By Danish Lim, Investment Analyst, Phillip Nova

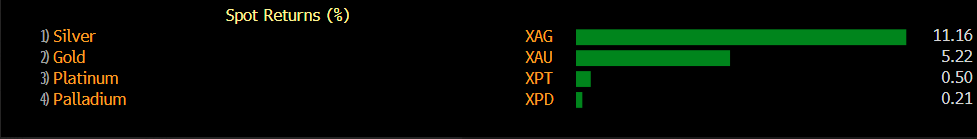

Precious Metals spot returns (%) for March:

While Gold has done well in March as banking sector turmoil fuel safe haven demand, Silver has done even better.

Silver has historically had a strong positive correlation to Gold at 0.7285:

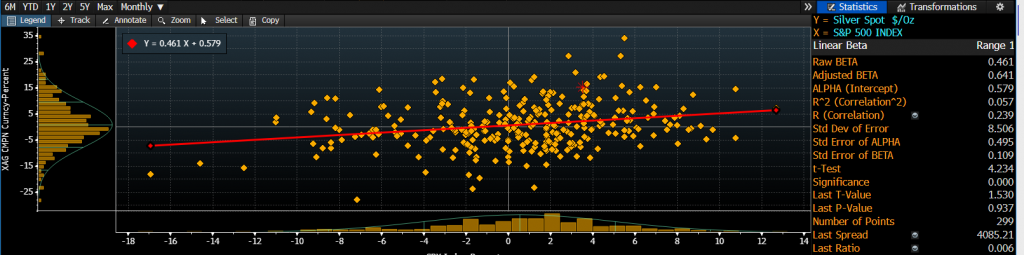

However, Silver has a higher Beta to the S&P 500 at 0.461, compared to Gold at 0.065. This makes it relatively more volatile as it is more closely linked to the industrial economy due to its various commercial applications (electronics, coins, jewellery, dentistry, industrial machinery, etc).

The 2 metals differ in terms of their utility – as Gold is mainly used in jewellery/investment, whereas Silver has far more industrial and commercial use cases. Silver can also serve as a cheaper proxy with similar qualities to Gold. This makes it more accessible for retail investors who wish to own Silver as a physical asset.

Hence, to sum up:

Silver: Typically outperforms Gold when the economy is doing well – which raises demand for Silver due to its various industrial applications. Ideal if you have a bullish view on the economy.

Gold: Outperforms during periods of instability (banking sector turmoil) due to its status as a safe haven; serves as a portfolio diversification tool due to its low correlation to equity markets. Ideal for recession protection.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0