By Danish Lim, Investment Analyst, Phillip Nova

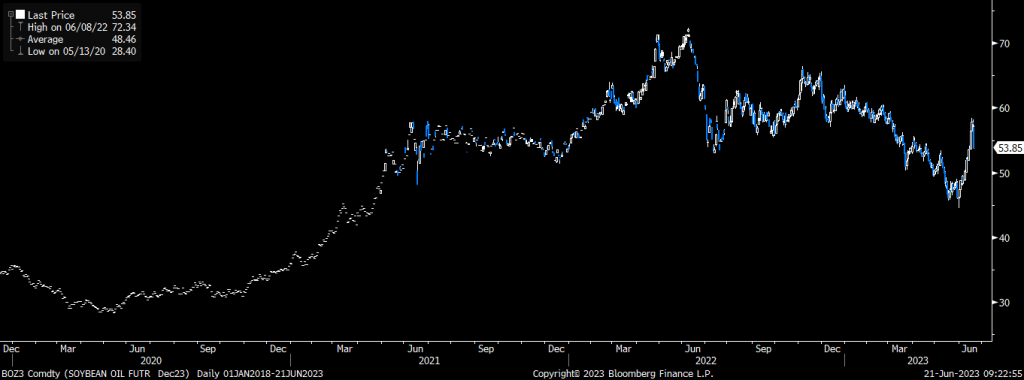

The benchmark soybean oil contract for December delivery plunged by -6.77% to 53.95 cents per pound (lbs) as of 9:18 local time.

How are prices moving for the year?

As of 21 June 2023, the contract has plunged by -12.76% YTD.

What is the all-time high and all-time low?

The all-time high for the contract was 72.34 cents per lb on 8 June 2022. The all-time low was 28.40 cents per lb on 13 May 2020.

Why are prices moving?

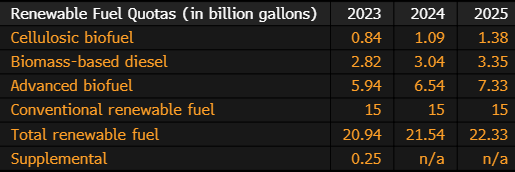

The Environmental Protection Agency (EPA) disappointed with its new federal quotas for biofuel and renewable diesel that markets say ignores a surge in production and a wave of investment in new manufacturing plants. The quotas mandate how much biofuel can be blended into US gasoline and diesel supply.

Set to be finalized later today, the EPA will require the use of 2.82B gallons of biomass-based diesel (generally made from soybean oil and other fats) in 2023. This was just a 2.2% increase over the 2.76B gallons mandated last year. 2024 and 2025 quotas are set at 3.04B and 3.35B gallons respectively. At the same time, quotas for conventional corn-based ethanol have also been reduced to 15B galloon in 2024 and 2025, down from 15.25B originally proposed.

The increase in fat-based fuel quotas are well below the increase sought by bio and renewable diesel producers, who were pushing for an additional 500M gallons annually. They highlighted the need for much higher quotas due to recent surges in US production, as well as their planned investments in renewable fuel capacity.

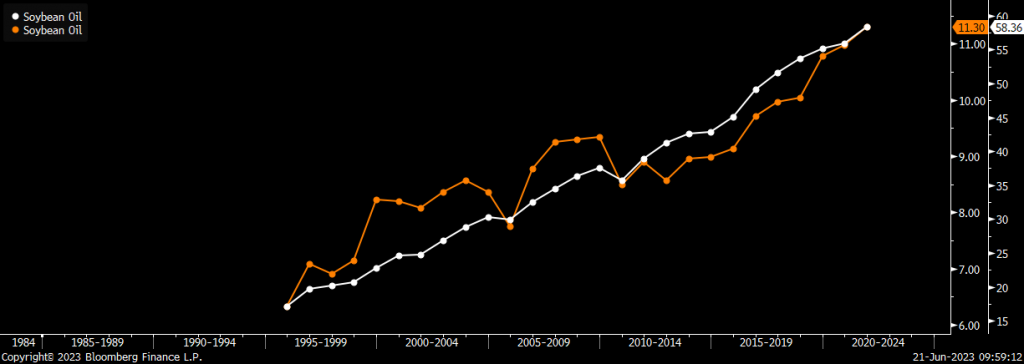

Demand is driven by the quota requirements under the US Renewable Fuel Standard. Thus, the latest quota runs the risk of worsening the demand-supply picture, running the risk of overproduction.

Republican Zach Nunn called the reported requirements “inadequate compared to production potential, failing to support farmers, protect our environment or keep up with demand”.

Are there other things I should know?

Darling Ingredients, the top US producer of renewable diesel, plunged by -7.22% during Tuesday’s trading session.

Other agriculture players such as Archer-Daniels-Midland Co. and Bunge also fell by -1.85% and -3.03% respectively.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova