By Danish Lim, Investment Analyst, Phillip Nova

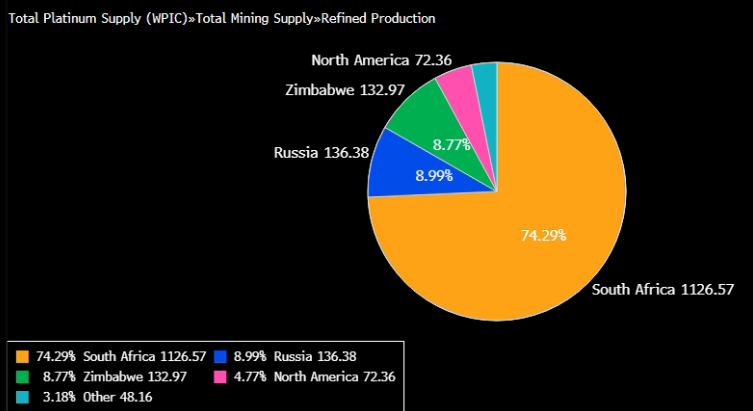

Platinum, despite being 30 times rarer than gold and having usage as both a precious and industrial metal, often goes unnoticed. The majority of platinum mining is concentrated in South Africa.

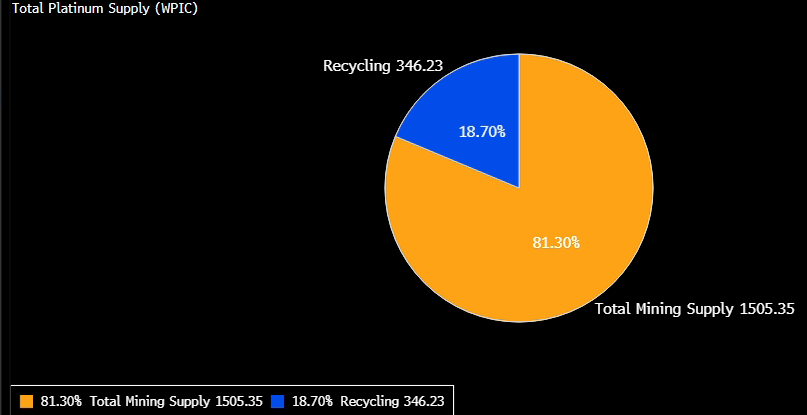

From a supply perspective, there are 2 main supply sources:

- Mining

- Recycling supply from auto catalysts and jewellery

However, new mining production requires significant capital investment and may take over 10 years to bring online. (World Platinum Investment Council)

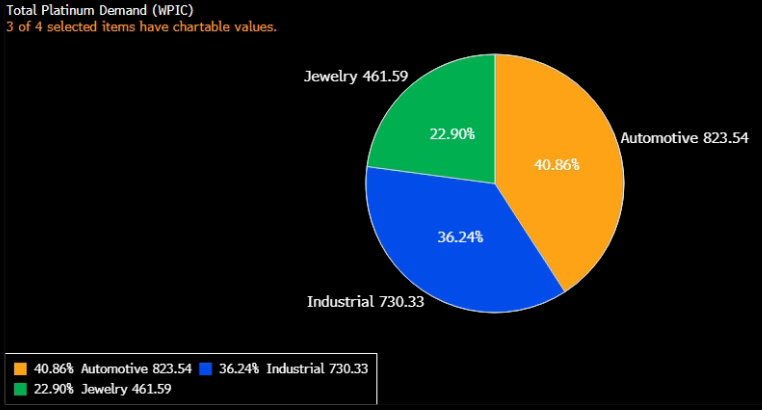

From a demand perspective, the majority of platinum’s demand comes from 3 key sectors:

- Automotive – platinum is heavily used in catalytic converters (autocatalysts)- which helps reduce and control harmful vehicle emissions. Stricter emission standards across the globe are expected to boost long-term demand for platinum.

- Industrial – Platinum is used in a variety of industrial applications such as electronics, biomedical devices, dentistry, and the manufacturing of glass fibre.

- Jewellery – Engagement rings, etc

The investment case for platinum

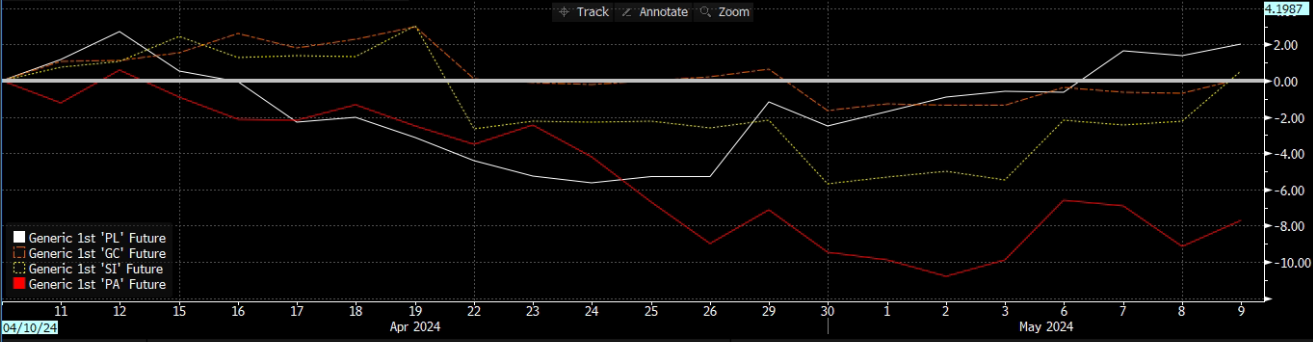

Over the past 1 month, Platinum futures has outperformed Gold futures and other precious metals, as seen below: Platinum (white) vs Gold (orange), Silver (yellow), & Palladium (red).

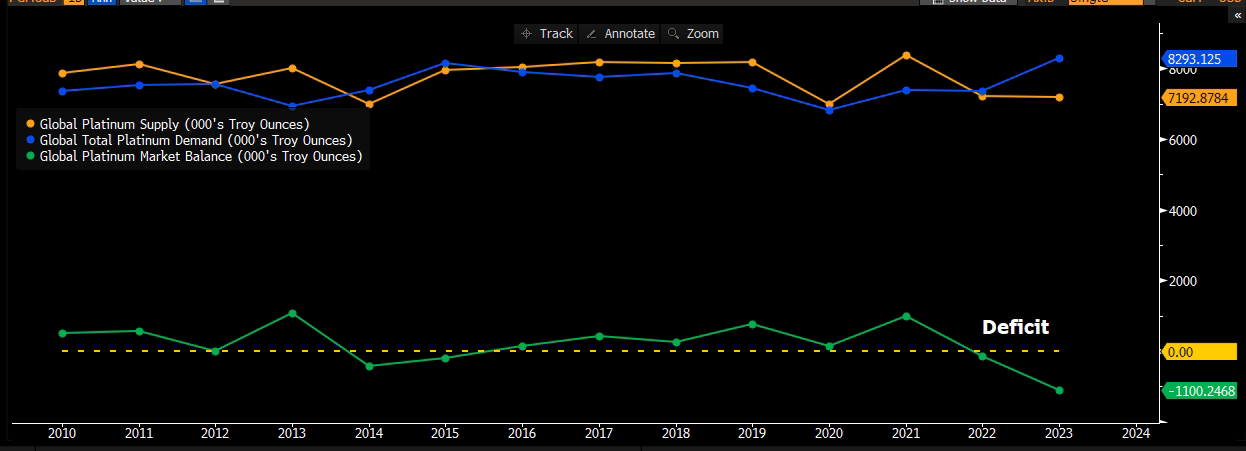

Supply/demand fundamentals are showing signs of improvement, with Platinum markets expected to have its biggest supply deficit in 10 years. Indicating constrained supply and strong demand.

Constrained supply

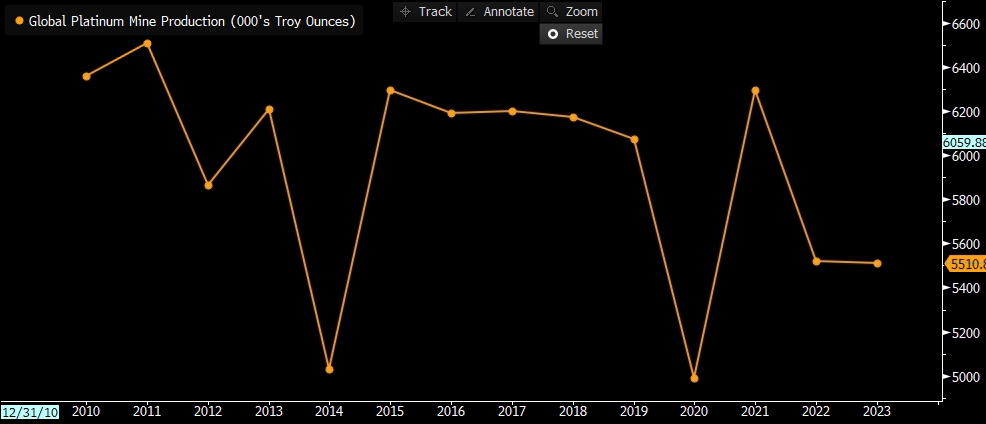

As seen in Bloomberg data below, Platinum mining production is well below its peak at the end of 2011.

Due to a considerable decline in the prices of Platinum-Group Metals (PGMs) in 2023, particularly Palladium and Rhodium; many PGM miners have seen a decline in margins and mining profitability.

Miners like Sibanye-Stilwater and Amplats have responded by choosing to defer growth, and/or restructure or idle production. Thus, production is forecasted to remain weak, keeping supply constrained.

Demand Upside

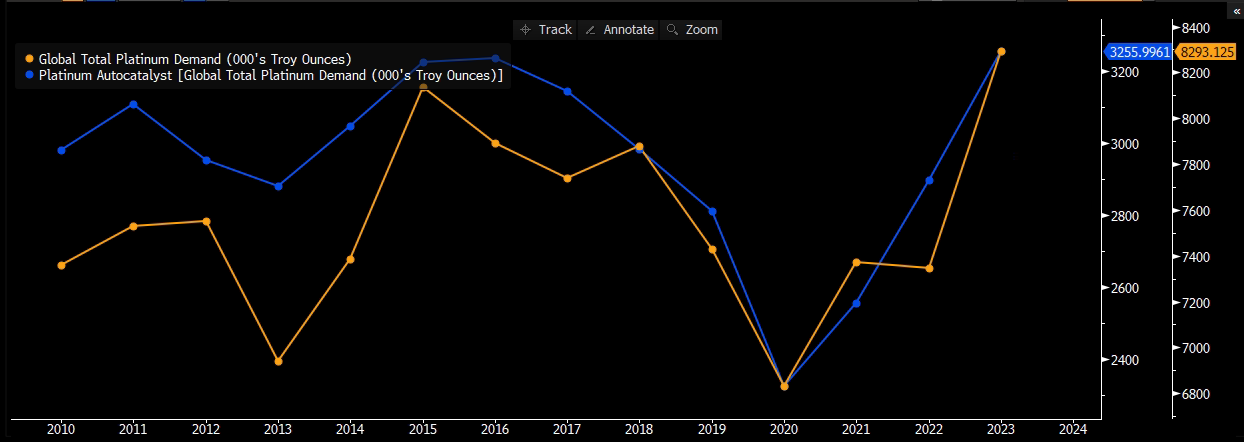

Demand has remained strong, led by surging demand for platinum in autocatalysts.

Crucially, there is significant demand upside for platinum in the emerging end-market of hydrogen fuel cells; where it is used as a catalyst to separate hydrogen into protons and electrons, which then generates an electric current. Hydrogen is expected to play a pivotal role as a renewable energy source of the future.

The World Platinum Investment Council expects the hydrogen end-market to account for 11% of total annual platinum demand by 2030.

Market Deficit

As seen above, the platinum market is in a deficit. This deficit is forecasted to be sustained through 2027 (World Platinum Investment Council).

Relationship with Palladium

Both Platinum and Palladium are used in autocatalysts, making them substitute products. The Platinum-Palladium spread is a key indicator for investors to monitor.

As seen in the spread above, Palladium prices have recently fallen below Platinum, as demand for palladium waned due to being substituted out of autocatalysts for Platinum. This has been somewhat excacerbated by the auto industry’s shift towards EVs, which don’t require catalytic converters.

Although both metals face a threat from EVs, palladium is more exposed, with 80% of its demand coming from autos. Platinum is also expected to benefit from other areas of growth, particularly in hydrogen fuel cells.

Platinum in a portfolio

Platinum can be included in an investor’s portfolio via:

- Physical bars and coins

- Physically-backed ETFs (e.g. abrdn Physical Platinum Shares ETF)

- Futures contracts (e.g. NYMEX Platinum Futures)

Our analysis shows a positive correlation of 0.48 between the prices of platinum and gold. However, Platinum has a higher beta to the S&P 500 (0.556 vs 0.111 for Gold), making Platinum more sensitive to the overall economy, likely due to its various industrial use cases.

Outlook

Since 2014, our analysis seen below shows that the mean Gold/Platinum ratio is around 1.5. The ratio currently stands at 2.3, about 2 standard deviations above the mean.

Thus, assuming Gold prices stays at or above $2,000, mean reversion could imply that Platinum prices could rally to $1,570 to $1,600 in the long-run based on the historical mean Gold/Platinum ratio of 1.5.

In the near-term (3-6 months), based on Fibonacci levels drawn from the March 2020 low around 562 to the February 2021 high at 1,348. We expect platinum prices to test key resistance level around 1,047 – 1,050. We believe our thesis is validated if prices breach this level and see a sustained close above 1,050. Prices could head further upwards towards 1,160 – 1,162 if upside momentum sustains. A Golden Cross supports our bullish thesis.

Trade opportunities in the CME Platinum Futures on Philip Nova 2.0. Open an account now!

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova