By Danish Lim, Senior Investment Analyst for Phillip Nova

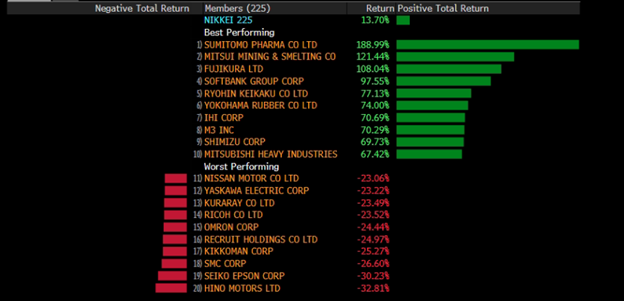

As of 17 September (12:58 SGT), the Nikkei 225 index is up 13.70% YTD. In this article, we will discuss whether the Nikkei 225 can maintain this momentum and what are some of the key events to look out for.

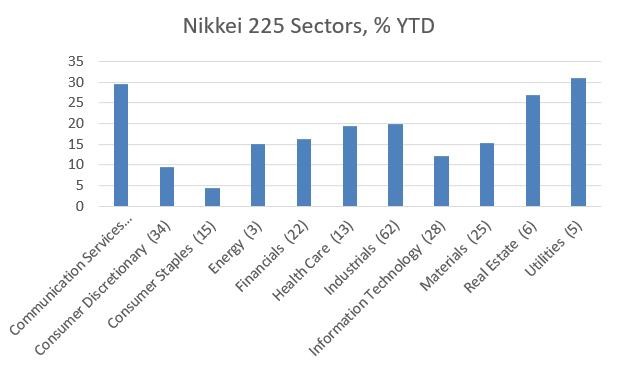

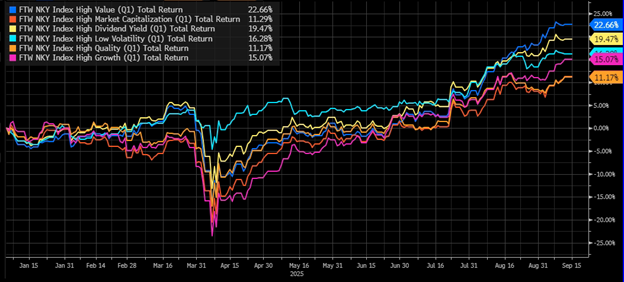

Our data shows that in terms of sectors, Communication Services and Utilities performed the best YTD. However, due to classification methodologies, we note that Communication Services includes non-telco companies like Nintendo, Softbank, Konami, and Nexon. From a factor view, we see that Value stocks outperformed.

The rally in the Nikkei 225 is inline with our views, as we previously predicted here. The catalysts mentioned in the articles remain relevant today. Namely, this include:

- Trade Deal with US, lowered car duties to 15%

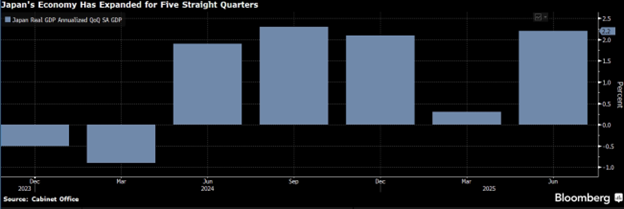

- Strong corporate earnings and revised GDP report that came in stronger than expected

- Improving corporate governance, attractive valuations, and increasing cash flow to shareholders (dividends and buybacks).

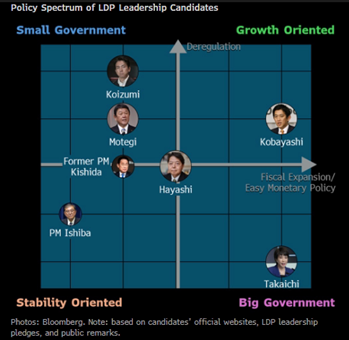

Crucially, one major development since our previous article is the resignation of PM Ishiba. The incumbent Liberal Democratic Party (LDP) will select a new president on 4 October. The Yen fell while the Nikkei 225 rose on the news, with contenders offering sharply differing visions for the economy, raising the prospects of aggressive fiscal expansion at a time when inflation is returning. Nevertheless, the ruling LDP party lacks a majority in both houses of parliament, and even the new LDP leader voted in on 4 Oct may fail to gain enough support in parliament.

On the day of the announcement, we note that export-oriented JP shares benefitted from the weaker yen:

- Chipmaker SocioNext (+7.20%), 34% of revenue from Asia, 17% from Americas

- Mazda (+6.15%), 55% of revenue from North America, only 18.6% from Japan,

- Chip Tester Advantest (+3.85%), 89% of revenue from Asia ex Japan

- Sony (+3.62%), 31.8% from US, 20% from Europe

- Kawasaki Heavy Industries (+2.48%), 31.5% revenue from US

- Fast Retailing (+2.39%), only 40.8% from Japan, 17.5% from China, Remainder 41.7% from Overseas.

At the same time, Ishiba’s exit has added uncertainty to the BOJ’s interest rate trajectory. At the time of this writing, the BOJ is expected to keep their policy rate at 0.5% on 19 September as officials continue to assess the economic impact of US tariffs. With inflation hovering at or above the BOJ’s 2% target, speculation remains on whether the central bank will lift rates by the end of the year.

The chart below shows potential contenders based on their degree of appetite for expansionary macro policies and deregulation:

The lineup ranges from small-government (deregulation) reformers like Shinjiro Koizumi and Toshimitsu Motegi, to big-spending advocate Takayuki Kobayashi.

Opinion:

In our view, a victory for Kobayashi could result in a risk-on mood in markets, driven by expectations of aggressive fiscal expansion and easy monetary policy.

At the same time, a win for reform-minded candidates like Koizumi or Motegi could lead to sector-specific winners and losers, depending on the specific deregulation proposed.

On the flipside, Yoshimasa Hayashi, the chief cabinet secretary in the current administration, would result in policy continuity, and hence likely result in status quo.

Index Target

With our previous index target of 41,000 and 43,000 already being hit, we see room for further upside to around the 46,000 level, especially in the scenario where a favourable LDP president who prioritizes fiscal expansion (Kobayashi or Takaichi) is chosen.

Key Stocks % Gain YTD

Sumitomo Pharma (TSE: 4506)

Sumitomo Pharma gained on reports that the Japanese specialty and generic pharma company announced that it will co-promote diabetes drug Ozempic in a pact with Denmark’s Novo Nordisk.

- Earlier in April, shares rose by the daily limit in Tokyo after results of a study showed the safety and potential benefits of stem cells used to treat Parkinson’s disease. The study used stem cells manufactured by Sumitomo Pharma.

- The company is preparing to run clinical trials in the US to assess the safety of the treatment, bringing it one step closer to commercialization.

Mitsui Mining (TSE: 5706)

- The base metal company recently announced in late August that it will increase production capacity for its VSP electro-deposited copper foil for high-frequency circuit boards. Looking to boost output by 45% to 840tons per month from 580 tons announced in January

- The VSP copper foil is used in servers and routers, with demand accelerating for the product due to its AI server-related applications

Fujikura (TSE: 5803)

- The optical fiber maker is seeing tailwinds from AI and data center-related demand, driven by data center scaling out, which requires more optical wiring.

Softbank (TSE: 9984)

- Riding on gains from its stakes in Nvidia, TSMC, and tech startups.

- The Vision Fund saw a profit of ¥451.39b, fueled by tech valuations and gains on holdings such as Coupang Inc, Auto1 Group SE, Symbotic Inc, and Swiggy Ltd.

IHI Corp (TSE: 7013)

- Defense equipment maker IHI produces aircraft jet engines, rocket propulsion systems, and ships for military and commercial use.

- It also constructs nuclear power plants.

- Japan has long limited defense spending to 1% of GDP. However, escalating geopolitical tensions and pressure from the US has prompted the government to target an increase in the defense budget to 2%.

Mitsubishi Heavy Industries (TSE: 7011)

- The company manufactures gas turbines, nuclear/wind power generators, engines for aircrafts, as well as commercial and defense aircraft.

- Company aims to double its gas turbine capacity in the next 2 years amid stronger demand for the equipment due to the proliferation of data centers.

- Natural gas is seen as an alternative to wind and solar, is cleaner than burning coal, and is more readily available than nuclear energy.

- Turbines installed decades ago are nearing the end of their useful life.

- Australia also selected Mitsubishi Heavy to build a new class of naval frigates.

Ryohin Keikaku (aka MUJI, TSE: 7453)

- The company was seen as a tariff-resilient company, given its Americas exposure made up <5% of revnue.

- MUJI has raised its FY25 guidance in all 3 quarters so far this year.

Trade Japan stocks at 0.08% commission with no minimum fees on Phillip Nova 2. Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0