By Danish Lim, Senior Investment Analyst for Phillip Nova

The SiMSCI Index (SGX MSCI Singapore Free Index) Futures contract is the most liquid equity index futures on SGX, offering exposure to Singapore’s large- and mid-cap stocks. Comprising of 17 constituents and covering about 85% of the market’s free float-adjusted capitalisation, the index is anchored by DBS, OCBC, UOB, Singtel, Sea Ltd, and Grab.

In 2025, the contract has drawn strong attention. As of 26 August, the SiMSCI posted a total return of +23.35% YTD in SGD terms, comfortably outperforming the Straits Times Index (STI), which gained +16.64% YTD. The STI itself reached an all-time high of 4,282.80 on 14 August, underscoring the resilience of Singapore equities.

From a macro lens, the outlook remains constructive. Singapore’s equity market benefits from a unique blend of compelling valuations, strong sovereign fundamentals, and supportive policy initiatives. These factors reinforce its role as a safe-haven destination within Asia.

Valuations stand out as a key driver. The SiMSCI trades at 16.6x LTM P/E, representing a ~40% discount to the S&P 500’s 27.5x and below its own five-year average of 18.0x. This relative and absolute discount strengthens the case for re-rating, particularly when combined with a 12-month dividend yield of ~3.8%.

Fundamentals also remain robust. Singapore is the only AAA-rated sovereign in Asia, with reciprocal tariffs capped at just 10% — among the lowest in the region. Such strengths provide insulation against global market shocks and currency volatility, helping sustain investor confidence.

Policy support is another tailwind. The Monetary Authority of Singapore (MAS) recently announced a S$5bn Equity Market Development Program to deepen liquidity and broaden institutional participation. At the same time, local corporates are becoming more shareholder-friendly, with rising dividends and share buybacks enhancing returns.

For investors seeking growth exposure, the SiMSCI is particularly appealing. Bloomberg factor data shows the index tilts more toward growth and volatility compared to the STI, making it a preferred instrument for higher-beta strategies.

On the rates front, falling borrowing costs should further support equity valuations. We expect the 3M-SORA to decline as the Federal Reserve embarks on rate cuts. Risks remain, including potential volatility if Fed independence is challenged politically, but Singapore’s safe-haven profile should limit downside.

Technical Outlook

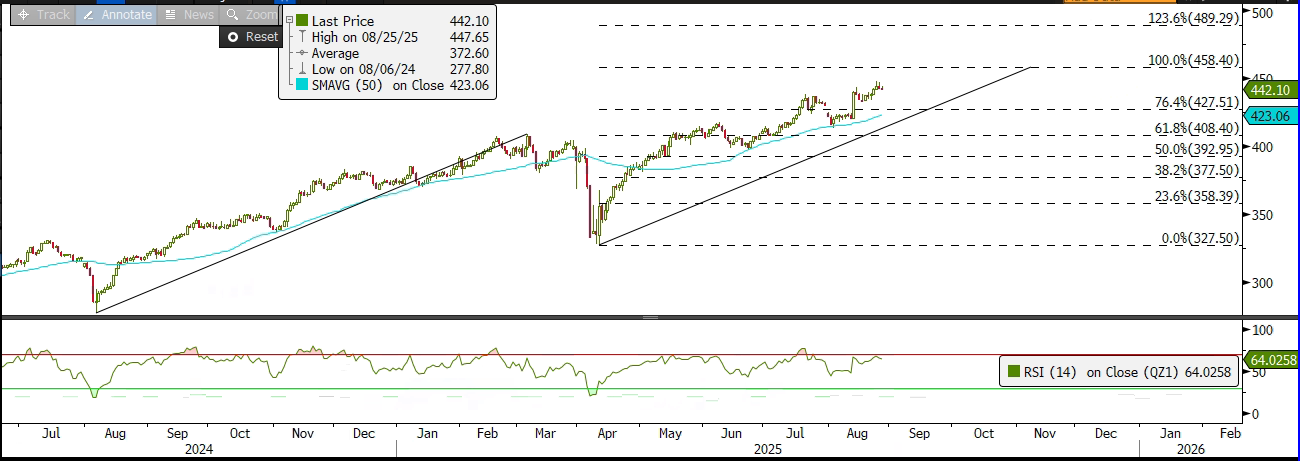

Technically, momentum favors the bulls. The SiMSCI rebounded from its April low of 327.50 and broke above the 76.4% Fibonacci extension in August, propelled by a sharp rally in Sea Ltd’s shares (+19% in a single session). A sustained breakout above 460 could open the path to 490 — the 123.6% Fibonacci extension level and our year-end target.

Support lies at the 50-day moving average near 420, providing a strong technical floor. While RSI levels suggest short-term consolidation is possible, the broader trend remains constructive, underpinned by earnings strength, macro resilience, and policy catalysts.

With attractive valuations, safe-haven fundamentals, and bullish technical signals, the SiMSCI Index Futures continues to shine as the preferred vehicle for investors seeking both defensive stability and growth exposure in Singapore’s equity market.

Take a view on the SiMSCI now with the lowest rate in Singapore

Trade the SGX MSCI Singapore Index Futures at only S$1.38 on Phillip Nova 2.0 now! Learn more now!

Or take a view via Singapore stocks, or explore opportunities in ETFs via the Phillip MSCI Singapore Daily (2X) Leveraged ETF (LSS) or the

Phillip MSCI Singapore Daily (-1X) Inverse ETF (SSS) now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0