Risk is often associated with leveraged trading products like Forex and CFDs, but how are so many traders still making consistent profits navigating through the volatile market? The secret (not so much of a secret) is actually Risk Management! In this short article, we will guide you through managing your risk while trading on Phillip MetaTrader 5..

General concepts on risk management

1. Always trade with stop losses

As the forex market can be highly volatile, we should always set a stop loss to protect our positions against adverse price movements. By setting a stop loss order, your positions will be liquidated automatically when the price hits a specified level to cut the losses. This prevents your account from over-loss and forced liquidation in the event of your balance dropping below 20% of initial margin.

Stop loss can be set by 2 methods on MT5.

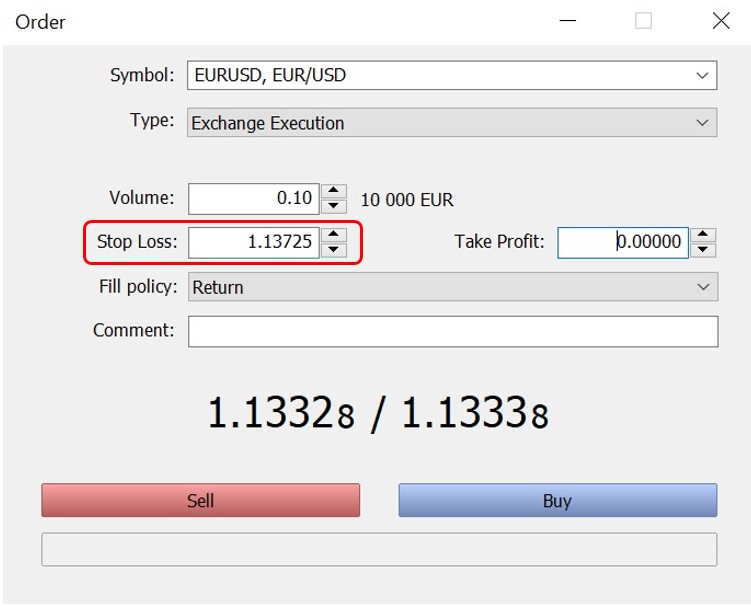

a. Order Ticket

When placing a trade, you are able to input the stop loss level on the trading ticket. In a long position, stop loss level should be below entry price. Opposite applies for a short position.

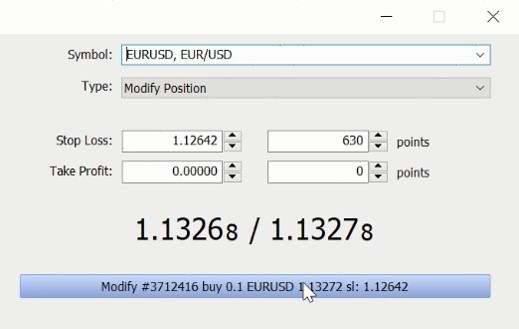

b. Modify trades on charts

Step 1: After a trade is placed, you will see a dotted line at the price which your trade was executed. To modify your trade, hover your cursor over the dotted line.

Step 2: For a buy order, you may set take profit by dragging the dotted line upwards. To set stop loss, simply drag it down to your desired price level. The opposite applies for a sell order.

Step 3: After modifying your trade on chart, you will be prompted to confirm the action. Click on the “Modify” button to confirm.

2. Utilize trailing stop losses

A different variation of stop loss is something called the trailing stop losses. Trailing stop loss levels are dynamic and it moves along the price if its headed the favourable direction. When the price stops moving or move against you, the trailing stop loss level remains. This effectively allows traders to protect profits by enabling a trade to remain open as long as price is moving in favour, and closes the position if price changes direction by a specified dollar amount.

Step 1: Right click on your trade done on your chart.

Step 2: Click on Trailing Stop and select points for the trailing stop order.

3. Risk-reward ratio

Risk-reward ratio is another important concept in risk management. It provides a quantifiable and objective approach in setting up a trade. Risk-reward ratio simply reflects the proportion of risk a trade is taking relative to the potential reward. A general rule of thumb is that a trade should not be any riskier than 1:2 risk-reward ratio.

Illustration:

Entry price: $100

Take Profit: $150

Stop Loss: $75

Potential profit: $150 – $100 = $50

Potential loss: $100 – $75 = $25

Risk-reward ratio: $25:$50 = 1:2

4. % to risk in portfolio

A simple way to manage risk is by determining the percentage of your trading capital that you are risking with each trade. A rule of thumb is to not risk more than 1-2% of your capital with a single trade.

Illustration 1:

Account balance: $1,000

You bought a mini lot (0.1) of EURUSD at 1.1300.

Stop loss: 1.1200

Risk in pips: 1.1300-1.1200 = 100pips

Risk in dollar value: 100 pips x lot size = 100 X 0.1 = $10

% of risk relative to total balance: $10/$1000 = 1%

Illustration 2:

Account balance: $1,000

You bought a standard lot (1) of EURUSD at 1.1300.

Stop loss: 1.1200

Risk in pips: 1.1300-1.1200 = 100pips

Risk in dollar value: 100 pips x lot size = 100 X 1 = $100

% of risk relative to total balance: $100/$1000 = 10%

In illustration 2, you are risking 10% of your overall account balance in 1 single trade!

5. Trading a suitable lot size

In extension to the above example, traders should not trade a lot size that will cause them to risk more than 1-2% of their portfolio in each trade.

In summary, risk management is of paramount important in order to have a sustainable and profitable trading journey!

Before placing a trade, trader should plan out their trade by determining the volume, stop loss level, risk-reward ratio, % of their portfolio that is risked in that trade.