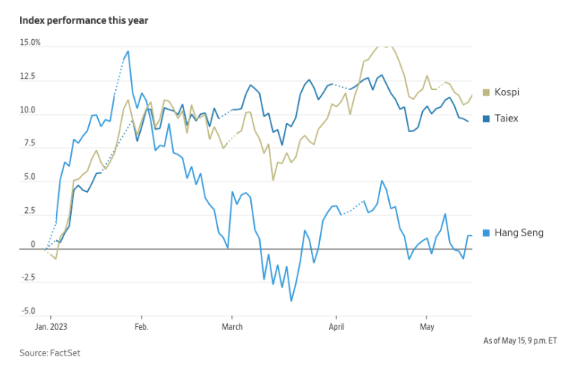

The Taiwanese stock index Taiex has gained more than 12% since the start of 2023, making it the best performing stock market in Asia so far this year (as of 15 May 2023). Korea’s KOSPI is close behind at 9.7%.

MorningStar reported that 2022 ESG net annual inflow of $3.1B was well below the average $47B over the past 3 years. I think that mainly the negative broader market environment drove this, with a majority of sectors under performing in 2022. At the same time, ESG ETFs were typically underweight Energy, which was the top performer in 2022.

Taiwan’s Position Amid US-China Tensions

Like it or not, Taiwan has been caught up in tensions between US and China due to its unique geopolitical position. The impact on Taiwan can be both positive and negative.

Positive impact include:

1. Increased trade opportunities for Taiwan

As US-China tensions escalate and investors and companies look for alternative supply chains and consider diversifying their operations, Taiwan could benefit with its advanced technology sector and manufacturing capabilities.

2. More investment flows into Taiwan

Tensions in China and US may lead investors to reevaluate their trading strategies and capital flows. Many may diversify their portfolios or redirect investments into Taiwan based on geopolitical risks and market conditions.

3. Increased demand and supply for Taiwanese products

The intensifying competition between US and China in terms of emerging technologies such as 5G, AI and semiconductors could benefit Taiwan. Many investors consider Taiwan a global leader in semiconductor manufacturing, hence they see Taiwan as a good alternative supplier to Chinese suppliers. Taiwan therefore would benefit from an increased demand for its products and services in the technology sector.

That said, uncertainties are still present due to Taiwan’s delicate political situation and relationship with China. US-China tensions could negatively impact Taiwan’s stability which can still overall affect investor sentiment and confidence. Some negative impact could include:

1. Geopolitical Risks

Taiwan’s relationship with China has always been complex. The deepening political divide between Taiwan and China could introduce uncertainties. Taiwan has the potential to be a flash point in U.S.-China relations, so increased tensions between the US and China may impact Taiwan’s security concerns and regional stability.

2. Export dependence

Taiwan’s economy relies heavily on exports, particularly to China. If the tensions between the US and China result in trade disruptions or increased tariffs, Taiwan’s export-oriented industries could face challenges, impacting its economy. The potential for supply chain restructuring or relocation of manufacturing facilities from China to other countries could have mixed effects on Taiwan. If relations sour between Taiwan and China, Taiwan’s exports would be negatively impacted as well.

The Attractiveness of the Taiwan Futures Contract

The Taiwan Futures Exchange (TAIFEX) futures contract allows bi-directional trading. Investors and traders may find opportunities in both bull and bear markets and may take a long or short position depending on how they view the Taiwanese stock market.

For contract specs on TAIFEX futures, please click here.

FREE Seminar about Opportunities in Taiwan

On Tue 23 May at 6:30 pm, professional trader Wong Kon How, will share about the liquidity and growth potential of the Taiwanese market and how you can benefit from trading TAIFEX futures.

Date: Tue 23 May 2023

Time: 6:30 pm – 8:00 pm (includes buffet dinner)

Venue: Raffles City Tower Level 6 (above City Hall MRT station)

Register for the seminar here.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova