In Total Returns, as of 19 August Market Close:

STI: +15.79% YTD

SiMSCI: +21.59% YTD

FTSE ST All-Share (Top 98% by market cap): +15.59% YTD

FTSE ST Mid Cap: +9.99% YTD

FTSE ST Small Cap: +20.35% YTD

SGX MSCI Singapore Index Futures hit fresh records last month after it climbed to an 18-year high of 444.26 on 13 August (not too far from the all-time high of 481.23 on 10 October 2007). Strong investor confidence and rising institutional demand fuelled an 18% MoM jump in open interest, reaching an all-time peak of US$7.1B.

What are the key drivers for the Singapore Index Futures?

- Singapore equities stand out as an attractive safe haven, with the SiMSCI having a dividend yield of 3.86%.

- Reciprocal tariffs of 10% are low compared to Asian peers.

- Valuations: The SiMSCI is currently trading below the 5-year average of 18.0x LTM P/E, at 16.4x (-8.9% discount).

- Companies are becoming more aggressive in returning capital to shareholders via higher payouts and share buybacks.

- Crucially, the planned S$5bn to be spent on Singapore equities by MAS’s equity market development programme (EQDP) should be beneficial for our local stock market.

Where are the prices headed?

Our price target for the SiMSCI Index by Dec-2025 is near the 123.6% extension level at 480. We see immediate resistance at 450, which if breached, could see the index push further upwards towards our year-end price target.

The SiMSCI Index stands out with its exposure to international-listed constituents like Sea (18% of index), and Grab (3.5% of index).

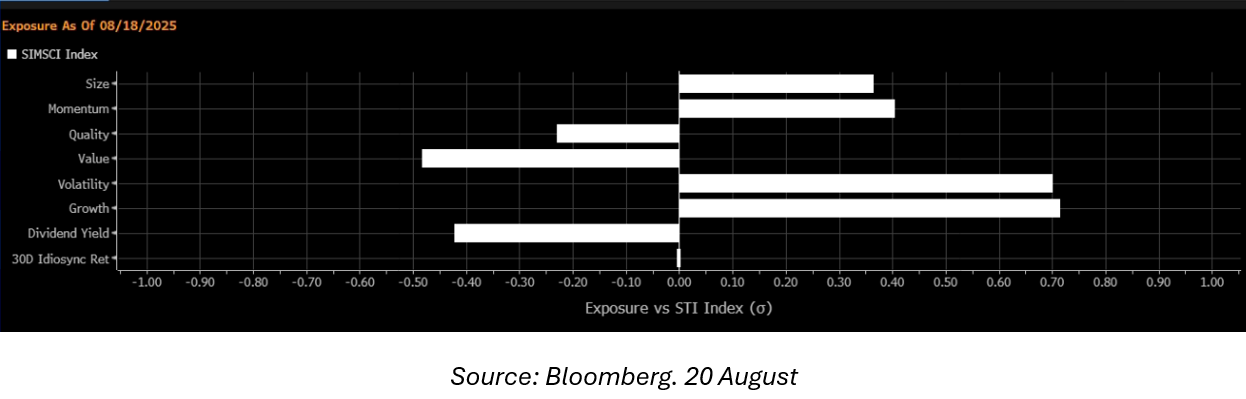

Hence, in terms of factor tilt, as seen below, the SiMSCI Index has noticeably higher exposure to growth and volatility compared to the STI.

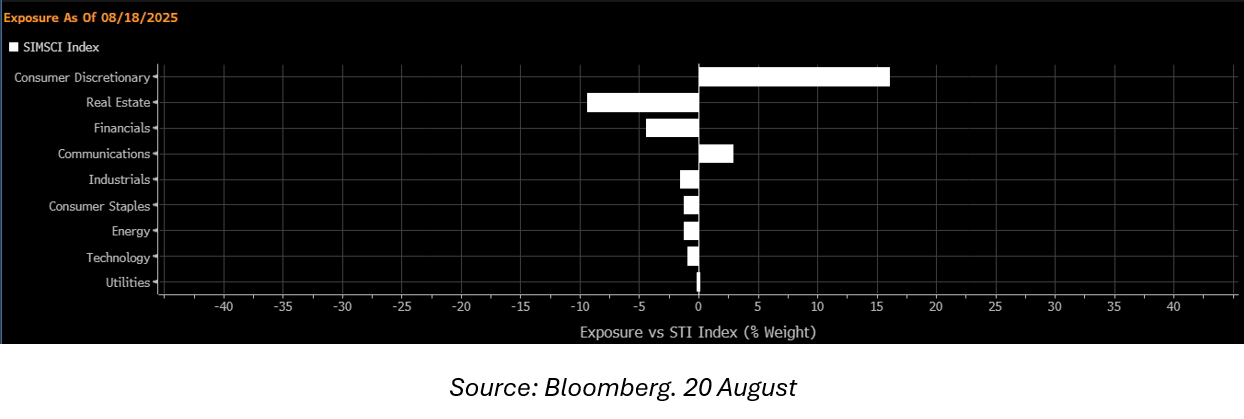

In terms of sector exposure, the SiMSCI has a lower allocation to Real Estate, namely S-REITs, than the STI.

Equity Market Review:

Singapore’s 3 local banks all reported compressed Net Interest Margins (NIM) in 2Q2025, as a lower 3-month SORA weighed on interest income.

- As of 20 August, the 3M-SORA continued to slide down to 1.69%, the lowest since September 2022.

- We expect the 3M-SORA to continue declining as Fed rate cuts are expected. With market participants pricing in a 84% likelihood of a 25bps rate cut in the 17 September FOMC meeting.

- Nevertheless, lower rates led to an increase in Singapore loan growth (May25: 5.83% vs Apr25: 4.5%). A surge in trading activity also boosted non-interest income (NOII).

DBS announced that its 2Q net profit rose 1% to S$2.82 billion, beating estimates of S$2.79b.

- Net interest income was higher on strong deposit growth while fee income and treasury customer sales rose to their second-highest quarterly levels.

- The bank declared an ordinary dividend of S$0.60 per share and a capital return dividend of S$0.15 per share for the period. This brings the quarter’s total dividend payout to S$0.75 per share, up from S$0.54 in the year-ago period.

UOB’s Q2 net profit fell by -6% YoY, as net interest income eased on lower margins.

- Declared an interim dividend of S$0.85 per share for 1H25, a decrease from S$0.88 in the year prior.

- In addition, a second tranche of UOB’s S$0.50 per share special dividend will be paid out to shareholders.

- Net interest income for the quarter fell 3%, as net interest margin declined 14bps to 1.91%, down from 2.05% the year before.

OCBC’s Net Income beat estimates, driven by a jump in fee income, which offset a decline in interest income.

- Net income fell -6.6% to S$1.8b (vs est of S$1.78b). Net interest income -6% YoY, Non-interest income +5.4% YoY.

- Net interest margin (NIM) fell to 1.92%, down by 28bps YoY, due to a faster drop in loan repricing rates in SG than decreases in deposit rates.

- Nevertheless, wealth management fees rose by 32%.

- Management lowered the 2025 guidance for NIM as interest rates decline.

- Bank also cut its interim dividend to 41 cents a share, down from 44 cents last year

- Remains committed to previously announced S$2.5b capital return which includes a special dividend amounting to 10% of FY25 net profit and share buybacks over 2 years, to be completed in 2026.

POSITIVE: We believe banks can withstand NIM compression from the steepening yield curve and higher CASA levels.

- Dividend yield of ~5.7% is attractive as capital return initiatives continue in FY25 and share buybacks improve ROE & EPS.

- A beneficiary of the trade war has been trading volumes, with YTD 2025 volumes up ~24% YoY.

BBG 12M Price Target: 1) DBS S$51.87 | 2) UOB S$37.69 | 3) OCBC S$17.72

Grab-ADR (BBG 12M Price Target: $6.10) topped estimates on strong demand for ride-hailing and delivery services.

- 2Q Revenue rose 23% to $819m, above consensus estimates of S$812.2m, despite tough competition from Indonesia’s GoTo (GoJek).

- Deliveries Revenue S$439m, vs estimate S$432.4m

- Mobility Revenue S$295.0m vs estimate S$293.2m

- Financial Services Revenue S$84.0m vs estimate S$82.8m

- Management sees full-year revenue at S$3.33b to S$3.4b.

- This comes amid speculation that Grab is looking to acquire GoTo.

- The company is currently expanding to autonomous technology, collaborating with South Korean vehicle Technology provider Autonomous A2Z Co.

Sea Ltd-ADR (BBG 12M Price Target: $196.95) saw 2Q results beat estimates as Shopee raised the commissions it charges merchants by about a third since the start of last year.

- Shopee’s fees are higher than rivals like TikTok and Lazada, but merchant retention is still high thanks to a broad user base and well-established delivery network– handled by its logistics arm, SPX Express.

- Crucially, we believe Shopee has an advantage over rival TikTok as users typically open the Shopee app with a clear intent to purchase, whereas TikTok usage is more discovery-driven and less transaction-oriented.

- Revenue +38% YoY to $5.26b vs est of $5.01b.

- E-Commerce (Shopee) showed strong growth with 29% increase in orders to $3.3b and 28% GMV growth to $29.8b, citing higher commissions and ad revenue.

- Digital Financial Services (Monee) saw revenue grow 70%.

- Gaming (Garena) saw 23% bookings growth.

- All 3 segments now EBITDA positive since 2H last year and generating cash

- Management raised guidance for Garena, expecting booking to grow over 30% YoY in 2025.

Add these bubbling Singapore market opportunities into your watchlist now!

Trade the SGX MSCI Singapore Index Futures at only S$1.38 on Phillip Nova 2.0 now! Learn more now!

Or take a view via Singapore stocks, or explore opportunities in ETFs via the Phillip MSCI Singapore Daily (2X) Leveraged ETF (LSS) or the

Phillip MSCI Singapore Daily (-1X) Inverse ETF (SSS) now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0