By Danish Lim, Investment Analyst, Phillip Nova

The Japanese stock market has been on a stellar uptrend, seemingly hitting new fresh highs after every trading day. As of 12 April, the Nikkei 225 Index (+18.64%) has outpaced both the S&P 500 (+9.44%) and Nasdaq (+9.06%) in terms of total return YTD.

Many of the driving factors behind the exuberance in Japanese equities have been elaborated and much discussed, this includes structural factors such as improving corporate profits, Buffett’s endorsement, exit from decades-long deflation, and corporate governance reforms. A weak Yen has also served as a key tailwind for Japanese exporters such as Toyota.

We believe the Bank of Japan’s recent decision to end its negative interest rates regime could be a major inflection point and we discuss its implication for the Japanese stock market.

End of Japan’s negative interest rate regime:

On March 19, the BoJ signalled that its price stability target of 2% is “in sight”, and decided to overhaul its monetary policy:

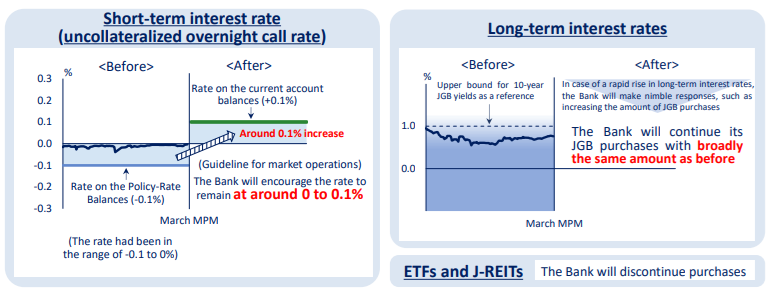

- The BoJ exited its negative interest rate policy, and will guide the short-term interest rate (uncollateralized overnight call rate) within the range of 0 – 0.1%.

- Scrapped its Yield Curve Control (YCC) – which involved a soft cap of 1% on 10-year JGB yields. But will continue to purchase long-term JGBs at roughly the same pace

- Discontinued new purchases of ETFs and J-REITs.

- The BoJ emphasized that “accommodative financial conditions will be maintained for the time being”, given the current outlook for economic activity and prices.

The Nikkei 225 Index surprisingly saw a gain of 0.66% on the day of the BoJ move. We attribute this gain to markets having a dovish interpretation of the policy manoeuvre – viewing it as a “one-and-done” move.

Implications for equity markets:

A key risk for the equity market involves the BoJ hiking rates more than expected, thereby strengthening the Yen and weighing on export-oriented stocks. We believe Yen direction will also depend heavily on the Fed, given the prevalence of Yen carry trades. An early Fed rate cut and hawkish BoJ could strengthen the Yen and weigh on equities.

- With the interest rate trajectory still uncertain, we favour currency- hedged ETFs which are able to help hedge yen fluctuations. This includes WisdomTree Japan Hedged Equity Fund (DXJ) and iShares Currency Hedged MSCI Japan ETF (HEWJ).

Nevertheless, the macro story remains intact, and structural tailwinds such as corporate reforms and geopolitics should underpin the Japanese stock market. We expect rising wages and a return of inflation to have a positive impact on the economy through stronger sustained consumer spending.

In this scenario, we anticipate a longer-run outperformance of Japanese stocks. Investors can gain broad exposure to Japanese equities via the iShares MSCI Japan ETF (EWJ).

From the above chart, we see that the value factor has outperformed YTD. Value stocks tend to outperform in an inflationary environment- where inflation, interest rates, and economic growth are rising.

- We like value-oriented stocks that benefit from corporate governance changes and are linked to high dividend yields and share buybacks. This include ETFs like MSCI Japan Value ETF (EWJV) and WisdomTree Japan SmallCap Dividend Fund (DFJ).

Trade opportunities in the Nikkei 225 Futures and the USDJPY on Philip Nova 2.0. Open an account now!

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova