By Danish Lim, Senior Investment Analyst for Phillip Nova

The Singapore index has surged 13.44% year-to-date in 2025, nearly doubling the S&P 500’s 7.38% gain — a standout performance that has caught the attention of global investors. As the nation approaches its 60th birthday, the question now is whether this momentum can carry through the second half of the year. In this article, we explore the factors driving the STI’s strong showing, why it remains an attractive value proposition, and which sectors may offer further upside in the months ahead.

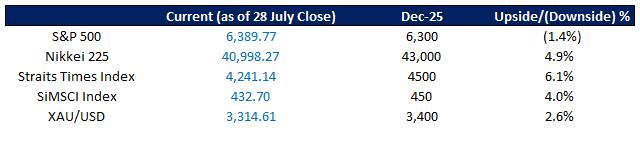

As of 28 July Market Close:

STI: +14.79% YTD

FTSE ST All-Share (Top 98% by market cap): +14.58% YTD

FTSE ST Mid Cap: +8.04% YTD

FTSE ST Small Cap: +20.57% YTD

What makes the STI a compelling value proposition for investors?

The STI hit a new all-time high of 4,274.32 on 24 July. The SiMSCI Index also hit a new record of 436.32 on 21 July.

- Singapore equities stand out as an attractive safe haven, with a dividend yield of ~5%.

- Reciprocal tariffs of 10% are low compared to Asian peers.

- Valuations: The STI is currently trading below the 5-year average of 15.4x at a TTM P/E of 12.1x. (-21% discount)

- Companies are becoming more aggressive in returning capital to shareholders via higher payouts and share buybacks.

- Crucially, the planned S$5bn to be spent on Singapore equities by MAS’s equity market development programme (EQDP) should boost mid and small caps.

For these reasons, we have raised our index targets for the STI from 4,300 to 4,500.

Review by sector

Consumer results have been subpar, a reflection of weak consumer spending in Singapore.

- Thai Beverage (-13.76% YTD), Delfi (-3.37% YTD) as Cocoa futures hit a 60-year high in January.

- Sheng Siong (+29.27% YTD) reported 7.1% revenue growth to S$403.0 million and a 6.1% rise in net profit in its 1QFY25 Business Update, driven by new store openings and festive Hari Raya sales.

- Genting Singapore (-2.61% YTD) 1Q25 profit down 41% YoY as travel weakened due to a strong SGD and the temporary closure of Hard Rock Hotel for renovation reduced room availability amid RWS 2.0 upgrades.

Significant outperformers were utilities and telcos as investors flock to more defensive sectors.

- Significant buybacks and dividend hikes. Yields started to match Banks.

- Singtel (+30.84% YTD) unveiled its first S$2 bn buy-back program, funded via capital recycling.

- Keppel (+19.44% YTD) and Sembcorp (+38.22% YTD) are set to open new power plants in 2026. Power demand driven by greater prevalence of EVs, renewables, data centres in Singapore.

Banks and S-REITs in “wait-and-see” mode until rates decisively fall and tariff uncertainty clears. But outflows have halted.

- 3 banks all reported single-digit NIM compression in 1Q25, guided for more if Fed cuts again.

- But volatile market conditions helped boost capital market, wealth management, and trading operations.

- UOB (+1.64% YTD) suspended 2025 guidance due to tariff threats.

- Pure-play data centre Keppel DC REIT (+7.34% YTD) joined the STI, expected to increase S-REITs’ combined weight in the index to over 10%. Increases the total number of S-REITs in the index to 8.

Shipping and transportation have been victims of trade war. Technology rebounded as the AI theme started to regain its fire.

- Risk of fees on Chinese-made vessels docking in the US hurt Yangzijiang Shipbuilding (-15.38%)

- Venture Corp (-5.86% YTD): ~73.5% of FY24 Revenue came from outside Singapore.

- AEM (+14.58%): Semiconductor test solutions, “stress-test” finished chips before they leave the factory [Back-end]

- UMS Integration (+47.57%): Component manufacturer (e.g., Precision vacuum chambers) for Applied Materials [Front-end]

- Frencken (+46.90%): Mechatronics modules for lithography giants, notably ASML. [Front-end]

Other Homegrown Opportunities to look at – Non-STI Stocks with Market Cap >S$3B:

- Keppel DC REIT

- Comfort DelGro’s (+7.43% YTD) overseas revenue topped 50% of total revenue for the first time in history

- SIA Engineering (+32.07% YTD) FY24/25 net profit increased 44% YoY, recently announced that it had signed S$1.3 billion services agreements with Singapore Airlines and Scoot.

- Suntec REIT (+0.85% YTD), CapitaLand Ascott Trust (+5.61% YTD), Olam Group (-13.93% YTD)

Stocks with Market Cap between S$1B and S$3B:

- Sheng Siong is the largest, 1QFY25 revenue increased 7.1% YoY

- Parkway Life REIT (+7.63% YTD), and Singapore Post (+15.09% YTD)

- StarHub (+2.48% YTD), Raffles Medical (+18.82% YTD)

Stocks with Market Cap between S$250M and S$1B:

- Food Empire (+141.72% YTD), the largest stock,1QFY25 revenue was up 16.3% YOY. Southeast Asia led contributions for the first time, driven by a 44.6% surge in Vietnam sales. Main markets are central Asia– Russia, Ukraine, Kazakhstan.

- Wing Tai (+13.71% YTD), Sasseur Reit (+0.74% YTD), PropNex (+46.27% YTD), MoneyMax Financial Services (+100% YTD), Q&M Dental (+44.64% YTD), Banyan Tree (+95.65% YTD).

- Yangzijiang Financial (+124.10% YTD), Centurion Corporation (+80.21% YTD)

Banks:

- 3M-SORA continued to slide down to 1.85%, the lowest since September 2022.

- We expect the 3M-SORA to continue declining as Fed rate cuts are expected.

- Nevertheless, lower rates led to an increase in Singapore loan growth (May25: 5.83% vs Apr25: 4.5%).

- A surge in trading activity also boosted non-interest income (NOII)

BULLISH: We believe banks can maintain their NIMs from the steepening yield curve and higher CASA levels.

- Dividend yield of ~5.7% is attractive as capital return initiatives continue in FY25 and share buybacks improve ROE & EPS.

- A beneficiary of the trade war has been trading volumes, with YTD 2025 volumes up ~24% YoY.

BBG 12M Tgt Px: DBS S$47.43, UOB S$38.27, OCBC S$17.46

S-REITs:

- At dividend yield of 5.24% and P/NAV of 0.9x (>1x s.d.), we see this as an attractive entry point with interest rate cuts on the horizon.

BULLISH stance on S-REITs:

- Trading at a forward dividend yield spread of 3.9%.

- Should see lower finance costs due to interest rates decreasing and interest savings from loan repayments. Most REITs already reported interest savings.

- S-REITs have reported minimal impact from tariffs. Potential effects are likely 2nd or 3rd order in nature, for example via lower consumption due to a slower economy.

- We favour AI-related REITs, retail and hospitality sub-sectors, supported by positive rental reversions.

- Catalysts include BLACKPINK concert in Nov’, inorganic growth through asset recycling, and interest rate cuts.

How to take a view on the Singapore market?

- Take a view via the SGX MSCI Singapore Index Futures (SiMSCI) Futures. Trade at only $1.38*, click here to learn more about our exclusive rate for the SiMSCI Futures now.

- Take a view via Singapore stocks. Trade Singapore stocks from as low as 0.08% with no minimum commission.

- You can also consider trading the Phillip MSCI Singapore Daily (-1X) Inverse ETF and the Phillip MSCI Singapore Daily (2X) Leveraged ETF.

Understanding the ETF products

1) Phillip MSCI Singapore Daily (2X) Leveraged ETF (LSS)

Designed to achieve 2 times the daily return/losses of the MSCI Singapore Index. The product has a published leveraged factor of 2 times and will apply the returns for a particular day only. Returns/losses for holding period more than 1 day will be compounded.

2) Phillip MSCI Singapore Daily (-1X) Inverse ETF (SSS)

Designed to deliver the opposite of the daily performance of the MSCI Singapore Index. That means investors can make money when the market or the underlying Index declines, but without having to sell anything short. Returns/losses for holding period more than 1 day will be compounded.

Trade the SiMSCI Futures, Singapore stocks and ETFs Singapore stocks (with no minimum commission) on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks on NOVA

Features of trading on NOVA

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges - Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets. - Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators - True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on NOVA - USD Shares Margin Rate at Only 4.5% p.a

- Fractional Shares from US$1