Fractional Shares: Big Stocks. Small Slices.

Trade US stocks fractionally at a flat fee of USD0.38 per order.

What Does Fractional Shares Mean?

Fractional stocks, or fractional shares, represent a portion of a full share of a company’s stock. Instead of buying a whole share of a company like Apple, Tesla, or Amazon, which can cost hundreds or thousands of dollars, investors can purchase a fraction of a share for a lower amount that fits their budget.

For example, if a single share of Company XYZ trades at $1,000, and you invest $100, you’d own 0.1 shares – your proportionate piece of that stock. With Phillip Nova, you can purchase a fractional stock with a budget from as low as $1!

Benefits of Trading US Stocks Fractionally

-

1. Lower Barrier to Entry

It’s an excellent way for beginners or younger investors to enter the market, build confidence, and diversify their portfolio without needing a large upfront investment. -

2. Diversification with Limited Funds

An investor could buy fractional shares of five US companies in different sectors instead of being limited to one or two full sized Tech stocks with a capital of $500.

-

3. Dollar-Cost Averaging (DCA)

Fractional shares work seamlessly with DCA strategies, where investors invest a fixed amount regularly, regardless of the stock price (e.g., $100 every month). -

4. Access to High-Priced Stocks

Fractional shares give direct access to premium stocks at a price point that works for everyone. This includes easier access to tech giants like Meta, Apple, Amazon, Netflix and Google!

Commission Rate & Exchange Fees

| EXCHANGE | COMMISSION (ONLINE TRADES) | COMMISSION (CALL-IN TRADES) |

| United States (NYSE, AMEX, NASDAQ) | Fractional Share New Flat fee of USD0.38 per order |

0.18% (minimum of USD18 per order) |

| Standard Share 0.01% (minimum of USD3.88 per order) |

| Exchange | Type | Charges | Charged By |

| United States (NYSE, AMEX, NASDAQ) | SEC Membership Fee (Sell only) | 0.0% of trade value (effective 13 May 2025) | SEC (U.S. Securities and Exchange Commission) |

| Trading Activity Fee (Sell only) | USD0.000195 per share, max USD9.79 (w.e.f 1 Jan 2026) | FINRA (Financial Industry Regulatory Authority) | |

| ADR (American Depositary Receipt) Fee | USD0.01 – 0.05 per share | DTCC (U.S. Depository Trust & Clearing Corporation) |

Note: ADR fees are charged by the DTCC. These are service fees charged periodically to compensate the agent bank for the provision of custodial services. More details on any such fees should be available on the ADR prospectus.

| EXCH. | COMM. (ONLINE) | COMM. (CALL-IN) |

| US (NYSE, AMEX, NASDAQ) | Fractional Share New Flat fee of USD0.38 per order |

0.18% (min. of USD18 per order) |

| Standard Share 0.01% (min. of USD3.88 per order) |

| Exch. | Type | Charges |

| US (NYSE, AMEX, NSDQ) | SEC Mbrsp Fee (Sell only) by SEC (U.S. Securities and Exchange Commission) | 0.0% of trade value (eff. 13 May 2025) |

| Trading Activity Fee (Sell only) by FINRA (Financial Industry Regulatory Authority) | USD 0.000195 per share, max USD 9.79 | |

| ADR Fee by DTCC (U.S. Depository Trust & Clearing Corporation) | USD 0.01 – 0.05 per share |

Note: ADR fees are charged by the DTCC. These are service fees charged periodically to compensate the agent bank for the provision of custodial services. More details on any such fees should be available on the ADR prospectus.

Trade With Our Multi Asset Trading Platform

The NOVA Suite

Capture opportunities from over 11,000 Stocks, ETFs, CFDs, Forex, Futures, Options and Precious Metals with NOVA.

Enjoy charting powered by TradingView, trade effectively with an inbuilt market depth tool and experience our tight forex spreads. Focus only on trading with zero custodian and platform fees too.

Charting powered by TradingView

- Gain access to over 100 technical indicators

Tight Spreads

- Choose from 31 Forex pairs with spreads from as low as 0.8 pips

Set Price Alerts

- Never miss a trading opportunity

True multi-asset trading of over 11,000 global products

- Trade Stocks, ETFs, CFDs, Forex, Futures, Options and Precious Metals

Market Depth

- View liquidity and trades for a particular price in the market easily

Comes with light & dark modes

- Gain better focus with your preferred mode

How to trade fractional shares by notional amount on NOVA?

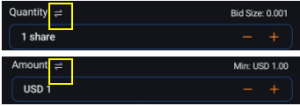

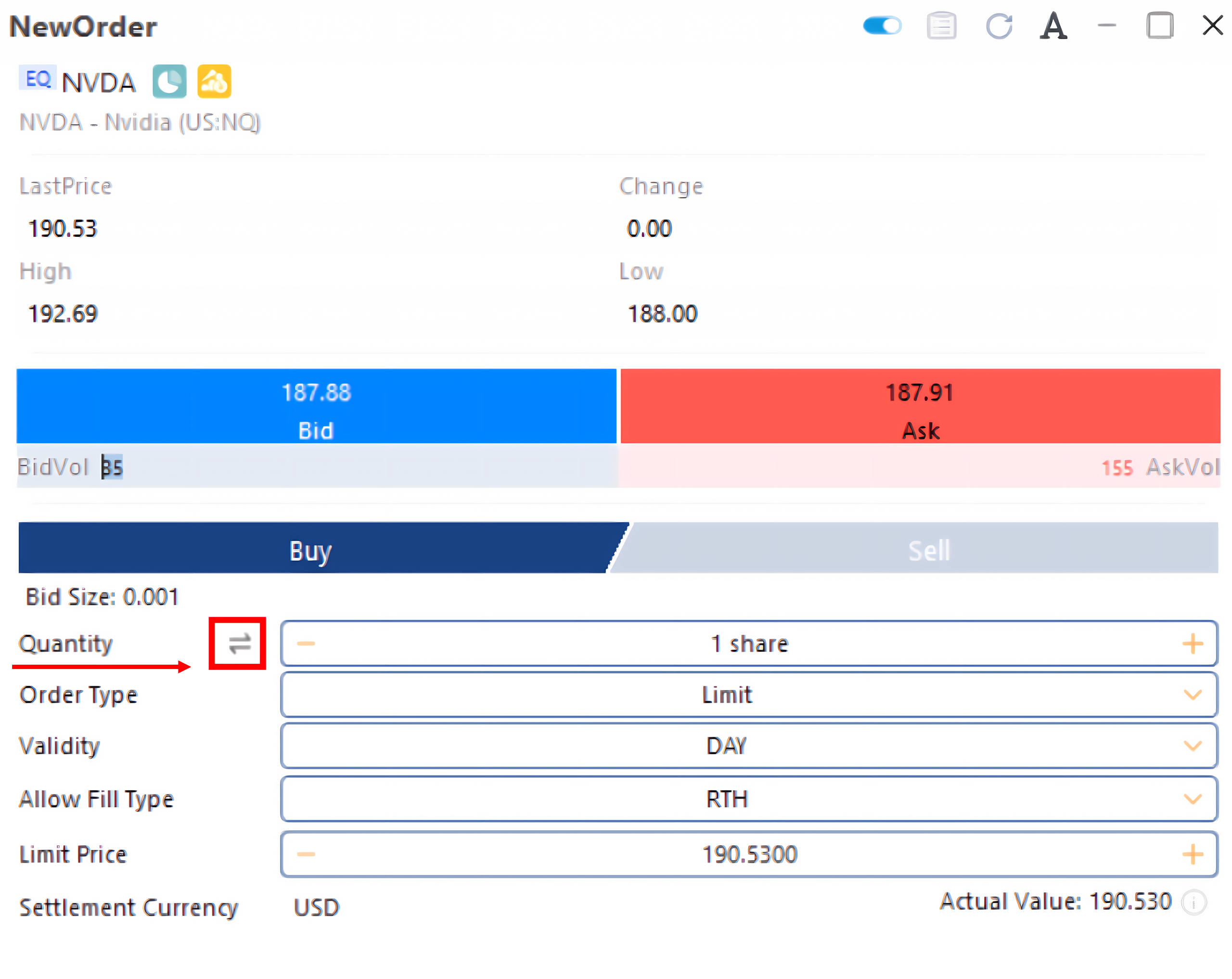

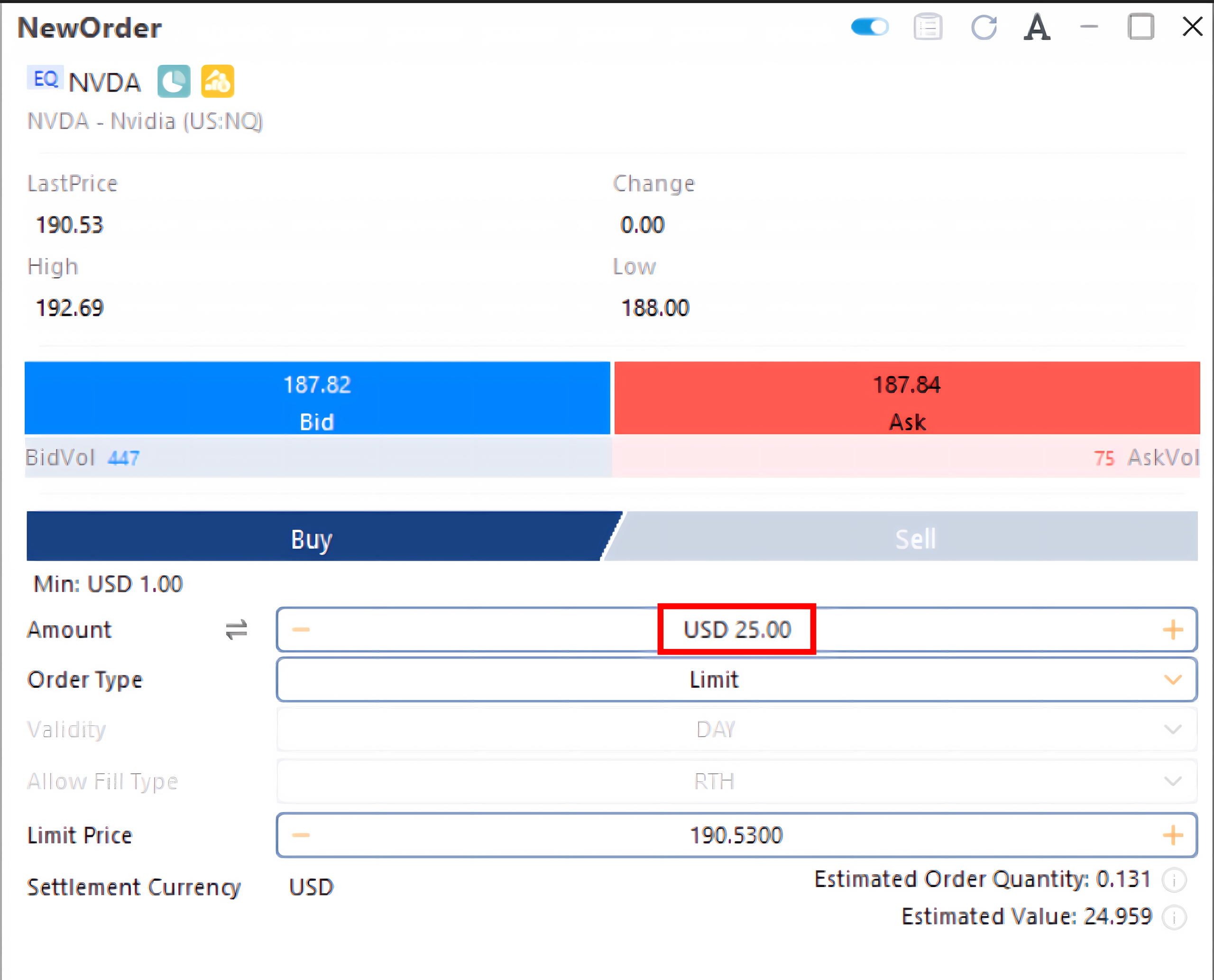

| Step 1: Click on the swap icon to switch between order quantity and notional amount trading. |  |

| Step 2: Upon clicking the swap icon, you should then see the notional amount trading order screen on your right. You may key in the desired notional amount, from as low as $1. |  |

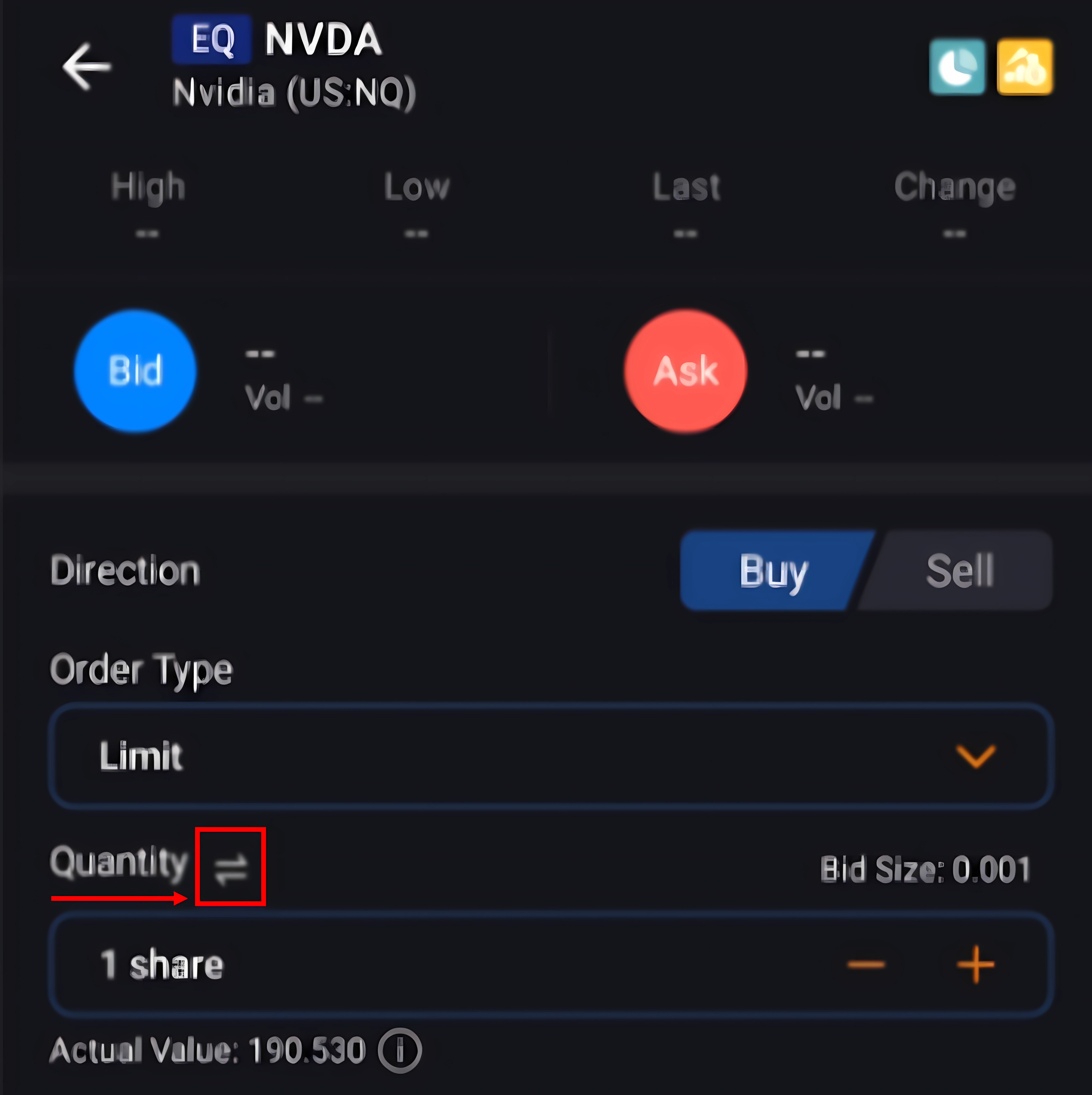

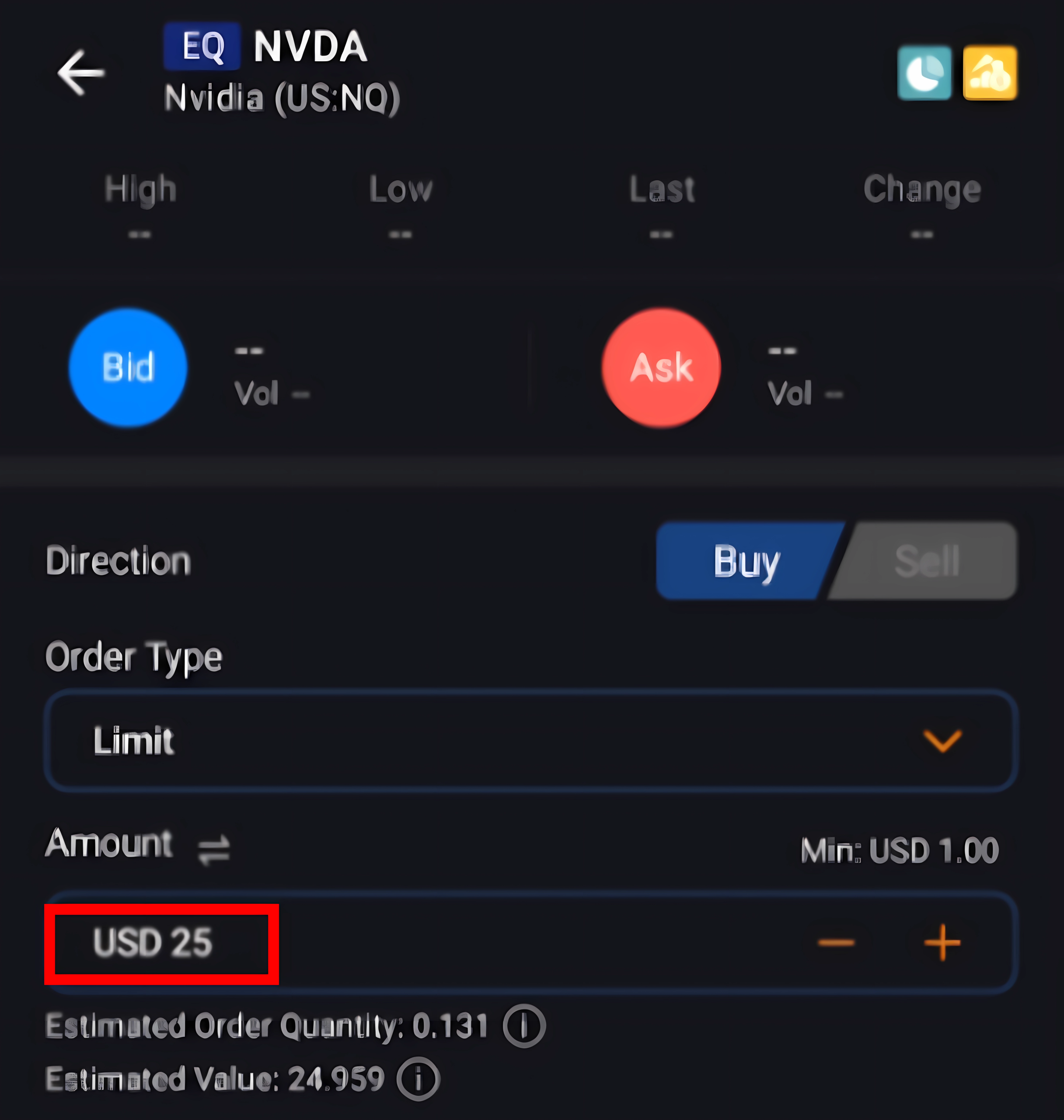

| Step 1: Click on the swap icon to switch between order quantity and notional amount trading. |  |

| Step 2: Upon clicking the swap icon, you should then see the notional amount trading order screen on your right. You may key in the desired notional amount, from as low as $1. |  |

Step 1: Click on the swap icon to switch between order quantity and notional amount trading. |

Step 2: Upon clicking the swap icon, you should then see the notional amount trading order screen as shown below. You may key in the desired notional amount, from as low as $1. |

Step 1: Click on the swap icon to switch between order quantity and notional amount trading. |

Step 2: Upon clicking the swap icon, you should then see the notional amount trading order screen as shown below. You may key in the desired notional amount, from as low as $1. |

Fractional Trading & Amount-based Order FAQs

A fractional share is a portion of a whole share. For example, holding 1.5 shares means you own one full share and half a share—this 0.5 portion is considered a fractional share.

An amount-based order allows you to specify the total dollar amount you wish to trade instead of entering the number of shares. This is useful when you prefer to invest a fixed amount—such as USD 50—without having to calculate the exact share quantity.

For securities that do not support fractional share trading, the entered amount is used to calculate and submit the maximum whole-share quantity.

Only Day Market and Day Limit orders are supported. Sell orders are not permitted for amount-based orders.

Securities that support fractional share trading

Market Orders

- The amount entered is submitted directly as an amount-based order.

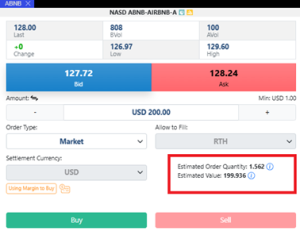

Market Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 using a Market order to buy.

- The executed amount may return as USD 199.936, depending on the fill quantity and execution price.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

Limit Orders

- Nova converts the entered amount into an estimated share quantity, rounded down to three decimal places, and submits the order using this calculated quantity at the specified limit price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

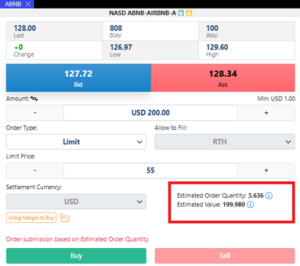

Limit Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 with a Limit Price of USD 55 to buy.

- Nova calculates an order quantity of 3.636 shares (USD 200 ÷ USD 55).

- This quantity will be submitted at the limit price, resulting in an executed amount of up to USD 199.98 (3.636 × USD 55), but never more than USD 200.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

Securities that do not support fractional share trading

For these securities, the amount-based order field functions as a calculation aid. Nova converts the entered amount into the maximum whole-share quantity based on the applicable price and submits the order using this calculated quantity.

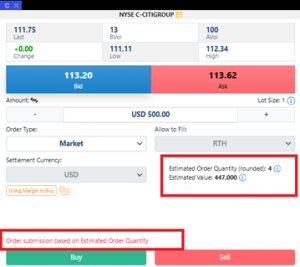

Market Orders

- Nova calculates the order quantity using the entered amount divided by the prevailing market price.

- The quantity is rounded down to the nearest whole share.

- The Estimated Order Value shown on Nova is based on the calculated quantity × prevailing market price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

Market Order Example

- Company XYZ is not eligible for fractional share trading. The Last Traded Price is USD 40.

- You place an amount-based order of USD 100 as a Market Order to buy

- Nova calculates and sends an order for 2 shares (USD 100 ÷ USD 40) to be purchased at the market

- The executed amount may differ from the estimated value depending on the final execution price.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value

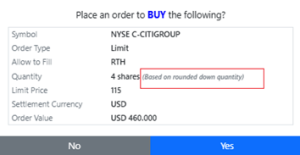

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

Limit Orders

- Nova calculates the order quantity based on the entered amount divided by the Limit Price.

- The quantity is then rounded down to the nearest whole share.

- The resulting Actual Order Value is the calculated quantity × Limit Price.

- You will be prompted that order submissions are based on the Actual (rounded down) Order Quantity

Limit Order Example

- Company XYZ is not eligible for fractional share trading

- You place an amount-based order of USD 100 with a Limit Price of USD 30.

- Nova calculates and sends an order for 3 shares (USD 100 ÷ USD 30) to be purchased at USD 30

- The order submitted is 3 shares, with an executed amount of up to USD 90.

In the Order Ticket, you will be informed of the Actual (rounded) Order Quantity and its Estimated Value.

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

You are advised to always review the derived share quantity before submitting the order.

How NOVA Determines the Prevailing Market Price

US securities:

- Uses the Last Traded Price from the Regular Trading Session.

- If unavailable, the Closing Price is used.

Non-US securities:

- Uses the Last Traded Price.

- If unavailable, the Closing Price is used.

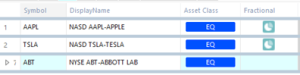

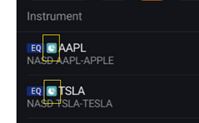

- Nova Web/Desktop: Look for the “Fractional” column in the Watchlist or on the Order Ticket. A pie symbol indicates eligibility.

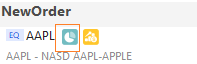

- Mobile app: The pie symbol appears next to the symbol code in the Watchlist and on the Order Ticket

Amount-based orders can only be placed via the Order Ticket. Clicking the toggle icon will switch order placement in “Quantity” to “Amount”. Click the same button again to revert to order placement in “Quantity”.

- Nova Web/Desktop:

- Mobile app:

Fractional share trading and amount-based orders are currently supported only for U.S. exchanges, including NYSE, Nasdaq, and AMEX.

However, not all securities listed on these exchanges are eligible. Only securities that support fractional share trading can be executed as true amount-based orders.

Fractional share orders are routed to a separate execution venue. When you place an order that includes both whole and fractional shares, your order is submitted as a single order but may be executed in parts—whole share(s) and fractional shares separately—potentially at different prices.

You must opt in and agree to our Fractional Shares Trading Terms and Conditions.

You can opt in via:

- Nova Web/Desktop: Settings > Trade > Slide “On” for Opt-in to Fractional Shares Trading

- Order Ticket: “Opt-in to Fractional Shares” (visible only for eligible securities) > Click “Agree” on Fractional Shares Trading Terms and Conditions

Orders with fractional shares are only supported during regular trading hours.

Trading fractional shares involves risks similar to trading whole shares, including market volatility and security-specific risks. However, fractional shares may also be subject to limited liquidity and execution constraints.

For full details, please refer to our Fractional Shares Trading Disclosure Statement.

Yes, if a stock pays dividends, you will receive a pro-rated dividend based on the fractional amount you hold.

Shareholder rights and/or participation in stock splits, mergers, or other mandatory corporate actions is subjected to the discretion of the Company and/or issuer.

No, fractional shares do not carry voting rights.

No, fractional shares cannot be transferred in or out of your account.

Commission for amount-based orders are based on quantity executed.

Please refer to our website here for the latest commission structure and applicable fees.

About Us

Phillip Nova (formerly known as Phillip Futures) was inaugurated in 1983 as a member of PhillipCapital Group and is one of the founding clearing members of Singapore Exchange Derivatives Trading (SGX-DT). We have since grown to become one of the region’s top brokerages for the trading of Stocks, CFD, Forex, global Futures and Commodities. The Group has clearing memberships in 21 global exchanges, including APEX, BMD, CME Group exchanges, DGCX, HKEX, ICDX, ICE Singapore, JPX Group exchanges, NSE, TFEX, TOCOM and SGX.