By Danish Lim, Investment Analyst for Phillip Nova

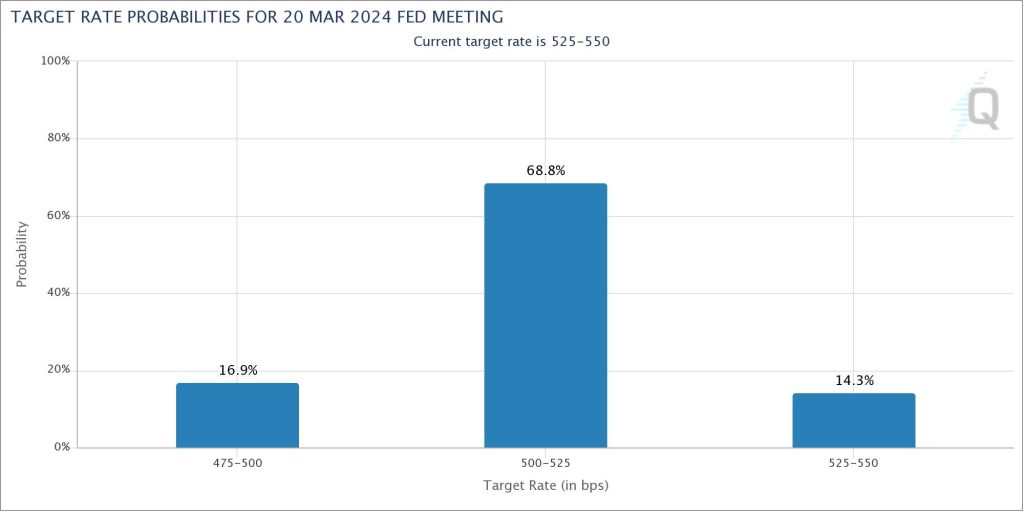

So far this week we’ve been seeing some relatively mild movements in the market, likely because traders are gearing up for the FOMC’s interest rate decision later tonight at 3am. Traders will definitely be watching comments from Fed chair Jerome Powell for any clues on the interest rate trajectory.

And I think what is really driving market movements recently have been the expectations of a soft landing – which is a scenario where the Federal Reserve will be able to effectively tame inflation without triggering a recession. And this caused investors to start pricing in interest rate cuts in the 1st half of 2024. And I believe this is probably one key reason as to why stock prices have been moving higher.

The Magnificent 7 and what seems to be driving them

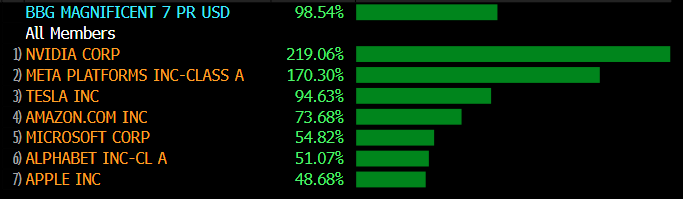

The main reason for the outperformance of US tech stocks is mainly because of this so-called magnificent seven. These 7 stocks are:

Collectively they make up about 28% of the S&P 500 and almost 50% of the Nasdaq 100. So they have a huge influence on the market, in fact, they are responsible for around 74%-75% of the S&P 500’s YTD gains. So these are the companies that are essentially seeing and attracting the most investor dollars.

All of them are highly focused on technological megatrends and they are leaders in the fields of Artificial Intelligence, cloud computing, Electric Vehicles.

One reason for their outperformance is probably due to their high exposure to Artificial Intelligence. For example, Nvidia has seen very high demand for their GPU chips which been used to train AI programs like ChatGPT. Other than that, we are also seeing other Big Tech companies like Microsoft and Alphabet trying to integrate AI into their products and services. I think Alphabet also recently launched their own ChatGPT equivalent called Gemini.

If you look at things from a macro perspective, I believe that expectations of a soft landing and rate cuts early next year also likely helped to drive up the valuations of the Magnificent 7.

From a more micro perspective, the Magnificent 7 has been able to deliver very strong earnings growth and high operating margins. In fact, I think the average operating margin for the Magnificent Seven is at 19.91%, which is a lot higher than the S&P 500 at 13.5%.

One more reason for the outperformance of the Magnificent 7 could also be because of their “Megacap” status. These are some of the largest and most valuable companies in the world. This has created a perception that they can function as a sort of “safe haven” investment in times of volatility. Because, unlike smaller caps, these mega-cap tech companies have more wiggle room to continue generating profits even during volatile periods thanks to their strong business models, healthy balance sheets, and competitive advantages.

Can the Magnificent 7 continue to outperform?

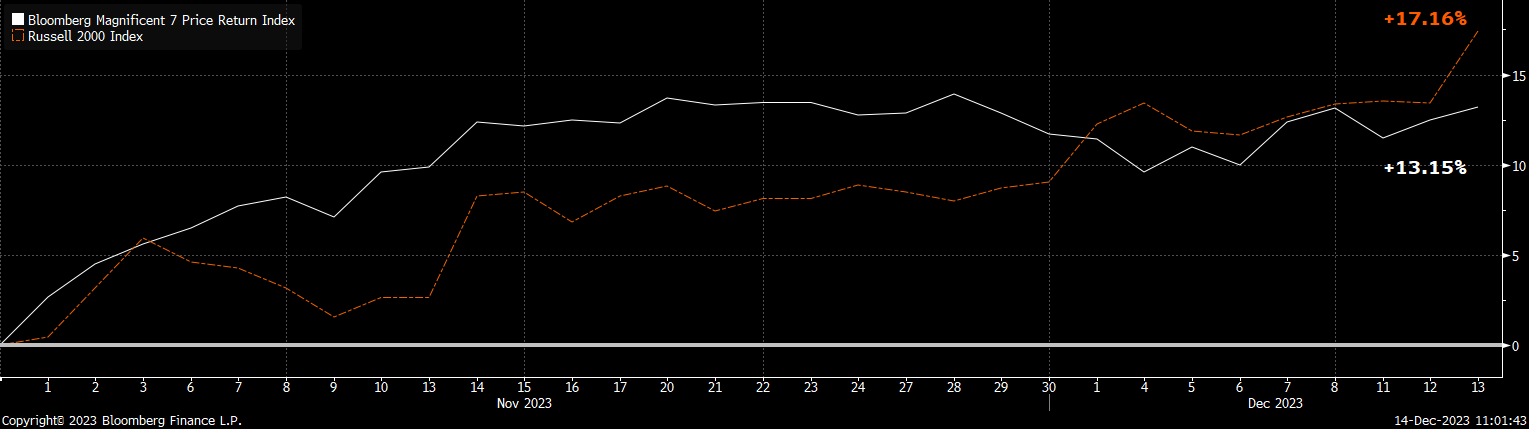

From my perspective at least, I think the Magnificent 7 should continue to see positive gains, but they may find it harder to outperform the rest of the market, at least to the same magnitude that they did for most of this year.

In fact, since the end of October, the Magnificent 7 has returned about 13%, but if you were to take a look at the Russell 2000, it has gone up by about 17%, which is actually higher than the Magnificent 7. So what this tells me is that capital is flowing away from the Magnificent 7 and moving into some of the smaller cap companies. One reason for this is probably because people are expecting a soft landing.

So If a soft landing does happen, I believe investors will start looking for cheaper opportunities in the overlooked corners of the market including small caps.

From a valuation perspective, valuations in the small cap corner of the market are more attractive, mainly because they haven’t rallied as much as the Magnificent 7 which are currently trading at a Trailing 12 Mths P/E ratio of 35.7x, compared to a P/E ratio of just 18.3 for the S&P 500 Equal Weighted Index.

This means that investors right now have to pay quite a huge premium just to own the Magnificent 7 and moving forward it could be hard for these already massive companies to justify their sky-high valuations.

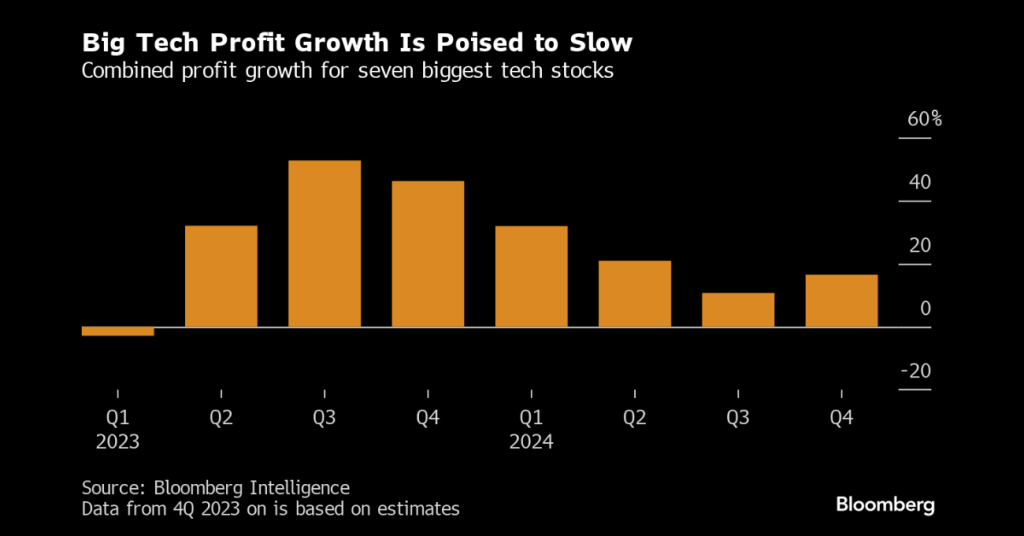

What are some of the challenges ahead for the tech giants?

A fundamental risk is that some of these tech giants, they may struggle to deliver the same incredible growth rates that they have shown due their massive sizes. For example, a $1 billion increase in revenue, could mean a lot for a smaller cap company, but it will represent about a 1.1% growth in revenue for Apple, whose Q4 revenue was nearly 90 billion dollars. So they may struggle to match and justify their valuations.

The magnificent 7 are also very focused on cyclical sectors. If a recession occurs, it could significantly affect their growth, and given their premium price tags, I think it may result in a steep decline in their stock prices.

Another overlooked risk is that these 7 companies, because they are the biggest companies, they may also see greater scrutiny from the government. For example, the US government recently imposed a couple of export restrictions on some of Nvidia’s AI chips, particularly their exports to China. So this is also another challenge that some of these tech giants may face.

US equity market outlook in 2024

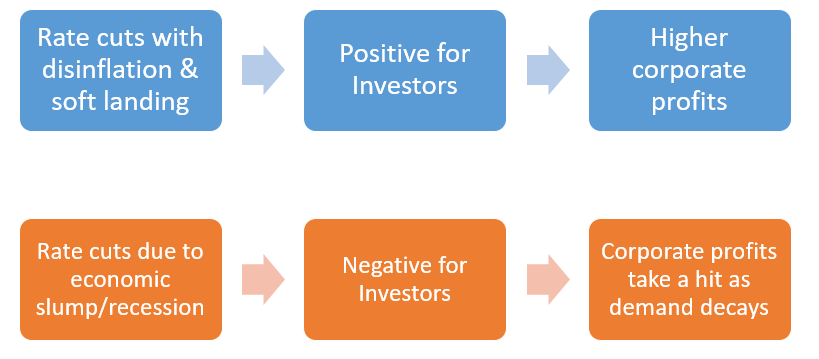

When it comes to the opportunities for 2024, I think the first thing that investors have to address will be “WHY” the Fed will cut interest rates. There’s 2 scenarios:

1) If the central bank cuts interest rates because of a soft landing, that’s good news for investors, because it means that a soft landing is in view and stock prices will rise.

2) BUT if the fed is cuts interest rates because of a recession, that’s bad news as corporate profits may take a hit because of demand destruction.

Ideally you want the Fed to cut interest rates next year because inflation has come down sufficiently enough, and not because the economy is in a recession.

Because of this, moving into 2024, I think a barbell strategy would be more appropriate, and this is really a strategy where you focus your investments mainly on the higher risk stocks and lower risk stocks, while completely avoiding stocks with moderate amount of risk.

Higher risk stocks could include companies in sectors such as Artificial Intelligence, or emerging market stocks, or Chinese stocks.

The main benefit of this barbell strategy is that it will allow you take advantage of and capture profits in some of the riskier areas such as AI that are expected to outperform. But you are also able to balance out that additional risk with your investments in the lower risk spectrum- which could include stocks in the Utilities or Healthcare sector.