In investing, uncertainty is unavoidable. Markets move; headlines change, and short-term outcomes are rarely predictable. What investors like you can control, however, is how you participate over time.

This is why long-term investing often rewards consistency and discipline rather than perfect timing. Strategies such as Dollar-Cost Averaging (DCA) and the power of compounding are built around this principle, and fractional shares make both easier to apply in practice.

Why consistency often matters more than timing

Many investors delay investing while waiting for the “right” moment. When prices fall, uncertainty rises. When prices climb, investments feel expensive. In both cases, hesitation can lead to prolonged inactivity.

Long-term investing shifts the focus away from a single decision point toward ongoing participation. By investing regularly, decisions are spread across time, reducing the pressure to get any one entry point exactly right.

This approach does not eliminate market risk, but it helps you reduce decision risk which is often driven by emotion rather than fundamentals.

Dollar-Cost Averaging (DCA): A Disciplined Approach

Dollar-Cost Averaging involves investing a fixed amount at regular intervals, regardless of market conditions. Some investments will be made at higher prices and others at lower prices, resulting in a more balanced entry over time.

DCA is not designed to predict markets or maximize short-term returns. Its value lies in structure and discipline, helping investors remain invested through different market environments.

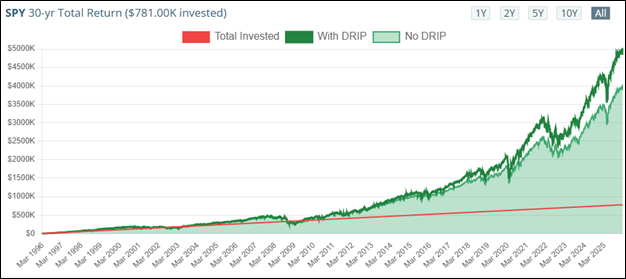

Source: DRIPCalc

Drawing on Warren Buffett’s long-term investing philosophy, we can examine how the S&P 500 ETF (AMEX: SPY) would have performed under a monthly US$500 Dollar-Cost Averaging strategy over 30 years. Total contributions of approximately US$781,000, including dividends, would have grown to about US$4.97 million, which is a cumulative increase of 536%. This highlights the power of long-term compounding through consistent exposure to quality companies in the S&P 500.

Research by global asset managers including Morningstar shows that while lump-sum investing may outperform in steadily rising markets, DCA can be more suitable for investors who are uncomfortable committing large amounts upfront or who wish to reduce emotional and timing-related risks.

In essence, DCA is less about optimization and more about consistency.

How fractional shares make DCA practical

Without fractional shares, regular investing can become inconsistent. When share prices rise, investors like you may need to delay purchases until you have enough capital to buy whole units, breaking the investing habit. Fractional shares remove this constraint.

Fractional shares on NOVA allows you to:

- Invest fixed amounts consistently from as low as US$1

- Continue investing even as share prices change

- Focus on the process, not the price of a single share

By lowering practical barriers, fractional shares help you follow disciplined strategies rather than pause or abandon them.

Compounding: Patience Over Speed

Compounding works when returns remain invested and are allowed to grow over time. Its effect is gradual at first and becomes more noticeable the longer investments are left uninterrupted.

The key drivers of compounding are not complexity or aggressiveness, but:

- Starting earlier rather than later

- Investing consistently

- Avoiding unnecessary interruptions

In a study published by Cambridge University Press, behavioral finance research also demonstrates that psychological biases and emotions frequently lead investors to make suboptimal decisions that undermine long‑term investment performance (Akin & Akin, 2024).

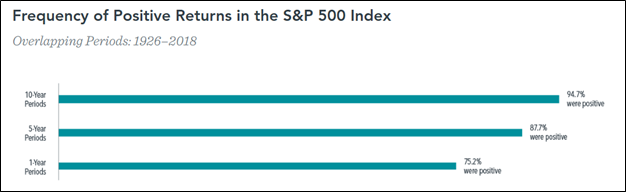

Source: Dimensional Fund Advisors

The chart produced by Dimensional illustrates how investors’ odds of generating positive returns improve as the investment horizon lengthens. Fractional shares on Nova can support long-term compounding by making it easier to maintain consistent growth with small, repeatable contributions.

Small amounts, sustained over time

You do not need a fortune to start; you need a system. Fractional shares turn investing from a high-pressure decision into a consistent habit. Investors can put Dollar-Cost Averaging into practice using broad, liquid, and well-established assets that can be held across market cycles such as:

|

Ticker |

Name |

Focus/Sector |

|

AMEX: SPY |

SPDR S&P 500 ETF Trust |

Large Cap |

|

AMEX: VTI |

Vanguard Total Stock Market ETF |

Total Market |

|

AMEX: GLDM |

SPDR Gold MiniShares Trust |

Gold |

|

NYSE: KO |

Coca-Cola Co |

Consumer Non-durables |

|

NASD: WMT |

Walmart Inc. |

Retail Trade |

With fractional shares on NOVA, investors can start from as low as US$1 and focus on consistency and long-term compounding, rather than timing the market. Get started now!

Invest in Fractional Shares from just $1, at a flat fee of USD0.38. Click here to learn more now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0