By Danish Lim, Investment Analyst, Phillip Nova

The Australian Dollar (AUD) has plunged against the US Dollar (USD) since July 14, when incumbent Governor of the Reserve Bank of Australia (RBA) Phillip Lowe was replaced with Deputy Governor Michele Bullock, the first female head of Australia’s central bank. Lowe’s 7-year term is slated to end on September 17. The AUD/USD Micro Futures contract for September Delivery sunk as low as 0.6371, the lowest since last November.

Nevertheless, the monetary policy outlook for the RBA remains unchanged. In our view, the trajectory for AUD/USD will be dictated by labour and inflation trends, interest rate differentials, commodity price movements, and China’s economic woes.

4 Considerations in Forming Our View

We expect the Aussie Dollar to remain weak against the USD, supporting AUD/USD short positions. Our view depends on several variables and how they evolve moving forward will have huge implications on the trajectory of AUD/USD:

1. RBA Monetary Policy & Australia’s Labour Market

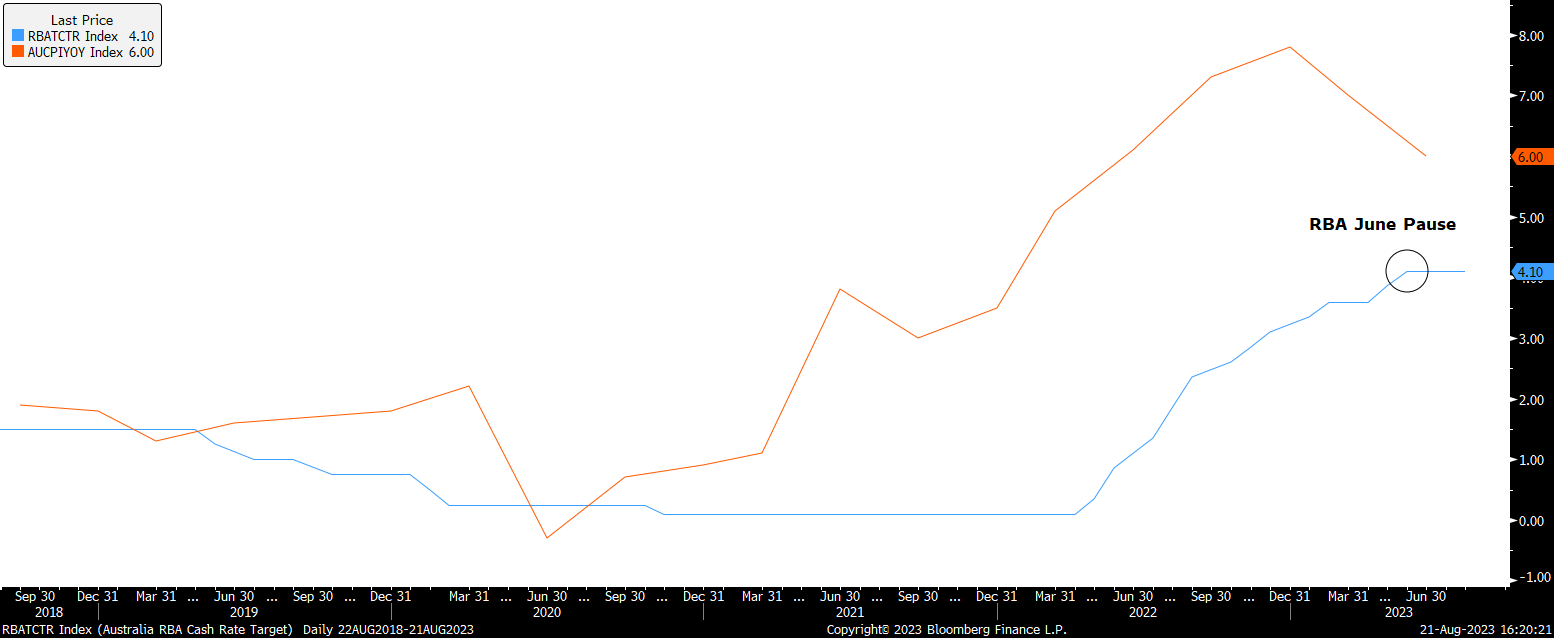

The RBA paused rate hikes in June after hiking by 400bps from a record low 0.1% since May 2022. The central bank left its cash rate unchanged at 4.1% in August, the highest level since 2012.

Minutes from the RBA’s August meeting showed that the decision to pause was based on the belief that the lagged impact of rates hikes are already slowing the economy and that tightening was “working as intended”. Officials saw a “credible path” to achieving sustainable inflation around 2-3% with rates at present levels. Among other reasons to pause, board members also highlighted concerns that unemployment may trend higher over the coming months.

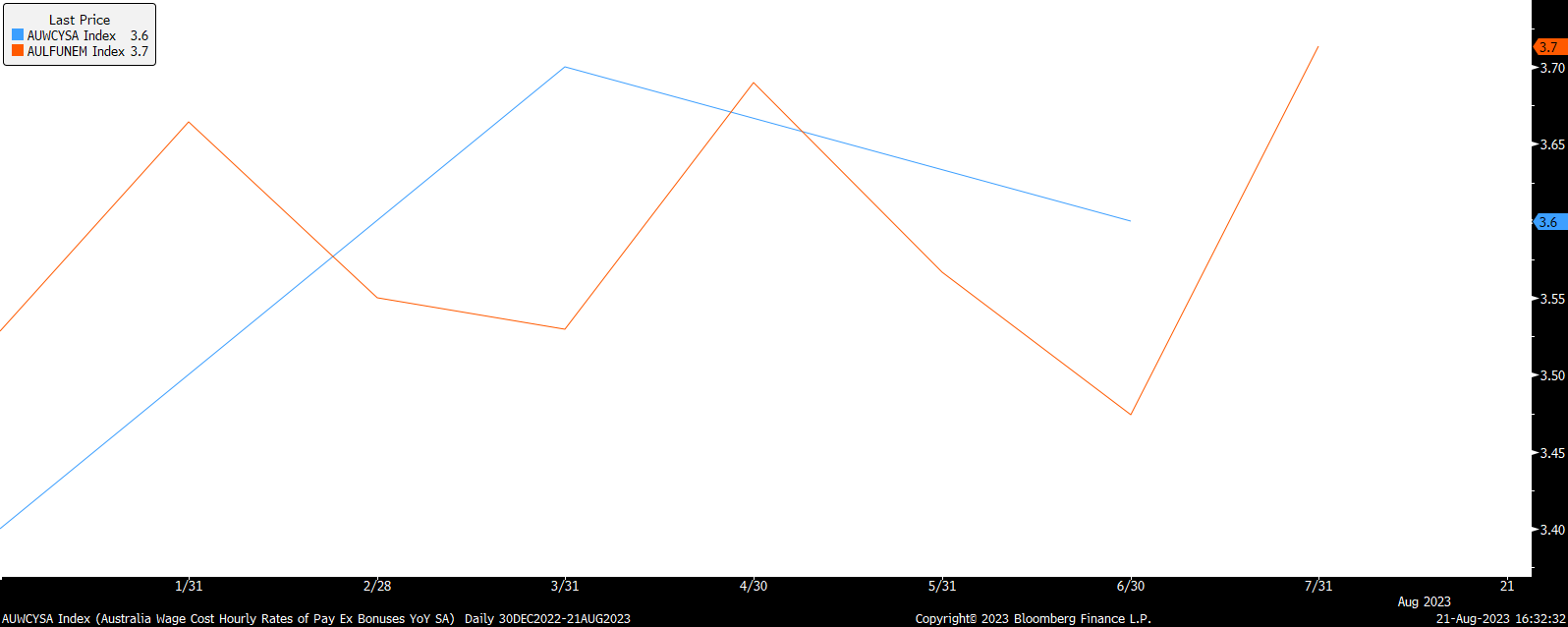

As seen above, boosting the case for a pause was Q2 Wage Price Index data declining to 3.6% YoY, as well as the Unemployment Rate climbing to 3.7% from 3.5%. This reinforces the case for the RBA to pause for a 3rd straight month at its September 5 meeting. Muted wage growth relative to global counterparts suggests that Australia can avoid a wage-price spiral that has plagued developed economies like the UK.

We think the latest wage growth and unemployment numbers hint that RBA tightening is starting to take effect. This should encourage the RBA to leave monetary policy on hold until inflation is soundly defeated.

2. Interest Rate Differential & Dollar Strength

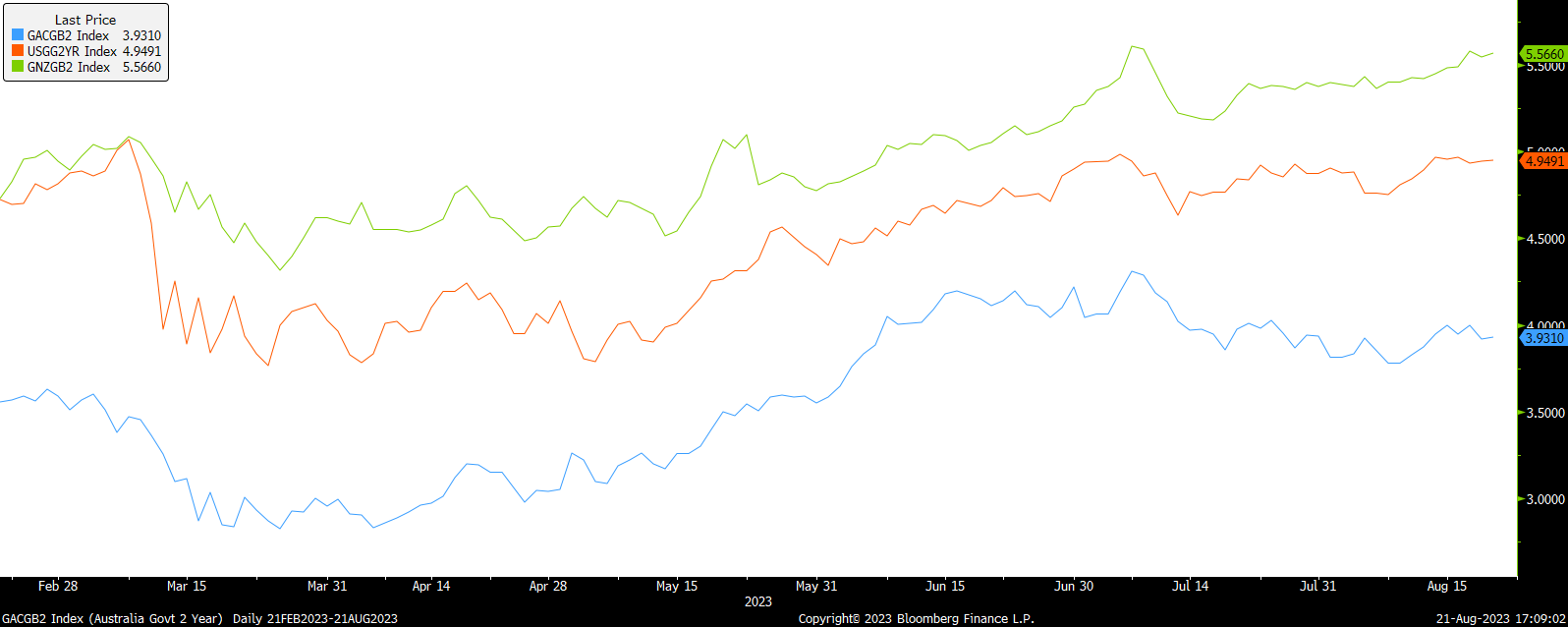

Australia’s interest rate at 4.1 % currently trails other developed economies, with the US at a 22-year high of 5.25% to 5.5%, and New Zealand’s Official Cash Rate at 5.5%.

In contrast to the belief that the RBA’s work is done, a resilient US economy has led to expectations for the Fed to keep rates “higher for longer”, causing a surge in Treasury yields which strengthened USD.

As seen above, Aussie 2Y yield spreads are negative to the US and New Zealand. This gap incentivizes investors to buy higher-yielding currencies such as the USD and NZD, while selling AUD. “Higher for longer” interest rates from the Fed could potentially further widen this yield gap, resulting in downward pressure on AUD/USD.

3. AUD as a Commodity Currency

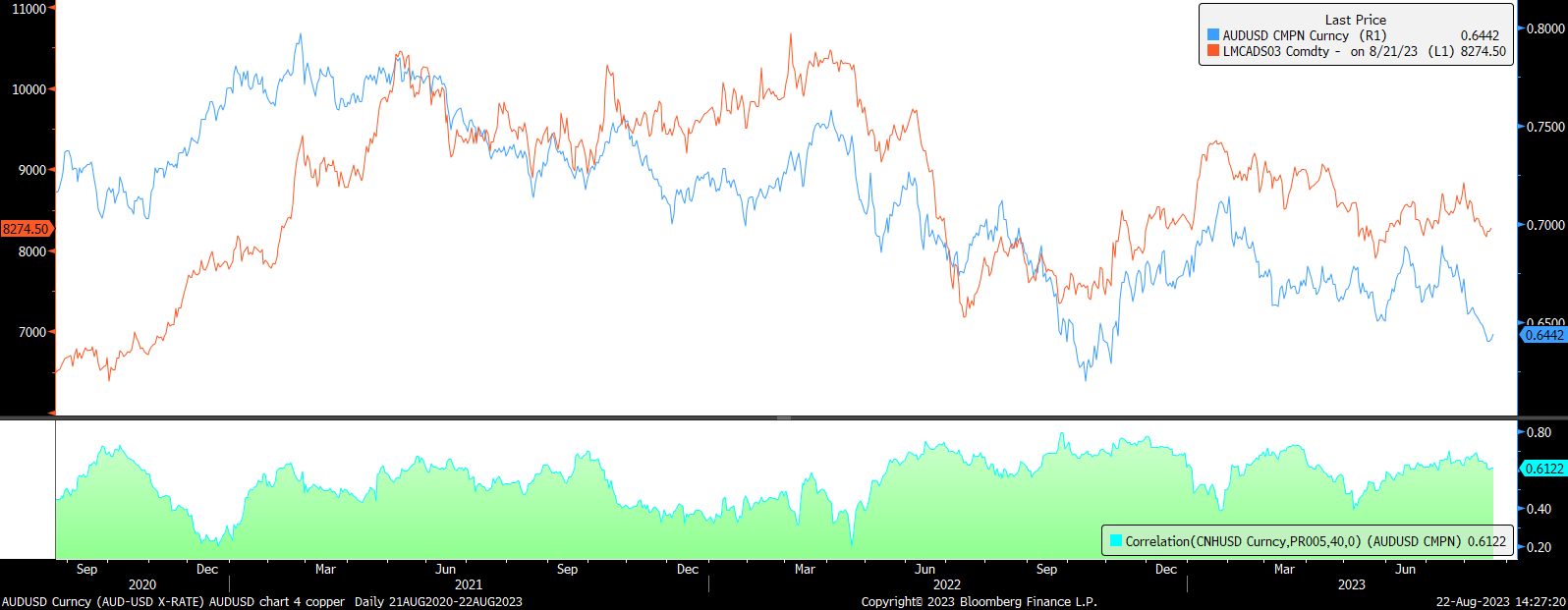

Australia is a major producer of copper and other commodities. Thus, as seen above, AUD has historically had a strong correlation with copper prices.

Higher commodity export prices mean that more Aussie Dollars are required to purchase the same amount of commodity exports. This translates to higher demand for the Aussie Dollar, resulting in AUD appreciation.

In our view, we believe Copper prices will remain weak as demand from largest importer China remains well below pre-pandemic levels. Manufacturing downturns in major economies and persistent troubles in China’s debt-ridden property sector will likely continue weighing on the industrial metal.

4. Proxy to China

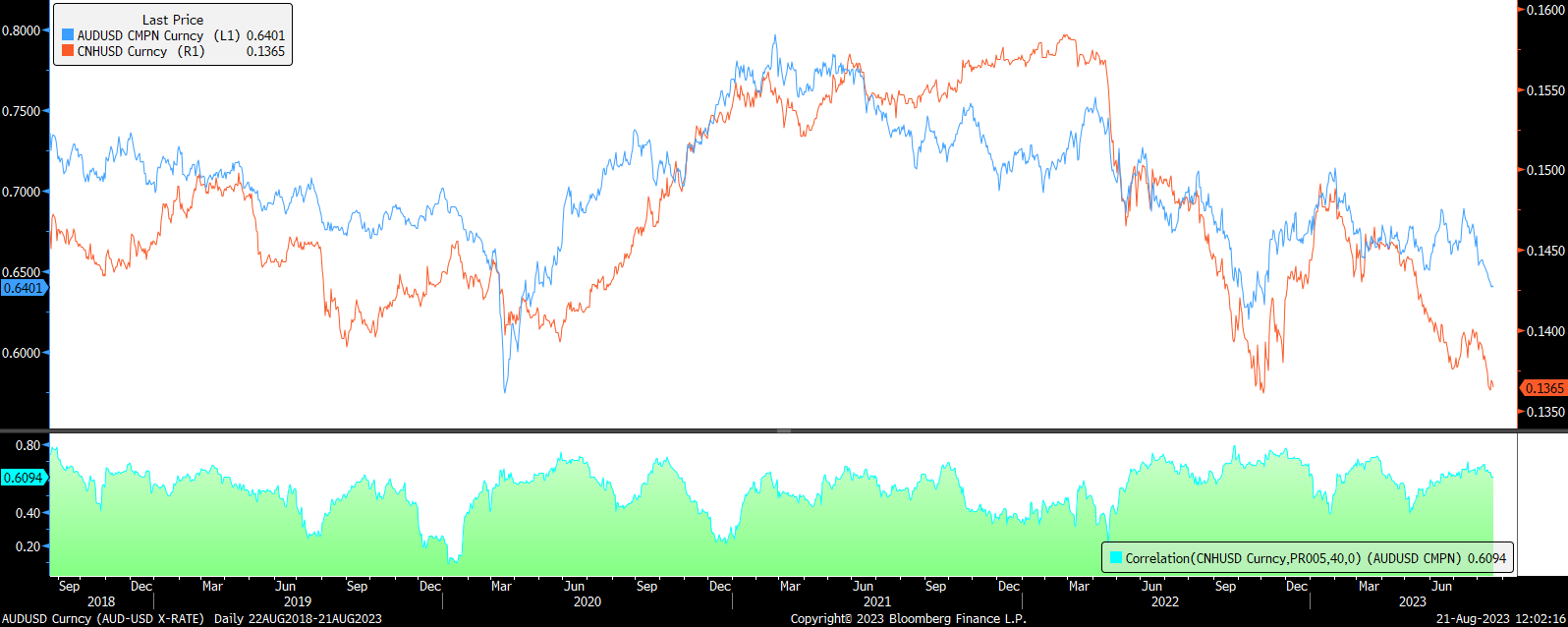

China is Australia’s biggest trading partner and a massive importer of commodities, including base metals like Copper. The Aussie Dollar is often seen as a proxy for China, with Australia’s exports to China (+ Hong Kong) at AUD 19.773B in June, more than the next 4 countries combined. Thus, China’s recent economic woes pose a serious threat to AUD. This relationship can be seen in the positive correlation between AUD and the offshore Yuan as seen below.

The RBA cited “China’s uneven recovery from Covid-19 restrictions” as the top of its “key domestic uncertainties” list in its August statement of monetary policy. Weakness in China will dampen demand for commodities and, in turn, weigh on the prices of Australia’s key exports.

In our view, worsening economic conditions and deflationary pressures in China will continue to serve as a headwind to the Aussie Dollar. We do not envision any massive stimulus or big rate cuts from the PBoC as the central bank struggles to maintain a balance between economic stimulus and Yuan weakness. The Yuan should continue to be pressured by lower interest rates and a widening yield gap with other developed economies, resulting in AUD depreciation.

Our View

We expect the AUD to remain weak against the USD, supporting AUD/USD short positions. We believe that the RBA’s tightening cycle is over, supported by rising unemployment figures and moderating inflation. On the other hand, USD should continue to stand tall as Treasury yields climb and the “Higher for Longer” interest rate narrative gains traction. Waning commodity demand and economic woes in China should also limit any meaningful upside for AUD/USD.

Barring inflation surprising to the upside, we think that the RBA has no reason to hike rates any further.

Expressing Our View

We favour the hypothetical trade setup below in order to express our view.

We favour taking a short position with entry at the present level of 0.6443, target level at 0.6200, and stop loss above 0.6500 psychological resistance at 0.6550. Losses in AUD/USD could accelerate once monthly low at 0.6370 is breached. The contract may head towards the October low of 0.6200- which coincides with a fundamental backdrop with US 10Y yields above 4.2% and factory protests in China.

This setup delivers a reward: risk ratio of 2.08x.

- Entry Level: Present level of 0.6443

- Target Level: 0.6200

- Stop Loss Level: 0.6550

- Profit at Target: 223 pips x USD 1= USD 223

- Loss at Stop: 107 pips x USD 1 = USD 107

- Reward: Risk Ratio: 2.08x

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova