By Eric Lee, Sales Director, Phillip Nova

Introduction:

ThaiBev Group, a prominent beverage company in Southeast Asia and the largest in Thailand, had faced some rough times during the COVID-19 pandemic. Despite its robust business lines encompassing spirits, beer, non-alcoholic drinks, and food, its share price had experienced a significant decline. However, amid this adversity, there are crucial indicators and potential catalysts that investors should keep an eye on for the company’s share price to reverse its current downward trend.

Expansion and Diversification:

ThaiBev’s journey to prominence began with its listing on the Singapore Stock Exchange in 2006. Subsequent strategic acquisitions, notably Fraser & Neave (F&N) in 2012 and Grand Royal Group (GRG) in 2017, positioned the company as a regional powerhouse in the beverage industry. These acquisitions not only expanded ThaiBev’s product portfolio but also solidified its presence in key markets such as Singapore, Myanmar, and Vietnam.

Challenges Amid COVID-19:

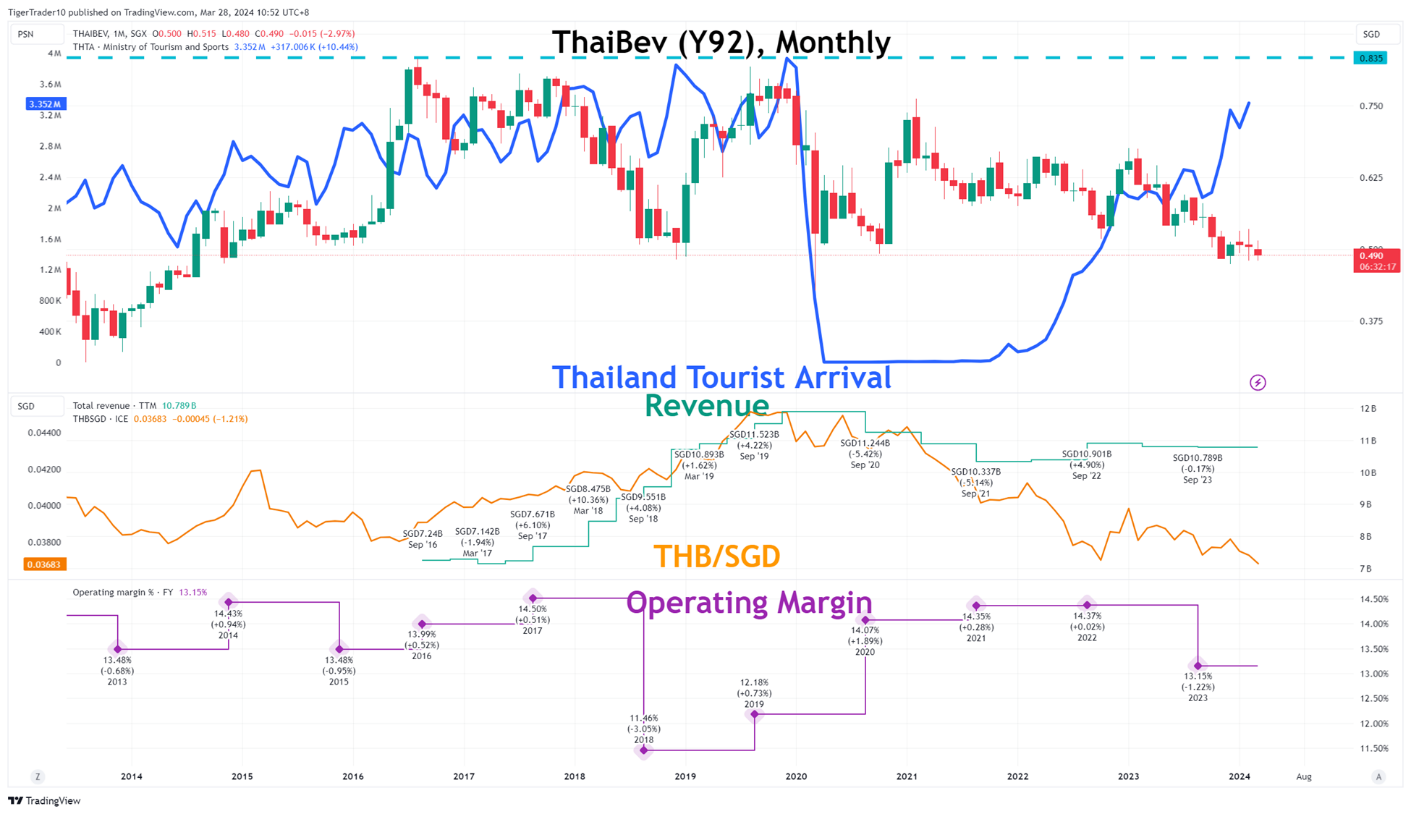

Since the onset of the COVID-19 pandemic, ThaiBev’s share price has experienced a sharp decline, plummeting from its peak above $0.80 to levels below $0.50, reminiscent of 2014 prices. Despite the World Health Organization (WHO) declaring an end to the global health emergency in May 2023, ThaiBev’s share price continued to slide, indicating persistent challenges beyond the pandemic’s immediate impact.

Key Catalysts for Share Price Recovery:

1) Improving Tourist Arrivals:

– Forecasts from the Bank of Ayudhya and the Ministry of Tourism and Sports suggest a significant uptick in tourist arrivals in Thailand, with estimates reaching pre-pandemic levels by 2024.

– Factors such as visa exemption policies, new flight routes, and increased flight frequencies are expected to drive this resurgence in tourism.

– Higher tourist arrivals would positively impact ThaiBev’s revenue, particularly through increased consumption of its beverage products.

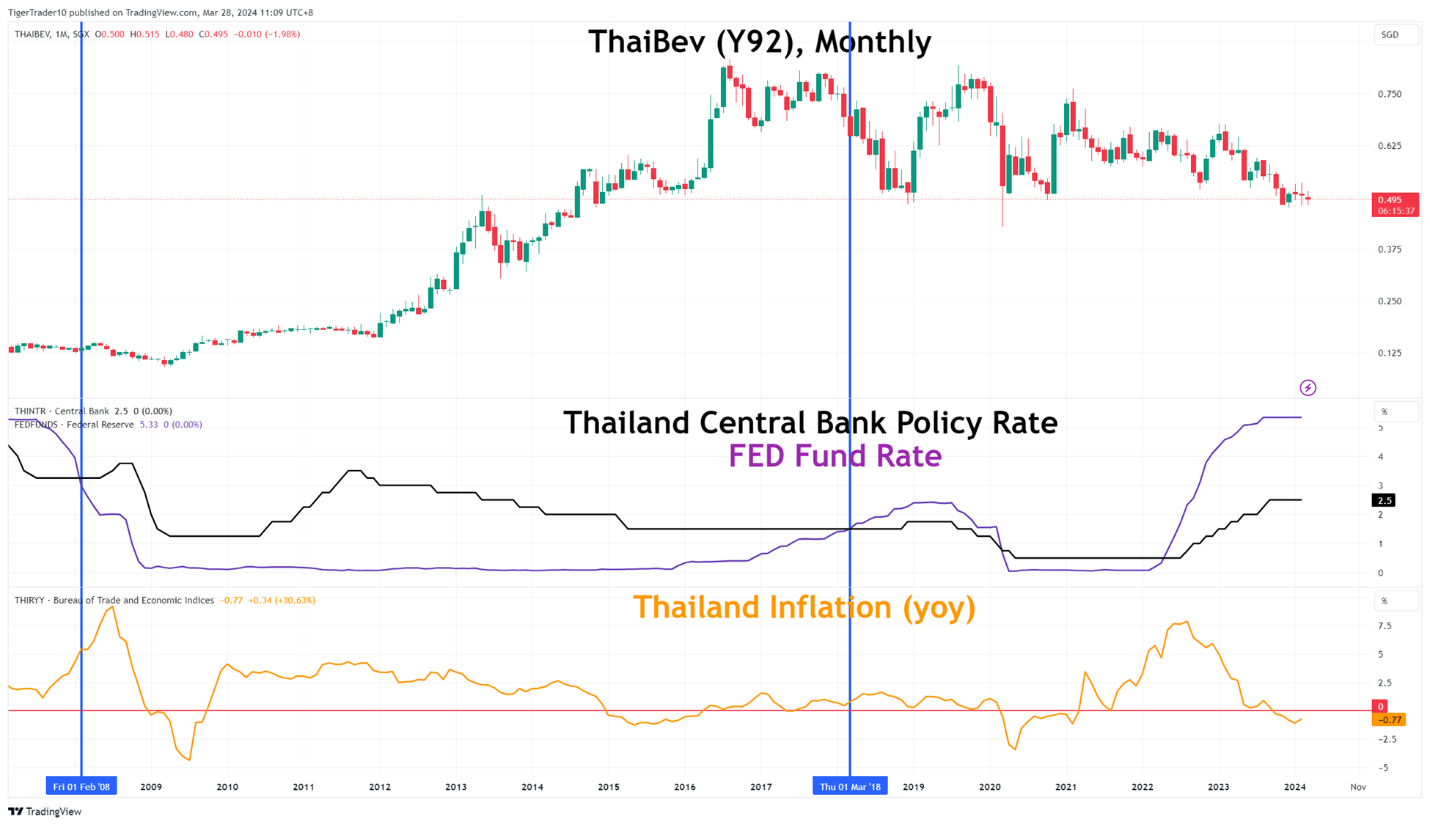

2) Impending Federal Reserve Rate Cut:

– The THB/SGD exchange rate is currently at historically low levels, adversely affecting ThaiBev’s financial reporting as it earns in THB but trades on the Singapore Exchange in SGD.

– With Thailand’s Central Bank policy rate at 2.5% and predictions of modest headline inflation for 2024, there is room for further rate cuts to stimulate the economy.

– A potential rate cut by the Federal Reserve, exceeding that of Thailand’s Central Bank, could stabilise or even elevate the THB/SGD exchange rate, offering a much-needed boost to ThaiBev’s share price.

Conclusion:

ThaiBev Group’s resilience and strategic positioning in the ASEAN beverage market provides a strong foundation for potential share price recovery. However, overcoming the challenges posed by the COVID-19 pandemic requires vigilant monitoring of key catalysts such as improving tourist arrivals and potential shifts in central bank policies. Investors poised to capitalise on these opportunities stand to benefit from ThaiBev’s long-term growth trajectory and resurgence in share price.

For more insights from Eric Lee, do not miss his upcoming webinar on 30 April on How to Use Smart Money As Your Investment Compass. Eric will discuss Smart Money strategies and its impact o, as we delve into the world of Smart Money and its impact on stock market trends. Don’t miss this webinar, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.