By Danish Lim, Investment Analyst, Phillip Nova

What’s the latest so far?

- Property tycoon Srettha Thavisin endorsed by Thai king as new PM

- Exiled ex-PM Thaksin Shinawatra was moved to a police hospital from prison a day after his return to Thailand after suffering health problems

- Current valuations make a good entry point as political risks ease

- Government data showed that foreign tourist arrivals reached 17m, generating 714.4b baht worth of revenue. May see further influx of tourists following relaxed visa approval process for Chinese tourists and public holidays in Malaysia.

- Consumer, Finance, and Tourism plays to benefit , given pre-election promises including digital handouts, higher minimum wage, etc

- Thai power and tycoon-linked stocks have been rallying over the past few days, thanks to optimism that Srettha’s government will steer away from policies on electricity price caps

- Stocks to watch: CP ALL-SDR (SGX: TCPD), Airports of Thailand- SDR (SGX: TATD), PTTEP-SDR (SGX: TPED), iShares MSCI Thailand (AMEX: THD)

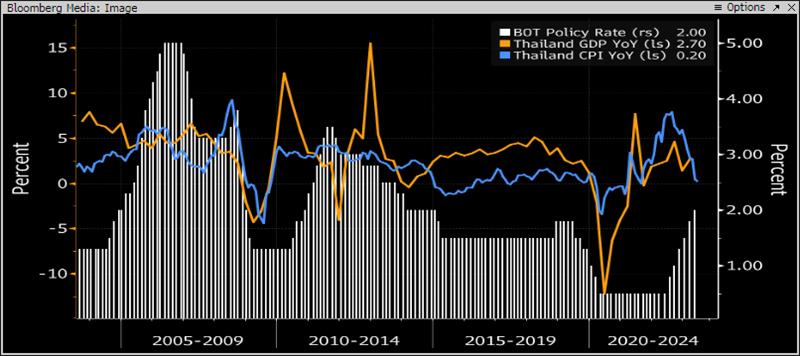

Equities and the Baht may rally as the 3-month long political impasse winds down. Sretta’s Pheu Thai party has campaigned for stimulus (minimum wage, handouts, etc) that should boost the economy at this critical juncture. But risks in China’s worsening growth outlook may limit upside. Fundamentals still look promising and inline with the previous market trends article (SET50 Futures).

Things to watch:

- whether the new PM will follow through with his campaign pledges such as a 70% hike in minimum wage, household income guarantee of 20,000 baht per month, and tripling of farm profits to lift economic growth, and a “digital wallet” scheme which gives every Thai 16 years old and above 10,000 Baht each.

- Thailand’s trade-and-tourism reliant economy still faces headwinds from China, which has damaged Thai exports.

- Whether the Bank of Thailand will continue hiking interest rates after hiking to a 9-year high of 2.25% in August.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova