By Danish Lim, Senior Investment Analyst for Phillip Nova

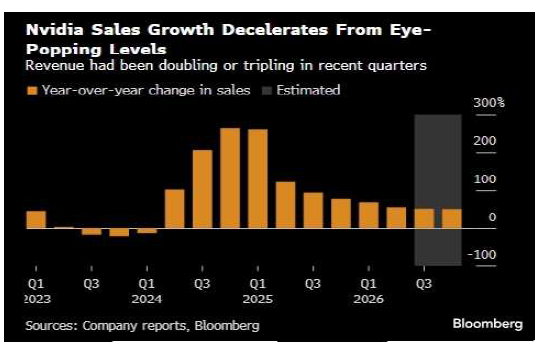

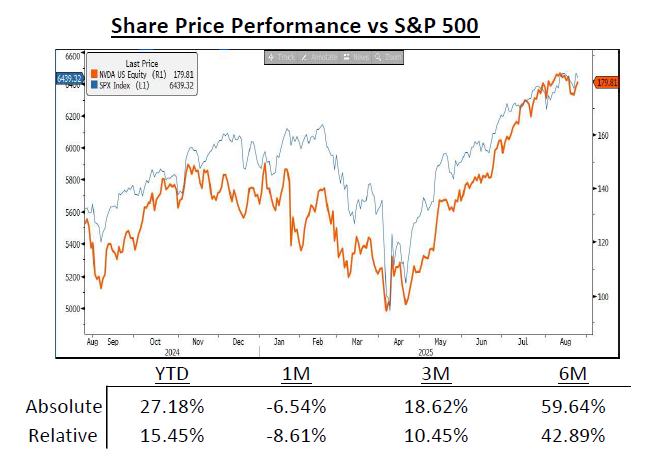

Nvidia is up 30.23% YTD, but tariff uncertainty and the recent miss of 2Q earnings estimates has left investors wondering if the tech giant’s straegic moat is still intact. In this Market Trends article, we will analyse if Nvidia is still well positioned to rise with the rapid development in AI.

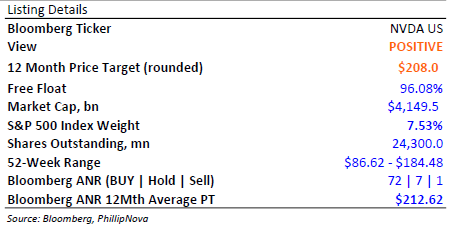

- We are POSITIVE on Nvidia and have a base-case 12month PT of $208, which gives us an upside potential of +21.8%.

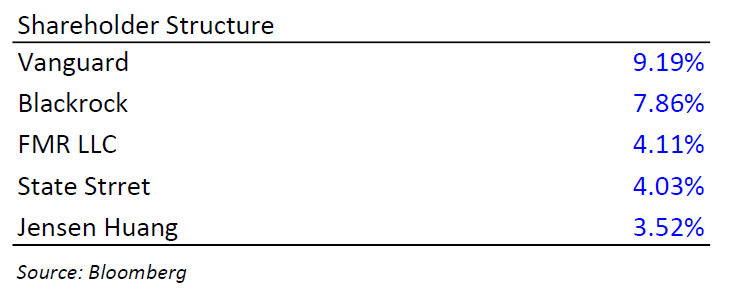

- Co-founded in 1992 by Stanford-trained engineer Jensen Huang, who was already a veteran of AMD, as well as fellow industry veterans Chris Malachowsky and Curtis Priem. The company made it’s IPO in 1999, the following year, Microsoft chose Nvidia to supply the graphics chips for its XBOX video game console.

- Nvidia provides a complete, end-to-end, full-stack data center compute and networking solutions across processing units, interconnects, and software. CAPEX from Big Tech is a major revenue contributor.

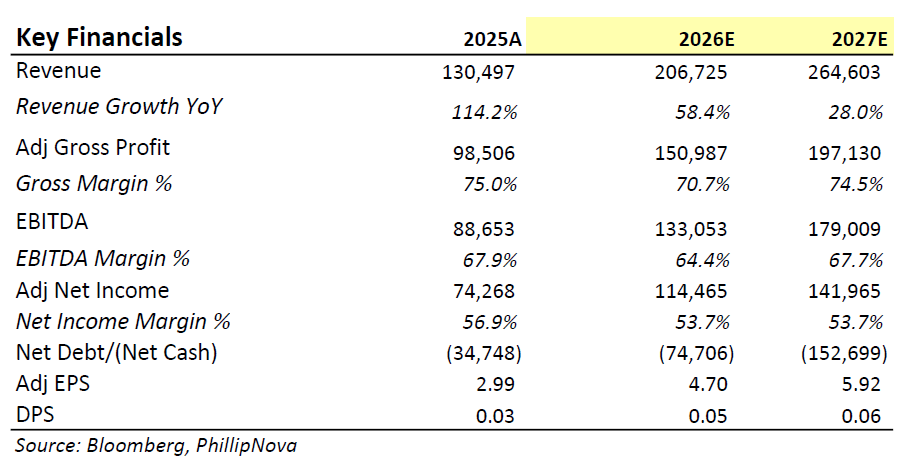

- Nvidia mainly reports in 5 main segments – Data Centers (~90% of revenue), Gaming, professional visualization, automotive, and OEM.

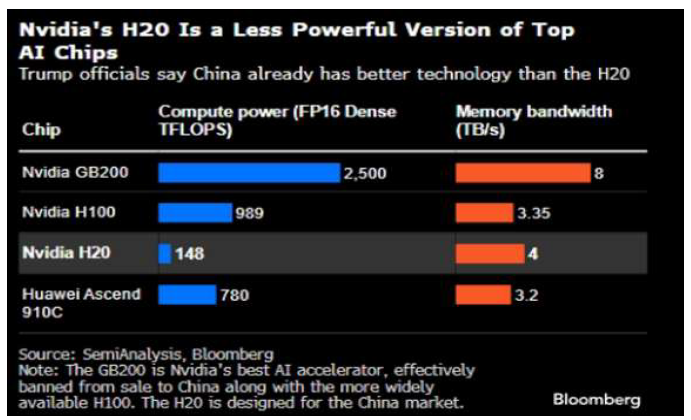

- The US has granted export licenses for NVIDIA’s H20 chip (and AMD’s MI308), subject to a groundbreaking arrangement: chipmakers must remit 15% of their China-related AI chip revenue to the U.S. government.

- Management shared that while a select number of China-based customers have received licenses, Nvidia has not shipped any H20 based on those licenses. The USG has not published a regulation codifying the 15% revenue sharing

requirement. - Following the license reversal, NVIDIA placed an order for 300,000 more H20 chips from TSMC to meet strong demand in China.

- 3Q guidance excludes H20 sales, Nvidia expects potential $2b – $5b in H20 revenue in 3Q if geopolitical issues resolve.

- 10 September: At the AI Infra Summit in Santa Clara, NVDA unveiled Rubin CPX, based on the company’s next-gen Rubin chip, which will by available at the end of 2026, to power inference workloads. We think this will help prevent market share loss to rivals like Google, Amazon, Microsoft that have developed inference-focused chips, aiming to exploit the previous lack of an Nvidia chip customized for such workloads. Open AI and Apple have also been developing inference chips with the help of Broadcom.

- Blackwell platform reached record levels, growing sequentially by 17%. GB200 NVL system seeing widespread adoption at data center scale for both training next-gen

models and serving inference models. - The new GB300 (Blackwell Ultra) is in full production, with a smooth transition from GB200 due to their shared architecture.

- New Rubin chips are in fabrication, on track for volume production next year.

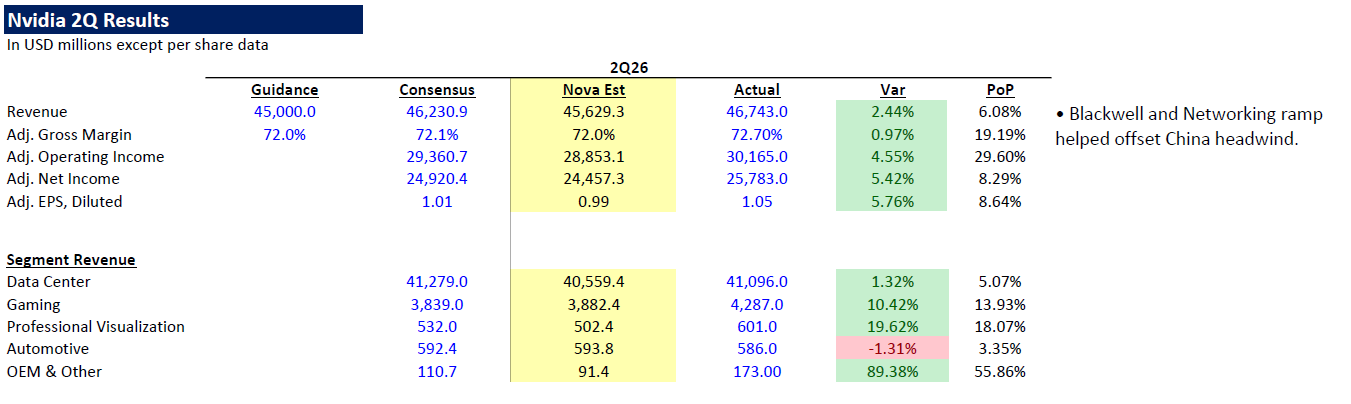

- Gaming revenue was a record $4.3 billion, a 14% sequential increase and a 49% jump YoY, driven by the ramp of Blackwell GeForce GPUs. This quarter, NVDA shipped GeForce RTX 5060 Desktop GPUs. Blackwell is also coming to GeForce NOW, NVDA’s cloud gaming service, in September. GeForce NOW catalog doubled to over 4,500 titles, the largest library of any cloud gaming service.

- Professional Visualisation revenue reached $601 million, a 32% YoY increase. Growth was driven by an adoption of the high-end RTX workstation GPUs and AIpowered workload, like design, simulation, and prototyping. Activision Blizzard uses RTX workstations to enhance creative workflows.

- Automotive revenue, which includes only in-car compute revenue, was $586 million, up 69% YoY, driven by self-driving solutions. NVDA has begun shipments of Jetson Thor SoC, the successor to Orin. It runs the latest generative and reasoning AI models at the edge in real time, enabling state of the art robotics.

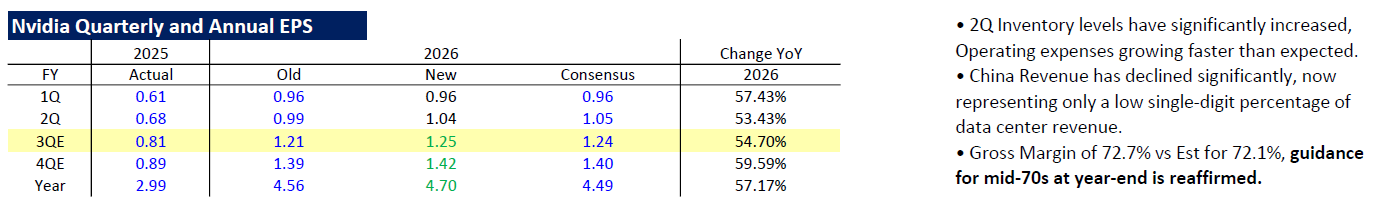

2QFY26 Results & 3QFY26 Guidance

- Record 2Q revenue of $46.7b, higher than its previous guidance of $45b ±2%. The company forecast

sales of ~$54b in the current quarter (3Q), which although roughly inline with median estimates,

failed to meet the higher-end of estimates (3Q forecast ranges 48.4b – 63.4b). - This forecast explicitly excludes data center revenue from China, particularly the H20 chips, which

Nvidia has reportedly halted production of. Currently, Huang is looking to seek approval from Trump

to sell scaled-back versions of its latest Blackwell chips to China. Jensen Huang said China may

represent a $50b opportunity for Nvidia this year. - We model via a switch a potential $2-$5 billion upside if H20 licenses are cleared, with scope for

more if political conditions ease. - Strong growth in networking as rising demand for AI compute clusters necessitate high-efficiency and low-latency networking. Record

$7.3b with Spectrum-X ethernet. - Successful ramp up of GB300 (Blackwell Ultra), with production at 1,000 racks per week. Blackwell revenue up 17% sequentially.

- Next-gen Rubin platform is on track with all chips already in fabrication.

- Top 2 hyperscalers account for 39% of revenue, but we believe this should normalize as Blackwell adoption broadens across tier 2 CSPs and sovereign projects. Growth in Sovereign AI (UAE, Saudi Arabia), expected to exceed $20B this year.

Investment Thesis

- For much of it’s history, Nvidia was known for gaming, not for AI. It designs Graphics Processing

Units (GPUs) that render realistic video game images via parallel computing. As Huang put it — AI has

“become more useful because its smarter, it can reason, it is more used” and the amount of compute

necessary has grown tremendously. - Nvidia has already twice innovated new chips specifically to get around US restrictions. We also

look favorably upon Nvidia’s 12-18 month product refresh cycle. - Nvidia has built an extensive library of code for using its GPU chips for AI purposes– called Compute

Unifed Device Architecture (CUDA). Introduced in 06, CUDA unlocked the power of GPUs for generalpurpose

computing – changing GPUs from graphics-only to general-purpose. - Most AI frameworks (TensorFlow, PyTorch) today use CUDA libraries (cuDNN) to accelerate deep

learning. When tools like PyTorch are used, it automatically tries to use Nvidia’s GPUs via Cuda if one

is available. This results in an entire software ecosystem that enable plug-and-play compute

acceleration through CUDA-enabled GPUs. - Together with hardware, this software stack is typically bundled together to be sold as an entire

computer system (e.g., DGX-1) - Huang has repeatedly emphasized that NVIDIA is no longer just a GPU company, but a broad AI infrastructure

provider.

Network products include:

1) Scale Up: NVLink 72 (vs Hopper’s NVLink 8) which connects 72 GPUs into one virtual compute

node at the rack level.(entire rack = one unified computer), vs. the old NVLink 8 where only a single

node/server acted as a unit.

• 2) Scale-Out (across nodes): InfiniBand (Higher performance) and Spectrum-X Ethernet (Designed

for customers with existing Ethernet-based data centers, connects distributed data centers for scaling

up and speeding up GPU-to-GPU communication speed)

• 3) Scale-Across (multi-site / giga-scale): Spectrum-XGS → connects muliple AI factories into one

Product Roadmap:

- Hopper → Blackwell → Rubin (Est CY2026) → Vera (Est CY2027)

Huang highlighted a massive long-term market opportunity of $3-4 trillion in AI infrastructure by end of this

decade, driven by reasoning agentic AI requiring orders of magnitude more training and inference compute,

buildouts for sovereign AI, enterprise AI adoption, and the arrival of physical AI and robotics.

Valuation:

- Nvidia became the first public company to reach $4 trillion in market value. • Will benefit from expectations of Fed rate cuts.

- Based on BF P/E, due to it’s industry-leading position, Nvidia has traded at a average historical premium of 50% to peers over the past 5 years. Currently trading at 30.4x BF P/E, vs peer average of 31.3x– implying a discount 3% that is -1.4 standard deviations below the mean trading premium.

Trump Open to Nvidia Selling Scaled-Back Blackwell to China

- Nvidia reportedly started winding down production of the H20, and started work on a more powerful successor.

Trump said he was open to cutting a deal to permit Nvidia to sell a successor to the H20, provided it was scaled back

“30% to 50%”. CEO Jensen Huang reportedly plans to ask the Trump administration’s permission to sell this more

powerful chip to Chinese companies. - There were reports that Nvidia was halting production of its H20 chip after Beijing asked local companies not to

buy it over concerns over “security backdoors”. Reacting to the reported security weakness in Nvidia chips, the

company said that Nvidia does not have such ‘backdoors’ in our chips that would give anyone a remote way to

access or control them.”

ASICS vs NVIDIA

-

During the earnings call, Huang also spoke at length about ASICs and where Nvidia’s products stand.

-

ASICs provide advantages such as lower cost and greater efficiency as they are typically custom-built for specific workloads.

-

However, Huang shared that ASIC startups are plentiful but rarely succeed. Because accelerated computing is full-stack, it is not just chips, but also hardware +

software co-design (NVDA GPUs + CUDA). He stressed that AI workloads are too dynamic and complex for fixed-function ASICs. AI is evolving fast and supporting this

breadth of models requires adaptable platforms, not one-off chips.

Nvidia’s Differentiators

- According to Huang, Nvidia GPUs provide “everywhere availability” as NVIDIA GPUs run in every cloud, OEM, and edge/robotics platform.

- One programming model (CUDA/cuDNN/etc.) across all environments.

- Full AI pipeline coverage– covering data prep, pre-training ,post-training, and inference. This makes Nvidia-based data centers more useful over a longer lifetime as it can adapt as AI architecture change.

- Ultimately, NVIDIA isn’t just GPUs, they integrated: Silicon Layer (GPU compute + HBM CPUs), the Scale-up Interconnect (NVLink) which allows for scaling up to an AI computer that is functionally just “one massive GPU”, Scale-out Networking (InfiniBand and Spectrum-X Ethernet) to connect between GPU clusters, are co-designed with Compute Software & Frameworks (CUDA libraries, NeMo for training, TensorRT-LLM for inference acceleration).

- These layers give Nvidia an entire infrastructure-level moat—competitors can’t beat Nvidia with just chip performance, a key reason NVIDIA has outpaced rivals and become the most valuable company in tech.

Trade Nvidia and other US stocks on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0