Global news can flip markets in an instant. A surprise rate hike, an election result, or a sudden big headline can send prices jumping or tumbling. For Singapore traders who use CFDs (Contracts for Difference), those swings are where the action is: global events can quickly turn into trading opportunities—but also into sharp, leveraged losses if you’re not prepared.

That’s why it’s important to know which events matter and how markets usually react. In this article, we look at key global events that move CFD prices, the role of trader psychology, and how Phillip Nova – as an MAS-regulated broker in Singapore – supports CFD traders with platforms, tools and education to navigate headline-driven markets more confidently.

What is CFD Trading?

A Contract for Difference (CFD) is a way to trade on the price movements of things like shares, indices, ETFs, and commodities without actually owning them. You’re simply trading the difference between the price when you open and close your position. Because CFDs are often used for short-term moves, any sudden global news that shakes these markets can quickly show up in your CFD profits or losses.

Why Global Events Matter for CFD Trading

Global events reset how investors value assets. When central banks change interest rates, governments roll out new policies, or unexpected headlines hit the wires, investors rethink how much risk they’re willing to take and what they’re willing to pay for different assets. That change in expectations shows up as price movements and volatility.

For CFD traders, this is where both risks and opportunities come from. Because CFDs react in real time and allow you to go long or short without owning the underlying asset, you can try to benefit from both rallies and sell-offs. When there are more surprises, volatility usually rises – which means more potential setups, but also more room for sharp reversals. Some traders lean into this with event-driven CFD trading, building ideas around key dates such as economic data releases, elections or earnings. Even if you don’t trade every event, understanding how these catalysts typically move markets can help you read price action better and avoid being blindsided.

Economic Events: What Traders Should Watch

Inflation, employment and other economic data are key clues central banks use when deciding interest rates. Interest rates matter because they influence the cost of borrowing money for businesses and consumers. When borrowing costs change, it affects company debts, earnings, spending and, ultimately, stock prices.

That’s why economic events – such as major data releases and central bank announcements – are so important for markets like stocks, indices, ETFs, and even commodities. On Phillip MetaTrader 5, traders can access CFDs on these markets.

As a rough guide:

- Strong growth and moderate inflation tend to support stable or lower interest rates and can be positive for equity markets.

- Very high or rising inflation data can hurt markets if investors fear higher interest rates.

- Very weak or declining economic growth data can also weigh on markets if investors start to worry about recession.

Central bank communication and guidance can also move markets. For example, on 22 August, Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Summit signalled a focus on supporting the job market with rate cuts towards year-end. When the rate cut was delivered on 18 September, it helped extend the uptrend in US stocks and index CFDs.

Source: Phillip MetaTrader 5

So, what can CFD traders do with this? You don’t need to predict every data release or central bank decision, but it helps to know when major economic events are coming and which CFDs are most sensitive to them by monitoring a reliable economic calendar. Some traders prefer to stay on the sidelines just before big announcements; others look for opportunities right after event releases. Either way, adjusting position size and stop levels around key dates is a simple but powerful risk habit.

Phillip Nova sends daily push notifications about key economic events on Phillip MetaTrader 5 and the NOVA platform, so traders can stay aware of what’s coming up without checking the calendar constantly.

Political & Geopolitical Shocks: What They Mean for Markets

Politics and geopolitics can move markets as much as economic data. Elections, policy changes, and tensions between countries all affect how confident investors feel about future business growth and company profits. When the level of confidence shifts, it often shows up quickly in stocks and indices and, by extension, in stocks and indices CFD.

Source: Phillip MetaTrader 5

In the S&P 500 Index CFD chart above, you can see how this played out from the US election to new trade policies. After 5 November, when Donald Trump won the election, the market initially moved higher but then turned choppier as investors tried to guess what his policies would be and how they would affect the US economy and corporate earnings.

Subsequent headlines on China added another layer of uncertainty. Restrictions on Chinese investments and the threat of extra tariffs in February, followed by broader tariffs on more trade partners on 2 April, led to sharp drops in the S&P 500 Index CFD as worries about global growth and profits increased. In contrast, the US–China agreement to reduce tariffs on 12 May eased some of those fears and helped the S&P 500 CFD back into an uptrend, which later faced another pullback on 10 October when Trump warned tariffs on China could rise again.

For CFD traders, the practical takeaway is similar to economic events: stay aware of key political events and headline risks. Big moments like elections, major policy announcements, or high-stakes negotiations can create gaps and sharp moves in CFDs. Sudden, unexpected shocks often move markets the most. Tools such as news feeds and alerts from reliable sources, together with charting and price alerts on a trading platform like Phillip MetaTrader 5, can help Singapore traders stay informed, react more calmly, and reduce the chances of being caught off guard when politics and geopolitics drive the market.

Global Corporate Events & Themes: How Traders Trade Around Them

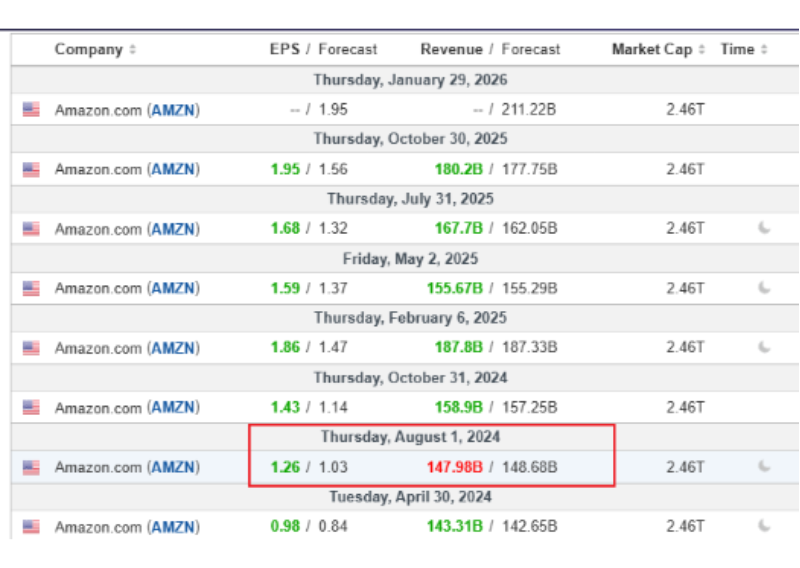

While central banks and governments grab many of the headlines, corporate events can be just as important for CFD traders. When global giants report earnings, change guidance or lead new themes like AI or new drugs, those moments can move stock and index CFDs in a big way. Every quarter, listed companies report their results. An earnings calendar (like the one below) shows dates, company names, earnings per share (EPS) and revenue vs forecasts, and whether the release is before or after the market close. When a company beats expectations, its share price often jumps; if it disappoints, the price can fall sharply.

Source: Investing.com

For example, as shown in the calendar above, on 1 August 2024, Amazon released earnings after the US market closed: EPS beat forecasts but revenue fell short. Because Amazon had usually beaten both numbers in past quarters, this revenue miss was a negative surprise. The stock dropped more than 9% on 2 August, and NAS100 also fell by over 2% on the day.

Source: Phillip MetaTrader 5

Beyond a single company’s results, bigger themes can drive whole indices for months or years. Since 2023, the clearest example has been artificial intelligence (AI) in the tech-heavy Nasdaq 100 (NAS100). After ChatGPT’s launch in late 2022, investors piled into AI-related tech stocks. Strong revenue forecasts from Nvidia in May 2023 and May 2024 triggered fresh rallies as traders priced in booming demand for AI hardware and cloud services. By early 2025, new AI models in China added competition and made price action choppier. The NAS100 CFD rallied after April led by the “Magnificent 7” tech names increasing their investments in AI, but the move became less stable now as valuations climbed and talk of an “AI bubble” grew.

Source: Phillip MetaTrader 5

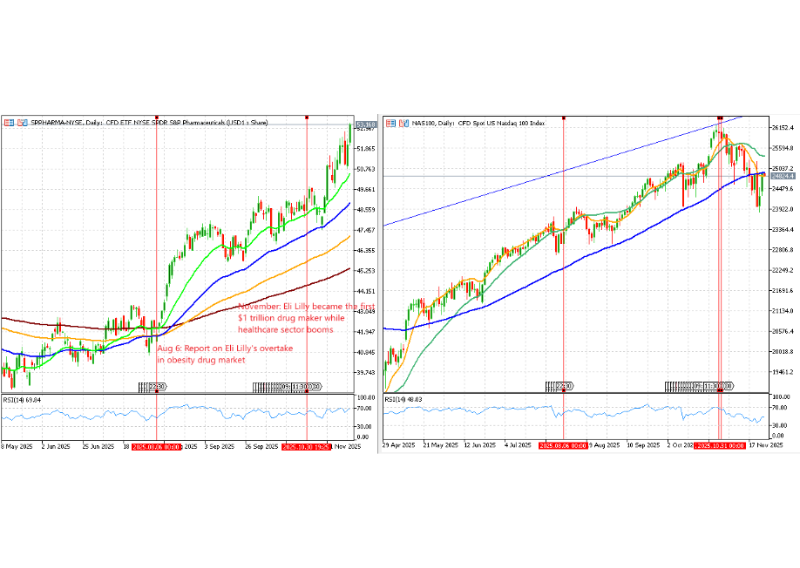

Around the same time, another theme was gaining ground. From August 2025 onward, the SPDR S&P Pharmaceuticals ETF CFD began to trend higher as Eli Lilly’s GLP-1 obesity-drug story strengthened and investors rotated from expensive tech stocks into more defensive healthcare names. Reports about Eli Lilly’s breakthrough in obesity-drug market, and Lilly later becoming the first US$1 trillion drugmaker, helped support that uptrend. In the chart below, the pharma ETF CFD (left) moves steadily higher after August, while the NAS100 CFD (right) turns more volatile over the same period.

Source: Phillip MetaTrader 5

For CFD traders, these global corporate events and themes highlight three simple ideas:

- Earnings events matter: big surprises and strong guidance from major companies can move individual shares and the indices they sit in, creating short-term trading opportunities in stock and indices CFD.

- Themes matter: when a story keeps showing up in headlines and earnings calls, and big companies say they’re investing heavily – it can drive a sector for a time.

- Rotation happens: after a strong run, that same theme can become crowded and expensive, and money often moves into another area (for example, rotating out of AI leaders into defensive pharma), creating new opportunities.

On Phillip Nova’s Phillip MetaTrader 5 platform, traders can monitor a wide range of shares CFD and ETFs CFD and spot opportunities across different market themes. By watching both company-specific earnings and the bigger industry themes behind them, Singapore traders can turn global corporate events into more informed CFD trading decisions.

How Market Psychology Shapes Event-Driven Moves

Markets don’t just react to events; they react to how people feel about those events. Around big surprises, fear of loss and fear of missing out can easily dominate. That’s why you sometimes see a sharp move right after an announcement, a drift as traders keep adjusting positions, and then another swing when headlines or data later look “mixed”.

A clear example is 2 April 2025, “Liberation Day”, when US President Donald Trump announced sweeping new import tariffs on most trading partners at 4 p.m. EST. The US market was shocked, and the S&P 500 CFD dropped sharply right after the announcement (2025.04.02 23:00 on Phillip MetaTrader 5 time). Over the next few days, fears about global growth and trade conflict kept pressure on prices and the index pushed even lower. By 9 April, however, as investors gathered more information and reassessed the risks, the market had bounced back to the level where it first plunged.

Source: Phillip MetaTrader 5

From a behavioural point of view, this pattern makes sense. The first drop shows shock and loss aversion, as traders quickly cut risk to protect earlier gains. The drift lower reflects ongoing uncertainty, with investors digesting negative headlines and thinking through worst-case scenarios. The rebound comes once the market starts to look at the news more calmly, some fears are seen as overdone, and bargain hunters step in. The event itself didn’t change dramatically; what changed was the market’s interpretation.

For CFD traders, big shocks like “Liberation Day” are a reminder that emotion can easily shift prices. A simple plan can help:

Pause: don’t react on the first sharp move. Take a moment, read the headline and look at the chart.

Plan: ask yourself, do I still believe in this trade after this news and how much am I willing to lose if I’m wrong? If the honest answer is “not much”, consider reducing or closing the position.

Protection: use stop-losses, keep position sizes sensible and avoid opening new trades just to “win back” losses. It’s okay to sit out until the market calms down.

For most CFD traders, especially beginners, the main goal during big global events isn’t to catch every move—it’s to stay in the game so you’re ready for the next opportunity.

Trading Global Events with CFDs: How Phillip Nova Supports Singapore

Global events won’t slow down – the key is how ready you are when they hit. Phillip Nova’s platforms are designed to help Singapore CFD traders spot, trade, and manage event-driven moves more confidently.

On Phillip MetaTrader 5 and the NOVA platform, you can:

- Keep trading costs low

You can trade all the CFD contracts with zero commissions and competitive spreads, helping you focus more on your strategy and less on fees.

- Stay informed

Get daily alerts on key economic releases and central bank meetings, plus news and calendars so you know what’s coming and which markets may move.

- Trade global themes

Access CFDs on stocks, indices, ETFs and commodities, plus spot Forex – making it easy to link events to instruments (for example, NAS100 for AI stories or gold for geopolitical tension).

- Use trading tools that fit events

Analyse charts, mark important event levels, and view free trading signals and our analysts’ views directly in Phillip MetaTrader 5.

If you’re in Singapore and want to trade global markets with more confidence around big news, you can start by opening a free demo account and exploring Phillip Nova’s CFD offering on Phillip MetaTrader 5 and NOVA.