By Danish Lim, Investment Analyst, Phillip Nova

ESG on the rise

In recent times, interest in ESG related issues has been on the rise, even becoming embroiled in political debates in Washington- with President Joe Biden recently veto-ing a Republican proposal to bar 401(k) plans and other workplace retirement plans from offering ESG funds. Naysayers and sceptics have blasted ESG funds as just a form of “woke” investing.

MorningStar reported that 2022 ESG net annual inflow of $3.1B was well below the average $47B over the past 3 years. I think that mainly the negative broader market environment drove this, with a majority of sectors underperforming in 2022. At the same time, ESG ETFs were typically underweight Energy, which was the top performer in 2022.

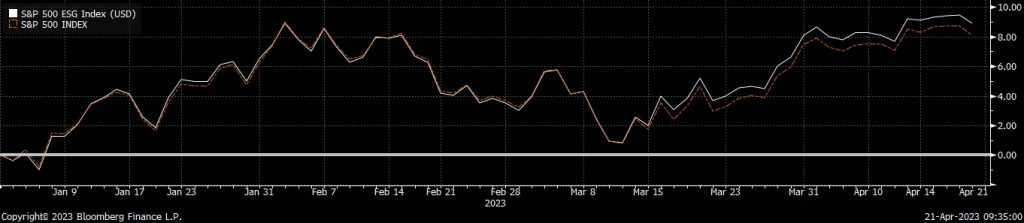

Looking into the data, the S&P 500 ESG Index has actually outperformed the broader S&P 500 index over the past 10 years. It is also up by 8.89% YTD, slightly better than the S&P 500 at 8.20%. I would attribute this outperformance to a majority of ETFs being overweight ESG friendly sectors such as Tech, which has outperformed so far in 2023.

What factors investors should take note of?

When looking for an ESG ETF, investors should take a deeper look at the funds’ holdings and make sure that it aligns with their value. For example, if you are against gun violence, you should look for ETFs that exclude companies with exposure to the weapons industry. Similarly, a high sector exposure to Energy may not be ideal. In this scenario, there have been instances where funds holding Energy stocks still rank quite highly in terms of ESG ratings. Thus, due diligence is recommended when it comes to looking at the fund’s underlying holdings.

ESG ratings scored by independent organizations such as MSCI, S&P Global, and MorningStar should also be taken into account. According to Morningstar, Apple has a “low” ESG risk rating of 16.91, while Tyson Foods has a “high” ESG risk rating of 36.53.

Investors should also look at the fund’s Expense Ratio, which is a crucial aspect of ETF investing as higher expenses can eat into profits. It is also important to note that ESG funds can be divided into passively or actively managed funds, with active funds typically having higher Expense Ratios.

Risks for investors when investing in ESG ETFs

Narrow your investment opportunities

Investors run the risk of sacrificing returns by leaving profitable investments on the table. For example, an ESG investor likely would have suffered losses in 2022 by missing out on Energy stocks. Exxon grew by roughly 80% in 2022.

Risk of becoming under-diversified & Greenwashing

The pool of ESG-compliant companies is typically smaller than the pool of available publicly traded companies. Companies may also make false and misleading claims about their ESG practices to entice would-be ESG investors and make a profit.

However, I am of the opinion that pros of ESG investing outweigh the risks.

Benefits for investors when investing in ESG ETFs

Lower downside risk

Companies with proactive ESG policies should see fewer business disruptions and produce more stable profits over the long-run. ESG issues may generate negative publicity and threaten corporate profitability. E.g. Volkswagen’s emissions scandal in September 2015, or “Dieselgate”, contributed to a -36% slump for the month of September.

Align your investments with personal values

Reward ethical companies and encourage other corporations to uphold similar values. Achieve twin goal of generating profit while aligning your investments with personal values.

Expert watchlists & why these are worth investing in:

- Vanguard ESG US Stock ETF (ESGV), Expense ratio 0.09%

This ETF tracks the performance of the FTSE US All Cap Choice Index. It has a well-diversified pool of stocks, 70% of which are large caps. The fund is based on exclusionary principles- excluding companies with exposure to industries like weapons, tobacco, gambling, and adult entertainment. ESGV’s exposure to the energy sector is nearly 0%, but has around 32% exposure to Tech, 16% to Consumer Discretionary, and 15% to Healthcare.

2. VanEck Green Bond ETF (GRNB), Expense ratio 0.20%

The fund seeks to replicate the performance of the S&P Green Bond US Dollar Select Index. Its holdings are mainly comprised of “green bonds” that were issued by governments or corporations to fund environmentally friendly projects. The fund has a MorningStar 4-star rating. It also has a 12-month yield of 2.71%. GRNB is most heavily weighted towards the Financials (38.3%) and Utilities (20.3%) sectors.

3. iShares Global Clean Energy ETF (ICLN), Expense ratio 0.40%

The fund aims to track the investment results of the S&P Global Clean Energy Index. It provides exposure to companies that focus on producing clean energy from solar, wind, and other renewable energy sources. Some of its largest holdings include renewable energy stocks such as First Solar, Vestas Wind Systems, and Enphase Energy.

Future Outlook for ESG:

In the long-run, as the world becomes more aware of ESG-related issues, ESG considerations could start to play a greater role in people’s investment decisions and consumer preferences. In my opinion, ESG analysis can serve as a complement to traditional financial analysis by helping investors evaluate non-financial risks that typically goes unnoticed.

Increased availability of standardized ESG data and improved reporting standards can help investors and managers make better investment decisions. In December 2022, the EU adopted the Corporate Sustainability Reporting Directive (CSRD), which expanded the number of companies that are required to report sustainability information, from around 12,000 to 50,000. Therefore, over time, we could start to see ESG information being further integrated into fundamental analysis.

Do you have questions for Danish or you want to deep dive into how to build your personalised portfolio?

Hear from the experts: Danish Lim, Investment Analyst from Phillip Nova and Alvin Chow, CEO of Dr. Wealth.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova