DOW30

Bias: Bullish

We look to Buy at 34832 with target prices of 35130 and 36100, and a stop price of 34700

Confidence: 40%

Technical Analysis

- Further upside is expected and we look to set longs in early trade

- A break of yesterdays high would confirm bullish momentum

- Short term oscillators are moving higher

- Further upside is expected, however, due to the strong resistance above we prefer to buy a break of 34800, which will confirm the bullish sentiment

NASDAQ

Bias: Bearish

We look to Sell at 14687 with target prices of 14072 and 13855, and a stop price of 14905

Confidence: 60%

Technical Analysis

- Preferred trade is to sell into rallies

- Expect trading to remain mixed and volatile

- There is scope for mild buying at the open but gains should be limited

- This provides an excellent risk/reward opportunity to fade the current bullish move

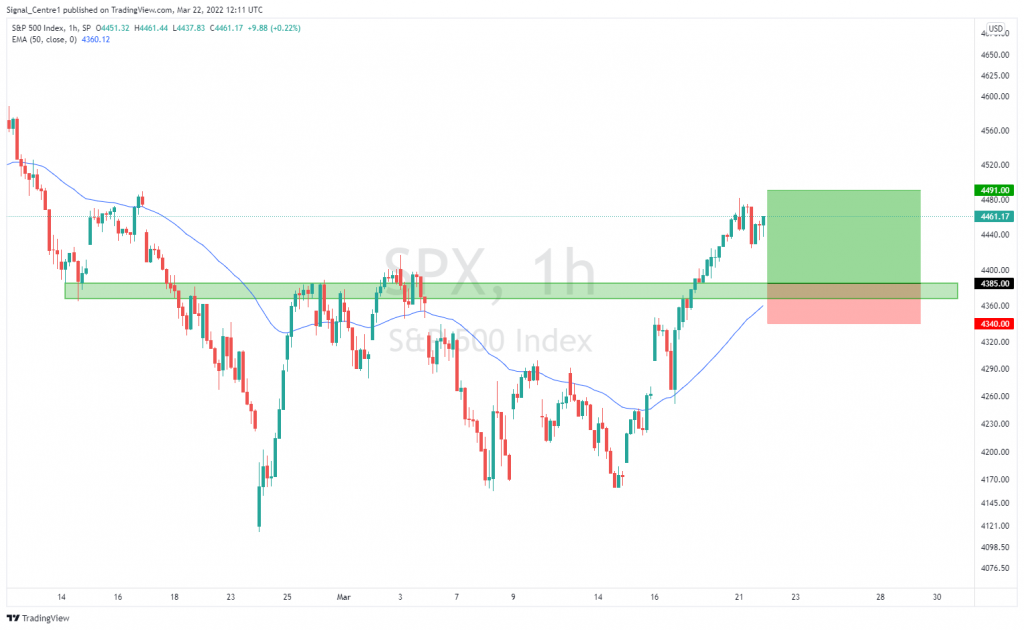

US500

Bias: Bullish

We look to Buy at 4385 with target prices of 4491 and 4530, and a stop price of 4340

Confidence: 40%

Technical Analysis

- We look to buy dips

- There is scope for mild selling at the open but losses should be limited

- 50 4hour EMA is at 4360

- 4 positive daily performances in succession

- This move is expected to continue and we look to set longs at good risk/reward levels

Trading ideas at a glance.

Download the Acuity Signal Center plugin.

The Acuity Signal Centre combines experienced, human-led analysis with powerful AI technology to conduct deep analyses of the markets whilst drawing on professional trading expertise to deliver transparent trade ideas that support novice and advanced traders alike.

- Clear Calls to Action

Each trade idea consists of clear target levels, confidence ratings, and continuous updates

- Transparent Strategies

Every trade idea is generated by a team of expert analysts and is accompanied by the strategies behind them

- Performance Monitoring

The performance of every signal is monitored and translated into the confidence rating of each new signal