By Eric Lee, Account Manager, Phillip Nova

Whether we like it or not, government’s policy and budget greatly impacts the direction and outcome for companies. Take for example, the US-China trade war and China’s tech crackdown this year. Many companies have taken a hit because of policy change. On a positive note, many companies continue to enjoy growth due to government’s policy changes and budget.

One of the growing trends that we all experienced globally is that of Climate Change. Nations all over have set goals of carbon neutrality, emission reduction and electrification of the economy. European Union climate plan require carmakers to reduce emissions of new cars by 2030 and to sell 100% emissions-free cars by 2035. China targets for a 40% share of new energy vehicles by 2030. President Biden issued an executive order aimed at making half of all new vehicles sold electric in 2030.

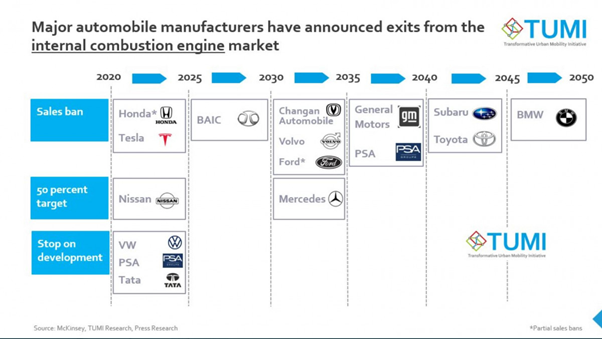

It’s not just governments all over the world, carmakers had made similar commitments.

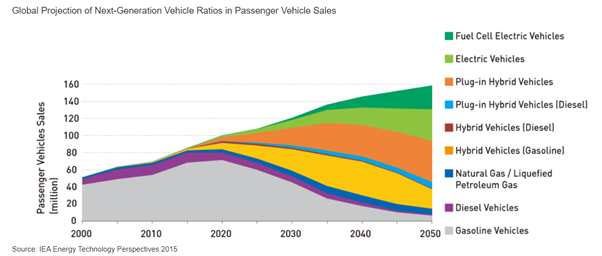

The shift to electric vehicles is one of the most disruptive technological trends over the next 2 decades, and despite the meteoric rise of Tesla and the recently- IPOed Rivian, we are only at the starting line. As can be seen from the chart below, according to International Energy Agency (IEA), sales of gasoline and diesel vehicles will peak in 2020, after which Hybrid Vehicles (HVs) and Plug-in Hybrid Vehicles (PHVs)/Plug-in Hybrid Electric Vehicles (PHEVs) are expected to take the lead. After 2040, it is predicted that the number of Internal Combustion Engine (ICE) vehicles will steadily decrease as the number of Electric Vehicles (EVs) and Fuel Cell Vehicles (FCVs) grows.

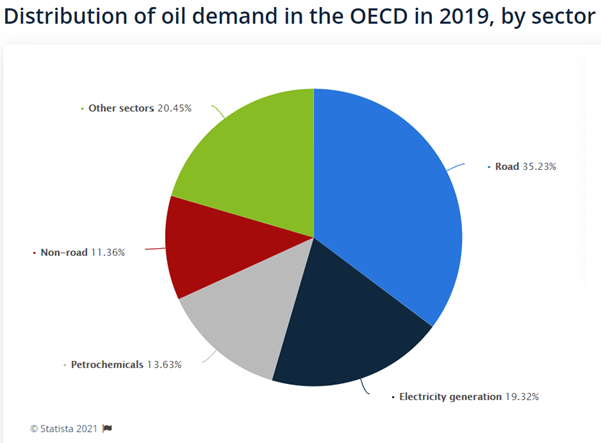

Road transportation together with electricity generation occupies nearly 55% of the global demand for crude oil. Thus, to solve the climate crisis that the world is in, the move toward Electric Vehicles (EVs) and green energy technology is crucial as that would reduce our consumption of crude oil by half. For the automotive industry to transition successfully, manufacturing capacities have to be established, essential raw materials for batteries must be mined, electrical grid and charging stations to be laid out to handle the demand from EVs on top of the existing demand for the proper function of the economy. To support the carmakers’ EV manufacturing capabilities, automotive suppliers have to transition as well to provide the essential components used in Electric Vehicles. One such EV component supplier that I am interested in is BorgWarner (NYSE: BWA).

Source: Statista

Founded in 1928, BorgWarner has a long history as a company, having gone through many technological changes and is currently supporting the automotive industry in realizing clean propulsion and efficient technology solutions.

Source: Borg Warner Website (https://www.borgwarner.com/investors)

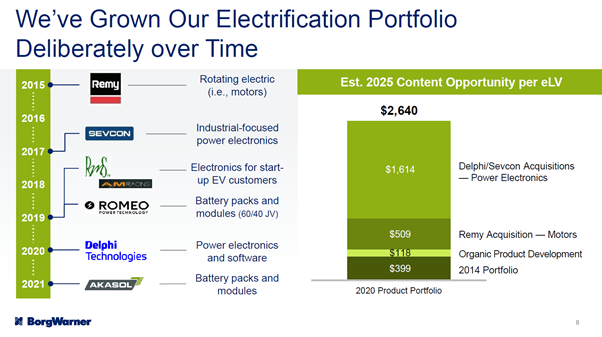

Since 2015, with its acquisition of Remy Motors, BorgWarner has been gradually building up its EV capabilities through other M&A and its in-house product development effort. I think the company is finally ready to step on their accelerator in the transitioning process.

Source: Borg Warner Website (https://www.borgwarner.com/investors)

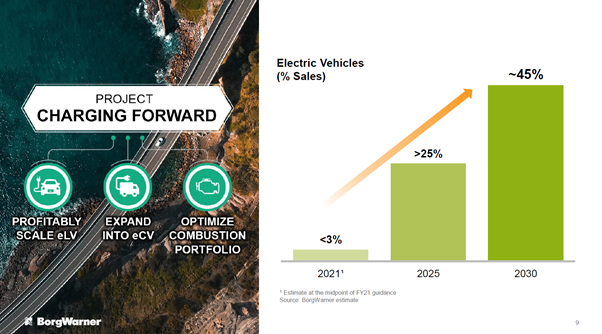

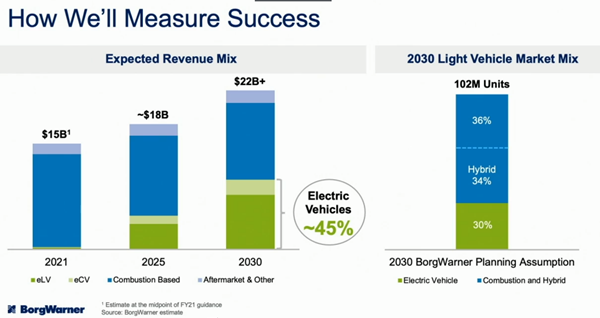

During its Q4 2021 Investor Day presentation, management laid out an ambitious electrification plan that they named “Project Charging Forward”. They set the target for growing their EV business solutions, which is currently only worth less than 3% of its overall revenue, to more than 25% in 2025 and about 45% by 2030.

Their strategy for electrification over the next few years are summarised as follow:

- Shift organic investment towards electrification

- Deploy up to $5.5b toward M&A

- Disposing about $3-$4billion worth of revenue, to raise capital and also to better optimise its Internal Combution Engine (ICE) portfolio.

Source: Borg Warner Website (https://www.borgwarner.com/investors)

Even as the company embark in its electrification plan, management is projecting for its revenue to continue to grow till 2030 and beyond. Based on its past performance and future projection, it is not farfetched to expect a 10-12% p.a. return from this investment, inclusive of dividend payouts and share buy-backs. If the market begins to revalue the company to match the valuation it awards to other EV companies, then shareholders may benefit further with multiple expansion.

Source: Borg Warner Website (https://www.borgwarner.com/investors)

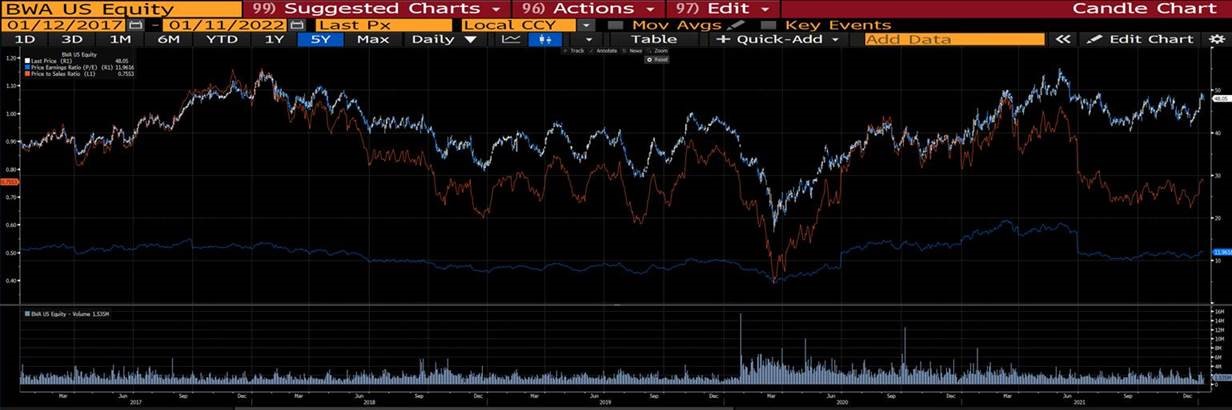

Recent price correction offers interested investors an opportunity to add some BorgWarner to their portfolio. With its 100+ years of experience, the company’s culture has proven to be adaptable to technological changes and we expect it to continue to do so as this is only the beginning of the secular trend for EV technology. It helps to know that both its Price-to-Earnings & Price-to-Sales ratio are trading close to 5-year historical lows.

Eric Lee is an Account Manager with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.