– Armed with a cash balance of US$1.1 billion, Hongkong Land’s management is certainly able to start a new share purchase program, if they want to.

– The current dividend yield of 7% is attractive, and the company’s ability to generate operating cash flow ensures the celebration continues with dividends and potential share buybacks.

The risks to consider:

1) Ballooning Debt:

– The debt balloon has inflated from US$4 billion to US$6.7 billion, raising eyebrows among investors.

– However, the healthy interest coverage ratio and debt-to-equity ratio suggest that Hongkong Land can juggle its debts and even pay them off in less than 10 years if the need arises.

Potential Entry:

1) Technical Analysis:

– Stochastic indicators are signalling at oversold region, and the Average Directional Index (ADX) is peaking at 55, hinting at a potential short-term rebound in Hongkong Land’s share price

– Traders can choose to wait for the Stochastic to make a comeback above 20 or for its share price to break through the resistance level of US$3.50 for a confirmation before considering investing in the company.

2) Market Sentiment:

– Hongkong Land’s share price, is influenced by the market sentiment around China’s economic storyline. Recent pledges by the central government to support the market might just be the plot twist needed to lift Hongkong Land’s share price from its doldrums.

– The bullish case for investing in Hongkong Land can be summarised by its strategic share buyback program, irresistible valuation metrics, and robust financial health. While the ballooning debt may add a touch of concern, Hongkong Land’s financial strength suggests a potentially favourable outlook. Timing considerations, fuelled by technical analysis and positive market sentiment, add a touch of excitement to the investment journey.

– Hongkong Land (H78) is listed on Singapore Exchange and is available for trading on Phillip Nova account. Always remember to conduct your due diligence and gauge your risk tolerance.

– For more insights like this on Singapore stocks, make a date with me on 27 February 2024 at 7pm for the webinar, “Smart Money Strategies for Singapore Stocks,” where we will uncover what the professional traders and investors are looking at in our local stock market. Register here!

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.