By Eric Lee, Sales Director, Phillip Nova

The aluminium market has been buzzing with activity recently, pointing to a growing surplus that has everyone talking. It all started with falling physical premiums, a clear sign that supply was outpacing demand. Then, in a dramatic twist, the London Metal Exchange (LME) reported an 88% spike in aluminium stocks in early May 2024, leading supplies to rocket to the highest levels since January 2022. This included an eye-popping one-day deposit of 425,575 tons in Port Klang, Malaysia. This highly unusual event has industry insiders scratching their heads, with one of the traders calling it “insane”. You may refer to the Reuters links below for more details.

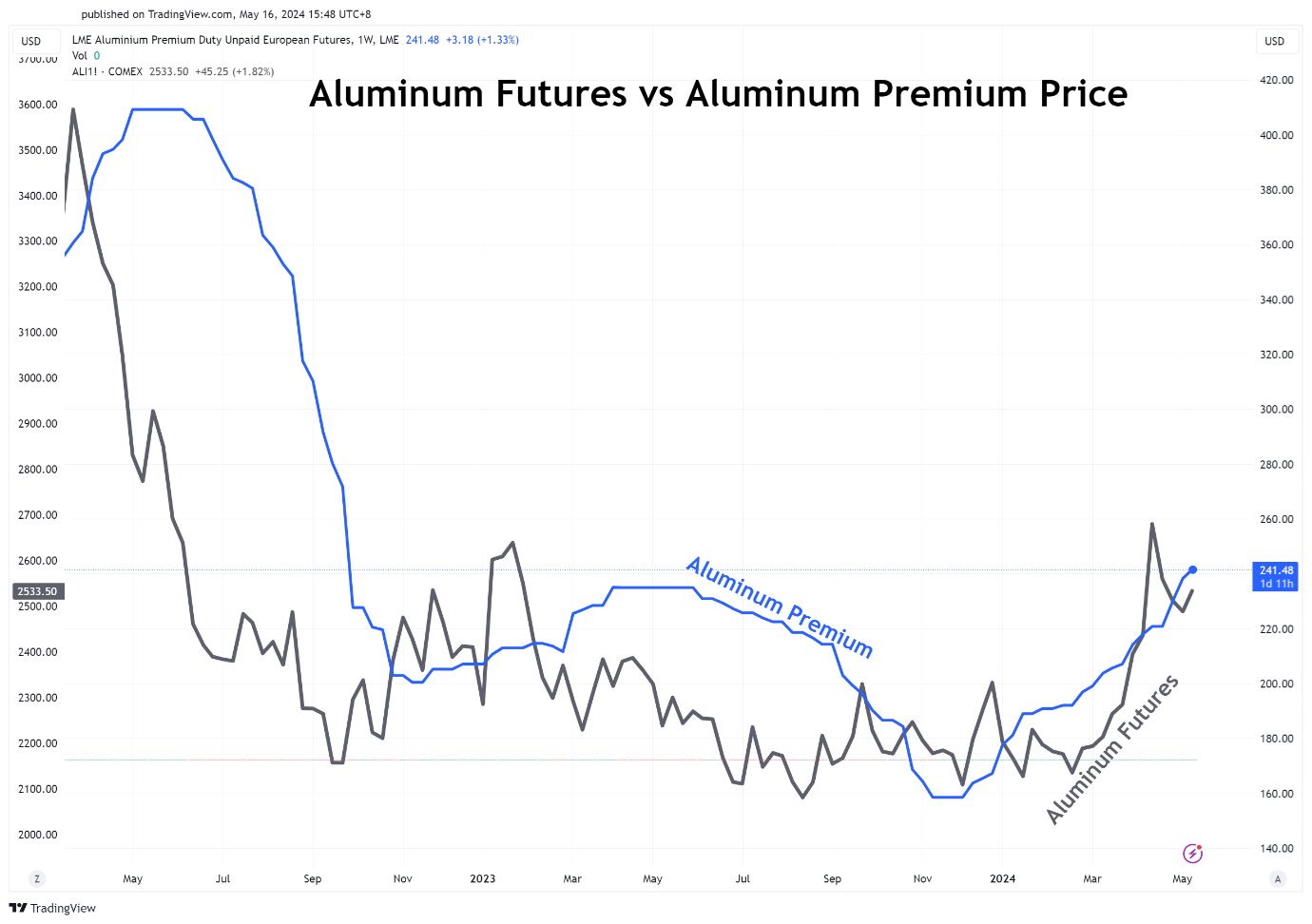

The chart below compares the price of Aluminium to that of Aluminium Premium. Just as the 1st article had implied, Aluminium Premium tells us a better story about the demand for the metal and clearly there’s a strong correlation between the 2. Unlike the Aluminium Futures chart, which is very choppy, even on a weekly chart, Aluminium Premium allow traders to tell the underlying trend of the commodity much more clearly.

Shortly after the release of the 1st article by Reuters on 8 Dec 2023, we see that the Aluminium Premium (blue line), started trending higher and as of now, still in the upward trajectory. This is followed by the actual Aluminium Futures price, which only started trend up from Feb 2024 onwards.

In its recent article dated 28 Nov 2023, the World Economic Forum stated that global aluminium demand will rise 40% by 2030. If this is true, then the current run up in Aluminium prices may have legs to continue further. One way to directly gain exposure to Aluminium is through the Aluminium Futures. For an indirect exposure into the metal, investors can also consider Press Metal Aluminium Holding Bhd, listed on the Bursa Stock Exchange, with the ticker code 8869. The company is fairly large with market capitalisation of MYR44b.

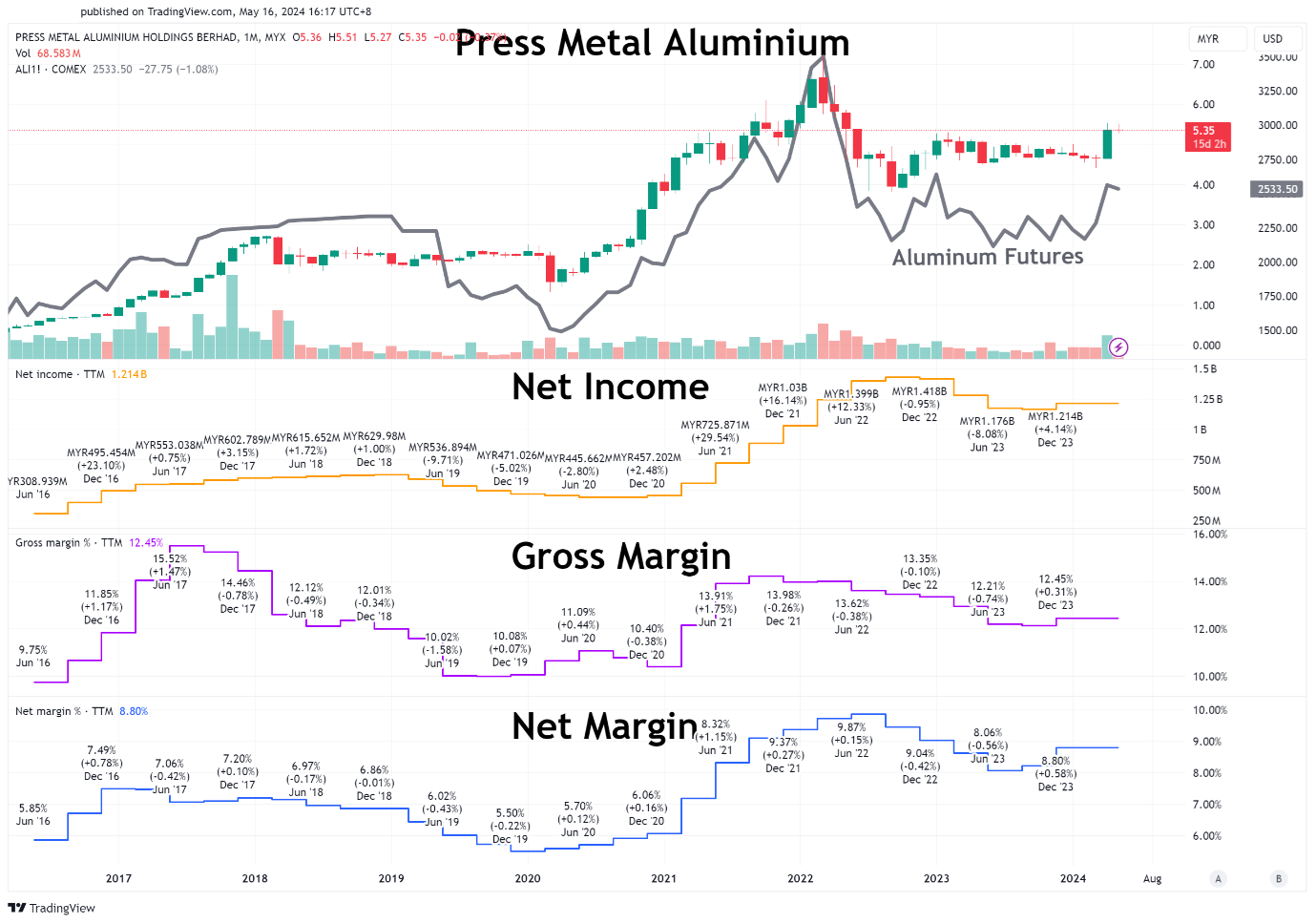

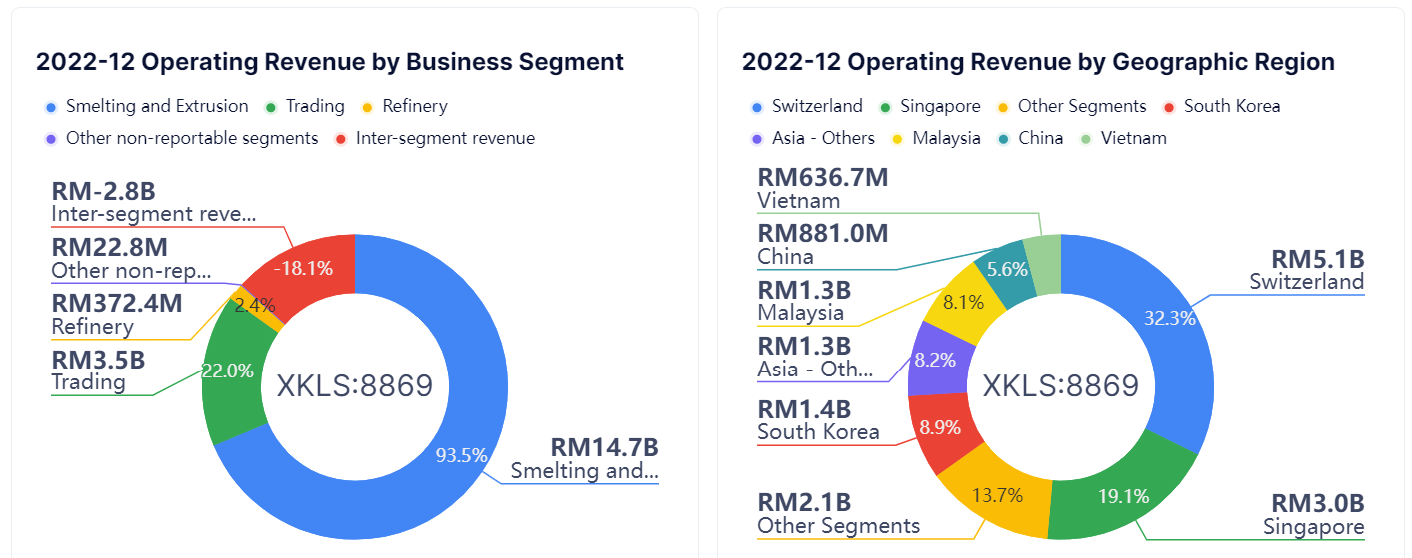

Press Metal Aluminium Holdings Bhd manufactures and sells extruded aluminium and other aluminium products to customers worldwide. The company operates in two segments based on function. The Smelting and Extrusion segment, which generates the vast majority of revenue, purchases aluminum scrap and produces extruded aluminium and aluminium alloys for industrial customers. The Trading segment markets aluminium products.

The chart below compares the performances of Press Metal Aluminium shares price, its financial performances and the price of Aluminium Futures from 2017 till to-date. We can see that there’s a very strong correlation and the rise and fall of Aluminum prices had directly resulted in the performances of its business and that of its share price.

In conclusion, higher Aluminium Premiums and the forecasted rise in demand for the metal by the World Economic Forum seem to indicate that the price of Aluminium is likely to trend higher in the future. Given that this has a strong influence on the business and share performance of Press Metal Aluminium (8869), this makes the stock a good proxy for investors who would like to have some exposure to aluminium.

Currently, the stock is in consolidation, forming up to a Bollinger “Squeeze” on its daily chart. A breakout from this “Squeeze” to the upside can be taken as a buy signal for momentum traders. Please note that the company is projected to release Q1 2024 earnings results on 27 May 2024.

Phillip Nova offers futures and stocks trading. It’s the one multi-asset account you need to capitalise on opportunities available in the global markets.

Upcoming Webinar By Eric Lee

For more insights from Eric Lee, do not miss his upcoming webinar on 25 June on Navigating Singapore’s Financial Currents. In this strategy webinar, Eric will discuss smart money strategies and share actionable insights on identifying companies where institutional funds are likely to flow into. Don’t miss his insights, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.