By Danish Lim, Investment Analyst, Phillip Nova

Singapore’s 2023 Budget is scheduled to be released on 14th February at 3:30pm Singapore Time. This comes at a time where inflation remains elevated albeit easing from its peak, with December’s All-Items Consumer Price Index coming in at 6.5%, down from 6.7% in November. The Monetary Authority of Singapore (MAS)’s Core Inflation measure, which excludes private road transport and accommodation costs, remained unchanged at 5.1%, driven by persistent food & services inflation. Hence, we expect businesses to continue passing through costs to consumers via price increases. This coincides with the recent GST hike of 8% effective Jan.1 and 9% effective Jan.1 2024, which could add to current inflationary pressures and weigh on consumer spending.

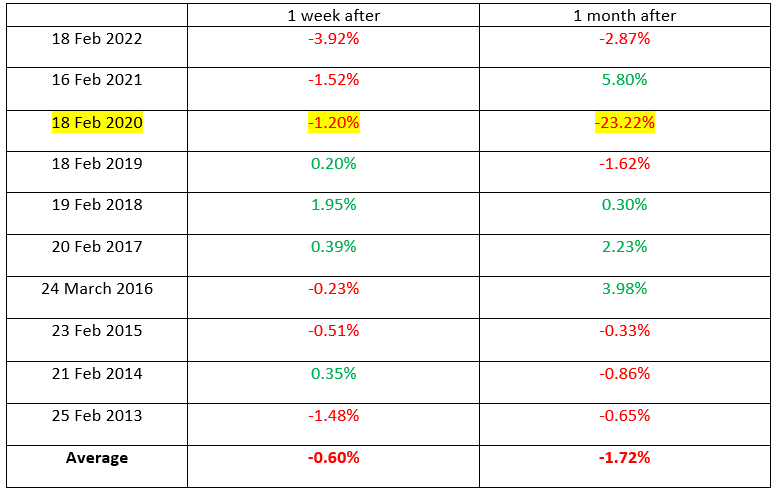

An analysis of the price movement in the Straits Times Index (STI) 1 week and 1 month after the Budget announcement over the past 10 years shows mixed results. The STI only saw gains in 4 of the past 10 years, falling by an average of -0.60% and -1.72% 1 week and 1 month after the Budget respectively. Extreme readings were seen in 2020 at the height of the COVID-19 pandemic.

With no Fed pivot in sight, we think it is wise to abide by the mantra of “Don’t Fight the Fed” and remain cautious in chasing the recent rally as recession and overtightening risks remain high. Although peak inflation is encouraging, oIn our view, Budget 2023 may revolve around 3 core themes that could present investors with an opportunity to profit from additional policy support:

1. Addressing the rising cost of living

IWe forecast enhanced support packages in Budget 2023 aimed at helping households cope with the rising cost of living. Finance Minister Lawrence Wong announced that the budget will be his “Valentine’s Day present to all”. This is of greater importance as the recent GST hike is taking place at the same time as rising prices. Singaporean households have been able to claim $300 worth of Community Development Council (CDC) vouchers since Jan 3; while up to $700 has been given to adult Singaporeans via GST Vouchers (GSTV) in December 2022.

To weather near-term bearishness, we recommend discounted low beta stocks with good profitability and a strong baIn our view, there could be an extension or enhancement of last year’s $6B Assurance Package. This may involve additional cash pay-outs, rebates, or extending the list of eligible GSTV merchants. We think this will boost consumer spending and benefit businesses that provide staples and basic necessities such as:

- Stride Inc (NYSE: LRN), +36.03% YTD. Technology-based online and blended education provider; also offers career learning/training.

- Sheng Shiong Group Ltd $1.63 (SGXT: OV8), -0.61% YTD, operates grocery chains across Singapore, eligible for GSTV use.

- DFI Retail Group Holdings Ltd US$3.30 (SGXT: D01), +10.58% YTD, operates supermarkets (Cold Storage, Giant), convenience stores (7-Eleven), and drugstores.

- QAF Ltd $0.855 (SGXT: Q01), +3.01% YTD, manufactures and sells bakery and confectionary products

2. Decarbonisation, facilitating the Green Transition and EV adoption.

The Energy Crisis showed the importance of reducing dependency on oil and gas for most developed nations across the globe. In this regard, Singapore saw rising electricity bills over the past few years as it relies on imported natural gas for about 95% of its electricity supply, according to the Energy Market Authority (EMA).

Singapore has already taken steps to advance its green agenda, having named the first government chief sustainability officer in December 2022 and laying out the Singapore Green Plan 2030 in 2021. The presence of fully electric public buses on the road shows the early impact of these initiatives. Similar to Budget 2022, we could see an increase in Singapore’s Carbon Tax to facilitate decarbonisation. Tax Credits for EVs like what we see in the US are also not outside the realm of possibility. Hence, we believe Budget 2023 will likely highlight the government’s commitment to accelerating the green transition, serving as tailwind for stocks such as:

- NIO Inc $11.00 (SGXT: NIO), +8.8% YTD. Manufactures and sells electric vehicles (EVs), as well as battery charging services.

- Sembcorp Industries Ltd $3.73 (SGXT: U96), +10.36% YTD. One of Singapore’s largest home-grown renewable energy players, with a deep portfolio of wind, solar, and energy storage assets in key markets such as Singapore, China, and the UK. Aims to quadruple gross installed renewable energy capacity to 10Gigawatt (GW) by 2025, up from about 2.6GW at the end of 2020.

- Keppel Infrastructure Trust $0.55 (SGXT: A7RU), +1.85% YTD A listed business trust that invests in a large and diversified portfolio comprised of strategic assets and businesses in 3 core segments- Energy Transition, Environmental Services, and Distribution & Storage. Has heavily invested in offshore wind farms in Europe. The Trust has Increased renewable energy exposure from 0% to around 10% of AUM at the end of 2022; it plans to increase renewable energy exposure to 25% of AUM by 2030.

3. Strengthening Singapore’s Digital Capabilities

Chinese markets have rebounded since the start of 2023, underpinned by a faster than expected re-opening ever since Last year, Finance Minister Lawrence Wong called for further efforts to improve Singapore’s digital capabilities in order to “stay in the race”. This includesupgrading Singapore’s broadband infrastructure to increase broadband access speeds by 10-fold over the next few years and “ride the next communications and connectivity wave”; as well as investing in future technologies such as 6G.

We expect much of the same in Budget 2023, with policy measures likely to focus on driving digital transformation to help companies stay relevant in an ever-changing business landscape. Our top stock picks are:

- Singapore Telecommunications Ltd $2.53 (SGXT: Z74), -1.56% YTD

- Netlink NBN Trust $0.865 (SGXT: CJLU), +4.22% YTD

- Starhub Ltd $1.05 (SGXT: CC3), +0.96% YTD

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova