By Stephen Ong, Senior Account Executive, Phillip Futures

TLSA Update: TSLA plunged to $966.41 on Monday, 13 December 2021, a drop of almost 5%, to the lowest stock price in the last four trading days. Fears of the Omicron covid variant spreading, coupled with the Fed interest rate anxiety, triggered a broad sell-off in the stock market. NASDAQ index lost 1.40%, causing TSLA to break the $1000 support level on Monday, 13 December.

According to financial filings out on Monday, CEO Elon Musk, the Time Magazine’s 2021 Person of the Year, had sold another 934,091 shares of TSLA worth about US$906.49 million. Musk had also exercised options to buy 2.134 million shares of TSLA at the strike price of $6.24 per share which was allotted to him based a 2012 pay package.

As of this writing, TLSA has beaten the market this year handsomely with a year-to-date return of 44% despite the price dip on 13 December. Hence, it’s not surprising to see TLSA shares taking a breather as investors reassess the valuation of TLSA.

Moreover, TLSA has also announced that it has stopped taking new orders for its flagship Model X and Model S outside North America, according to Reuters. Market demand for electric vehicles (EV) remains firm as more countries offer incentives for EV purchases in order to combat climate change.

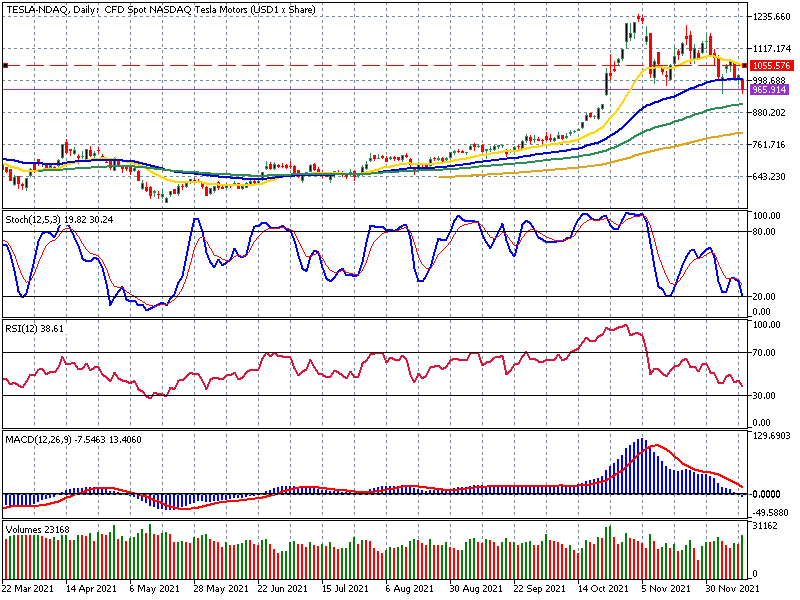

Tesla (TSLA) Daily chart MT5

TSLA Stock Forecast: will $910 support breach on 22 October hold?

As of this writing, TLSA seems to be heading towards the gap at $910 before the end of 2021. Buyers tried to held on to the psychological support level at $1,000 on Friday, but this level at $1000 was breached once again due to the increase in onslaught by sellers. For now, it looks likely that smart money from institutions are staying away from TLSA this week and the rise in bearish assault by sellers may cause a rapid decline in TLSA price to $910. The stock is currently curbed by the 20-day exponential moving averages and only a break above $1056 may change the bearish tone to bullish.

Breaking $910 could further create a lower low price action and reaffirm the short term bearish TLSA downtrend. The combination of both Relative Strength Index (RSI) and Stochastic (STO) both are just starting to descent into the oversold regions. This is not surprising given the plunged in TLSA shares on Monday 13th Dec. TLSA prices remain bearish at current levels and momentum indicators such as RSI and STO continue to retreat into bearish levels. This signifies that it is less likely for a price rebound in the short term.

Overall, outlook for TLSA still favors the bears, market participants could continue see TLSA sliding lower in the coming days and revisit other lower support floors.

So, what is your opinion on TLSA? Are you bullish or bearish? Open a trading account now and stay on top of the latest Tesla news and price performance on Phillip MT5 to help you decide on your trading position.

Click here to let me know what topics/sectors you would like me to write about next.

Stephen Ong is a Senior Account Executive with Phillip Nova. With over 20 years of experience in Stocks and Derivatives, including Forex and Futures, he offers actionable financial insights on multiple asset classes and how best to implement a successful trading plan on market view.