Introduction

The final quarter of 2025 is shaping up to be one of the most eventful periods for global markets, with major central banks set to deliver their final interest rate decisions and year-end economic outlooks. These announcements, along with key data releases on inflation, jobs, and growth, will guide investor expectations and shape forex trends heading into 2026.

An economic calendar is an essential tool for navigating this busy season. It helps traders stay on top of market-moving events, anticipate volatility, and align strategies with evolving monetary policies. This article will explain how to use the economic calendar effectively, highlights the most important global and regional events in Q4, and concludes with a look at how the ongoing U.S. government shutdown may disrupt key data releases and market sentiment.

Why and How Economic Data Releases Impact the Forex Market

Why Economic Data Impacts the Forex Market

Currency values move with shifts in supply and demand, when more investors want a currency, it strengthens; when demand falls, it weakens. Economic data strongly influences that demand because it signals how healthy a country’s economy is and what returns investors might expect. Reports on interest rates, inflation, jobs, and growth together shape expectations of monetary policy which are among biggest drivers of forex markets.

In practice, traders focus less on the data itself and more on how it compares to forecasts. A stronger-than-expected report can lift a currency by raising expectations of tighter policy, while weaker data can have the opposite effect.

How Major Economic Data and Central Bank Decisions Move Currencies

Central Bank Interest Rate Decisions

Interest rate decisions are among the most powerful factors in forex market. Higher interest rates usually strengthen a currency by attracting capital seeking better yields, while rate cuts often lead to weakness. However, markets often move before official data release or announcement if they are already expected. Hence, forward guidance by central banks and investor confidence can also matter as much as data release itself. It’s also worth noting that currency don’t always move in line with interest rate changes. A currency can appreciate after a cut if long-term yields stay attractive or the economic outlook remains solid.

Inflation Data (e.g., CPI, PCE, PPI)

Because controlling inflation is a central bank’s key mandate, price data is closely watched. Hotter-than-expected inflation raises the odds of rate hikes, supporting the currency; softer inflation reduces that pressure and may weaken it.

Job Market Data (e.g., Non-Farm Payrolls, jobless claims)

Job market data signals overall economic strength. Strong job growth or falling unemployment supports currency appreciation by reinforcing confidence in the economy and expectation of higher incomes, consequently higher inflation rate, while weak figures may spur expectation of interest rate cut and weigh on the currency.

Economic Growth (e.g., GDP, retail sales, PMI, consumer confidence)

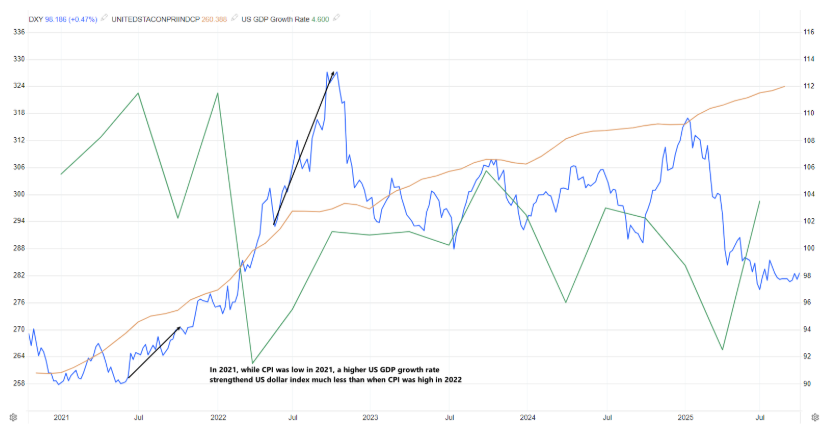

Growth indicators affect currencies in subtler ways, depending on inflation and central bank priorities. When inflation is high, strong growth can signal overheating and strengthen the currency through higher rate expectations. But if inflation is low and stable, robust growth may not trigger tightening, limiting the impact.

For instance, In early 2021, U.S. GDP rebounded strongly but price level was relatively low, so the dollar barely moved. When inflation rose, shown as surged CPI, in 2022, a higher GDP growth rate strengthened rate-hike expectations and a much stronger dollar.

Indirect Effects of Economic Data

Major economic reports don’t just affect their own country’s currency, they can influence global markets too. When key data like U.S. jobs numbers or European inflation surprise traders, it often changes overall market sentiment and prompts investors to shift money across currencies and assets.

For example, a weaker-than-expected U.S. jobs report might directly push the dollar lower, but it can also spark caution in the market. Investors may move funds into safe-haven currencies such as the Japanese yen or Swiss franc, causing those currencies to rise not only against the dollar but also against others like the euro or pound.

How to Use an Economic Calendar Effectively

An economic calendar is only useful when you know how to use it properly. Here’s how traders can make the most of it:

- Pick a reliable calendar: Use trusted sources such as Bloomberg, Investing.com, Forexstreet.com or ForexFactory.

- Adjust to your time zone: Make sure the release times match your local time (e.g., GMT+8 for Singapore) so you don’t miss releases.

- Know the impact level: Calendars label events as high, medium, or low impact. High-impact releases such as U.S. Non-Farm Payrolls, Consumer Price Index, and central bank meetings tend to cause the biggest market moves.

- Compare the three numbers: Compare the previous, forecast, and actual data. Market often react sharply when the actual result differ largely from forecasts because expectations are already priced in before the release.

- Loot at historical data trends: Quality calendars show past data. Reviewing how currency pairs reacted to releases can help traders anticipate how surprises might impact a currency pair.

- Apply in trading decisions:

- Mark upcoming high-impact events and prepare strategies for both stronger- and weaker-than-expected results.

- Check whether the market has already priced in an outcome. For example, before the U.S. rate cut on September 18, the dollar had weakened in anticipation, but when the cut was confirmed, the dollar strengthened, as the event matched expectations rather than surprising traders.

- Before major releases, consider reducing position sizes or setting protective stop-loss orders, especially when data uncertainty is high.

- Avoid trading immediately before a release. It’s often wiser to let the market react first, observe the direction, and then enter once the price action confirms the trend.

Key Economic Releases for Q4 2025

| Date & Timing | Currency | Event / Data Release |

| Oct 9 20:30 | USD | Fed’s Chair Powell Speech |

| Oct 15 20:30 SGT | USD | US Consumer Price Index (Sep) |

| Oct 30 2:00 SGT | USD | Federal Reserve Interest Rate Decision |

| Oct 30 tentative | JPY | BoJ Interest Rate Decision |

| Oct 30 18:00 SGT | EUR | Eurozone GDP Growth Rate (Q3) |

| Oct 30 21:15 SGT | EUR | European Central Bank Interest Rate Decision |

| Oct 31 7:30 SGT | JPY | Japan Consumer Price Index |

| Oct 31 18:00 SGT | EUR | European Monetary Union Consumer Price Index (Oct) |

| Nov 6 20:00 SGT | GBP | Bank of England Interest Rate Decision |

| Nov 7 21:30 SGT | USD | US Non-Farm Payrolls (NFP) |

| Nov 13 21:30 SGT | USD | US Consumer Price Index (Oct) |

| Nov 26 21:30 SGT | USD | US GDP Growth Rate (Q3) |

| Dec 2 18:00 SGT | EUR | European Monetary Union Consumer Price Index (Nov) |

| Dec 5 21:30 SGT | USD | US Non-Farm Payrolls (NFP) |

| Dec 10 21:30 SGT | USD | US Consumer Price Index (Nov) |

| Dec 11 3:00 SGT | USD | Federal Reserve Interest Rate Decision |

| Dec 11 21:15 SGT | EUR | European Central Bank Interest Rate Decision |

| Dec 18 20:00 SGT | GBP | Bank of England Interest Rate Decision |

| Dec 19 Tentative | JPY | Bank of Japan Interest Rate Decision |

In the final quarter of 2025, major central banks will have two monetary policy meetings, the first between late October and early November, and the second in mid-December. These meetings will determine year-end interest rate policies and shape each bank’s economic and policy outlook heading into 2026.

Since the Federal Reserve is widely expected to cut rates in October, traders will focus on the data that follows to gauge whether more easing is likely. Economic data and central bank announcements released in November and early December will show how the economy is responding to the rate cut. If these indicators stay strong, markets may expect the Fed and other central banks to pause further cuts; if they weaken, expectations for continued easing could rise. Thus, the post-October data might carry more weight in shaping market sentiment and central bank guidance into year-end.

⚠️ Special Risk Watch: U.S. Government Shutdown

As of October 1, 2025, the U.S. government has entered a shutdown after Congress failed to extend funding. During this period, government agencies such as the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) will suspend economic data releases such as NFP, unemployment rate, CPI, and GDP.

In the short term, the market impact of shutdown remains limited because investors have largely priced in the Federal Reserve’s expected 25-basis-point rate cut in October and are optimistic that the shutdown will have minimal immediate economic impact. However, the longer the closure lasts, the harder it becomes for Federal Reserve to assess real-time economic conditions. Without official data, Fed officials’ statements and speeches will have more impacts on market sentiment as the central bank decides whether to pause its interest rate cut or maintain the policy path.

For traders, the shutdown also means private-sector data such as the ADP employment report and the University of Michigan Consumer Sentiment Index will carry greater weight. Fed Chair Jerome Powell’s speech on Oct 9 at 8:30 p.m. SGT will be closely watched for clues on how the Fed might adapt its strategy if the shutdown persists. Once the government reopens, a wave of delayed data releases could trigger greater short-term volatility as markets quickly reprice the U.S. dollar based on the new information.

Conclusion

As Q4 2025 unfolds, central bank meetings and major data releases will shape currency trends and drive volatility across global markets. Keeping track of events like Fed rate decisions, inflation reports, and job data helps traders anticipate and prepare for shifts in policy expectations and position strategically.

Even with the ongoing U.S. government shutdown delaying official data, traders can stay ahead with Phillip MetaTrader 5. Its embedded indicators, custom indicators and expert advisers help traders interpret market signals, manage risk, and capture trading opportunities confidently.

Register for a free demo account today to practice risk-free, and when ready, open a live account with Phillip Nova.