by Phillip Research Sdn Bhd

Key focus for 2H25

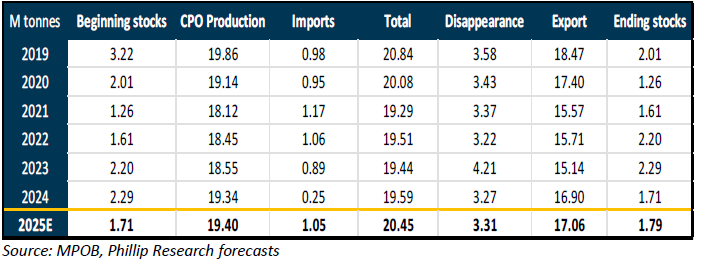

The sector faces structural headwinds, including declining yields, constrained landbank expansion, and rising regulatory and sustainability compliance costs. This is further compounded by softer global demand amid persistent macroeconomic uncertainty. We project CPO output to remain essentially flat at 19.4m tonnes in 2025, as ageing trees and slow replanting progress hamper productivity gains. Domestic inventories are expected to rise 4.6% YoY by end-2025, potentially weighing on prices. While restocking activity may offer near-term support in 2H25, long-term price competitiveness is increasingly at risk due to narrowing discounts to soybean oil and structurally higher production costs. Additional pressure may stem from a recovering global soft oil supply and intensifying competition. Key external monitoring factors include China’s drive for oilseed self-sufficiency, potential US trade policy shifts, and the industry’s ongoing pivot towards traceability and sustainability standards.

Earnings outlook

The sector is projected to register 14.7% YoY earnings growth in 2025E. The weaker 1Q25 earnings were mainly due to seasonal production declines, partly cushioned by higher CPO and PK prices. Earnings momentum is expected to strengthen in 2H25 on the back of: 1) seasonally higher production, 2) cost relief from normalising fertiliser prices, and 3) continued cost discipline and operational efficiency improvements. Our house view assumes average CPO prices of RM4,100/MT in 2025E and RM4,000/MT in 2026E.

Sector view and strategy for 2H25

Given the current landscape, we favour upstream-focused planters with younger estates, improving FFB yields, and efficient cost structures, as these are better positioned to navigate margin compression and capitalise on any potential recovery in CPO prices. Our strategy centres on the selective accumulation of upstream names offering yield improvement and operational leverage. For investors seeking more stable returns, integrated players with consistent dividends and resilient earnings profiles also warrant consideration.

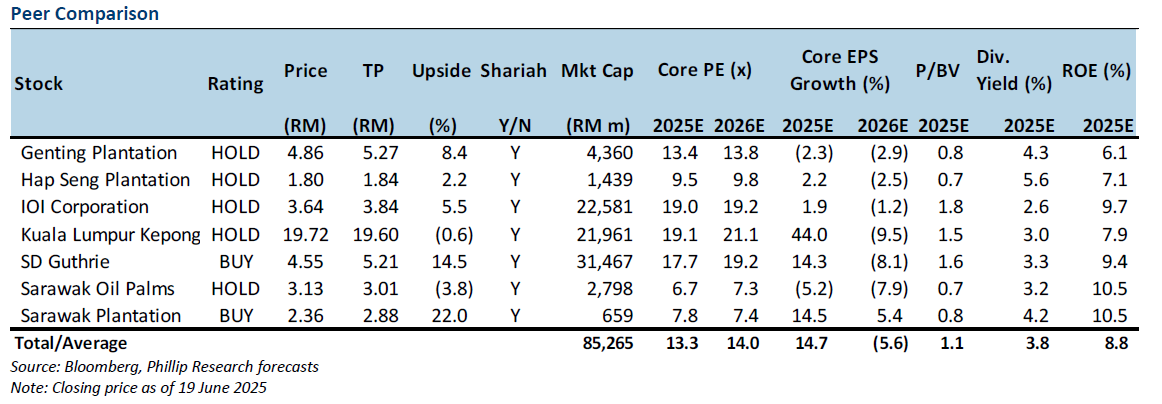

Valuation and recommendation

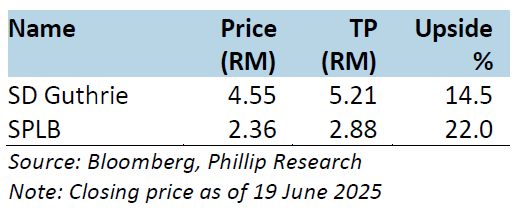

The sector is trading at 15x forward PE, below its 10-year mean of 31.3x. We see limited downside risks but also capped upside amid ongoing structural headwinds. We believe valuations appear attractive for selected small-to-mid cap names such as SPLB, HAPL, and SOP. A sector re-rating could materialise if CPO prices stabilise, ESG risks are more fully priced in, and global edible oil dynamics turn favourable in 2H25. We maintain our NEUTRAL call on the sector with SDG (BUY; TP: RM5.21) and SPLB (BUY; TP: RM2.88) as our top picks.

Planntation key annual statistics – forecast figure for 2025

Peer comparison

Coverage Buy Calls

Trade Malaysian Stocks at just 0.08% on Phillip Nova 2.0 now

Capture opportunities in the Malaysian stock market now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0