By Danish Lim, Senior Investment Analyst, Phillip Nova

The SGX FTSE Taiwan Index Futures contract tracks the FTSE Taiwan RIC Capped Index, offering exposure to roughly 130 large- and mid-cap Taiwanese stocks. To reduce concentration risk, the index caps any single stock at 20% of total weight.

Taiwanese equities have surged to record highs, largely fuelled by strong demand linked to artificial intelligence and semiconductors. In 2025, the futures contract delivered a total return of 23.88%, outperforming the Nasdaq 100’s 21% gain over the same period.

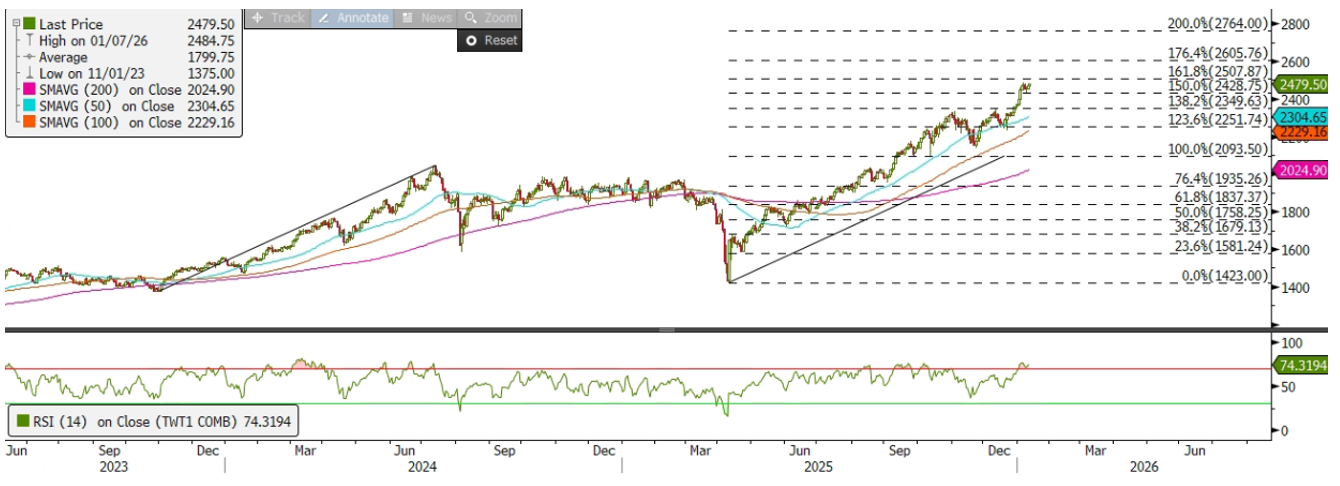

While the longer-term outlook remains bullish, near-term consolidation is likely. Momentum indicators suggest the market is currently overbought, and geopolitical risks remain an important tail risk. The 14-day Relative Strength Index (RSI) is hovering around 74, signalling the potential for a short-term pullback.

Technically, prices could retreat toward the 123.6% Fibonacci retracement level near 2,250, which also aligns with the 100-day moving average. As long as the contract holds above this level, momentum is expected to rebuild, with upside targets at the 161.8% extension near 2,500, and potentially 2,600 at the 176.4% extension. The bullish thesis remains intact unless the contract records a sustained break below the 2,250 level.

A defining feature of the index is its heavy technology exposure, which accounts for over 62% of total weight—nearly double the S&P 500’s tech allocation. Major constituents include TSMC, MediaTek, and Hon Hai Precision Industry (Foxconn).

From a tactical standpoint, TSMC’s weighting is a key consideration. As the world’s leading semiconductor foundry and a critical supplier to companies like Apple, Nvidia, AMD, and Sony, TSMC is widely viewed as a proxy for global AI infrastructure spending. While TSMC represents about 43% of the uncapped FTSE Taiwan Index, its weight is limited to around 20% in the capped version. This cap helps reduce concentration risk, making the FTSE Taiwan RIC Capped Index—and its futures contract—more diversified and potentially less volatile.

Trade the SGX FTSE Taiwan Index Futures (TWN) at just $1.38 now!

Click here to learn more about our exclusive SGX FTSE Taiwan Index Futures (TWN) promotion now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0