By Danish Lim, Investment Analyst, Phillip Nova

The SGX Nikkei 225 Index Futures contract, which closely tracks the benchmark Nikkei 225 index presents a potentially enticing opportunity for investors. In this article we will explore structural underpinnings and technical nuances that underscore the optimistic outlook for this futures contract, against the backdrop of a dynamic Japanese market landscape.

Structural Drivers Fuelling Growth

The Japanese stock market has demonstrated resilience, outperforming many of its developed market counterparts. Year-to-date, the contract has surged by 13.44%, eclipsing the S&P 500’s gains. Key structural drivers, including enhanced corporate profits, bolstered corporate governance, tax incentives via the Nippon Individual Saving Account (NISA) program, and robust inflation and wage growth, buoy the market’s momentum.

Technical Insights

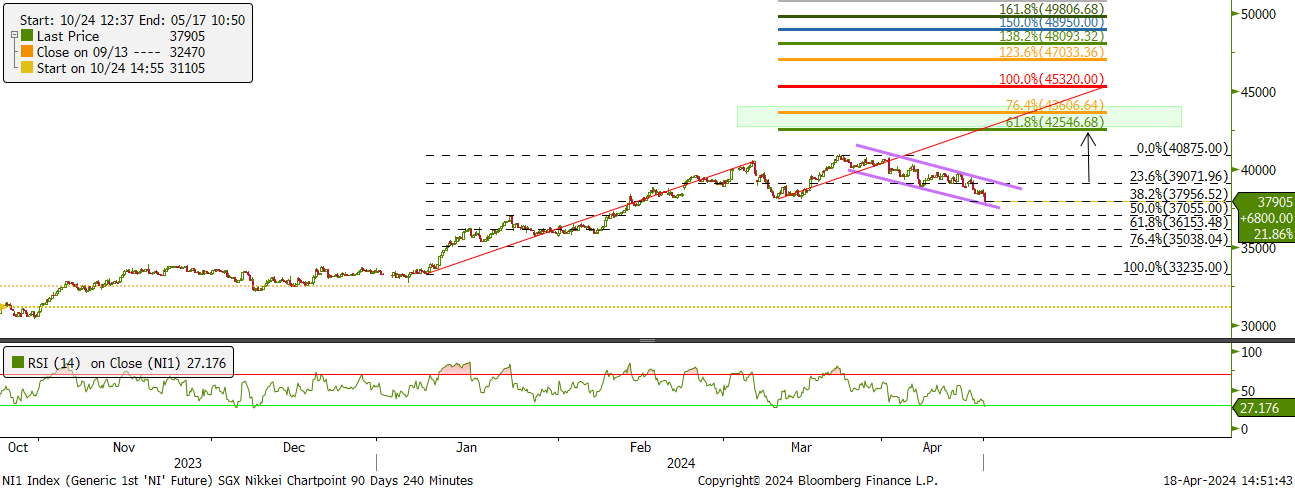

Looking at the 4-hourly technical chart, we can see that the contract has broken below key psychological support at the 38.2% retracement level, approximately around 37,956 – 38,000. We expect to see a potential retracement above this level in a false breakout. Other technical observations to support this view include:

- The 14-day Relative Strength Index (RSI) indicator is currently in the oversold territory of below 30. Typically a buy signal is usually triggered when the indicator breaks past 30 from below.

- Despite intervention risks, we think it’s worth noting that the BoJ views the USD/JPY rate of change as the key catalyst for intervention, rather than a specific exchange rate level.

Sectoral Dynamics and Growth Prospects

The Nikkei 225 Index boasts a significant exposure to the burgeoning artificial intelligence (AI) sector, positioning Japan favorably for AI-driven innovations. Furthermore, the resurgence of inflation and wage growth bodes well for the Consumer Goods sector, heralding a shift towards increased consumption and investment patterns.

Mitigating Risks

Despite inherent risks, including intervention concerns by the Bank of Japan, strategic risk management measures can mitigate potential downsides. Maintaining a stop loss slightly below the 50.0% retracement level serves as a prudent safeguard against adverse market movements.

In conclusion, the SGX Nikkei 225 Index Futures contract presents a compelling avenue for investors seeking exposure to the robust Japanese equities market. While short-term fluctuations may persist, the overarching growth narrative remains intact. By leveraging structural drivers and astute technical analysis, investors can navigate market volatilities and capitalise on the promising trajectory of Japanese equities.

Trade opportunities in the Nikkei 225 Futures and the USDJPY on Philip Nova 2.0. Open an account now!

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova