By Eric Lee, Account Manager, Phillip Nova

AEM Holdings Ltd is a company that provides handling and testing solutions in the semi-conductor industry. The company was founded on 21 July 2000 and is headquartered in Singapore.

When we performed a Total Return Analysis on the share price performance of AEM over the past 5 years, we can see that its growth was phenomenal at an annualised rate of 68% p.a. When its dividend was re-invested into the stock, its annualized rate was 73% p.a. as boxed up in blue above.

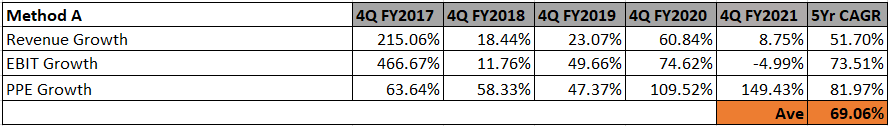

One technique I use for tracking and understanding the performance of a stock is by measuring the average growth rate of its Revenue, Earnings Before Interest & Tax (EBIT) and its Property, Plant & Equipment (PPE) over a period of years. Usually, it is best to study the numbers of at least a 5 year period to derive a meaningful average.

A company’s share price is a function of its business operations. As a business grows, its growth should also be observed in its sales, earnings and assets. As shown on the table below, the average growth rate of these 3 metrics over the past 5 years for AEM was 69%, which is very close to the annualised growth of its share price over the same period as in the Bloomberg chart above.

Firstly, we can conclude that the share price is fairly valued based on the above method. Secondly, we should also continue to monitor the growth of these 3 metrics when the company announces its quarterly results. If there no signs of slowdown in growth, we can project its average growth rate and use that as a basis for its share price projection.

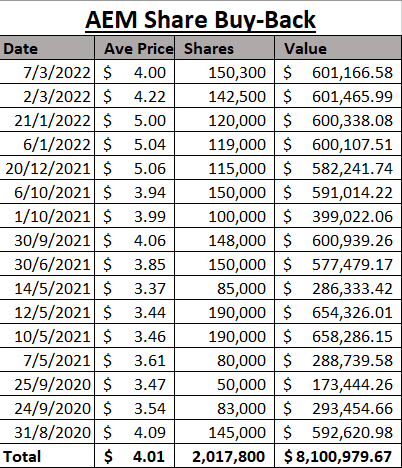

Another observation we can make, was that the AEM management has also been actively buying back its shares in the market since 2012. Below are the records from their share buy-back from August 2020 to March 2022. The buy-back prices of these dates are closer to current share price and thus more relevant to our analysis. Looking too far back will not yield much benefit. If you are interested to find out more, can refer to the link provided below. From the dates of their share buy-back, we can see that management have been actively buying back shares since May 2021.

Source: https://www.sgx.com/securities/company-announcements

Source: Phillip Nova

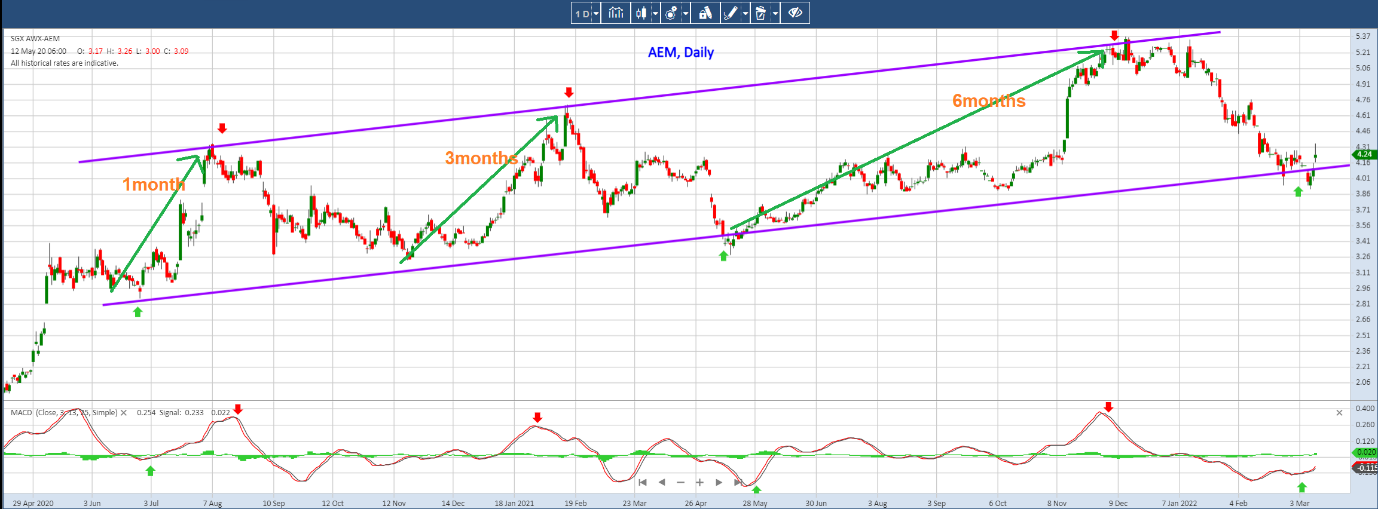

Technical analysis wise, the share price looks to be bouncing up from the lower boundary of the upward-sloping channel (in purple). This is the 3rd time the bounce on this channel is observed. The first time was in May 2020. Second time in December 2020, when it hit the upper boundary of the channel. Is it going to happen again this time? No one knows for sure, so we can only trade based on what we have observed and always have a proper money management strategy in place to protect against a potential downside.

An interesting thing to note is that it took the share price 1 month to reach from the bottom to the top of the channel in May 2020. It then took it 3 months to reach from the bottom to the top of the channel in December 2020. During its most recent run-up, it took the share price 6 months to move from bottom to top. Assuming that the pattern was to repeat, we can then project that it may take the share price 9-12 months to reach the upper boundary of the channel, indicating a possible target price of $6-$6.20 region 9-12 months later.

Eric Lee is an Account Manager with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.